✅ Fundamental Analysis

🔹 The consecutive weakness in U.S. PPI (2.6%) and Non-Farm Payrolls (22,000) has strengthened rate-cut expectations. In addition, global central banks have increased their gold reserves for 10 consecutive months, with official purchases exceeding 1,000 tons for three consecutive years, providing long-term support.

🔹 Market sentiment remains divided: ETF-SPDR holdings are stable at a high level of 979 tons, while COMEX options positions have surged to 830,000 tons, indicating active short-term speculative trading. This raises the risk of profit-taking after sharp rallies.

🔹 Today’s focus will be on U.S. CPI data (previous: 2.7%). If the actual figure comes in below expectations, it will reinforce the rate-cut outlook and gold may break above the $3,674 resistance. If it comes in higher, gold could enter a short-term corrective phase.

✅ Technical Analysis

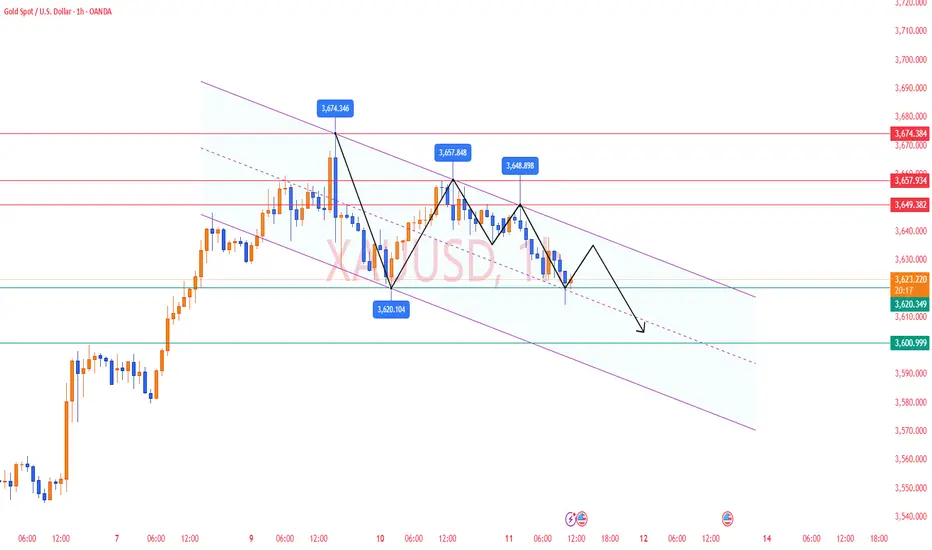

🔸 On the 4-hour chart, gold attempted to rise again yesterday but failed to break higher, showing strong resistance above. The price has now fallen below the midline of the Bollinger Bands, weakening the one-sided bullish momentum, with further downside risk toward the lower band.

🔸 On the 1-hour chart, gold faced a second rejection around $3,657 and turned lower, suggesting the strong trend has failed to extend. After falling quickly from the highs, gold has formed a clear downward channel and is currently finding support around $3,614. If the price fails to regain momentum after the pullback, it will likely shift into a consolidation phase.

🔴 Resistance: 3645–3650

🟢 Support: 3620–3600

✅ Trading Strategy Reference:

🔻 Short Position Strategy:

🔰Consider entering short positions in batches if gold rebounds to the 3640-3645 area. Target: 3630-3620;If support breaks, the move may extend to 3600.

🔺 Long Position Strategy:

🔰Consider entering long positions in batches if gold pulls back to the 3600-3605 area. Target: 3610-3620;If resistance breaks, the move may extend to 3630.

🔥Trading Reminder: Trading strategies are time-sensitive, and market conditions can change rapidly. Please adjust your trading plan based on real-time market conditions. If you have any questions or need one-on-one guidance, feel free to contact me🤝

🔹 The consecutive weakness in U.S. PPI (2.6%) and Non-Farm Payrolls (22,000) has strengthened rate-cut expectations. In addition, global central banks have increased their gold reserves for 10 consecutive months, with official purchases exceeding 1,000 tons for three consecutive years, providing long-term support.

🔹 Market sentiment remains divided: ETF-SPDR holdings are stable at a high level of 979 tons, while COMEX options positions have surged to 830,000 tons, indicating active short-term speculative trading. This raises the risk of profit-taking after sharp rallies.

🔹 Today’s focus will be on U.S. CPI data (previous: 2.7%). If the actual figure comes in below expectations, it will reinforce the rate-cut outlook and gold may break above the $3,674 resistance. If it comes in higher, gold could enter a short-term corrective phase.

✅ Technical Analysis

🔸 On the 4-hour chart, gold attempted to rise again yesterday but failed to break higher, showing strong resistance above. The price has now fallen below the midline of the Bollinger Bands, weakening the one-sided bullish momentum, with further downside risk toward the lower band.

🔸 On the 1-hour chart, gold faced a second rejection around $3,657 and turned lower, suggesting the strong trend has failed to extend. After falling quickly from the highs, gold has formed a clear downward channel and is currently finding support around $3,614. If the price fails to regain momentum after the pullback, it will likely shift into a consolidation phase.

🔴 Resistance: 3645–3650

🟢 Support: 3620–3600

✅ Trading Strategy Reference:

🔻 Short Position Strategy:

🔰Consider entering short positions in batches if gold rebounds to the 3640-3645 area. Target: 3630-3620;If support breaks, the move may extend to 3600.

🔺 Long Position Strategy:

🔰Consider entering long positions in batches if gold pulls back to the 3600-3605 area. Target: 3610-3620;If resistance breaks, the move may extend to 3630.

🔥Trading Reminder: Trading strategies are time-sensitive, and market conditions can change rapidly. Please adjust your trading plan based on real-time market conditions. If you have any questions or need one-on-one guidance, feel free to contact me🤝

✅𝐃𝐚𝐢𝐥𝐲 𝟐-𝟒 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐒𝐢𝐠𝐧𝐚𝐥𝐬🔥

✅𝐇𝐢𝐠𝐡 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝟗𝟎%-𝟗𝟓% 🔥

✅𝐖𝐞𝐞𝐤𝐥𝐲 𝐲𝐢𝐞𝐥𝐝 𝟔𝟎%-𝟖𝟓%🔥

👉Free Channel:t.me/+AMHhMKEIj_IzN2Vl

✉️VIP Guidance : t.me/Jack_blackwell

✅𝐇𝐢𝐠𝐡 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝟗𝟎%-𝟗𝟓% 🔥

✅𝐖𝐞𝐞𝐤𝐥𝐲 𝐲𝐢𝐞𝐥𝐝 𝟔𝟎%-𝟖𝟓%🔥

👉Free Channel:t.me/+AMHhMKEIj_IzN2Vl

✉️VIP Guidance : t.me/Jack_blackwell

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

✅𝐃𝐚𝐢𝐥𝐲 𝟐-𝟒 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐒𝐢𝐠𝐧𝐚𝐥𝐬🔥

✅𝐇𝐢𝐠𝐡 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝟗𝟎%-𝟗𝟓% 🔥

✅𝐖𝐞𝐞𝐤𝐥𝐲 𝐲𝐢𝐞𝐥𝐝 𝟔𝟎%-𝟖𝟓%🔥

👉Free Channel:t.me/+AMHhMKEIj_IzN2Vl

✉️VIP Guidance : t.me/Jack_blackwell

✅𝐇𝐢𝐠𝐡 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝟗𝟎%-𝟗𝟓% 🔥

✅𝐖𝐞𝐞𝐤𝐥𝐲 𝐲𝐢𝐞𝐥𝐝 𝟔𝟎%-𝟖𝟓%🔥

👉Free Channel:t.me/+AMHhMKEIj_IzN2Vl

✉️VIP Guidance : t.me/Jack_blackwell

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน