🎯 TSLA: The "Thief Strategy" Playbook | Swing/Day Trade Setup 📈

🔥 Quick Overview

Asset: Tesla, Inc. (TSLA)

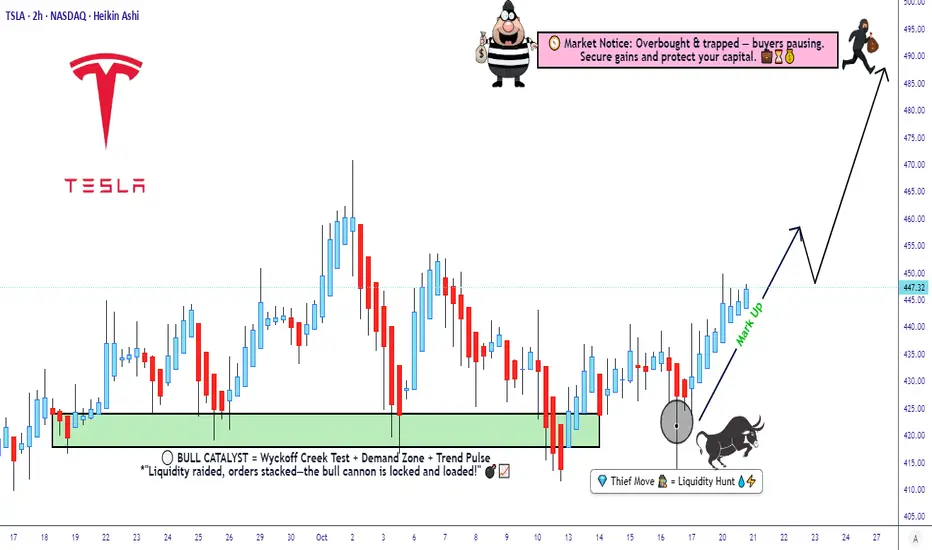

Bias: 🐂 BULLISH

Strategy Type: Thief Layering Entry Method

Risk Level: Medium-High (Swing/Day Trade)

💰 The "Thief" Entry Strategy Explained

The "Thief Strategy" uses multiple limit orders (layering method) to accumulate position at different price levels. Think of it like setting traps at various floors of a building—you catch opportunities wherever price decides to visit! 🎣

📊 Entry Zones (Layer Your Orders):

Layer 1: $430.00

Layer 2: $435.00

Layer 3: $440.00

💡 You can add more layers based on your own risk appetite and account size. The beauty of layering? You average your entry and reduce timing risk!

🛡️ Stop Loss (SL):

Thief SL: $415.00

⚠️ Important Note: This is MY stop loss level based on the Thief Strategy framework. You're the captain of your own ship! 🚢 Adjust your SL based on YOUR risk tolerance and account management rules. Trade at your own risk—make money, take money, manage wisely!

🎯 Target (TP):

Primary Target: $490.00

🚨 Why $490? This zone represents a confluence of:

Strong resistance area

Potential overbought conditions

Historical trap zone where bulls get exhausted

📢 Thief OG's Reminder: I'm NOT saying you MUST take profit only at my TP level. If you see profits that make you smile, SECURE THEM! 💵 The market gives, and the market takes. Be greedy when you can, be smart always.

🔍 Technical Analysis Breakdown

Tesla is showing bullish momentum structure with potential for continuation toward the $490 resistance zone. The layering strategy allows us to build position as price potentially dips into demand zones before the next leg up.

Key Technical Levels:

Support Zone: $430-$440 (Our entry layers)

Invalidation: Below $415 (Stop loss)

Resistance Target: $490

📌 Related Pairs to Watch (Correlation Play)

Understanding correlated assets helps confirm your thesis:

SPY (S&P 500 ETF)

SPY (S&P 500 ETF)

TSLA often moves with broader market sentiment

Watch SPY for overall risk-on/risk-off environment

QQQ (Nasdaq 100 ETF)

QQQ (Nasdaq 100 ETF)

Tech-heavy index where TSLA is a major component

Strong correlation with TSLA price action

NVDA (NVIDIA)

NVDA (NVIDIA)

Both are high-beta tech growth stocks

Often move together during risk appetite shifts

DXY (US Dollar Index)

DXY (US Dollar Index)

Inverse correlation: Strong dollar = pressure on growth stocks like TSLA

Weak dollar = tailwind for equities

💡 Key Point: If SPY/QQQ are bullish + DXY weakening = Strong confirmation for TSLA upside!

⚡ Trading Tips for Thief OG's

Don't FOMO — Let price come to your layers

Manage position size — Each layer should be equal weight

Trail your stop — Once profitable, protect gains

Watch volume — Confirm breakouts with volume spikes

Stay flexible — Market conditions change; so should you!

🎬 Final Words

This setup is all about patience, precision, and profit extraction! 🎯 The Thief Strategy isn't about stealing from the market—it's about being SMART and setting yourself up for success with calculated entries.

Remember: The best trades are the ones where you're prepared, not scared! 😎

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#TSLA #TeslaStock #SwingTrading #DayTrading #ThiefStrategy #LayeringStrategy #StockMarket #TradingIdeas #TechnicalAnalysis #BullishSetup #TradingStrategy #RiskManagement #StockTrading #MarketAnalysis #TradingCommunity

🔥 Quick Overview

Asset: Tesla, Inc. (TSLA)

Bias: 🐂 BULLISH

Strategy Type: Thief Layering Entry Method

Risk Level: Medium-High (Swing/Day Trade)

💰 The "Thief" Entry Strategy Explained

The "Thief Strategy" uses multiple limit orders (layering method) to accumulate position at different price levels. Think of it like setting traps at various floors of a building—you catch opportunities wherever price decides to visit! 🎣

📊 Entry Zones (Layer Your Orders):

Layer 1: $430.00

Layer 2: $435.00

Layer 3: $440.00

💡 You can add more layers based on your own risk appetite and account size. The beauty of layering? You average your entry and reduce timing risk!

🛡️ Stop Loss (SL):

Thief SL: $415.00

⚠️ Important Note: This is MY stop loss level based on the Thief Strategy framework. You're the captain of your own ship! 🚢 Adjust your SL based on YOUR risk tolerance and account management rules. Trade at your own risk—make money, take money, manage wisely!

🎯 Target (TP):

Primary Target: $490.00

🚨 Why $490? This zone represents a confluence of:

Strong resistance area

Potential overbought conditions

Historical trap zone where bulls get exhausted

📢 Thief OG's Reminder: I'm NOT saying you MUST take profit only at my TP level. If you see profits that make you smile, SECURE THEM! 💵 The market gives, and the market takes. Be greedy when you can, be smart always.

🔍 Technical Analysis Breakdown

Tesla is showing bullish momentum structure with potential for continuation toward the $490 resistance zone. The layering strategy allows us to build position as price potentially dips into demand zones before the next leg up.

Key Technical Levels:

Support Zone: $430-$440 (Our entry layers)

Invalidation: Below $415 (Stop loss)

Resistance Target: $490

📌 Related Pairs to Watch (Correlation Play)

Understanding correlated assets helps confirm your thesis:

TSLA often moves with broader market sentiment

Watch SPY for overall risk-on/risk-off environment

Tech-heavy index where TSLA is a major component

Strong correlation with TSLA price action

Both are high-beta tech growth stocks

Often move together during risk appetite shifts

Inverse correlation: Strong dollar = pressure on growth stocks like TSLA

Weak dollar = tailwind for equities

💡 Key Point: If SPY/QQQ are bullish + DXY weakening = Strong confirmation for TSLA upside!

⚡ Trading Tips for Thief OG's

Don't FOMO — Let price come to your layers

Manage position size — Each layer should be equal weight

Trail your stop — Once profitable, protect gains

Watch volume — Confirm breakouts with volume spikes

Stay flexible — Market conditions change; so should you!

🎬 Final Words

This setup is all about patience, precision, and profit extraction! 🎯 The Thief Strategy isn't about stealing from the market—it's about being SMART and setting yourself up for success with calculated entries.

Remember: The best trades are the ones where you're prepared, not scared! 😎

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#TSLA #TeslaStock #SwingTrading #DayTrading #ThiefStrategy #LayeringStrategy #StockMarket #TradingIdeas #TechnicalAnalysis #BullishSetup #TradingStrategy #RiskManagement #StockTrading #MarketAnalysis #TradingCommunity

การซื้อขายยังคงดำเนินอยู่

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน