Intraday trend on 15m/30m remains down. The 6,396–6,407 band is the pivot/decision zone. Tomorrow’s session is dominated by Powell’s Jackson Hole keynote (10:00 ET) — plan around it.

Fundamentals & Risk Clock (ET)

• 10:00 — Fed Chair Powell speaks at the Jackson Hole Economic Policy Symposium. Treat this as the day’s primary catalyst; no new entries 09:55–10:05 per risk rules.

• Otherwise, the U.S. calendar is relatively light vs. today’s prints; markets will key off the Powell tone and subsequent positioning.

Structure Map (carry-forward levels)

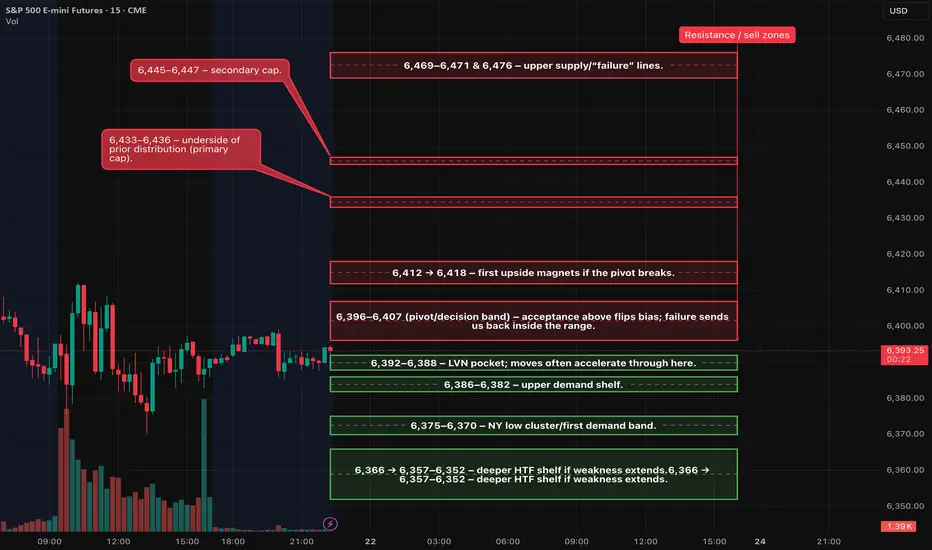

Resistance / sell zones

• 6,396–6,407 (pivot/decision band) – acceptance above flips bias; failure sends us back inside the range.

• 6,412 → 6,418 – first upside magnets if the pivot breaks.

• 6,433–6,436 – underside of prior distribution (primary cap).

• 6,445–6,447 – secondary cap.

• 6,469–6,471 & 6,476 – upper supply/“failure” lines.

Support / buy zones

• 6,392–6,388 – LVN pocket; moves often accelerate through here.

• 6,386–6,382 – upper demand shelf.

• 6,375–6,370 – NY low cluster/first demand band.

• 6,366 → 6,357–6,352 – deeper HTF shelf if weakness extends.

Preferred Setup (A++): Range-Continuation Short

Take only with confirmation; score ≥9.

• Trigger: First 5-minute close ≤ 6,390.5 after a failed probe of 6,396–6,407, and the next bar fails to reclaim 6,392–6,394.

• Entry: 6,390.5 (MOS).

• Stop: 6,396.5 (≈6 pts).

• Targets:

• TP1: 6,375.5 (+15)

• TP2: 6,366.0 (+24)

• TP3: 6,358.0 (+32)

• Management: Scale ½ at TP1; move stop → BE only after a fresh 5m lower-low or a clean close through the TP1 zone. If no extension within 2×5m bars, cut to half/scratch.

• Disqualifiers: Thick support immediately stacks under entry or a 15m acceptance back above 6,396–6,407.

Flip Setup (A++ if accepted): Acceptance Long above Pivot

Counter-trend unless 15m turns; size accordingly.

• Trigger: First 5-minute close ≥ 6,407.5 and the next bar does not reclaim < 6,405.

• Entry: 6,407.5 (MOS).

• Stop: 6,401.5 (≈6 pts).

• Targets:

• TP1: 6,418.0 (+10.5 from trigger; acceptable given clean path)

• TP2: 6,435.0 (+27.5)

• TP3: trail toward 6,446+ if momentum persists.

• Disqualifier: Quick slip back < 6,405 after trigger.

Timing & Playbook

• Primary trade windows: 09:45–11:30 ET and 13:50–15:45 ET.

• Powell (10:00 ET): Plan around the speech; entries before the print must have exceptional quality, otherwise wait for post-event structure.

• MOC module (15:40–16:10 ET): Use the imbalance as a tiebreaker: modest (<$0.5B) = range; strong (≥$1B) can drive a directional push into the cross.

Fundamentals & Risk Clock (ET)

• 10:00 — Fed Chair Powell speaks at the Jackson Hole Economic Policy Symposium. Treat this as the day’s primary catalyst; no new entries 09:55–10:05 per risk rules.

• Otherwise, the U.S. calendar is relatively light vs. today’s prints; markets will key off the Powell tone and subsequent positioning.

Structure Map (carry-forward levels)

Resistance / sell zones

• 6,396–6,407 (pivot/decision band) – acceptance above flips bias; failure sends us back inside the range.

• 6,412 → 6,418 – first upside magnets if the pivot breaks.

• 6,433–6,436 – underside of prior distribution (primary cap).

• 6,445–6,447 – secondary cap.

• 6,469–6,471 & 6,476 – upper supply/“failure” lines.

Support / buy zones

• 6,392–6,388 – LVN pocket; moves often accelerate through here.

• 6,386–6,382 – upper demand shelf.

• 6,375–6,370 – NY low cluster/first demand band.

• 6,366 → 6,357–6,352 – deeper HTF shelf if weakness extends.

Preferred Setup (A++): Range-Continuation Short

Take only with confirmation; score ≥9.

• Trigger: First 5-minute close ≤ 6,390.5 after a failed probe of 6,396–6,407, and the next bar fails to reclaim 6,392–6,394.

• Entry: 6,390.5 (MOS).

• Stop: 6,396.5 (≈6 pts).

• Targets:

• TP1: 6,375.5 (+15)

• TP2: 6,366.0 (+24)

• TP3: 6,358.0 (+32)

• Management: Scale ½ at TP1; move stop → BE only after a fresh 5m lower-low or a clean close through the TP1 zone. If no extension within 2×5m bars, cut to half/scratch.

• Disqualifiers: Thick support immediately stacks under entry or a 15m acceptance back above 6,396–6,407.

Flip Setup (A++ if accepted): Acceptance Long above Pivot

Counter-trend unless 15m turns; size accordingly.

• Trigger: First 5-minute close ≥ 6,407.5 and the next bar does not reclaim < 6,405.

• Entry: 6,407.5 (MOS).

• Stop: 6,401.5 (≈6 pts).

• Targets:

• TP1: 6,418.0 (+10.5 from trigger; acceptable given clean path)

• TP2: 6,435.0 (+27.5)

• TP3: trail toward 6,446+ if momentum persists.

• Disqualifier: Quick slip back < 6,405 after trigger.

Timing & Playbook

• Primary trade windows: 09:45–11:30 ET and 13:50–15:45 ET.

• Powell (10:00 ET): Plan around the speech; entries before the print must have exceptional quality, otherwise wait for post-event structure.

• MOC module (15:40–16:10 ET): Use the imbalance as a tiebreaker: modest (<$0.5B) = range; strong (≥$1B) can drive a directional push into the cross.

If you want to contact me here is my Discord channel discord.gg/wPHfYgv892

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

If you want to contact me here is my Discord channel discord.gg/wPHfYgv892

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน