ค้นหาในสคริปต์สำหรับ "scalping"

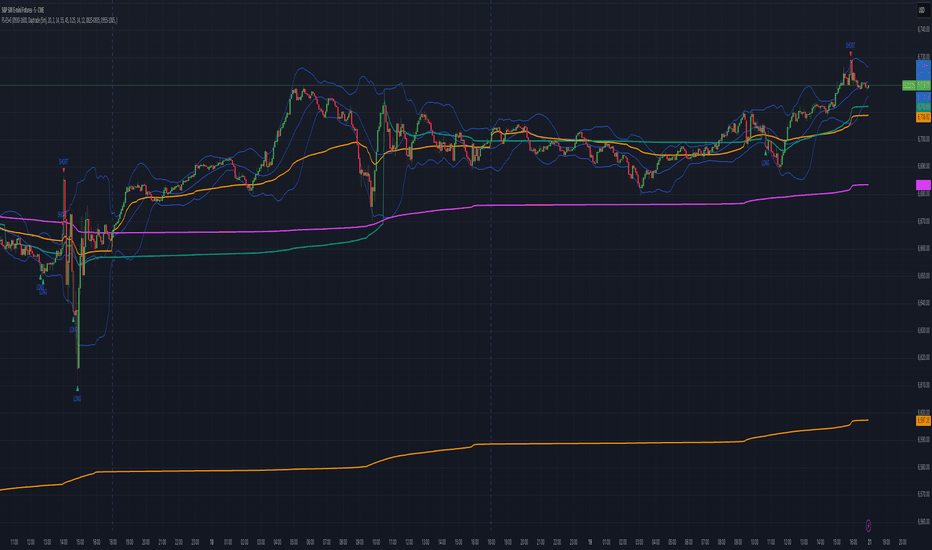

FlowSpike ES — BB • RSI • VWAP + AVWAP + News MuteThis indicator is purpose-built for E-mini S&P 500 (ES) futures traders, combining volatility bands, momentum filters, and session-anchored levels into a streamlined tool for intraday execution.

Key Features:

• ES-Tuned Presets

Automatically optimized settings for scalping (1–2m), daytrading (5m), and swing trading (15–60m) timeframes.

• Bollinger Band & RSI Signals

Entry signals trigger only at statistically significant extremes, with RSI filters to reduce false moves.

• VWAP & Anchored VWAPs

Session VWAP plus anchored VWAPs (RTH open, weekly, monthly, and custom) provide high-confidence reference levels used by professional order-flow traders.

• Volatility Filter (ATR in ticks)

Ensures signals are only shown when the ES is moving enough to offer tradable edges.

• News-Time Mute

Suppresses signals around scheduled economic releases (customizable windows in ET), helping traders avoid whipsaw conditions.

• Clean Alerts

Long/short alerts are generated only when all conditions align, with optional bar-close confirmation.

Why It’s Tailored for ES Futures:

• Designed around ES tick size (0.25) and volatility structure.

• Session settings respect RTH hours (09:30–16:00 ET), the period where most liquidity and institutional flows concentrate.

• ATR thresholds and RSI bands are pre-tuned for ES market behavior, reducing the need for manual optimization.

⸻

This is not a generic indicator—it’s a futures-focused tool created to align with the way ES trades day after day. Whether you scalp the open, manage intraday swings, or align to weekly/monthly anchored flows, FlowSpike ES gives you a clear, rules-based signal framework.

NQ Scalping System (1-Min Optimized) — StrategyNQ Scalping System — What this does (in plain English)

You’re buying pullbacks in an uptrend and selling pullbacks in a downtrend.

Trend = EMA89. Entries lean on EMA8/EMA21 touches + a StochRSI reset & cross so you’re not chasing candles. Optional Volume and MACD filters keep you out of weak moves. A time window avoids dead markets and the first noisy minute.

Long setup

Price above EMA89 (trend up)

Price pulls back to EMA8 (or EMA21 if fallback is on) by at least your Min Pullback (NQ points)

StochRSI resets to oversold and %K crosses up %D

(Optional) Volume thrust and MACD momentum confirm

Within your session window

Short = mirror image.

Exits you control

Stop/Target: ATR-based (adaptive) or fixed scalp points

Trailing stop: only arms after price moves your way by X points, then trails by your offset

Early exit options: StochRSI fade, EMA break, trend break, or opposite divergence

Quick scalp: grab a few points or bail after X bars if nothing happens

Reality check

This is a rules → orders system. It will not match eyeballed indicator labels. Fills, gaps, and trail behavior are real. That’s the point.

How I’d run it (defaults that won’t waste your time)

Use ATR stops/targets by default

EMA21 fallback = ON (you’ll miss fewer good pullbacks)

MACD filter = ON when choppy; OFF when trends are clean

Volume multiplier: start modest, bump it up if you get chopped

Session: keep RTH (e.g., 09:30–15:45 ET) and skip the first minute

Quick presets for higher timeframes

Use these as starting points and then nudge to taste.

5-Minute (intraday swings)

OB/OS: 80 / 20

Volume Multiplier: 1.3

MACD: 8 / 21 / 5

ATR Stop× / Target×: 1.8–2.2 / 2.5–3.0

Min Pullback: 1.0–1.5 pts

Quick Scalp: 6–10 pts, Bars: 12–20

Trailing: Activation 6–8 pts, Offset 3–4 pts

Divergence: Hidden ON, MTF OFF

15-Minute (session legs)

OB/OS: 85 / 15

Volume Multiplier: 1.4

MACD: 8 / 21 / 5

ATR Stop× / Target×: 2.0–2.5 / 3.0–4.0

Min Pullback: 1.5–2.5 pts

Quick Scalp: 12–18 pts, Bars: 16–30

Trailing: Activation 10–14 pts, Offset 5–6 pts

Divergence: Hidden ON, MTF ON (LTF = 5m)

30-Minute (bigger intraday trends)

OB/OS: 88 / 12

Volume Multiplier: 1.5

MACD: 12 / 26 / 9 (or 8 / 21 / 5 if you want faster)

ATR Stop× / Target×: 2.2–2.8 / 3.5–5.0

Min Pullback: 2.5–4.0 pts

Quick Scalp: 18–28 pts, Bars: 20–40

Trailing: Activation 16–24 pts, Offset 6–8 pts

Divergence: Hidden ON, MTF ON (LTF = 5m or 15m)

1-Hour (multi-hour swings)

OB/OS: 90 / 10

Volume Multiplier: 1.6–1.8

MACD: 12 / 26 / 9

ATR Stop× / Target×: 2.5–3.5 / 4.0–6.0

Min Pullback: 4–7 pts

Quick Scalp: 30–50 pts, Bars: 24–60

Trailing: Activation 28–40 pts, Offset 10–15 pts

Divergence: Hidden ON, MTF ON (LTF = 15m)

Tuning tips (read this)

Getting chopped? Raise Min Pullback, raise Volume Multiplier, leave MACD ON, and narrow your session.

Missing moves? Turn EMA21 fallback ON, lower Volume Multiplier, relax OB/OS (e.g., 75/25 on 5m).

Flat days? Use Quick Scalp and a tighter Trail Activation to lock gains.

Sine Weighted Trend Navigator [QuantAlgo]🟢 Overview

The Sine Weighted Trend Navigator utilizes trigonometric mathematics to create a trend-following system that adapts to various market volatility. Unlike traditional moving averages that apply uniform weights, this indicator employs sine wave calculations to distribute weights across historical price data, creating a more responsive yet smooth trend measurement. Combined with volatility-adjusted boundaries, it produces actionable directional signals for traders and investors across various market conditions and asset classes.

🟢 How It Works

At its core, the indicator applies sine wave mathematics to weight historical prices. The system generates angular values across the lookback period and transforms them through sine calculations, creating a weight distribution pattern that naturally emphasizes recent price action while preserving smoothness. The phase shift feature allows rotation of this weighting pattern, enabling adjustment of the indicator's responsiveness to different market conditions.

Surrounding this sine-weighted calculation, the system establishes volatility-responsive boundaries through market volatility analysis. These boundaries expand and contract based on current market conditions, creating a dynamic framework that helps distinguish meaningful trend movements from random price fluctuations.

The trend determination logic compares the sine-weighted value against these adaptive boundaries. When the weighted value exceeds the upper boundary, it signals upward momentum. When it drops below the lower boundary, it indicates downward pressure. This comparison drives the color transitions of the main trend line, shifting between bullish (green) and bearish (red) states to provide clear directional guidance on price charts.

🟢 How to Use

Green/Bullish Trend Line: Rising momentum indicating optimal conditions for long positions (buy)

Red/Bearish Trend Line: Declining momentum signaling favorable timing for short positions (sell)

Steepening Green Line: Accelerating bullish momentum with increasing sine-weighted values indicating strengthening upward pressure and high-probability trend continuation

Steepening Red Line: Intensifying bearish momentum with declining sine-weighted calculations suggesting persistent downward pressure and optimal shorting opportunities

Flattening Trend Lines: Gradual reduction in directional momentum regardless of color may indicate approaching consolidation or trend exhaustion requiring position management review

🟢 Pro Tips for Trading and Investing

→ Preset Strategy Selection: Utilize the built-in presets strategically - Scalping preset for ultra-responsive 1-15 minute charts, Default preset for balanced general trading, and Swing Trading preset for 1-4 hour charts and multi-day positions.

→ Phase Shift Optimization: Fine-tune the phase shift parameter based on market bias - use positive values (0.1-0.5) in trending bull markets to enhance uptrend sensitivity, negative values (-0.1 to -0.5) in bear markets for improved downtrend detection, and zero for balanced neutral market conditions.

→ Multiplier Calibration: Adjust the multiplier according to market volatility and trading style. Use lower values (0.5-1.0) for tight, responsive signals in stable markets, higher values (2.0-3.0) during earnings seasons or high-volatility periods to filter noise and reduce whipsaws.

→ Sine Period Adaptation: Customize the sine weighted period based on your trading timeframe and market conditions. Use 5-14 for day trading to capture short-term momentum shifts, 14-25 for swing trading to balance responsiveness with reliability, and 25-50 for position trading to maintain long-term trend clarity.

→ Multi-Timeframe Sine Validation: Apply the indicator across multiple timeframes simultaneously, using higher timeframes (4H/Daily) for overall trend bias and lower timeframes (15m/1H) for entry timing, ensuring sine-weighted calculations align across different time horizons.

→ Alert-Driven Systematic Execution: Leverage the built-in trend change alerts to eliminate emotional decision-making and capture every mathematically-confirmed trend transition, particularly valuable for traders managing multiple instruments or those unable to monitor charts continuously.

→ Risk Management: Increase position sizes during strong directional sine-weighted momentum while reducing exposure during frequent color changes that indicate mathematical uncertainty or ranging market conditions lacking clear directional bias.

Nifty 50 Scalping - Bullish Buy & Bearish Sell (5 Target / 2 SL)Nifty 50 Scalping - Bullish Buy & Bearish Sell (5 Target / 2 SL)

EMA + RSI Daily Bias Clarity Indi📊 EMA + RSI Daily Bias • Clarity Panel

This indicator is built for clarity, structure, and confidence in trading.

It combines EMAs, RSI, and a Daily Bias filter into one panel that helps you quickly understand trend, momentum, and alignment without cluttering your chart.

It does not provide signals or financial advice — instead, it simplifies your decision-making process by presenting conditions in a clear format.

🔧 Features

📈 Customizable EMAs (Fast & Slow)

Define short-term vs. medium-term trend direction.

Adjust the lengths for scalping, intraday, or swing trading.

🎯 RSI Integration

Tracks momentum on your active timeframe.

Highlights overbought (OB) and oversold (OS) conditions.

Used to filter entries and avoid chasing stretched moves.

🧭 Daily Bias (Higher Timeframe RSI)

Pulls RSI from the Daily chart (or chosen HTF).

Helps confirm if your local trade setup is aligned with higher timeframe momentum.

✨ Clarity Panel with Emojis

Displays Trend, HTF Bias, RSI reading, and State.

States include:

⏳ WAIT → No alignment or unclear conditions.

🟢 / 🔴 CONFIRM → Trend, RSI, and bias all align for a setup.

💰 COLLECT → RSI stretched to OB/OS, take partials or be cautious.

⚡ Optional Chart Markers

BUY/SELL labels appear when conditions align.

Alerts can be enabled for CONFIRM and COLLECT conditions.

💡 How to Use

Start with EMAs → Check if price is trending above or below EMAs to determine short-term direction.

Look at Daily Bias → See if RSI bias from higher timeframe (Daily by default) agrees with your local setup.

Check RSI → If RSI is neutral, WAIT. If RSI confirms momentum with trend + bias, CONFIRM. If RSI is stretched into OB/OS, COLLECT.

Use Panel for Quick Reads → The panel gives you a “dashboard” view of conditions so you don’t second-guess.

Combine with Your Own Strategy → This script is best used as a clarity filter to stay disciplined, not as a standalone signal generator.

📊 Example Workflow

Price above both EMAs ✅

Daily Bias shows BULL ✅

RSI at 62 (above midline, not yet overbought) ✅

→ Panel shows 🟢 CONFIRM → consider entering long.

Later, RSI rises to 72 (overbought) → Panel switches to 💰 COLLECT → take profits or tighten stops.

⚠️ Disclaimer

This script is for clarity and educational purposes only.

It does not provide financial advice, signals, or guaranteed profits.

Always use proper risk management and combine with your own trading plan.

Balanced Big Wicks (50/50) HighlighterThis open-source indicator highlights candles with balanced long wicks (50/50 style)—that is, candles where both upper and lower shadows are each at least 30–60% of the full range and within ~8% of each other, while retaining a substantial body. This specific structure often reflects indecision or liquidity sweeps and can precede strong breakout moves.

How It Works (Inputs and Logic)

Min wick % (each side): 30–60% of candle range

Max body %: up to 60% of range (preserves strong body presence)

Equality tolerance: wicks within 8% of each other

ATR filter (multiples of ATR14): ensures only significant-range candles are flagged

When a “50/50” candle forms, it’s visually colored and labeled; audibly alertable.

How to Use It

Long setup: price closes above the wick-high → potential long entry (SL below wick-low, TP = 1:1).

Short setup: price closes below wick-low → potential short entry (SL above wick-high, TP = 1:1).

Especially effective on 5–15 minute scalping charts when aligned with high-volume sessions or HTF trend context.

Why This Indicator Is Unique

Unlike standard wick or doji voters, this script specifically filters for candles with a strong body and symmetrical wicks, paired with a range filter, reducing noise significantly.

Important Notes

No unrealistic claims: backtested setups indicate high occurrence of clean breakouts, though performance depends on market structure.

Script built responsibly: uses real-time calculations only, no future-data lookahead.

Visuals on the published chart reflect default input values exactly.

⛓️ Scalping Fusion [AlexSvet]An indicator with a table that takes into account the trend for scalping trading.

⛓️ Scalping (5-15) Fusion Signals — soft SELL/BUY [AlexSvet]Signals for scalping 5-15 minutes — soft SELL/BUY.

settings there is a checkbox ✅ "Consider volume filter in signal?".

If enabled → signals only when volume is confirmed.

If disabled → BUY/SELL arrows appear more often (volume is only displayed in the table).

Alerts work for both options.

Three-Step 9:30 Range Scalping# Three-Step 9:30 Range Scalping Strategy Rules

## Step 1: Mark the Levels (9:30 AM)

- Wait for the **first 5-minute candle** starting at 9:30 AM EST to close

- Mark the **HIGH** and **LOW** of this candle

- Switch to **1-minute chart** for trading

## Step 2: Find Your Entry (Trade for 1 hour only: 9:30-10:30 AM)

### BREAK Entry

- Need: **Fair Value Gap (FVG)** + **ANY** of the 3 FVG candles closes outside the range

- FVG = Gap between candle wicks (3-candle pattern)

### TRAP Entry

- Need: Break outside range → Retest back inside → Close back outside again

### REVERSAL Entry

- Need: Failed break in one direction → Opposite FVG back into the range

## Step 3: Trade Management

### Stop Loss:

- **Break/Trap**: Low/High of first candle that closed outside the range

- **Reversal**: Low/High of first candle in the FVG pattern

### Take Profit:

- **Always 2:1 risk-to-reward ratio**

- If you risk $100, you make $200

## Key Rules:

- ✅ **Body close** outside range (not just wicks)

- ✅ Trade on **1-minute chart** only

- ✅ Only trade **first hour** (9:30-10:30 AM EST)

- ✅ **Fixed 2:1** take profit every time

- ✅ One strategy, stay consistent

**That's it. No complicated indicators, no higher timeframe bias, no guesswork.**

FlowStateTrader FlowState Trader - Advanced Time-Filtered Strategy

## Overview

FlowState Trader is a sophisticated algorithmic trading strategy that combines precision entry signals with intelligent time-based filtering and adaptive risk management. Built for traders seeking to achieve their optimal performance state, FlowState identifies high-probability trading opportunities within user-defined time windows while employing dynamic trailing stops and partial position management.

## Core Strategy Philosophy

FlowState Trader operates on the principle that peak trading performance occurs when three elements align: **Focus** (precise entry signals), **Flow** (optimal time windows), and **State** (intelligent position management). This strategy excels at finding reversal opportunities at key support and resistance levels while filtering out suboptimal trading periods to keep traders in their optimal flow state.

## Key Features

### 🎯 Focus Entry System

**Support/Resistance Zone Trading**:

- Dynamic identification of key price levels using configurable lookback periods

- Entry signals triggered when price interacts with these critical zones

- Volume confirmation ensures genuine breakout/reversal momentum

- Trend filter alignment prevents counter-trend disasters

**Entry Conditions**:

- **Long Signals**: Price closes above support buffer, touches support level, with above-average volume

- **Short Signals**: Price closes below resistance buffer, touches resistance level, with above-average volume

- Optional trend filter using EMA or SMA for directional bias confirmation

### ⏰ FlowState Time Filtering System

**Comprehensive Time Controls**:

- **12-Hour Format Trading Windows**: User-friendly AM/PM time selection

- **Multi-Timezone Support**: UTC, EST, PST, CST with automatic conversion

- **Day-of-Week Filtering**: Trade only weekdays, weekends, or both

- **Lunch Hour Avoidance**: Automatically skips low-volume lunch periods (12-1 PM)

- **Visual Time Indicators**: Background coloring shows active/inactive trading periods

**Smart Time Features**:

- Handles overnight trading sessions seamlessly

- Prevents trades during historically poor performance periods

- Customizable trading hours for different market sessions

- Real-time trading window status in dashboard

### 🛡️ Adaptive Risk Management

**Multi-Level Take Profit System**:

- **TP1**: First profit target with optional partial position closure

- **TP2**: Final profit target for remaining position

- **Flexible Scaling**: Choose number of contracts to close at each level

**Dynamic Trailing Stop Technology**:

- **Three Operating Modes**:

- **Conservative**: Earlier activation, tighter trailing (protect profits)

- **Balanced**: Optimal risk/reward balance (recommended)

- **Aggressive**: Later activation, wider trailing (let winners run)

- **ATR-Based Calculations**: Adapts to current market volatility

- **Automatic Activation**: Engages when position reaches profitability threshold

### 📊 Intelligent Position Sizing

**Contract-Based Management**:

- Configurable entry quantity (1-1000 contracts)

- Partial close quantities for profit-taking

- Clear position tracking and P&L monitoring

- Real-time position status updates

### 🎨 Professional Visualization

**Enhanced Chart Elements**:

- **Entry Zone Highlighting**: Clear visual identification of trading opportunities

- **Dynamic Risk/Reward Lines**: Real-time TP and SL levels with price labels

- **Trailing Stop Visualization**: Live tracking of adaptive stop levels

- **Support/Resistance Lines**: Key level identification

- **Time Window Background**: Visual confirmation of active trading periods

**Dual Dashboard System**:

- **Strategy Dashboard**: Real-time position info, settings status, and current levels

- **Performance Scorecard**: Live P&L tracking, win rates, and trade statistics

- **Customizable Sizing**: Small, Medium, or Large display options

### ⚙️ Comprehensive Customization

**Core Strategy Settings**:

- **Lookback Period**: Support/resistance calculation period (5-100 bars)

- **ATR Configuration**: Period and multipliers for stops/targets

- **Reward-to-Risk Ratios**: Customizable profit target calculations

- **Trend Filter Options**: EMA/SMA selection with adjustable periods

**Time Filter Controls**:

- **Trading Hours**: Start/end times in 12-hour format

- **Timezone Selection**: Four major timezone options

- **Day Restrictions**: Weekend-only, weekday-only, or unrestricted

- **Session Management**: Lunch hour avoidance and custom periods

**Risk Management Options**:

- **Trailing Stop Modes**: Conservative/Balanced/Aggressive presets

- **Partial Close Settings**: Enable/disable with custom quantities

- **Alert System**: Comprehensive notifications for all trade events

### 📈 Performance Tracking

**Real-Time Metrics**:

- Net profit/loss calculation

- Win rate percentage

- Profit factor analysis

- Maximum drawdown tracking

- Total trade count and breakdown

- Current position P&L

**Trade Analytics**:

- Winner/loser ratio tracking

- Real-time performance scorecard

- Strategy effectiveness monitoring

- Risk-adjusted return metrics

### 🔔 Alert System

**Comprehensive Notifications**:

- Entry signal alerts with price and quantity

- Take profit level hits (TP1 and TP2)

- Stop loss activations

- Trailing stop engagements

- Position closure notifications

## Strategy Logic Deep Dive

### Entry Signal Generation

The strategy identifies high-probability reversal points by combining multiple confirmation factors:

1. **Price Action**: Looks for price interaction with key support/resistance levels

2. **Volume Confirmation**: Ensures sufficient market interest and liquidity

3. **Trend Alignment**: Optional filter prevents counter-trend positions

4. **Time Validation**: Only trades during user-defined optimal periods

5. **Zone Analysis**: Entry occurs within calculated buffer zones around key levels

### Risk Management Philosophy

FlowState Trader employs a three-tier risk management approach:

1. **Initial Protection**: ATR-based stop losses set at strategy entry

2. **Profit Preservation**: Trailing stops activate once position becomes profitable

3. **Scaled Exit**: Partial profit-taking allows for both security and potential

### Time-Based Edge

The time filtering system recognizes that not all trading hours are equal:

- Avoids low-volume, high-spread periods

- Focuses on optimal liquidity windows

- Prevents trading during news events (lunch hours)

- Allows customization for different market sessions

## Best Practices and Optimization

### Recommended Settings

**For Scalping (1-5 minute charts)**:

- Lookback Period: 10-20

- ATR Period: 14

- Trailing Stop: Conservative mode

- Time Filter: Major session hours only

**For Day Trading (15-60 minute charts)**:

- Lookback Period: 20-30

- ATR Period: 14-21

- Trailing Stop: Balanced mode

- Time Filter: Extended trading hours

**For Swing Trading (4H+ charts)**:

- Lookback Period: 30-50

- ATR Period: 21+

- Trailing Stop: Aggressive mode

- Time Filter: Disabled or very broad

### Market Compatibility

- **Forex**: Excellent for major pairs during active sessions

- **Stocks**: Ideal for liquid stocks during market hours

- **Futures**: Perfect for index and commodity futures

- **Crypto**: Effective on major cryptocurrencies (24/7 capability)

### Risk Considerations

- **Market Conditions**: Performance varies with volatility regimes

- **Timeframe Selection**: Lower timeframes require tighter risk management

- **Position Sizing**: Never risk more than 1-2% of account per trade

- **Backtesting**: Always test on historical data before live implementation

## Educational Value

FlowState serves as an excellent learning tool for:

- Understanding support/resistance trading

- Learning proper time-based filtering

- Mastering trailing stop techniques

- Developing systematic trading approaches

- Risk management best practices

## Disclaimer

This strategy is for educational and informational purposes only. Past performance does not guarantee future results. Trading involves substantial risk of loss and is not suitable for all investors. Users should thoroughly backtest the strategy and understand all risks before live trading. Always use proper position sizing and never risk more than you can afford to lose.

---

*FlowState Trader represents the evolution of systematic trading - combining classical technical analysis with modern risk management and intelligent time filtering to help traders achieve their optimal performance state through systematic, disciplined execution.*

[DrIntensiveCare17] Zero-Lag ScalpingThe Zero-Lag Scalping strategy is a short-term trading system designed for high-precision entries based on the relationship between a Zero-Lag Moving Average (ZLMA) and a standard Exponential Moving Average (EMA). It incorporates lateral market filtering, risk management with stop loss (SL) and take profit (TP), breakeven logic, visual trade markers, and a performance statistics table.

🔍 Confirmed Scalping Signals (Stoch+EMA+Supertrend)🔍 Confirmed Scalping Signals (Stoch+EMA+Supertrend)

Smart Trend Signals [QuantAlgo]🟢 Overview

The Smart Trend Signals indicator is created to address a fundamental challenge in technical analysis: generating timely trend signals while adapting to varying market volatility conditions. The indicator distinguishes itself by employing volatility-adjusted calculations that automatically modify signal sensitivity based on current market conditions, rather than using fixed parameters that perform inconsistently across different market environments. By processing Long and Short signals through separate dynamic calculation engines, each optimized for its respective directional bias, the indicator reduces the common issue of delayed or conflicting signals that plague many traditional trend-following tools. Additionally, the integration of linear regression-based trend confirmation adds another layer of signal validation, helping to filter market noise while maintaining responsiveness to genuine price movements. This adaptive approach makes the indicator practical for both traders and investors across different asset classes and timeframes, from short-term forex/crypto scalping to long-term equity position analysis.

🟢 How It Works

The indicator uses a straightforward calculation process that combines volatility measurement with momentum detection to generate directional signals. The system first calculates Average True Range (ATR) over a user-defined period to measure current market volatility. This ATR value is then multiplied by the Smart Trend Multiplier setting to create dynamic reference levels that expand during volatile periods and contract during calmer market conditions.

For signal generation, the indicator maintains separate calculation paths for Long/Buy and Short/Sell opportunities. Long signals are generated when price moves above a dynamically calculated level below the current price, confirmed by an exponential moving average crossover in the same direction. Short signals work in reverse, triggering when price moves below a calculated level above the current price, also requiring EMA confirmation. This dual-path approach allows each signal type to operate with parameters suited to its directional bias.

🟢 How to Use

Long Signals (Green Labels): Appear as "Long" labels below price bars when the indicator detects upward price momentum above the calculated reference level, confirmed by EMA crossover. These signals identify moments when price action demonstrates bullish characteristics based on the volatility-adjusted calculations.

Short Signals (Red Labels): Display as "Short" labels above price bars when downward price momentum below the reference level is detected and confirmed by EMA crossover. These signals highlight instances where price action exhibits bearish characteristics according to the indicator's mathematical framework.

Customizable Bar Coloring: This feature colors individual price bars to match the current signal direction. When enabled, each bar reflects the indicator's current directional bias, creating a continuous visual representation of trend periods across the chart timeline.

Built-in Alert System: Provides automatic notifications for new signals with detailed exchange and ticker information. The alert system monitors the indicator's calculations continuously and triggers notifications when new long or short signals are generated, allowing traders/investors to track multiple instruments simultaneously.

🟢 Pro Tips for Trading and Investing

→ Parameter Adjustment: Higher Smart Trend Multiplier settings generate fewer signals that may be more selective, while lower settings produce more frequent signals that may include more false positives. Test different settings to find what works for your trading style and market conditions.

→ Timeframe Analysis: Using higher timeframes for general trend direction and lower timeframes for entry timing is a common approach.

→ Risk Management: No indicator eliminates the need for proper risk management. Use appropriate position sizing and stop-loss strategies regardless of signal quality or frequency.

→ Market Conditions: The indicator may perform differently in trending versus ranging markets. Frequent signal changes might indicate choppy conditions. Backtest and paper trade before risking real capital.

AUD/USD 1-Min Scalping Strategy with LabelsHere’s a complete TradingView Pine Script v5 for the 1-minute AUD/USD scalping strategy we just discussed. This strategy uses:

EMA 13 and EMA 26 for trend filtering

Bollinger Bands for volatility extremes

RSI (4) for momentum confirmation

Mayfair Fx Scalper✅ Mayfair FX Scalper — By EastWave Capital

The Mayfair FX Scalper is a precision-focused, closed-source indicator designed for short-term intraday trading, particularly scalping on lower timeframes such as 1-minute, 3-minute, and 5-minute charts. This tool is developed by EastWave Capital and is based on a combination of Relative Strength Index (RSI) extremes and specific candlestick structure patterns to detect potential exhaustion and reversal points in the market.

🔍 How It Works:

The algorithm operates by evaluating three core elements:

RSI Extremes:

RSI is calculated using default settings.

Buy signals are considered only when the RSI on the previous candle is below 22 (oversold), and the current candle is bullish, while the previous one was bearish.

Sell signals are considered when the RSI on the previous candle is above 78 (overbought), and the current candle is bearish, while the previous one was bullish.

Candle Confirmation Logic:

The system waits for candle confirmation (e.g., shift in bullish/bearish structure) rather than triggering signals based on RSI alone.

This avoids false triggers in strong trends and filters weak entries.

SL/TP Estimation (Visual):

While not automatically placing orders, the indicator can optionally display lines or small labels showing a Stop Loss at the previous swing high/low (±0.5) and TP levels at 1R, 2R, and 3R based on that stop.

These visual aids help traders plan risk/reward and exits manually.

📈 How to Use:

Timeframes: Best suited for 1M, 3M, and 5M charts

Markets: Works well on Gold (XAU/USD), Forex majors, Indices, and Crypto

Session: Performs best during high volatility sessions (London & NY)

Use Case:

Wait for a signal label to appear after a clear momentum move.

Confirm price action and trend context.

Use provided visual SL/TP labels or apply your manual RR planning.

Combine with structure breaks, FVG zones, or liquidity sweeps for confluence.

⚠️ Important Notes:

This indicator does not repaint.

No automatic trades are executed. Signals are visual.

Not intended for use in isolation; best when combined with proper trade management and confirmation tools.

Past performance does not guarantee future results. Always manage risk appropriately

Time-Price Velocity [QuantAlgo]🟢 Overview

The Time-Price Velocity indicator uses advanced velocity-based analysis to measure the rate of price change normalized against typical market movement, creating a dynamic momentum oscillator that identifies market acceleration patterns and momentum shifts. Unlike traditional momentum indicators that focus solely on price change magnitude, this indicator incorporates time-weighted displacement calculations and ATR normalization to create a sophisticated velocity measurement system that adapts to varying market volatility conditions.

This indicator displays a velocity signal line that oscillates around zero, with positive values indicating upward price velocity and negative values indicating downward price velocity. The signal incorporates acceleration background columns and statistical normalization to help traders identify momentum shifts and potential reversal or continuation opportunities across different timeframes and asset classes.

🟢 How It Works

The indicator's key insight lies in its time-price velocity calculation system, where velocity is measured using the fundamental physics formula:

velocity = priceChange / timeWeight

The system normalizes this raw velocity against typical price movement using Average True Range (ATR) to create market-adjusted readings:

normalizedVelocity = typicalMove > 0 ? velocity / typicalMove : 0

where "typicalMove = ta.atr(lookback)" provides the baseline for normal price movement over the specified lookback period.

The Time-Price Velocity indicator calculation combines multiple sophisticated components. First, it calculates acceleration as the change in velocity over time:

acceleration = normalizedVelocity - normalizedVelocity

Then, the signal generation applies EMA smoothing to reduce noise while preserving responsiveness:

signal = ta.ema(normalizedVelocity, smooth)

This creates a velocity-based momentum indicator that combines price displacement analysis with statistical normalization, providing traders with both directional signals and acceleration insights for enhanced market timing.

🟢 How to Use

1. Signal Interpretation and Threshold Zones

Positive Values (Above Zero): Time-price velocity indicating bullish momentum with upward price displacement relative to normalized baseline

Negative Values (Below Zero): Time-price velocity indicating bearish momentum with downward price displacement relative to normalized baseline

Zero Line Crosses: Velocity transitions between bullish and bearish regimes, indicating potential trend changes or momentum shifts

Upper Threshold Zone: Area above positive threshold (default 1.0) indicating strong bullish velocity and potential reversal point

Lower Threshold Zone: Area below negative threshold (default -1.0) indicating strong bearish velocity and potential reversal point

2. Acceleration Analysis and Visual Features

Acceleration Columns: Background histogram showing velocity acceleration (the rate of change of velocity), with green columns indicating accelerating velocity and red columns indicating decelerating velocity. The interpretation depends on trend context: red columns in downtrends indicate strengthening bearish momentum, while red columns in uptrends indicate weakening bullish momentum

Acceleration Column Height: The height of each column represents the magnitude of acceleration, with taller columns indicating stronger acceleration or deceleration forces

Bar Coloring: Optional price bar coloring matches velocity direction for immediate visual trend confirmation

Info Table: Real-time display of current velocity and acceleration values with trend arrows and change indicators

3. Additional Features:

Confirmed vs Live Data: Toggle between confirmed (closed) bar analysis for stable signals or current bar inclusion for real-time updates

Multi-timeframe Adaptability: Velocity normalization ensures consistent readings across different chart timeframes and asset volatilities

Alert System: Built-in alerts for threshold crossovers and direction changes

🟢 Examples with Preconfigured Settings

Default : Balanced configuration suitable for most timeframes and general trading applications, providing optimal balance between sensitivity and noise filtering for medium-term analysis.

Scalping : High sensitivity setup with shorter lookback period and reduced smoothing for ultra-short-term trades on 1-15 minute charts, optimized for capturing rapid momentum shifts and frequent trading opportunities.

Swing Trading : Extended lookback period with enhanced smoothing and higher threshold for multi-day positions, designed to filter market noise while capturing significant momentum moves on 1-4 hour and daily timeframes.

Clarix 5m Scalping Breakout StrategyPurpose

A 5-minute scalping breakout strategy designed to capture fast 3-5 pip moves, using premium/discount zone filters and market bias conditions.

How It Works

The script monitors price action in 5-minute intervals, forming a 15-minute high and low range by tracking the highs and lows of the first 3 consecutive 5-minute candles starting from a custom time. In the next 3 candles, it waits for a breakout above the 15m high or below the 15m low while confirming market bias using custom equilibrium zones.

Buy signals trigger when price breaks the 15m high while in a discount zone

Sell signals trigger when price breaks the 15m low while in a premium zone

The strategy simulates trades with fixed 3-5 pip take profit and stop loss values (configurable). All trades are recorded in a backtest table with live trade results and an automatically updated win rate.

Features

Designed exclusively for the 5-minute timeframe

Custom 15-minute high/low breakout logic

Premium, Discount, and Equilibrium zone display

Built-in backtest tracker with live trade results, statistics, and win rate

Customizable start time, take profit, and stop loss settings

Real-time alerts on breakout signals

Visual markers for trade entries and failed trades

Consistent win rate exceeding 90–95% on average when following market conditions

Usage Tips

Use strictly on 5-minute charts for accurate signal performance. Avoid during high-impact news releases.

Important: Once a trade is opened, manually set your take profit at +3 to +5 pips immediately to secure the move, as these quick scalps often hit the target within a single candle. This prevents missed exits during rapid price action.

Quick Penny Run-Up Scalping StrategyQuick Penny Run-Up Scalping Strategy. Use it for 15 min within two hours

Intraday Trend Pro📈 Intraday Trend Pro — Multi-Timeframe Smart Indicator

Unlock precision in your intraday trading with Intraday Trend Pro, a powerful and versatile indicator built for serious traders. This tool is designed to:

✅ Identify the True Intraday Trend

Quickly and clearly spot bullish or bearish trends using a refined algorithm that filters out noise and false signals.

✅ Smart Entry & Stop Loss Suggestions

The script dynamically suggests optimal entry points and protective stop-loss levels, helping you manage risk and improve trade timing.

✅ Multi-Timeframe Analysis (MTF)

Enable the optional MTF mode to blend higher timeframes with the current chart for a more reliable signal confirmation, enhancing your confidence before entering a trade.

✅ Works Seamlessly Across Assets

Whether you’re trading indices like BankNifty, commodities like XAU/USD, or high-volume stocks, this indicator adjusts to deliver actionable insights.

✅ Customization Made Easy

Input controls allow you to fine-tune the trend settings, select timeframes, and adapt to your unique strategy—whether scalping or holding through the day.

Use Cases:

Confirming trend strength before entering trades

Determining accurate support/resistance for SL placement

Avoiding sideways markets and false breakouts

Aligning trades with higher timeframe momentum

Ideal For:

Intraday traders and scalpers looking for a clean, accurate, and multi-timeframe-aware tool to improve consistency.

Momentum Candle by Sekolah Trading## 🔷 Introduction

**Momentum Candle by Sekolah Trading** is a proprietary price action tool that identifies high-conviction candles with large bodies and minimal wicks, based on dynamically adjusted thresholds tailored to each pair and timeframe. This script helps traders recognize moments of price acceleration that often precede breakouts, trend continuation, or sharp reversals.

---

## 🔷 What Makes This Script Unique (Originality & Utility)

Unlike traditional candle filters that rely on static size comparisons, this indicator uses:

- **Instrument-specific pip sensitivity**: Automatically detects if the pair is XAUUSD, JPY-based, or other Forex instruments.

- **Timeframe-based calibration**: Adjusts body size thresholds dynamically for 5m, 15m, 30m, and 1h.

- **Wick ratio control**: Validates only candles with short wicks (<30%), filtering indecisive moves.

- **Non-repainting logic**: Signals appear after candle close, with no future data lookahead.

This logic has been tested and refined internally by **Sekolah Trading**, designed for scalpers and intraday traders who rely on clean price action structure.

---

## 🔷 How It Works

1. **Pair & Timeframe Detection**

Adjusts `minRange` dynamically based on:

- Gold (XAUUSD), JPY pairs, or other Forex

- Timeframe: 5m to 1h

2. **Candle Structure Analysis**

- Calculates body = `abs(open - close)`

- Wick = `upper + lower shadows`

- Valid only if wick is under 30% of total candle

3. **Conditions for Signal**

- Body ≥ minRange

- Wick ≤ 30%

- Clear bullish or bearish direction

4. **Plots**

- 🔺 Blue triangle = Bullish momentum candle

- 🔻 Red triangle = Bearish momentum candle

---

## 🔷 How to Use

1. **Add to any 5m–1h chart**, ideally on XAUUSD or major Forex pairs

2. **Wait for signal triangle** to appear at the close of a candle

3. Use with:

- Trend indicators (MA, Supertrend, etc.)

- Support/resistance zones

- Breakout levels

4. **Set alerts** using:

`Momentum Candle (Body)`

---

## 🔷 Why This Script is Closed-Source

This indicator includes proprietary logic created by **Sekolah Trading** for professional and community use:

- Original dynamic pip sensitivity calibration

- Custom multi-condition filtering

- Non-reused, non-public logic with adaptive precision

The source is protected to prevent unauthorized duplication. However, all relevant logic and intent have been clearly explained above as required by TradingView’s House Rules.

---

## 🔷 Disclaimer

This indicator does not provide financial advice or guaranteed signals. Always combine with your own analysis and risk management. Historical performance does not guarantee future results.

---

## 🔷 Suggested Tags

`momentum`, `price action`, `breakout`, `forex`, `xauusd`, `jpy`, `scalping`, `candle`, `non-repainting`, `trend confirmation`

Spreader – Real-Time Spread Detector for ScalpingSpreader is a professional tool built for scalpers and intraday traders, designed to visually display live bid-ask spread on your chart. By showing you the true market friction in real time, it helps you avoid poor entries and reduce immediate trade losses.

ChopFlow ATR Scalp StrategyA lean, high-velocity scalp framework for NQ and other futures that blends trend clarity, volume confirmation, and adaptive exits to give you precise, actionable signals—no cluttered bands or lagging indicators.

⸻

🔍 Overview

This strategy locks onto rapid intraday moves by:

• Filtering for directional momentum with the Choppiness Index (CI)

• Confirming conviction via On-Balance Volume (OBV) against its moving average

• Automatically sizing stops and targets with a multiple of the Average True Range (ATR)

It’s designed for scalp traders who need clean, timely entries without wading through choppy noise.

⸻

⚙️ Key Features & Inputs

1. ATR Length & Multiplier

• Controls exit distances based on current volatility.

2. Choppiness Length & Threshold

• Measures trend strength; only fires when the market isn’t “stuck in the mud.”

3. OBV SMA Length

• Smoothes volume flow to confirm genuine buying or selling pressure.

4. Custom Session Hours

• Avoid overnight gaps or low-liquidity periods.

All inputs are exposed for rapid tuning to your preferred scalp cadence.

🚀 How It Works

1. Long Entry triggers when:

• CI < threshold (strong trend)

• OBV > its SMA (positive volume flow)

• You’re within the defined session

2. Short Entry mirrors the above (CI < threshold, OBV < SMA)

3. Exit uses ATR × multiplier for both stop-loss and take-profit

⸻

🎯 Usage Tips

• Start with defaults (ATR 14, multiplier 1.5; CI 14, threshold 60; OBV SMA 10).

• Monitor signal frequency, then tighten/loosen CI or OBV look-back as needed.

• Pair with a fast MA crossover or price-action trigger if you want even sharper timing.

• Backtest across different sessions (early open vs. power hours) to find your edge.

⸻

⚠️ Disclaimer

This script is provided “as-is” for educational and research purposes. Always paper-trade any new setup extensively before deploying live capital, and adjust risk parameters to your personal tolerance.

⸻

Elevate your scalp game with ChopFlow ATR—where trend, volume, and volatility converge for clear, confident entries. Happy scalping!