Tesla  TSLA – Institutional Roadmap for September: Discount Zones, Breakout Triggers, and Squeeze Targets

TSLA – Institutional Roadmap for September: Discount Zones, Breakout Triggers, and Squeeze Targets

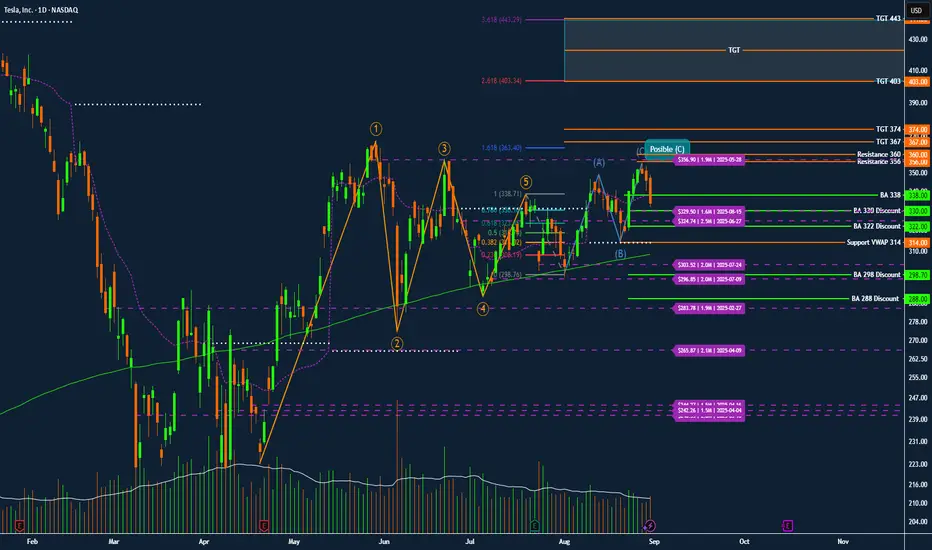

Tesla continues to trade as one of the clearest institutional battlegrounds in the market. The footprints in option open interest, dark pool levels, and anchored VWAP create a very precise map for swing traders who want to follow the flow rather than fight it.

Elliott Wave Context

Tesla completed a clean 1–5 impulse wave earlier in the year. The stock has since been retracing in an A–B–C corrective structure, with wave (C) still tentative. The rejection near 348–350 matches heavy open interest and serves as a possible end of (C). However, the high-volume sell candle at 333 suggests the correction may continue lower into discount zones before the next advance.

Institutional Discount Zones

330–332: first defense level, with recent dark pool support

322: deeper discount aligned with the 0.618 retracement

314: anchored VWAP level, a frequent institutional reload zone

298–300: July dark pool activity and strong confluence support

288: extreme discount zone from February

Breakout Triggers

BA 338: first bullish-above confirmation trigger, but only valid if defended by volume

356–360: the real battleground. Massive call open interest is stacked here. A clean break above confirms institutional participation

Upside Targets

367–374: first expansion target and resistance magnet

403: Fibonacci 2.618 extension

443: Fibonacci 3.618 extension

467: Fibonacci 4.236 extreme target if momentum continues

Flow and Volume Notes

Options flow shows concentrated put open interest between 300–320, confirming institutional defense of that floor. Call interest is stacked heavily at 350–360, which explains the recent rejection zone. The latest sell-off candle came with above-average volume, reinforcing the probability of a deeper retest into 330–322 or even 314 VWAP.

Trading Roadmap

If Tesla holds 330–332, expect a potential reversal with BA 338 as confirmation.

If 330 breaks, expect a move into 322 or 314, and a flush to 298 remains possible.

If 356–360 is reclaimed with volume, the squeeze path opens toward 367–374.

Breaking above 374 accelerates directly into 403 and later 443.

Conclusion

Tesla remains a classic institutional shakeout pattern rather than a breakdown. The map is clear: watch the discount zones for accumulation, use BA 338 and the 356–360 battleground as confirmation triggers, and follow the roadmap toward 374, 403, and 443 once the breakout validates. Patience is edge. Institutions will reload near VWAP and dark pool levels, while retail chases 350. Follow the Darkpools not the noise.

Tesla continues to trade as one of the clearest institutional battlegrounds in the market. The footprints in option open interest, dark pool levels, and anchored VWAP create a very precise map for swing traders who want to follow the flow rather than fight it.

Elliott Wave Context

Tesla completed a clean 1–5 impulse wave earlier in the year. The stock has since been retracing in an A–B–C corrective structure, with wave (C) still tentative. The rejection near 348–350 matches heavy open interest and serves as a possible end of (C). However, the high-volume sell candle at 333 suggests the correction may continue lower into discount zones before the next advance.

Institutional Discount Zones

330–332: first defense level, with recent dark pool support

322: deeper discount aligned with the 0.618 retracement

314: anchored VWAP level, a frequent institutional reload zone

298–300: July dark pool activity and strong confluence support

288: extreme discount zone from February

Breakout Triggers

BA 338: first bullish-above confirmation trigger, but only valid if defended by volume

356–360: the real battleground. Massive call open interest is stacked here. A clean break above confirms institutional participation

Upside Targets

367–374: first expansion target and resistance magnet

403: Fibonacci 2.618 extension

443: Fibonacci 3.618 extension

467: Fibonacci 4.236 extreme target if momentum continues

Flow and Volume Notes

Options flow shows concentrated put open interest between 300–320, confirming institutional defense of that floor. Call interest is stacked heavily at 350–360, which explains the recent rejection zone. The latest sell-off candle came with above-average volume, reinforcing the probability of a deeper retest into 330–322 or even 314 VWAP.

Trading Roadmap

If Tesla holds 330–332, expect a potential reversal with BA 338 as confirmation.

If 330 breaks, expect a move into 322 or 314, and a flush to 298 remains possible.

If 356–360 is reclaimed with volume, the squeeze path opens toward 367–374.

Breaking above 374 accelerates directly into 403 and later 443.

Conclusion

Tesla remains a classic institutional shakeout pattern rather than a breakdown. The map is clear: watch the discount zones for accumulation, use BA 338 and the 356–360 battleground as confirmation triggers, and follow the roadmap toward 374, 403, and 443 once the breakout validates. Patience is edge. Institutions will reload near VWAP and dark pool levels, while retail chases 350. Follow the Darkpools not the noise.

บันทึก

Have fun with คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน