📈 RAMCOCEM – Classic VCP Setup with Breakout Potential 🚀

🔍 Technical Structure: VCP (Volatility Contraction Pattern)

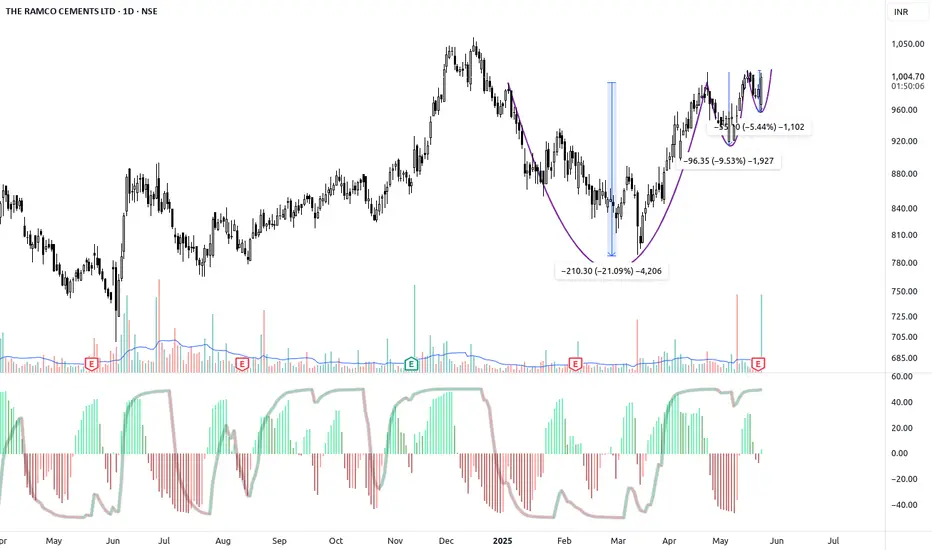

Ramco Cements is currently exhibiting a textbook Volatility Contraction Pattern (VCP) – a bullish continuation pattern popularized by Mark Minervini. This setup often precedes explosive breakouts, especially when accompanied by key technical confirmations.

✅ VCP Phases Observed:

Wave 1: Decline of ~21% (₹210) from swing high

Wave 2: Pullback of ~9.5% (₹96)

Wave 3: Most recent pullback ~5.4% (₹55)

Each contraction has been shallower and tighter — textbook VCP behavior.

The current base is tightening, and price is forming a mini-cup on the right side.

📊 Volume Action (Key to VCP)

Volume consistently drying up during each successive pullback — a sign of supply absorption.

Today’s session showed a spike in volume with a bullish candle, suggesting possible initiation of demand and interest at key resistance levels.

📈 Moving Averages Confirmation

Price is trading above all major moving averages:

🔹 20 EMA

🔹 50 EMA

🔹 100 SMA

🔹 200 SMA

All MAs are positively sloped, reinforcing a strong uptrend across short, medium, and long-term timeframes.

✅ Conclusion

Ramco Cements is forming a high-quality VCP setup supported by:

Strong volume contraction behavior,

Positive price action near breakout zone,

Clean structure above key MAs,

Bullish momentum and improving market sentiment.

📢 Keep this stock on high alert. A strong breakout above ₹1,020 could trigger a powerful upside rally.

🔍 Technical Structure: VCP (Volatility Contraction Pattern)

Ramco Cements is currently exhibiting a textbook Volatility Contraction Pattern (VCP) – a bullish continuation pattern popularized by Mark Minervini. This setup often precedes explosive breakouts, especially when accompanied by key technical confirmations.

✅ VCP Phases Observed:

Wave 1: Decline of ~21% (₹210) from swing high

Wave 2: Pullback of ~9.5% (₹96)

Wave 3: Most recent pullback ~5.4% (₹55)

Each contraction has been shallower and tighter — textbook VCP behavior.

The current base is tightening, and price is forming a mini-cup on the right side.

📊 Volume Action (Key to VCP)

Volume consistently drying up during each successive pullback — a sign of supply absorption.

Today’s session showed a spike in volume with a bullish candle, suggesting possible initiation of demand and interest at key resistance levels.

📈 Moving Averages Confirmation

Price is trading above all major moving averages:

🔹 20 EMA

🔹 50 EMA

🔹 100 SMA

🔹 200 SMA

All MAs are positively sloped, reinforcing a strong uptrend across short, medium, and long-term timeframes.

✅ Conclusion

Ramco Cements is forming a high-quality VCP setup supported by:

Strong volume contraction behavior,

Positive price action near breakout zone,

Clean structure above key MAs,

Bullish momentum and improving market sentiment.

📢 Keep this stock on high alert. A strong breakout above ₹1,020 could trigger a powerful upside rally.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน