OPEN-SOURCE SCRIPT

ที่อัปเดต: Crash Stats 15m (ETH) — X% | prev RTH min(VWAP, Close)

# Crash Stats 15m (ETH) — X% Drawdown Event Analyzer

A 15-minute indicator that scans up to the last 5 years to find **crash events** where the close falls by at least **X%** relative to the **lower of** the prior day’s **RTH VWAP** and **RTH close**. It then measures recovery and follow-through behavior, tags the market regime around each event, and summarizes everything in a table.

---

## What the script detects

**Crash event (trigger):**

* On a 15-minute bar, `close <= refPrice * (1 - X%)`.

* `refPrice = min(previous RTH VWAP, previous RTH close)`.

* First touch only: subsequent bars below the threshold on the same trading day are ignored.

* Extended hours (ETH) are supported; if ETH is off, the script safely infers the previous RTH reference.

**Per-event measurements**

1. **Time to “turn up”** – first close **above the event-anchored AVWAP** (AVWAP cumulated from the trigger bar onward).

2. **Time to recover the reference price** – first close ≥ `refPrice`.

3. **Time to recover Y% above the crash-day average price** – first close ≥ `crashDayVWAP * (1+Y%)`.

4. **Post-crash lowest price & timing** – the lowest low and how long after the event it occurs, within a user-defined horizon (default 10 trading days, approximated in calendar days).

5. **Intraday RTH low timing** – on the crash day’s RTH session, when did the day’s intraday low occur, and **was it on the first 15-minute bar**?

6. **First 15-minute low of the RTH day** – recorded for context.

All durations are shown as **D days H hours M minutes**.

---

## Regime tagging (A / B)

For each event the script classifies the surrounding trend using daily closes:

* Let `r6m = (prevClose – close_6mAgo) / close_6mAgo`,

`r12m = (prevClose – close_12mAgo) / close_12mAgo`.

* **A**: both `r6m > 0` and `r12m > 0` (uptrend across 6m & 12m).

* **B**: one positive, one negative, and `r6m + r12m ≥ 0` (mixed but net non-negative).

* Otherwise: **—**.

This helps separate selloffs in strong uptrends (A) from mixed regimes (B) and others.

---

## Inputs

* **X — Crash threshold (%)**: default 5.

* **Y — Recovery above crash-day average (%)**: default 5.

* **Lookback years**: default 5 (bounded by data availability).

* **Horizon for post-crash lowest (trading days)**: default 10 (approximated as calendar days).

* **RTH session**: default `09:30–16:00` (exchange timezone).

* **Show markers**: plot labels on triggers.

* **Rows to display**: last N events in the table.

---

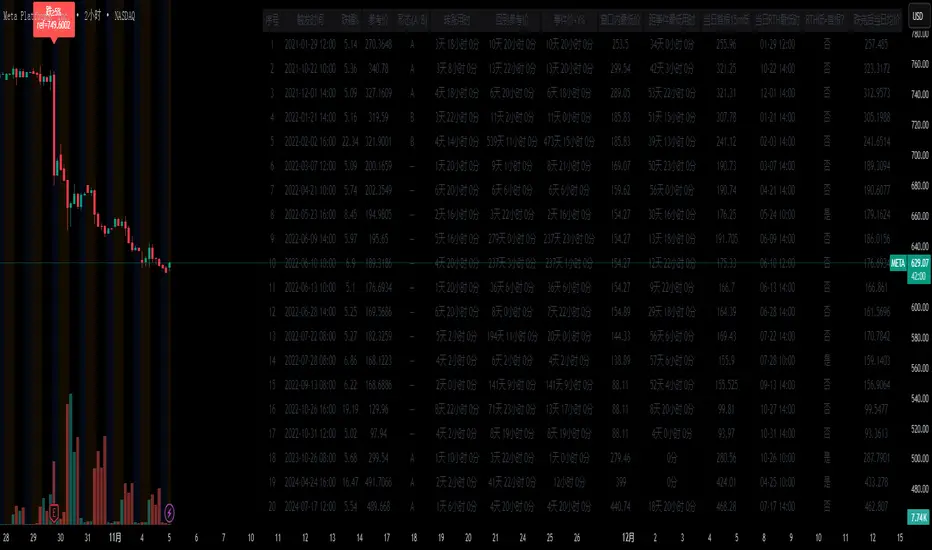

## Table columns

* Index, **Trigger time**, **Drop %**, **Ref price**, **Regime (A/B/—)**

* **Time to turn up** (above anchored AVWAP)

* **Time to ref price**, **Time to day VWAP + Y%**

* **Window lowest price**, **Time to window low**

* **RTH first-15m low**, **RTH lowest time**, **Was RTH low on first 15m?**

* **Crash-day VWAP**

---

## How to use

1. **Set chart to 15-minute** and **enable extended hours** for equities (recommended).

2. Keep defaults (**X=5%, Y=5%**) to start; tighten to 3–4% for more frequent events on less volatile symbols.

3. For non-US symbols or futures, adjust the **RTH session** if needed.

4. Read the table (top-right) for per-event diagnostics and aggregate averages (bottom row).

---

## Notes & implementation details

* Works whether ETH is on or off. If ETH is off, the script back-fills “previous RTH” references at the next RTH open and uses the prior daily close as a fallback.

* The “turn up” definition uses **event-anchored AVWAP**, a robust, price–volume anchor widely used for post-shock mean reversion analysis.

* Events are **de-duplicated**: only one event per trading day (per target RTH cycle).

* Lookback is limited by your plan and the data vendor. The script requests deep history (`max_bars_back=50000`), but availability varies by symbol.

* Durations use minute precision and are rendered as **days–hours–minutes** for readability.

---

## Quick troubleshooting

* **No events found**: lower **X%**, enable **ETH**, or ensure sufficient history is loaded (scroll back, or briefly switch to a higher timeframe to force deeper backfill, then return to 15m).

* **RTH boundaries off**: check the **RTH session** input matches the venue.

* **Few rows in table**: increase **Rows to display**.

---

## Typical use cases

* Back-test how fast different symbols tend to stabilize after a sharp gap-down or intraday shock.

* Compare recovery behavior across regimes **A / B** for sizing and risk timing.

* Build playbooks: e.g., if the RTH low occurs on the first 15m bar X% of the time, plan entries accordingly.

---

## Changelog

* **v1.0**: Initial public release with crash detection, anchored-AVWAP reversal, reference & VWAP+Y recovery timers, regime tagging, window-low timing, RTH low timing, and first-15m low capture.

A 15-minute indicator that scans up to the last 5 years to find **crash events** where the close falls by at least **X%** relative to the **lower of** the prior day’s **RTH VWAP** and **RTH close**. It then measures recovery and follow-through behavior, tags the market regime around each event, and summarizes everything in a table.

---

## What the script detects

**Crash event (trigger):**

* On a 15-minute bar, `close <= refPrice * (1 - X%)`.

* `refPrice = min(previous RTH VWAP, previous RTH close)`.

* First touch only: subsequent bars below the threshold on the same trading day are ignored.

* Extended hours (ETH) are supported; if ETH is off, the script safely infers the previous RTH reference.

**Per-event measurements**

1. **Time to “turn up”** – first close **above the event-anchored AVWAP** (AVWAP cumulated from the trigger bar onward).

2. **Time to recover the reference price** – first close ≥ `refPrice`.

3. **Time to recover Y% above the crash-day average price** – first close ≥ `crashDayVWAP * (1+Y%)`.

4. **Post-crash lowest price & timing** – the lowest low and how long after the event it occurs, within a user-defined horizon (default 10 trading days, approximated in calendar days).

5. **Intraday RTH low timing** – on the crash day’s RTH session, when did the day’s intraday low occur, and **was it on the first 15-minute bar**?

6. **First 15-minute low of the RTH day** – recorded for context.

All durations are shown as **D days H hours M minutes**.

---

## Regime tagging (A / B)

For each event the script classifies the surrounding trend using daily closes:

* Let `r6m = (prevClose – close_6mAgo) / close_6mAgo`,

`r12m = (prevClose – close_12mAgo) / close_12mAgo`.

* **A**: both `r6m > 0` and `r12m > 0` (uptrend across 6m & 12m).

* **B**: one positive, one negative, and `r6m + r12m ≥ 0` (mixed but net non-negative).

* Otherwise: **—**.

This helps separate selloffs in strong uptrends (A) from mixed regimes (B) and others.

---

## Inputs

* **X — Crash threshold (%)**: default 5.

* **Y — Recovery above crash-day average (%)**: default 5.

* **Lookback years**: default 5 (bounded by data availability).

* **Horizon for post-crash lowest (trading days)**: default 10 (approximated as calendar days).

* **RTH session**: default `09:30–16:00` (exchange timezone).

* **Show markers**: plot labels on triggers.

* **Rows to display**: last N events in the table.

---

## Table columns

* Index, **Trigger time**, **Drop %**, **Ref price**, **Regime (A/B/—)**

* **Time to turn up** (above anchored AVWAP)

* **Time to ref price**, **Time to day VWAP + Y%**

* **Window lowest price**, **Time to window low**

* **RTH first-15m low**, **RTH lowest time**, **Was RTH low on first 15m?**

* **Crash-day VWAP**

---

## How to use

1. **Set chart to 15-minute** and **enable extended hours** for equities (recommended).

2. Keep defaults (**X=5%, Y=5%**) to start; tighten to 3–4% for more frequent events on less volatile symbols.

3. For non-US symbols or futures, adjust the **RTH session** if needed.

4. Read the table (top-right) for per-event diagnostics and aggregate averages (bottom row).

---

## Notes & implementation details

* Works whether ETH is on or off. If ETH is off, the script back-fills “previous RTH” references at the next RTH open and uses the prior daily close as a fallback.

* The “turn up” definition uses **event-anchored AVWAP**, a robust, price–volume anchor widely used for post-shock mean reversion analysis.

* Events are **de-duplicated**: only one event per trading day (per target RTH cycle).

* Lookback is limited by your plan and the data vendor. The script requests deep history (`max_bars_back=50000`), but availability varies by symbol.

* Durations use minute precision and are rendered as **days–hours–minutes** for readability.

---

## Quick troubleshooting

* **No events found**: lower **X%**, enable **ETH**, or ensure sufficient history is loaded (scroll back, or briefly switch to a higher timeframe to force deeper backfill, then return to 15m).

* **RTH boundaries off**: check the **RTH session** input matches the venue.

* **Few rows in table**: increase **Rows to display**.

---

## Typical use cases

* Back-test how fast different symbols tend to stabilize after a sharp gap-down or intraday shock.

* Compare recovery behavior across regimes **A / B** for sizing and risk timing.

* Build playbooks: e.g., if the RTH low occurs on the first 15m bar X% of the time, plan entries accordingly.

---

## Changelog

* **v1.0**: Initial public release with crash detection, anchored-AVWAP reversal, reference & VWAP+Y recovery timers, regime tagging, window-low timing, RTH low timing, and first-15m low capture.

เอกสารเผยแพร่

# Crash Stats 15m (ETH) – Publication NotesA 15-minute scanner that finds historical crash events and measures how prices recover. It works on both RTH and ETH, and is designed for repeatable, exportable research.

## What it detects

An event is triggered when the 15-minute close falls by at least X% versus the reference price:

* Reference = min(previous RTH VWAP, previous RTH close).

* Default X = 5%.

* Events are de-duplicated: at most one event per trading day.

## What it measures (per event)

1. Time to turn up

First 15-minute bar where both conditions hold:

* Close > previous day’s close, and

* Today’s natural-day VWAP > previous day’s natural-day VWAP.

2. Time to reclaim reference price

First close ≥ the reference price defined above.

3. Time to recover Y% from the event base

* Event base = the event bar’s close.

* If the event occurs in ETH and the option is enabled, the base is updated to the lowest low observed until the next RTH open (captures “post-crash final dip”).

* Target = base × (1 + Y%). Default Y = 5%.

4. Post-crash window low

Lowest price and its time within a user-set window (approx. N trading days, implemented with natural days). Default window = 10 days.

5. RTH intraday extremes on the crash day

* First 15-minute bar’s low.

* RTH session’s lowest price and its timestamp.

* Boolean: did the RTH low occur on the first 15-minute bar?

6. Regime label (A/B) at the time of crash

* A: 6-month return > 0 and 12-month return > 0 (using the prior day’s closes).

* B: one positive and one negative, with (6m + 12m) ≥ 0.

* Else: —.

## Inputs

* X — Drop threshold (%) [default 5.0]

* Y — Recovery from event base (%) [default 5.0]

* Lookback years [default 5]

* Post-crash window (trading days) [default 10]

* RTH session time [default 09:30–16:00 exchange time]

* Show markers on chart [on]

* Table rows to display [default 40]

* Y% base update in ETH [on]

* Export settings:

* Enable export via Data Window

* Persist one bar (keeps values one extra bar to make Export easier)

* Optional: snapshot-to-alert/Webhook chunks (CSV)

## Table columns

* ID

* Trigger time (exchange time)

* Drop% (vs reference)

* Reference price

* Regime (A/B/—)

* Time to turn up

* Time to reference

* Time to Y% recovery (from event base; ETH base trailing if enabled)

* Window low (price)

* Time to window low

* First 15m low (crash day)

* RTH low time (crash day)

* RTH low is first-15m?

* Crash-day natural-day VWAP (for context)

Times are shown as d h m in the on-chart table; exported values are in minutes.

## ETH/RTH handling

* Reference uses the previous RTH only.

* Event detection runs on all bars (ETH included).

* If the crash occurs in ETH and the option is on, the Y% base trails to the lowest low until the next RTH open, then freezes.

## How to use

1. Add to a 15-minute chart. For ETH analysis, enable Extended Hours in TradingView.

2. Set X/Y, lookback years, post-crash window, and RTH session to match the venue.

3. Read the table for the last N events; markers show trigger bars.

4. For CSV:

* Turn on Enable export (Data Window).

* Use TradingView’s Export chart data; the series are named exp_*.

* Or enable snapshot-to-alert to push a full CSV via Any alert() function call.

## Notes and limits

* 15-minute resolution is assumed for triggers and timing. You can view on other timeframes, but precision is anchored to 15m closes.

* Post-crash window approximates trading days with natural days; ±1 day drift is possible on illiquid symbols/holidays.

* Backfill of previous-RTH reference is handled whether ETH is on or off.

* Historical depth depends on your data plan; some symbols may not have full 5-year 15m history.

## Interpretation tips

* A vs B regimes often split “crashes in uptrends” vs “mixed/transition regimes.” Compare average times across regimes.

* The ETH trailing-low base is useful for after-hours dumps; disable it if you prefer a strictly event-bar-close baseline.

* Combine with volatility or liquidity filters when comparing symbols.

## Change log (current)

* Turn-up definition changed to Close > prior day’s Close and Today VWAP > prior day VWAP.

* Y% recovery now uses event base; optional ETH trailing-low until next RTH.

* Added first-15m low, RTH low timing/flag, regime labels, and robust export paths.

* De-duplicate events within one trading day.

If you want, I can add a short, punchy marketplace blurb and screenshots checklist to go with this.

เอกสารเผยแพร่

# Crash Stats 15m (ETH) — Publication NotesA 15-minute research tool that finds historical crash events and measures how prices recover across ETH and RTH. Built for reproducible stats and export.

# What it detects

An event triggers when the 15-minute close falls by at least X% versus the reference price:

* Reference price = min(previous RTH VWAP, previous RTH close).

* Default X = 5%.

* De-duplication: at most one event per trading day.

# What it measures per event

1. Time to turn up

First 15-minute bar where both hold:

* Close > prior day’s close, and

* Today’s natural-day VWAP > prior day’s natural-day VWAP.

2. Time to reclaim reference

First close ≥ reference price.

3. Time to recover Y% from the event base

* Base = event bar’s close.

* If the event is in ETH and the option is enabled, the base trails to the lowest low until the next RTH open, then freezes.

* Target = base × (1 + Y%), default Y = 5%.

4. Post-crash window low

Lowest price and its timestamp within a user window (approx. N trading days, implemented with natural days). Default = 10.

5. RTH intraday extremes on the crash day

* First 15-minute bar low.

* RTH session lowest price and its timestamp.

* Flag: did the RTH low occur on the first 15-minute bar.

6. Regime label at crash time

* A: 6-month return > 0 and 12-month return > 0 (using prior-day closes).

* B: one positive and one negative, with 6m + 12m ≥ 0.

* Else: —.

7. Post-dip same-day average price

Average price from the dip-base timestamp to that natural day’s end (VWAP from base-time to 24:00). Matches the Y% base logic, including ETH trailing until next RTH if enabled.

# Inputs

* X: drop threshold percent (default 5.0)

* Y: recovery from event base percent (default 5.0)

* Lookback years (default 5)

* Post-crash window length in trading days (default 10)

* RTH session time (default 09:30–16:00, exchange time)

* Show chart markers (on)

* Table rows to display (default 40)

* ETH base trailing for Y% (on)

* Export options

* Data Window export (numeric exp_* series)

* Snapshot-to-alert/Webhook CSV (time strings consistent with the on-chart table)

# Table columns

* ID

* Trigger time (exchange time)

* Drop% (vs reference)

* Reference price

* Regime (A/B/—)

* Time to turn up

* Time to reference

* Time to Y% recovery

* Window low (price)

* Time to window low

* First 15m low (crash day)

* RTH low time (crash day)

* RTH low is first-15m

* Post-dip same-day average price

On-chart times are rendered as d h m. Webhook CSV uses the same human-readable format; Data Window export uses minutes for machine use.

# ETH/RTH handling

* Reference uses previous RTH only.

* Detection runs on all bars.

* For ETH events with trailing enabled, the Y% base and the dip-base timestamp update to the lowest low until the next RTH open; post-dip average then freezes for that natural day.

# How to use

1. Add on a 15-minute chart; enable Extended Hours for ETH.

2. Set X, Y, lookback, window, and RTH session for the venue.

3. Read the table for the last N events; markers show triggers.

4. Export

* Data Window: enable export, use TradingView’s Export chart data to get exp_* numeric series.

* Webhook: enable snapshot export, create an alert with Any alert() function call to receive full CSV chunks containing table-style time strings and postdip_avg.

# Notes and limits

* Precision is anchored to 15-minute closes.

* Window uses natural days to approximate trading days; ±1 day drift is possible around holidays/illiquid symbols.

* Historical depth depends on your data plan; some symbols may not provide full 5-year 15-minute history.

# Interpretation tips

* Compare recovery timings across regimes A vs B to separate crashes in uptrends vs mixed regimes.

* ETH trailing is helpful for after-hours dumps; turn it off if you prefer a strict event-bar baseline.

* Combine with volatility/liquidity filters when comparing symbols.

# Change log (current)

* Turn-up definition switched to close > prior close and today VWAP > prior day VWAP.

* Y% recovery now from event base; optional ETH trailing to next RTH.

* Added post-dip same-day average price and aligned webhook CSV times with the table.

* Added first-15m low, RTH low timing/flag, regime labels, robust export paths, and per-day de-duplication.

Marketplace blurb

A 15-minute ETH/RTH crash scanner that tags X% selloffs, measures multiple recovery clocks, and exports clean stats. Supports ETH trailing bases, regime labeling, window lows, first-15m/RTH lows, and post-dip same-day averages with table-style time formatting.

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้มันเป็นโอเพ่นซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันการทำงานของสคริปต์ได้ ขอแสดงความชื่นชมผู้เขียน! แม้ว่าคุณจะสามารถใช้งานได้ฟรี แต่อย่าลืมว่าการเผยแพร่โค้ดซ้ำนั้นจะต้องเป็นไปตามกฎระเบียบการใช้งานของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้มันเป็นโอเพ่นซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันการทำงานของสคริปต์ได้ ขอแสดงความชื่นชมผู้เขียน! แม้ว่าคุณจะสามารถใช้งานได้ฟรี แต่อย่าลืมว่าการเผยแพร่โค้ดซ้ำนั้นจะต้องเป็นไปตามกฎระเบียบการใช้งานของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน