1. Overall Trend

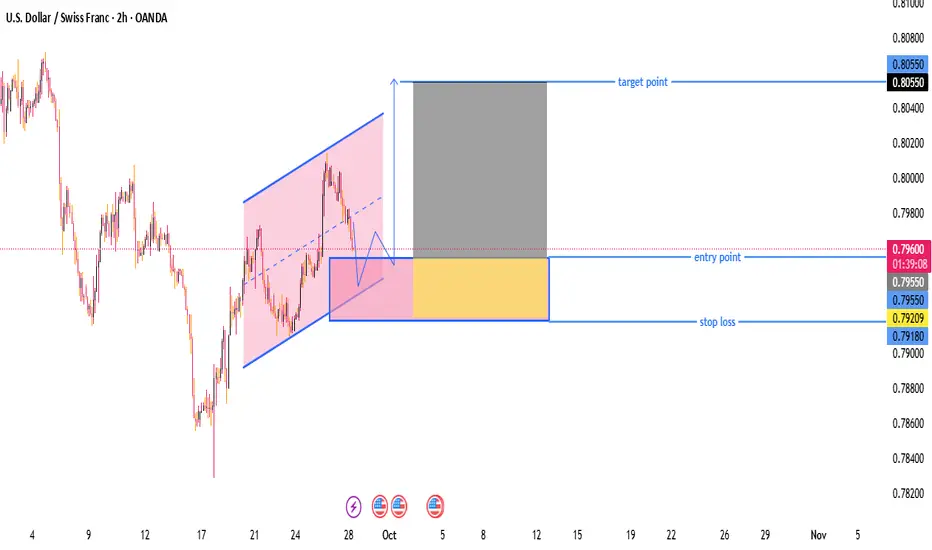

Price had been in a downtrend but recently reversed into a rising channel (highlighted in pink).

The price broke below the lower trendline of the channel, indicating a potential pullback or temporary correction.

2. Chart Pattern & Idea

After breaking the ascending channel, the chart suggests a potential bullish continuation (a breakout-retest strategy).

The drawn pattern shows a pullback to a support zone (highlighted in blue box) where price may bounce.

🟦 Trade Setup

Component Value Comment

Entry Point 0.79596 Current price, just above support zone

Stop Loss 0.79180 Below key support area

Target Point 0.80550 At prior resistance / measured move

✅ Risk/Reward Ratio

Risk: ~41 pips (0.79596 - 0.79180)

Reward: ~95 pips (0.80550 - 0.79596)

R:R Ratio: ~2.3:1 — favorable

📌 Key Technical Observations

Support Zone (Buy Area)

Between 0.79209 and 0.79550, this is a demand zone where price is expected to bounce.

Marked by a consolidation area and minor structure support.

Target Area

0.80550 aligns with a previous high and resistance level.

Also matches a measured move of the previous channel height.

Bullish Confirmation

Price might need to form a higher low or bullish candlestick pattern inside the support zone to validate entry.

⚠️ Potential Risks

If price breaks and closes below 0.79180, it invalidates the bullish thesis.

Market may retest lower support levels or re-enter the downtrend.

USD/CHF is also impacted by USD strength/weakness and Swiss Franc safe-haven flows (watch news).

📈 Summary: Trade Plan

Bias: Bullish

Entry: Buy around 0.79596 (or on bullish confirmation within support zone)

Stop Loss: 0.79180

Take Profit: 0.80550

Risk-Reward: Good (2.3:1)

Price had been in a downtrend but recently reversed into a rising channel (highlighted in pink).

The price broke below the lower trendline of the channel, indicating a potential pullback or temporary correction.

2. Chart Pattern & Idea

After breaking the ascending channel, the chart suggests a potential bullish continuation (a breakout-retest strategy).

The drawn pattern shows a pullback to a support zone (highlighted in blue box) where price may bounce.

🟦 Trade Setup

Component Value Comment

Entry Point 0.79596 Current price, just above support zone

Stop Loss 0.79180 Below key support area

Target Point 0.80550 At prior resistance / measured move

✅ Risk/Reward Ratio

Risk: ~41 pips (0.79596 - 0.79180)

Reward: ~95 pips (0.80550 - 0.79596)

R:R Ratio: ~2.3:1 — favorable

📌 Key Technical Observations

Support Zone (Buy Area)

Between 0.79209 and 0.79550, this is a demand zone where price is expected to bounce.

Marked by a consolidation area and minor structure support.

Target Area

0.80550 aligns with a previous high and resistance level.

Also matches a measured move of the previous channel height.

Bullish Confirmation

Price might need to form a higher low or bullish candlestick pattern inside the support zone to validate entry.

⚠️ Potential Risks

If price breaks and closes below 0.79180, it invalidates the bullish thesis.

Market may retest lower support levels or re-enter the downtrend.

USD/CHF is also impacted by USD strength/weakness and Swiss Franc safe-haven flows (watch news).

📈 Summary: Trade Plan

Bias: Bullish

Entry: Buy around 0.79596 (or on bullish confirmation within support zone)

Stop Loss: 0.79180

Take Profit: 0.80550

Risk-Reward: Good (2.3:1)

join my telegram channel t.me/goldmitalteamhttps://t.me/goldmitalteam

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

join my telegram channel t.me/goldmitalteamhttps://t.me/goldmitalteam

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน