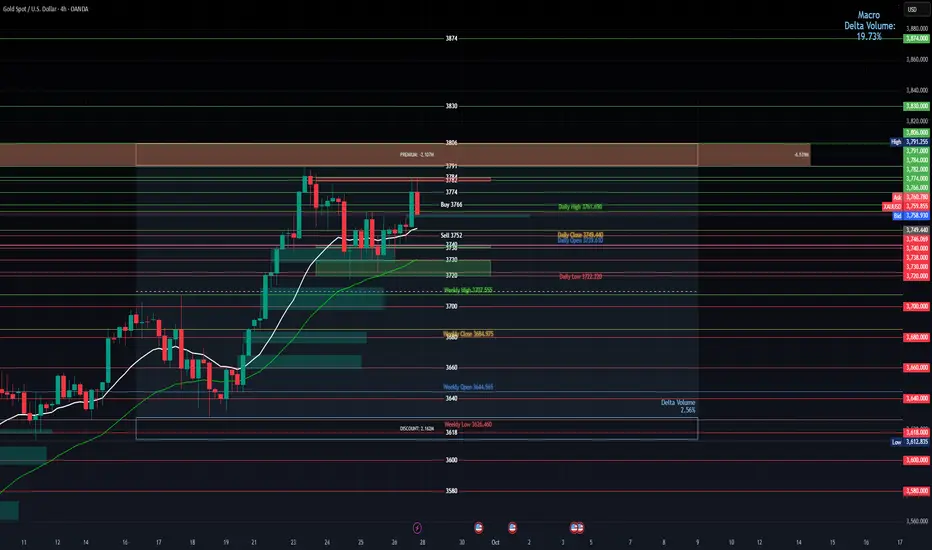

H4 structure and levels

Bias: Still bullish (higher highs/lows), price above EMAs.

Supply/resistance: 3774, 3781–3806 (primary supply), 3830, 3874.

Demand/support: 3750–3745 (pivot/EMA confluence), 3738–3735, 3730–3720, 3707, 3685.

Volatility context: Typical H4 range about $12–$20; your $5 stop is ~25–40% of that—usable, but it demands precise triggers.

Setup 1: Buy 3766

Context: Long below major supply (3781–3806); limited clearance overhead.

Probability:

Taken as marked (3766 with 50‑pip/$5 stop): 40–45% due to frequent pullbacks before any breakout.

Improves to ~58–65% if you only take it after H4 acceptance above 3781 (close above, then a held retest of 3778–3781).

Alternative long with same stop: buy a pullback at 3750 ±0.5 with SL 3745; ~55–60% since you’re buying demand, not into supply.

Targets and R:R (risk = 50 pips = $500/lot):

T1 3774: +80 pips ≈ 1.6R

T2 3791: +250 pips ≈ 5.0R

T3 3806–3830: +400–640 pips ≈ 8–12.8R

Setup 2: Sell 3752

Context: Counter‑trend into layered demand (3738 → 3720) with EMAs below.

Probability:

As marked (3752 with a 50‑pip stop): 35–40% while H4 holds above 3745.

Improves to ~55–60% only after a clean H4 breakdown/close below 3738–3735 and a failed retest (sell 3738–3742, SL 3743–3745).

Higher‑quality short that fits the stop: fade 3781–3806 on H4 rejection (enter 3800–3805, SL 3805–3810); ~56–62%.

Targets and R:R (risk = 50 pips):

T1 3738: +140 pips ≈ 2.8R

T2 3730: +220 pips ≈ 4.4R

T3 3707: +450 pips ≈ 9.0R

Which ideas best match a 50‑pip/$500 max stop

Longs: Prefer 3750–3745 pullbacks or post‑acceptance above 3781. Avoid chasing 3766 into supply without confirmation.

Shorts: Prefer H4 rejection inside 3781–3806, or breakdown/retest short after an H4 close below 3738.

Entry filters and management

Long filter: Either H4 close >3781 and hold retest, or wick‑down into 3750–3745 that quickly reclaims 3755+.

Short filter: H4 long‑wick rejection in 3781–3806 with lower close, or H4 close <3738 and failed retest into 3738–3742.

Move to breakeven after +80–120 pips or once the nearest opposing level is cleared (e.g., long above 3774; short below 3738).

Scale partials at first objective (3774 for longs, 3738 for shorts); let runners aim for 3791/3806 or 3730/3707.

Week‑ahead catalysts (verify exact dates on your calendar)

Likely in the coming week: ISM Manufacturing (early week), JOLTS (early week), ADP (mid‑week), ISM Services (later), and NFP/Unemployment/Average Hourly Earnings (Fri, Oct 3).

Implications:

Strong labor/earnings or firm ISM Prices Paid → higher yields/stronger USD → bearish gold. Favors shorts from 3781–3806 or breakdowns below 3738.

Softer data → weaker USD/real yields → bullish gold. Favors buy‑the‑dip at 3750 or break‑and‑hold above 3781.

Tactics: Avoid initiating fresh breakouts within 12–24h of NFP; if in profit pre‑data, consider partials and protective stops at BE or just beyond structure.

Position sizing

Lot size = Account risk $ / (50 pips × $10). Example: risking $500 → 1.00 lot; risking $250 → 0.50 lot.

Bottom line

Buy 3766: 40–45% as marked; 58–65% after acceptance above 3781 or from a 3750 pullback.

Sell 3752: 35–40% into demand; 55–60% after a 3738 breakdown/retest or on a rejection from 3781–3806.

With a strict 50‑pip/$500 stop, the cleanest plays are: buy 3750–3745 or post‑acceptance above 3781; sell rejections in 3781–3806 or breakdowns below 3738.

Bias: Still bullish (higher highs/lows), price above EMAs.

Supply/resistance: 3774, 3781–3806 (primary supply), 3830, 3874.

Demand/support: 3750–3745 (pivot/EMA confluence), 3738–3735, 3730–3720, 3707, 3685.

Volatility context: Typical H4 range about $12–$20; your $5 stop is ~25–40% of that—usable, but it demands precise triggers.

Setup 1: Buy 3766

Context: Long below major supply (3781–3806); limited clearance overhead.

Probability:

Taken as marked (3766 with 50‑pip/$5 stop): 40–45% due to frequent pullbacks before any breakout.

Improves to ~58–65% if you only take it after H4 acceptance above 3781 (close above, then a held retest of 3778–3781).

Alternative long with same stop: buy a pullback at 3750 ±0.5 with SL 3745; ~55–60% since you’re buying demand, not into supply.

Targets and R:R (risk = 50 pips = $500/lot):

T1 3774: +80 pips ≈ 1.6R

T2 3791: +250 pips ≈ 5.0R

T3 3806–3830: +400–640 pips ≈ 8–12.8R

Setup 2: Sell 3752

Context: Counter‑trend into layered demand (3738 → 3720) with EMAs below.

Probability:

As marked (3752 with a 50‑pip stop): 35–40% while H4 holds above 3745.

Improves to ~55–60% only after a clean H4 breakdown/close below 3738–3735 and a failed retest (sell 3738–3742, SL 3743–3745).

Higher‑quality short that fits the stop: fade 3781–3806 on H4 rejection (enter 3800–3805, SL 3805–3810); ~56–62%.

Targets and R:R (risk = 50 pips):

T1 3738: +140 pips ≈ 2.8R

T2 3730: +220 pips ≈ 4.4R

T3 3707: +450 pips ≈ 9.0R

Which ideas best match a 50‑pip/$500 max stop

Longs: Prefer 3750–3745 pullbacks or post‑acceptance above 3781. Avoid chasing 3766 into supply without confirmation.

Shorts: Prefer H4 rejection inside 3781–3806, or breakdown/retest short after an H4 close below 3738.

Entry filters and management

Long filter: Either H4 close >3781 and hold retest, or wick‑down into 3750–3745 that quickly reclaims 3755+.

Short filter: H4 long‑wick rejection in 3781–3806 with lower close, or H4 close <3738 and failed retest into 3738–3742.

Move to breakeven after +80–120 pips or once the nearest opposing level is cleared (e.g., long above 3774; short below 3738).

Scale partials at first objective (3774 for longs, 3738 for shorts); let runners aim for 3791/3806 or 3730/3707.

Week‑ahead catalysts (verify exact dates on your calendar)

Likely in the coming week: ISM Manufacturing (early week), JOLTS (early week), ADP (mid‑week), ISM Services (later), and NFP/Unemployment/Average Hourly Earnings (Fri, Oct 3).

Implications:

Strong labor/earnings or firm ISM Prices Paid → higher yields/stronger USD → bearish gold. Favors shorts from 3781–3806 or breakdowns below 3738.

Softer data → weaker USD/real yields → bullish gold. Favors buy‑the‑dip at 3750 or break‑and‑hold above 3781.

Tactics: Avoid initiating fresh breakouts within 12–24h of NFP; if in profit pre‑data, consider partials and protective stops at BE or just beyond structure.

Position sizing

Lot size = Account risk $ / (50 pips × $10). Example: risking $500 → 1.00 lot; risking $250 → 0.50 lot.

Bottom line

Buy 3766: 40–45% as marked; 58–65% after acceptance above 3781 or from a 3750 pullback.

Sell 3752: 35–40% into demand; 55–60% after a 3738 breakdown/retest or on a rejection from 3781–3806.

With a strict 50‑pip/$500 stop, the cleanest plays are: buy 3750–3745 or post‑acceptance above 3781; sell rejections in 3781–3806 or breakdowns below 3738.

ปิดการเทรด: ถึงเป้าหมายการทำกำไร

Buy ran 620 pips am closing out , i might do another chart on wednesday if theres any intrestการนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน