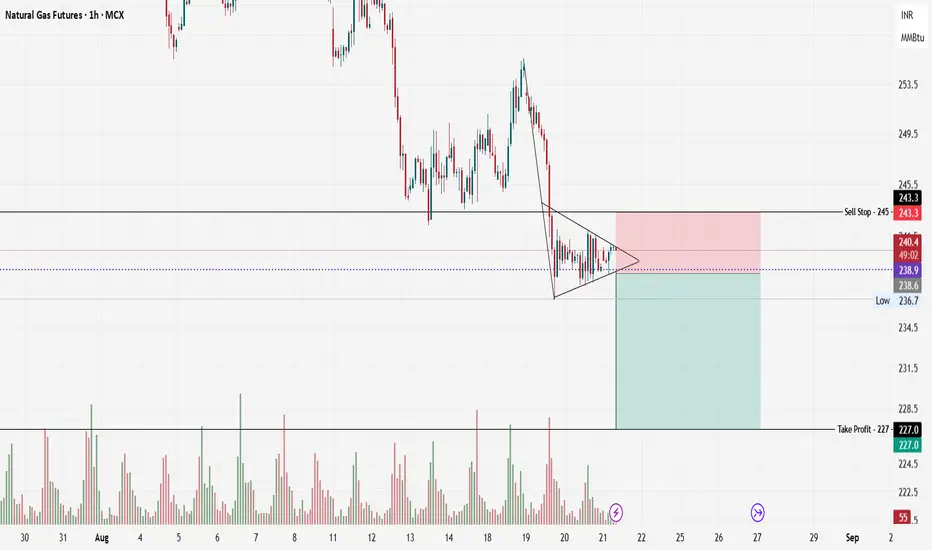

Here is my Natural Gas Futures (MCX, 1H) chart classic—candlesticks analysis.

Pattern Identification: The Bearish Pennant

I’ve spotted a textbook bearish pennant. Here’s how it forms and functions:

The pattern starts with a pronounced downward thrust (the flagpole), reflecting strong selling momentum.

Price action then contracts into a symmetrical triangle, as shown by the converging trend lines.

This pennant shape is a market’s “pause”: sellers digest gains, buyers offer token support, but neither side has control—for now.

The expectation “by the book” is that this pattern serves as a continuation formation, where a breakout (typically downward, in line with the preceding move) resumes the established trend.

Pattern Validation & Invalidation

Validation Criteria

Clear Downtrend: The initial flagpole is rapid and steep, matching textbook requirements.

Symmetrical Contraction: Multiple touches on both trendlines without breaking out show healthy consolidation.

Volume Confirmation: Notice how volume spikes before the consolidation, then diminishes as the pennant forms—a classic and critical signal. Lower volume during consolidation signifies indecision; a surge in volume on breakout validates the move.

Defined Risk/Reward: Levels for stop loss and target are clear and logical, anchored to visible support/resistance.

Invalidation Criteria

False Breakouts: If price breaks above the pennant’s upper boundary and sustains, the pattern is invalid.

Volume Anomaly: A breakout without accompanying volume suggests the move may not be trustworthy.

Failure to Breakout: Prolonged sideways action beyond the pennant’s apex reduces the pattern’s predictive value.

Capitalizing on the Analysis

If I want to turn this analytical insight into a trading opportunity, I’ll approach it methodically:

Wait for Confirmation: Act on the trade only when price closes below the lower trendline, and I’d like to see a volume spike to validate the breakout.

Set Entry and Risk: I position an entry order (sell stop) just below the pattern, around ₹238.6–₹240.

Define Stop Loss: I place my stop loss slightly above the upper pennant boundary—just above ₹243.3—to safeguard against failed breakdowns.

Calculate Target: My target is derived from the measured move principle—project the flagpole’s length from the breakout point, which centres the take profit around ₹227.

Size the Trade: I ensure my trade size aligns with my risk tolerance, strictly following capital management principles.

By systematically applying these rules, I aim to capitalize on the high-probability move that often follows a valid bearish pennant pattern.

Technical Chart Analyst

Track: Indian & US Markets

Indices | Commodities | Crypto

Telegram: @ChartPathik for NSE & MCX

& @ChartPathik_Global for US Ins. & Crypto

WhatsApp: +91-99293-91467 for updates.

Track: Indian & US Markets

Indices | Commodities | Crypto

Telegram: @ChartPathik for NSE & MCX

& @ChartPathik_Global for US Ins. & Crypto

WhatsApp: +91-99293-91467 for updates.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

Technical Chart Analyst

Track: Indian & US Markets

Indices | Commodities | Crypto

Telegram: @ChartPathik for NSE & MCX

& @ChartPathik_Global for US Ins. & Crypto

WhatsApp: +91-99293-91467 for updates.

Track: Indian & US Markets

Indices | Commodities | Crypto

Telegram: @ChartPathik for NSE & MCX

& @ChartPathik_Global for US Ins. & Crypto

WhatsApp: +91-99293-91467 for updates.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน