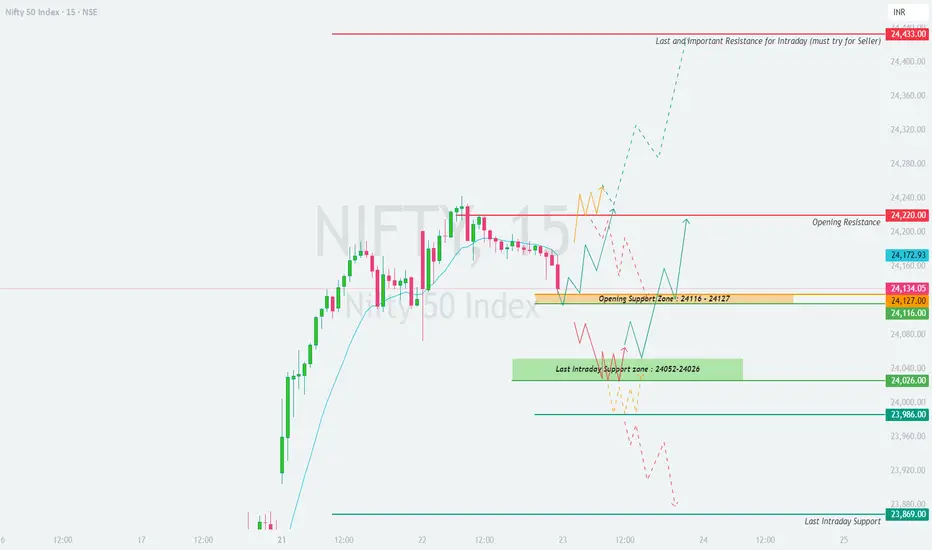

📊 NIFTY Intraday Trading Plan – 23-Apr-2025

Timeframe: 15-minute

Previous Close: 24,134.05

📌 Key Zones Marked on the Chart:

🟥 Opening Resistance: 24,220

🔴 Major Resistance Zone (Short opportunity): 24,433

🟧 Opening Support Zone: 24,116 – 24,127

🟩 Last Intraday Support Zone: 24,052 – 24,026

🔵 Final Intraday Support: 23,869

🟥 Scenario 1: Gap-Up Opening (Above 24,234 – i.e. +100 points)

If Nifty opens above 24,234, it will be above the immediate resistance zone of 24,220. This brings it closer to the 24,433 level — a last-resort intraday resistance that’s a key zone for aggressive short sellers.

💡 Educational Note: Strong opening gaps tend to invite profit booking near supply zones. Always wait for price confirmation before entering.

🟨 Scenario 2: Flat Opening (Between 24,127 – 24,220)

This scenario keeps Nifty in a neutral yet sensitive range between the support and resistance levels. Traders should be patient and wait for breakout or breakdown confirmation.

💡 Educational Note: In flat openings, the first 3 candles of the day often decide direction. Focus on volume and price range contraction or expansion for clues.

🟩 Scenario 3: Gap-Down Opening (Below 24,034 – i.e. -100 points)

A gap-down below 24,034 will place Nifty directly into the Last Intraday Support Zone: 24,052 – 24,026. This is a critical area for reversal setups or further breakdown.

💡 Educational Note: A gap-down into a known support zone creates high emotion. Don’t be tempted to buy blindly – always wait for support-holding confirmation.

🛡️ Options Trading Risk Management Tips

📘 Summary & Conclusion

📍 Important Levels:

🔺 Resistance: 24,220 | 24,433

⚠️ Opening Support: 24,116 – 24,127

🔻 Lower Supports: 24,052 | 24,026 | 23,986 | 23,869

🎯 On 23-Apr-2025, observe the first 15-minute candle carefully for structure. Trade only on confirmed breakout/breakdown from defined zones.

Use well-hedged strategies when near volatile support/resistance levels. Keep emotions in check and stay adaptive.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This trading plan is shared purely for educational purposes. Please consult your financial advisor before making any trading decisions.

Timeframe: 15-minute

Previous Close: 24,134.05

📌 Key Zones Marked on the Chart:

🟥 Opening Resistance: 24,220

🔴 Major Resistance Zone (Short opportunity): 24,433

🟧 Opening Support Zone: 24,116 – 24,127

🟩 Last Intraday Support Zone: 24,052 – 24,026

🔵 Final Intraday Support: 23,869

🟥 Scenario 1: Gap-Up Opening (Above 24,234 – i.e. +100 points)

If Nifty opens above 24,234, it will be above the immediate resistance zone of 24,220. This brings it closer to the 24,433 level — a last-resort intraday resistance that’s a key zone for aggressive short sellers.

- []Watch for price behavior near 24,433. If Nifty gives wick rejections or bearish engulfing candles, this is a low-risk shorting opportunity.

[]Targets on downside would be 24,220 and 24,127, with a stop loss above 24,470. - If price consolidates above 24,433 for more than 30 minutes, expect a breakout toward 24,500+. Use a bull call spread instead of naked options to control risk.

💡 Educational Note: Strong opening gaps tend to invite profit booking near supply zones. Always wait for price confirmation before entering.

🟨 Scenario 2: Flat Opening (Between 24,127 – 24,220)

This scenario keeps Nifty in a neutral yet sensitive range between the support and resistance levels. Traders should be patient and wait for breakout or breakdown confirmation.

- []If Nifty breaks above 24,220 with volume, it may attempt 24,300–24,433. Buy with a tight SL of 24,170.

[]If Nifty sustains below 24,116, price may drift towards 24,052 – 24,026. Consider puts or bear spreads below 24,116. - Avoid initiating trades in the first 15 minutes. Let the market structure itself after opening volatility.

💡 Educational Note: In flat openings, the first 3 candles of the day often decide direction. Focus on volume and price range contraction or expansion for clues.

🟩 Scenario 3: Gap-Down Opening (Below 24,034 – i.e. -100 points)

A gap-down below 24,034 will place Nifty directly into the Last Intraday Support Zone: 24,052 – 24,026. This is a critical area for reversal setups or further breakdown.

- []If this zone holds and we see a bullish hammer or strong green engulfing candle, a counter-trend bounce toward 24,116 is possible.

[]If Nifty breaks below 24,026 and sustains, watch for a fall to 23,986 or even 23,869. This is a bearish momentum zone. - Avoid long trades until the price forms a base above 24,026 again.

💡 Educational Note: A gap-down into a known support zone creates high emotion. Don’t be tempted to buy blindly – always wait for support-holding confirmation.

🛡️ Options Trading Risk Management Tips

- []Always use defined SL (stop loss) while trading directional options.

[]Avoid trading OTM options alone on Wednesdays and Thursdays due to higher theta decay.

[]Use spreads like Bull Call / Bear Put to reduce cost and hedge risk.

[]Do not take trades based on bias. Let price structure guide your decision. - Never risk more than 2–3% of your capital per trade, especially in volatile conditions.

📘 Summary & Conclusion

📍 Important Levels:

🔺 Resistance: 24,220 | 24,433

⚠️ Opening Support: 24,116 – 24,127

🔻 Lower Supports: 24,052 | 24,026 | 23,986 | 23,869

🎯 On 23-Apr-2025, observe the first 15-minute candle carefully for structure. Trade only on confirmed breakout/breakdown from defined zones.

Use well-hedged strategies when near volatile support/resistance levels. Keep emotions in check and stay adaptive.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This trading plan is shared purely for educational purposes. Please consult your financial advisor before making any trading decisions.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน