Hello fellow traders! Hope you're all doing well. As we navigate the markets, it's crucial to remember that support and resistance are only temporary momentum and trend strength matter more. This article dives deep into how these levels break and how to position yourself smartly. Stay adaptive, trade with confidence, and let the market guide your decisions. Wishing you profitable trades ahead!

Support and Resistance Are Meant to Be Broken-:

Support and resistance levels are widely used in technical analysis, but one key truth often gets overlooked they exist to be broken. No matter how strong a level appears, the market will eventually decide its fate not us. The real edge lies in anticipating when these levels will fail and positioning accordingly.

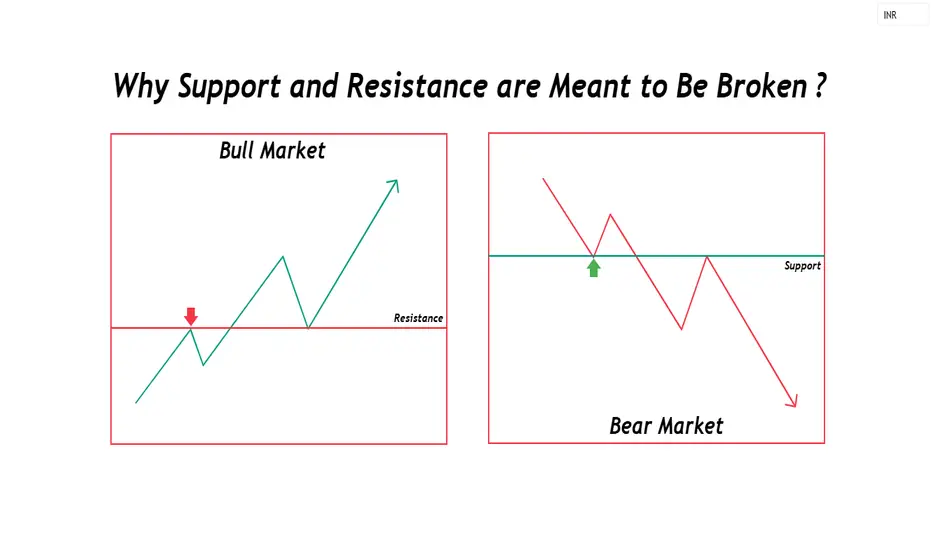

No Resistance in a Bull Market, No Support in a Bear Market-:

A strong bull market disregards resistance; price keeps climbing as buying pressure overwhelms selling interest. Similarly, in a bear market, support levels fail as fear and liquidation take over. Instead of focusing on static levels, traders should shift their mindset toward momentum and trend strength.

Understanding the Nature of Support and Resistance-:

Support and resistance levels are areas where price has historically reversed or consolidated. They act as psychological zones where traders expect a reaction. However, these levels are not fixed barriers; they shift over time due to changes in market sentiment, liquidity, and institutional activity.

When traders treat support and resistance as rigid, they often fall into the trap of expecting price to react the same way every time it reaches these levels. This can lead to false confidence and poor risk management. Instead, traders should recognize that these zones are fluid and influenced by broader market conditions.

Why Support and Resistance Are Temporary-:

Markets are driven by supply and demand dynamics. What once acted as strong resistance in a bullish market often becomes a stepping stone for higher prices. Similarly, in a bear market, previous support levels eventually collapse, leading to further declines. Understanding this concept helps traders avoid the common mistake of assuming levels will hold indefinitely.

A classic example of this is the support-turned-resistance (or vice versa) principle. When a support level is broken, it often turns into resistance as traders who were once buyers at that level now see it as a place to exit positions. The same applies to resistance turning into support in an uptrend. These shifts happen due to changes in trader behavior and order flow dynamics.

The Illusion of Strong Support and Resistance-:

Many traders believe in so-called “strong” support and resistance levels, expecting price to reverse exactly at these points. However, the truth is that markets evolve, and sentiment shifts. Institutions and large traders do not rely on fixed levels; instead, they adjust based on liquidity zones, order flow, and momentum.

Consider how large institutions trade. They do not place all their orders at a single price level. Instead, they spread their orders over a liquidity range where they can execute large trades without causing excessive slippage. This means that what retail traders see as a “strong level” may just be a general area where larger players are accumulating or distributing positions.

How to Identify Breakouts Before They Happen-:

The difference between an average trader and an exceptional one is the ability to anticipate breakouts and breakdowns. Here’s how you can do it:

Volume Confirmation – A breakout with increasing volume is more reliable. If a resistance level is being tested repeatedly with rising volume, it signals strong buying interest.

Market Structure Shifts – A series of higher highs in an uptrend or lower lows in a downtrend signals a potential breakout.

Liquidity Traps – Watch for false breakouts where price quickly reverses, trapping retail traders before the real move begins.

News and Catalysts – Major events often trigger breakouts beyond key levels. Earnings reports, economic data, or geopolitical events can create strong momentum.

Break and Retest Strategy – Sometimes, after breaking a level, price retests it before continuing in the breakout direction. This is a strong confirmation signal.

Divergence and Momentum Indicators – Tools like RSI, MACD, or moving averages can help confirm whether a breakout has strength behind it.

Practical Trading Strategies

Breakout Trading

Identify key support and resistance levels using daily or weekly charts.

Wait for price to approach these levels with increasing volume.

Confirm the breakout using momentum indicators or a retest.

Enter after confirmation, setting stop-losses slightly below (for long positions) or above (for short positions) the breakout zone.

Range Trading-:

🔹If price is consolidating between support and resistance, trade within the range.

🔹Look for signs of rejection at key levels, such as long wicks or reversal patterns.

🔹Use oscillators like RSI to gauge overbought/oversold conditions.

🔹Trend Following

🔹Identify the prevailing trend using moving averages or higher highs/lows.

🔹Avoid counter-trend trades unless there is strong reversal confirmation.

🔹Let winners run by trailing stop-losses instead of exiting too early.

Psychological Aspect of Support and Resistance:

One of the biggest mistakes traders make is placing too much faith in these levels without considering market conditions. Emotional biases like fear and greed often cloud judgment. For example, if a trader repeatedly sees price bounce off a support level, they may hesitate to sell when a clear breakdown occurs. Conversely, traders who expect resistance to hold may short too early, only to get stopped out as price breaks higher.

To overcome these psychological traps-:

🔹Always trade with a plan and predefined risk-reward ratio.

🔹Be flexible and adapt to new market information.

🔹Understand that no level is guaranteed to hold indefinitely.

Conclusion-:

Support and resistance are useful tools, but they are not unbreakable barriers. The market’s direction ultimately determines whether a level holds or fails. The ability to read price action, volume, and sentiment will always be more powerful than relying solely on predefined levels.

Instead of asking, “Will this support hold?” start asking, “What happens when this support breaks?” That shift in perspective is what separates skilled traders from the rest.

Best wishes and happy trading!

Support and Resistance Are Meant to Be Broken-:

Support and resistance levels are widely used in technical analysis, but one key truth often gets overlooked they exist to be broken. No matter how strong a level appears, the market will eventually decide its fate not us. The real edge lies in anticipating when these levels will fail and positioning accordingly.

No Resistance in a Bull Market, No Support in a Bear Market-:

A strong bull market disregards resistance; price keeps climbing as buying pressure overwhelms selling interest. Similarly, in a bear market, support levels fail as fear and liquidation take over. Instead of focusing on static levels, traders should shift their mindset toward momentum and trend strength.

Understanding the Nature of Support and Resistance-:

Support and resistance levels are areas where price has historically reversed or consolidated. They act as psychological zones where traders expect a reaction. However, these levels are not fixed barriers; they shift over time due to changes in market sentiment, liquidity, and institutional activity.

When traders treat support and resistance as rigid, they often fall into the trap of expecting price to react the same way every time it reaches these levels. This can lead to false confidence and poor risk management. Instead, traders should recognize that these zones are fluid and influenced by broader market conditions.

Why Support and Resistance Are Temporary-:

Markets are driven by supply and demand dynamics. What once acted as strong resistance in a bullish market often becomes a stepping stone for higher prices. Similarly, in a bear market, previous support levels eventually collapse, leading to further declines. Understanding this concept helps traders avoid the common mistake of assuming levels will hold indefinitely.

A classic example of this is the support-turned-resistance (or vice versa) principle. When a support level is broken, it often turns into resistance as traders who were once buyers at that level now see it as a place to exit positions. The same applies to resistance turning into support in an uptrend. These shifts happen due to changes in trader behavior and order flow dynamics.

The Illusion of Strong Support and Resistance-:

Many traders believe in so-called “strong” support and resistance levels, expecting price to reverse exactly at these points. However, the truth is that markets evolve, and sentiment shifts. Institutions and large traders do not rely on fixed levels; instead, they adjust based on liquidity zones, order flow, and momentum.

Consider how large institutions trade. They do not place all their orders at a single price level. Instead, they spread their orders over a liquidity range where they can execute large trades without causing excessive slippage. This means that what retail traders see as a “strong level” may just be a general area where larger players are accumulating or distributing positions.

How to Identify Breakouts Before They Happen-:

The difference between an average trader and an exceptional one is the ability to anticipate breakouts and breakdowns. Here’s how you can do it:

Volume Confirmation – A breakout with increasing volume is more reliable. If a resistance level is being tested repeatedly with rising volume, it signals strong buying interest.

Market Structure Shifts – A series of higher highs in an uptrend or lower lows in a downtrend signals a potential breakout.

Liquidity Traps – Watch for false breakouts where price quickly reverses, trapping retail traders before the real move begins.

News and Catalysts – Major events often trigger breakouts beyond key levels. Earnings reports, economic data, or geopolitical events can create strong momentum.

Break and Retest Strategy – Sometimes, after breaking a level, price retests it before continuing in the breakout direction. This is a strong confirmation signal.

Divergence and Momentum Indicators – Tools like RSI, MACD, or moving averages can help confirm whether a breakout has strength behind it.

Practical Trading Strategies

Breakout Trading

Identify key support and resistance levels using daily or weekly charts.

Wait for price to approach these levels with increasing volume.

Confirm the breakout using momentum indicators or a retest.

Enter after confirmation, setting stop-losses slightly below (for long positions) or above (for short positions) the breakout zone.

Range Trading-:

🔹If price is consolidating between support and resistance, trade within the range.

🔹Look for signs of rejection at key levels, such as long wicks or reversal patterns.

🔹Use oscillators like RSI to gauge overbought/oversold conditions.

🔹Trend Following

🔹Identify the prevailing trend using moving averages or higher highs/lows.

🔹Avoid counter-trend trades unless there is strong reversal confirmation.

🔹Let winners run by trailing stop-losses instead of exiting too early.

Psychological Aspect of Support and Resistance:

One of the biggest mistakes traders make is placing too much faith in these levels without considering market conditions. Emotional biases like fear and greed often cloud judgment. For example, if a trader repeatedly sees price bounce off a support level, they may hesitate to sell when a clear breakdown occurs. Conversely, traders who expect resistance to hold may short too early, only to get stopped out as price breaks higher.

To overcome these psychological traps-:

🔹Always trade with a plan and predefined risk-reward ratio.

🔹Be flexible and adapt to new market information.

🔹Understand that no level is guaranteed to hold indefinitely.

Conclusion-:

Support and resistance are useful tools, but they are not unbreakable barriers. The market’s direction ultimately determines whether a level holds or fails. The ability to read price action, volume, and sentiment will always be more powerful than relying solely on predefined levels.

Instead of asking, “Will this support hold?” start asking, “What happens when this support breaks?” That shift in perspective is what separates skilled traders from the rest.

Best wishes and happy trading!

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน