Gold closed the US session around 3,981, consolidating within a narrow range after a strong impulsive move from 3,946 → 3,991.

The pair continues to show bullish structure on all major timeframes, but with signs of momentum fatigue at current highs.

Asian session likely to provide either a minor correction or accumulation phase before next directional move during London.

⸻

📊 1️⃣ DAILY TIMEFRAME (D1)

• Structure: Strong bullish continuation since breaking out above 3,866 (last week’s BOS).

• EMAs: Price trading well above the 20 EMA (3,918) and 50 EMA (3,837) → showing strong trend control by buyers.

• RSI: 77 → overbought, risk of a short-term correction before further upside.

• Parabolic SAR: Still below price, confirming uptrend intact.

• Immediate resistance: 3,991–4,000 (psychological zone)

• Key support: 3,918–3,914

🔹 Bias: Trend remains bullish, but watch for exhaustion near 4,000. A corrective pullback toward 3,965–3,940 would be healthy for continuation.

⸻

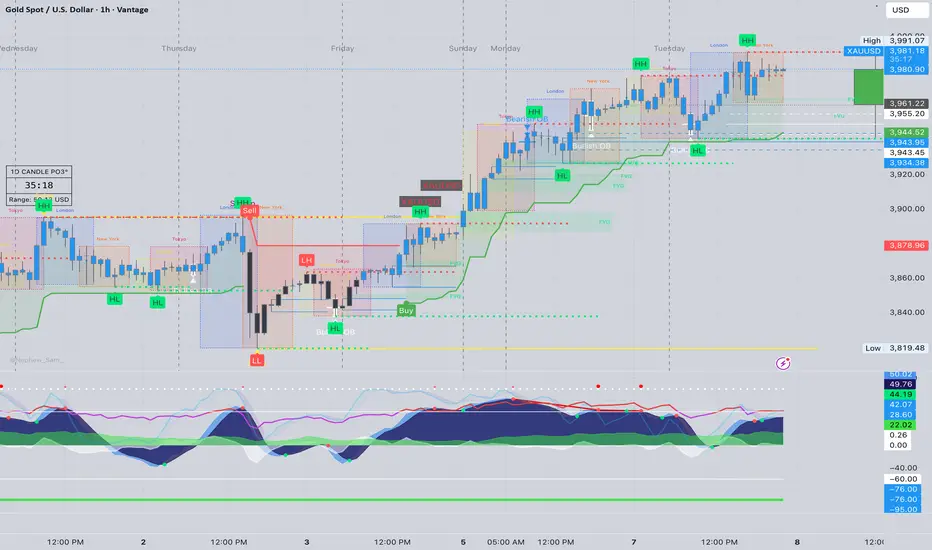

📉 2️⃣ 1H TIMEFRAME (H1)

• Price trading in a rising channel, currently at upper boundary (~3,981).

• Previous BOS confirmed at 3,965, turning that area into dynamic support.

• EMAs 20/50 (3,970–3,961) acting as intraday support band.

• MACD histogram slightly fading → momentum cooling, but still positive.

• RSI 64 → neutral, providing space for another push higher if buyers defend supports.

• Structure forming potential ascending triangle → breakout may target 3,991 → 4,000 zone.

🔹 Bias: Bullish above 3,961, neutral between 3,961–3,946, bearish only below 3,946.

⸻

⏱ 3️⃣ 15M TIMEFRAME (M15)

• Clear liquidity sweep below 3,961 earlier, followed by a Change of Character (CHoCH) to bullish.

• Price forming higher lows, consolidating between 3,977–3,982 → tight compression before breakout.

• MACD recovering from minor bearish phase, RSI 58 → modest bullish pressure.

• EMAs crossing upward again, aligning with structure support at 3,973–3,970.

🔹 Expect accumulation within 3,973–3,982 before breakout confirmation.

⸻

📈 4️⃣ 5M TIMEFRAME (M5 – Scalping Focus)

• Micro-structure: short-term consolidation with support at 3,970 and resistance at 3,983.

• Momentum: MACD showing flattening histogram, RSI neutral (~52) → potential low-volume Asian range.

• EMAs flatlining → ideal setup for scalpers awaiting breakout or pullback to golden zone.

⸻

✨ FIBONACCI GOLDEN ZONE (SHORT-TERM)

Measured from 3,946 (swing low) → 3,991 (swing high):

• 38.2% = 3,974

• 50% = 3,968

• 61.8% = 3,962

🔸 This forms the Golden Zone = 3,974–3,962 — high-probability buy reaction area if tested.

Aligns with trendline + EMA support, increasing confluence.

⸻

🚨 BREAKOUT LEVELS TO WATCH

Direction Breakout Zone Retest Confirmation Target Zones

Bullish Above 3,983–3,985 Retest 3,980–3,982 3,991 → 4,000 → 4,015

Bearish Below 3,961–3,958 Retest 3,962–3,965 3,946 → 3,940 → 3,927

⸻

🧭 ASIAN SESSION OUTLOOK

• Base Case (60% probability):

Sideways-to-slightly bullish consolidation above 3,970 ahead of London volatility.

Price likely to respect Golden Zone (3,974–3,962) before continuation.

• Alternative (30% probability):

Brief dip into 3,958–3,946 liquidity pocket before strong bounce upward.

• Low Probability (10%):

Sustained bearish breakdown below 3,946, invalidating intraday uptrend.

⸻

📊 SUMMARY

• Gold remains in a strong bullish uptrend, consolidating near the top of the channel.

• 3,974–3,962 (Golden Zone) remains key area for buyers to defend.

• Breakout above 3,985 will confirm continuation toward 4,000–4,015.

• Only a confirmed drop below 3,946 shifts structure bearish short term.

Bias for Asian Session:

🟢 Bullish above 3,962

⚪ Neutral between 3,962–3,946

🔴 Bearish below 3,946

⸻

🟡 Conclusion:

Expect calm range trading during Asia with bullish continuation probability if 3,970–3,962 holds.

Aggressive moves likely resume in London session.

Overall structure and indicators favor dip accumulation rather than shorting.

⸻

The pair continues to show bullish structure on all major timeframes, but with signs of momentum fatigue at current highs.

Asian session likely to provide either a minor correction or accumulation phase before next directional move during London.

⸻

📊 1️⃣ DAILY TIMEFRAME (D1)

• Structure: Strong bullish continuation since breaking out above 3,866 (last week’s BOS).

• EMAs: Price trading well above the 20 EMA (3,918) and 50 EMA (3,837) → showing strong trend control by buyers.

• RSI: 77 → overbought, risk of a short-term correction before further upside.

• Parabolic SAR: Still below price, confirming uptrend intact.

• Immediate resistance: 3,991–4,000 (psychological zone)

• Key support: 3,918–3,914

🔹 Bias: Trend remains bullish, but watch for exhaustion near 4,000. A corrective pullback toward 3,965–3,940 would be healthy for continuation.

⸻

📉 2️⃣ 1H TIMEFRAME (H1)

• Price trading in a rising channel, currently at upper boundary (~3,981).

• Previous BOS confirmed at 3,965, turning that area into dynamic support.

• EMAs 20/50 (3,970–3,961) acting as intraday support band.

• MACD histogram slightly fading → momentum cooling, but still positive.

• RSI 64 → neutral, providing space for another push higher if buyers defend supports.

• Structure forming potential ascending triangle → breakout may target 3,991 → 4,000 zone.

🔹 Bias: Bullish above 3,961, neutral between 3,961–3,946, bearish only below 3,946.

⸻

⏱ 3️⃣ 15M TIMEFRAME (M15)

• Clear liquidity sweep below 3,961 earlier, followed by a Change of Character (CHoCH) to bullish.

• Price forming higher lows, consolidating between 3,977–3,982 → tight compression before breakout.

• MACD recovering from minor bearish phase, RSI 58 → modest bullish pressure.

• EMAs crossing upward again, aligning with structure support at 3,973–3,970.

🔹 Expect accumulation within 3,973–3,982 before breakout confirmation.

⸻

📈 4️⃣ 5M TIMEFRAME (M5 – Scalping Focus)

• Micro-structure: short-term consolidation with support at 3,970 and resistance at 3,983.

• Momentum: MACD showing flattening histogram, RSI neutral (~52) → potential low-volume Asian range.

• EMAs flatlining → ideal setup for scalpers awaiting breakout or pullback to golden zone.

⸻

✨ FIBONACCI GOLDEN ZONE (SHORT-TERM)

Measured from 3,946 (swing low) → 3,991 (swing high):

• 38.2% = 3,974

• 50% = 3,968

• 61.8% = 3,962

🔸 This forms the Golden Zone = 3,974–3,962 — high-probability buy reaction area if tested.

Aligns with trendline + EMA support, increasing confluence.

⸻

🚨 BREAKOUT LEVELS TO WATCH

Direction Breakout Zone Retest Confirmation Target Zones

Bullish Above 3,983–3,985 Retest 3,980–3,982 3,991 → 4,000 → 4,015

Bearish Below 3,961–3,958 Retest 3,962–3,965 3,946 → 3,940 → 3,927

⸻

🧭 ASIAN SESSION OUTLOOK

• Base Case (60% probability):

Sideways-to-slightly bullish consolidation above 3,970 ahead of London volatility.

Price likely to respect Golden Zone (3,974–3,962) before continuation.

• Alternative (30% probability):

Brief dip into 3,958–3,946 liquidity pocket before strong bounce upward.

• Low Probability (10%):

Sustained bearish breakdown below 3,946, invalidating intraday uptrend.

⸻

📊 SUMMARY

• Gold remains in a strong bullish uptrend, consolidating near the top of the channel.

• 3,974–3,962 (Golden Zone) remains key area for buyers to defend.

• Breakout above 3,985 will confirm continuation toward 4,000–4,015.

• Only a confirmed drop below 3,946 shifts structure bearish short term.

Bias for Asian Session:

🟢 Bullish above 3,962

⚪ Neutral between 3,962–3,946

🔴 Bearish below 3,946

⸻

🟡 Conclusion:

Expect calm range trading during Asia with bullish continuation probability if 3,970–3,962 holds.

Aggressive moves likely resume in London session.

Overall structure and indicators favor dip accumulation rather than shorting.

⸻

— ElDoradoFx PREMIUM 3.0 Team 🚀

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

— ElDoradoFx PREMIUM 3.0 Team 🚀

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน