📊 SOL/USDT 4H – Bullish Reversal Setup 🚀

🔍 Market Structure Analysis

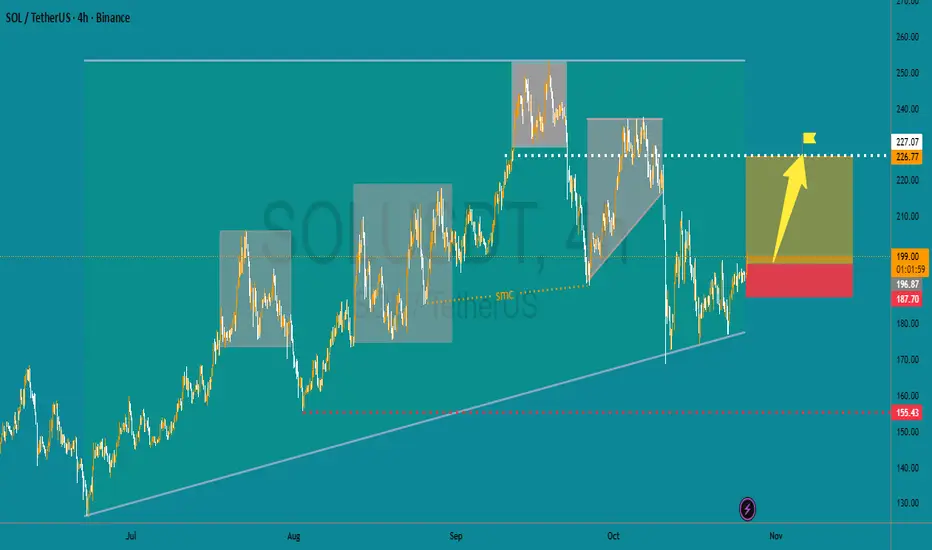

The market has shown a clear uptrend structure with higher lows (HLs) consistently forming along an ascending trendline 📈.

After a recent retracement, price respected the trendline support, signaling potential bullish continuation 🔁.

⚙️ Key Levels

Support Zone (Demand Area): 🟢 $185 – $190 → Buyers defending this region strongly.

Resistance Zone (Target Area): 🟡 $225 – $230 → Previous supply zone and structure high.

Invalidation (Stop-Loss Zone): 🔴 Below $185 → Break of structure if price drops here.

🧭 Trade Setup (as highlighted)

Entry Idea: Around $195 – $200 (current price range).

Stop-Loss: 🔻 Below $187 support.

Take Profit: 🎯 $227 zone (previous high).

Risk-to-Reward: Approximately 1:2.5, favorable for swing traders ⚖️.

💡 Market Psychology

The chart shows liquidity sweep of previous lows (liquidity grab 💧), followed by strong bullish momentum, indicating smart money accumulation (SMC concept).

The yellow arrow shows a potential break of structure (BOS) toward upside continuation.

📈 Summary

✅ Bullish momentum respected structure.

⚠️ Watch for confirmation candle close above $205–$210 before entering.

🔥 If confirmed, next bullish impulse could target $227+.

🏁 Conclusion: “Buy the Reversal, Ride the Trend” 🚀

Bias: Bullish 🟢

Strategy: Trend continuation after correction

Confidence: High if price holds above $190

🔍 Market Structure Analysis

The market has shown a clear uptrend structure with higher lows (HLs) consistently forming along an ascending trendline 📈.

After a recent retracement, price respected the trendline support, signaling potential bullish continuation 🔁.

⚙️ Key Levels

Support Zone (Demand Area): 🟢 $185 – $190 → Buyers defending this region strongly.

Resistance Zone (Target Area): 🟡 $225 – $230 → Previous supply zone and structure high.

Invalidation (Stop-Loss Zone): 🔴 Below $185 → Break of structure if price drops here.

🧭 Trade Setup (as highlighted)

Entry Idea: Around $195 – $200 (current price range).

Stop-Loss: 🔻 Below $187 support.

Take Profit: 🎯 $227 zone (previous high).

Risk-to-Reward: Approximately 1:2.5, favorable for swing traders ⚖️.

💡 Market Psychology

The chart shows liquidity sweep of previous lows (liquidity grab 💧), followed by strong bullish momentum, indicating smart money accumulation (SMC concept).

The yellow arrow shows a potential break of structure (BOS) toward upside continuation.

📈 Summary

✅ Bullish momentum respected structure.

⚠️ Watch for confirmation candle close above $205–$210 before entering.

🔥 If confirmed, next bullish impulse could target $227+.

🏁 Conclusion: “Buy the Reversal, Ride the Trend” 🚀

Bias: Bullish 🟢

Strategy: Trend continuation after correction

Confidence: High if price holds above $190

🔍 Market Structure Analysis

The market has shown a clear uptrend structure with higher lows (HLs) consistently forming along an ascending trendline 📈.

After a recent retracement, price respected the trendline support, signaling potential bullish continuation 🔁.

⚙️ Key Levels

Support Zone (Demand Area): 🟢 $185 – $190 → Buyers defending this region strongly.

Resistance Zone (Target Area): 🟡 $225 – $230 → Previous supply zone and structure high.

Invalidation (Stop-Loss Zone): 🔴 Below $185 → Break of structure if price drops here.

🧭 Trade Setup (as highlighted)

Entry Idea: Around $195 – $200 (current price range).

Stop-Loss: 🔻 Below $187 support.

Take Profit: 🎯 $227 zone (previous high).

Risk-to-Reward: Approximately 1:2.5, favorable for swing traders ⚖️.

💡 Market Psychology

The chart shows liquidity sweep of previous lows (liquidity grab 💧), followed by strong bullish momentum, indicating smart money accumulation (SMC concept).

The yellow arrow shows a potential break of structure (BOS) toward upside continuation.

📈 Summary

✅ Bullish momentum respected structure.

⚠️ Watch for confirmation candle close above $205–$210 before entering.

🔥 If confirmed, next bullish impulse could target $227+.

🏁 Conclusion: “Buy the Reversal, Ride the Trend” 🚀

Bias: Bullish 🟢

Strategy: Trend continuation after correction

Confidence: High if price holds above $190

🔍 Market Structure Analysis

The market has shown a clear uptrend structure with higher lows (HLs) consistently forming along an ascending trendline 📈.

After a recent retracement, price respected the trendline support, signaling potential bullish continuation 🔁.

⚙️ Key Levels

Support Zone (Demand Area): 🟢 $185 – $190 → Buyers defending this region strongly.

Resistance Zone (Target Area): 🟡 $225 – $230 → Previous supply zone and structure high.

Invalidation (Stop-Loss Zone): 🔴 Below $185 → Break of structure if price drops here.

🧭 Trade Setup (as highlighted)

Entry Idea: Around $195 – $200 (current price range).

Stop-Loss: 🔻 Below $187 support.

Take Profit: 🎯 $227 zone (previous high).

Risk-to-Reward: Approximately 1:2.5, favorable for swing traders ⚖️.

💡 Market Psychology

The chart shows liquidity sweep of previous lows (liquidity grab 💧), followed by strong bullish momentum, indicating smart money accumulation (SMC concept).

The yellow arrow shows a potential break of structure (BOS) toward upside continuation.

📈 Summary

✅ Bullish momentum respected structure.

⚠️ Watch for confirmation candle close above $205–$210 before entering.

🔥 If confirmed, next bullish impulse could target $227+.

🏁 Conclusion: “Buy the Reversal, Ride the Trend” 🚀

Bias: Bullish 🟢

Strategy: Trend continuation after correction

Confidence: High if price holds above $190

Join My Telegram Channel Link 👇

t.me/honeyspottrading

Join My Refferel Broker Link 👇

one.exnessonelink.com/a/uvd1etcgg1

Refferel code 👇

uvd1etcgg1

t.me/honeyspottrading

Join My Refferel Broker Link 👇

one.exnessonelink.com/a/uvd1etcgg1

Refferel code 👇

uvd1etcgg1

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

Join My Telegram Channel Link 👇

t.me/honeyspottrading

Join My Refferel Broker Link 👇

one.exnessonelink.com/a/uvd1etcgg1

Refferel code 👇

uvd1etcgg1

t.me/honeyspottrading

Join My Refferel Broker Link 👇

one.exnessonelink.com/a/uvd1etcgg1

Refferel code 👇

uvd1etcgg1

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน