PROTECTED SOURCE SCRIPT

TONYLASUERTE

Indicator Description

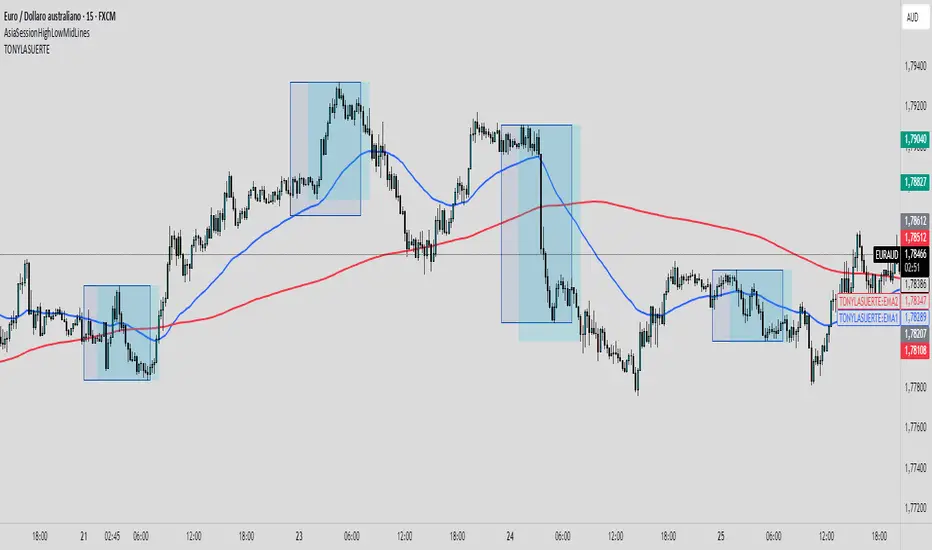

This indicator is designed to provide a clear market reading by combining trend analysis, low-activity zones, and potential reaction signals:

- Moving Averages (50 and 200 periods): the 50-period (blue) and 200-period (red) moving averages help define the overall market trend while also acting as dynamic support and resistance levels. Their alignment or crossover serves as a key signal for assessing market strength.

- Asian Session Highlighting: the indicator marks rectangles over the Asian session ranges, a phase typically characterized by low volatility and tight ranges. This helps avoid trading in low-interest conditions and focus on more liquid phases.

- Post-Asia Reactions: the imbalance occurring after the Asian session is highlighted, making it easier to spot potential breakout points and the start of directional moves.

- Divergent Candles (visual signals): divergence candles are highlighted with different colors. When combined with the moving averages and the post-Asia imbalance, they can anticipate possible reversals or confirm trend continuation.

📌 Indicator Objective: filter out low-quality trading phases, highlight key reaction zones, and improve entry timing by leveraging the interaction between trend (moving averages), divergences, and post-Asian session dynamics.

This indicator is designed to provide a clear market reading by combining trend analysis, low-activity zones, and potential reaction signals:

- Moving Averages (50 and 200 periods): the 50-period (blue) and 200-period (red) moving averages help define the overall market trend while also acting as dynamic support and resistance levels. Their alignment or crossover serves as a key signal for assessing market strength.

- Asian Session Highlighting: the indicator marks rectangles over the Asian session ranges, a phase typically characterized by low volatility and tight ranges. This helps avoid trading in low-interest conditions and focus on more liquid phases.

- Post-Asia Reactions: the imbalance occurring after the Asian session is highlighted, making it easier to spot potential breakout points and the start of directional moves.

- Divergent Candles (visual signals): divergence candles are highlighted with different colors. When combined with the moving averages and the post-Asia imbalance, they can anticipate possible reversals or confirm trend continuation.

📌 Indicator Objective: filter out low-quality trading phases, highlight key reaction zones, and improve entry timing by leveraging the interaction between trend (moving averages), divergences, and post-Asian session dynamics.

สคริปต์ที่ได้รับการป้องกัน

สคริปต์นี้ถูกเผยแพร่เป็นแบบ closed-source อย่างไรก็ตาม คุณสามารถใช้ได้อย่างอิสระและไม่มีข้อจำกัดใดๆ – เรียนรู้เพิ่มเติมได้ที่นี่

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

สคริปต์ที่ได้รับการป้องกัน

สคริปต์นี้ถูกเผยแพร่เป็นแบบ closed-source อย่างไรก็ตาม คุณสามารถใช้ได้อย่างอิสระและไม่มีข้อจำกัดใดๆ – เรียนรู้เพิ่มเติมได้ที่นี่

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน