b]📊 NIFTY 50 INTRADAY PLAN – 14 JULY 2025 (15-Min Chart Study)

Educational insights for all opening scenarios: Gap-Up, Flat, and Gap-Down.

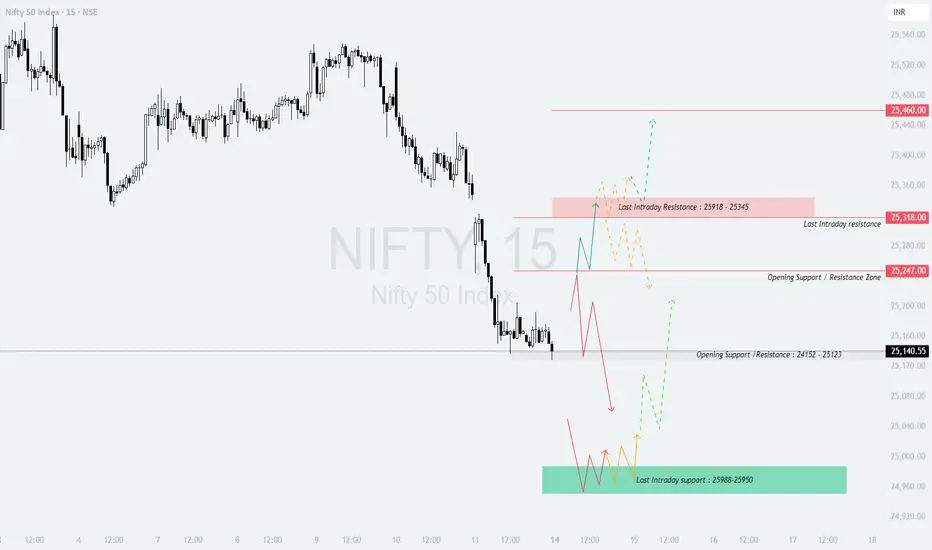

📌 KEY LEVELS TO MONITOR

🚀 SCENARIO 1: GAP-UP OPENING (Above 25,247) 📈

Bias: Bullish continuation possible

📊 SCENARIO 2: FLAT OPENING (Near 25,140 – 25,152) 🔄

Bias: Neutral-to-bearish bias

📉 SCENARIO 3: GAP-DOWN OPENING (Below 25,050) ⚠️

Bias: Bearish with bounce attempt from lower supports

💡 OPTIONS TRADING – RISK MANAGEMENT TIPS

📌 SUMMARY & CONCLUSION

Educational insights for all opening scenarios: Gap-Up, Flat, and Gap-Down.

📍 Previous Close: 25,140.55

📌 Gap opening threshold considered: 100+ points

⏱️ Tip: Let the first 15–30 minutes settle before entering trades based on levels.

📌 KEY LEVELS TO MONITOR

- []Resistance Zone: 25,460

[]Last Intraday Resistance: 25,318

[]Opening Support / Resistance Zone: 25,247

[]Opening Support / Resistance Zone: 25,152 – 25,123 - Last Intraday Support Zone: 25,088 – 25,050

🚀 SCENARIO 1: GAP-UP OPENING (Above 25,247) 📈

Bias: Bullish continuation possible

- []If Nifty opens above 25,247, watch for continuation towards 25,318 (Last Intraday Resistance).

[]Sustainable strength above 25,318 can lead to 25,460. That’s the upper profit booking zone.

[]If price shows exhaustion candles near 25,460, avoid fresh longs. Instead, look for selling opportunities with tight stop-loss.

[]Options Traders: Prefer ATM or slightly ITM calls; avoid chasing far OTM CE after gap-up. Time decay will be sharp in such cases.

📊 SCENARIO 2: FLAT OPENING (Near 25,140 – 25,152) 🔄

Bias: Neutral-to-bearish bias

- []If the market opens around 25,140 – 25,152, focus on whether the 25,152 – 25,123 zone holds as support or flips as resistance.

[]If price holds above 25,152, there’s potential for a bounce towards 25,247.

[]If price breaks and sustains below 25,123, expect a gradual drift towards the Last Intraday Support: 25,088 – 25,050.

[]Avoid quick trades here — observe the first 30 minutes’ range before committing capital.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 25,050) ⚠️

Bias: Bearish with bounce attempt from lower supports

- []If Nifty opens below 25,050, immediate attention should be given to Last Intraday Support: 25,088 – 25,050.

[]If that zone breaks, next major support becomes psychological round numbers or extreme supports which may form intraday.

[]Aggressive selling should only be considered if prices show no reaction around this zone. Watch for hammer or reversal patterns before taking contra long trades.

[]Options Traders: Avoid buying deep OTM puts after a large gap-down as premiums often get inflated due to IV spikes.

💡 OPTIONS TRADING – RISK MANAGEMENT TIPS

- []Focus on ATM or ITM strikes to reduce theta impact on both CE and PE buying.

[]Apply Stop-Loss based on 15-minute candle closes instead of absolute price ticks to avoid noise.

[]If VIX is high, hedge with vertical spreads instead of naked options buying.

[]Strictly maintain a 1–2% max risk of your capital per trade.

[]Avoid over-trading after 2:45 PM as theta erosion accelerates in options.

[]Keep tracking Bank Nifty as well for broader market cues.

📌 SUMMARY & CONCLUSION

- []Bullish Trigger: Above 25,247 → Target 25,318 – 25,460

[]Neutral Zone: 25,140 – 25,152 → Wait and watch zone

[]Bearish Trigger: Below 25,123 → Watch 25,088 – 25,050 for bounce

[]Keep your discipline intact and avoid emotional trades. - Options premium decay is real — always respect time and structure.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please do your own analysis or consult with a financial advisor before making trading decisions.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน