OPEN-SOURCE SCRIPT

Anchored VWAP

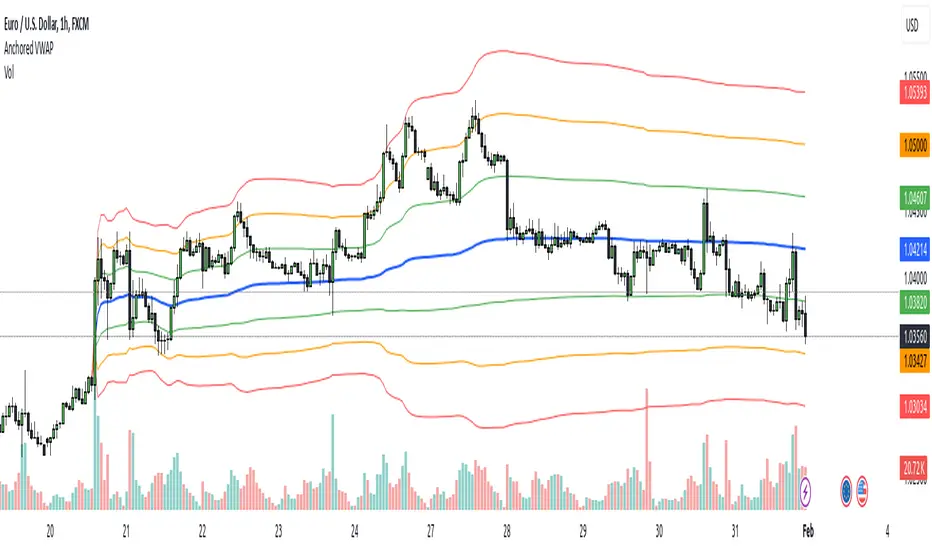

Anchored VWAP with 3 Standard Deviation Bands

📈 Version: Pine Script v5

📌 Author: Aymen Haddaji

🔍 Overview

This indicator calculates an Anchored Volume-Weighted Average Price (AVWAP), allowing traders to anchor the VWAP calculation from a user-defined date and time. It also plots three standard deviation bands above and below the AVWAP to help identify potential areas of overbought and oversold conditions.

📊 Features & Functionality

✔ Custom Anchor Point: Select a specific date and time to start the AVWAP calculation.

✔ OHLC/4 Calculation: Uses the average of Open, High, Low, and Close to smooth the price input.

✔ Three Standard Deviation Bands:

1st Deviation (Green): Moderate volatility zone.

2nd Deviation (Orange): High volatility zone.

3rd Deviation (Red): Extreme overbought/oversold areas.

✔ Real-Time Calculation: Updates dynamically with each price movement.

✔ Clear Visuals:

AVWAP (Blue Line) represents the fair market price from the anchor.

Deviation Bands (Dashed Lines) show potential support and resistance levels.

🛠 How It Works

VWAP Calculation

Uses a cumulative sum of price × volume divided by cumulative volume.

Calculation starts from the user-defined anchor time.

Standard Deviation Bands

Measures the price dispersion around the AVWAP.

The wider the bands, the higher the volatility.

When price touches or exceeds the 3rd deviation, a potential reversal zone is indicated.

Trading Strategies with AVWAP & Deviation Bands

Trend Confirmation:

Price above AVWAP = Uptrend (bullish).

Price below AVWAP = Downtrend (bearish).

Support & Resistance:

AVWAP acts as dynamic support or resistance.

1st & 2nd deviations often act as secondary levels.

Mean Reversion Trading:

When price reaches the 3rd standard deviation, a pullback is likely.

Breakout Confirmation:

A strong close above/below the 3rd deviation may indicate trend continuation.

⚙️ Input Settings

📍 Anchor Time: Allows you to set the exact date and time to start the AVWAP calculation.

🎯 Ideal For

✅ Intraday traders looking for short-term mean reversion plays.

✅ Swing traders identifying key support/resistance zones.

✅ Trend traders confirming long-term market direction.

✅ Volatility traders using standard deviation for trade entries.

📈 Version: Pine Script v5

📌 Author: Aymen Haddaji

🔍 Overview

This indicator calculates an Anchored Volume-Weighted Average Price (AVWAP), allowing traders to anchor the VWAP calculation from a user-defined date and time. It also plots three standard deviation bands above and below the AVWAP to help identify potential areas of overbought and oversold conditions.

📊 Features & Functionality

✔ Custom Anchor Point: Select a specific date and time to start the AVWAP calculation.

✔ OHLC/4 Calculation: Uses the average of Open, High, Low, and Close to smooth the price input.

✔ Three Standard Deviation Bands:

1st Deviation (Green): Moderate volatility zone.

2nd Deviation (Orange): High volatility zone.

3rd Deviation (Red): Extreme overbought/oversold areas.

✔ Real-Time Calculation: Updates dynamically with each price movement.

✔ Clear Visuals:

AVWAP (Blue Line) represents the fair market price from the anchor.

Deviation Bands (Dashed Lines) show potential support and resistance levels.

🛠 How It Works

VWAP Calculation

Uses a cumulative sum of price × volume divided by cumulative volume.

Calculation starts from the user-defined anchor time.

Standard Deviation Bands

Measures the price dispersion around the AVWAP.

The wider the bands, the higher the volatility.

When price touches or exceeds the 3rd deviation, a potential reversal zone is indicated.

Trading Strategies with AVWAP & Deviation Bands

Trend Confirmation:

Price above AVWAP = Uptrend (bullish).

Price below AVWAP = Downtrend (bearish).

Support & Resistance:

AVWAP acts as dynamic support or resistance.

1st & 2nd deviations often act as secondary levels.

Mean Reversion Trading:

When price reaches the 3rd standard deviation, a pullback is likely.

Breakout Confirmation:

A strong close above/below the 3rd deviation may indicate trend continuation.

⚙️ Input Settings

📍 Anchor Time: Allows you to set the exact date and time to start the AVWAP calculation.

🎯 Ideal For

✅ Intraday traders looking for short-term mean reversion plays.

✅ Swing traders identifying key support/resistance zones.

✅ Trend traders confirming long-term market direction.

✅ Volatility traders using standard deviation for trade entries.

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน