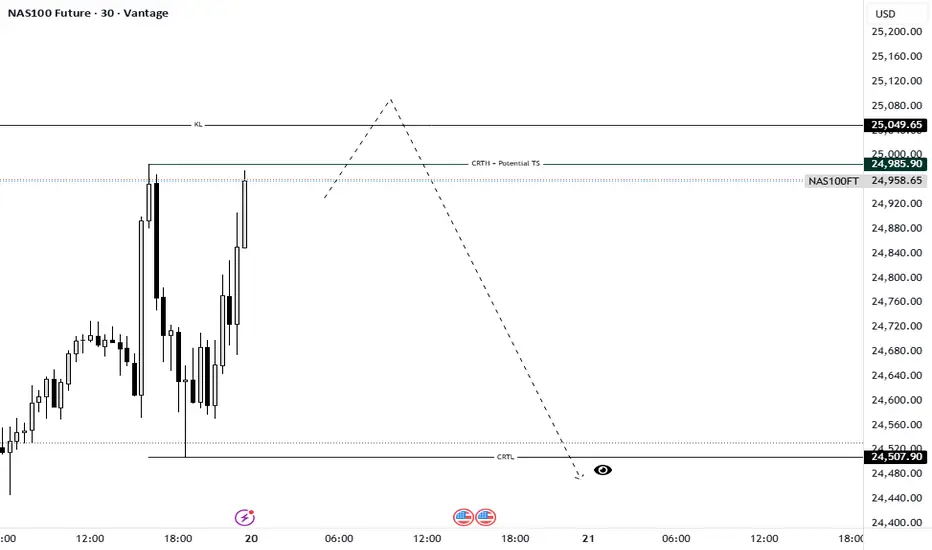

Timeframe: 30M | Model: Potential Turtle Soup (TS) / Bearish Model #1 Setup

The Nasdaq is setting up a crucial liquidity event that aligns perfectly with the CRT Manipulation (Candle 2) phase. We are currently consolidating just below a major structural high, which is acting as a magnetic zone for stops.

Here is the speculative short thesis:

The Trap Zone: The level at 24,985.90 is marked as the CRTH (Candle Range Theory High) and our "Potential TS" line. This is where most early breakout traders will place their buy stops, or where swing traders will look to enter short.

The Liquidity Hunt: We anticipate the market will execute a Turtle Soup—an aggressive spike above 24,985.90, potentially reaching the secondary resistance (RL) at 25,049.65, before immediately failing. This sweep is required to fuel the subsequent massive drop.

The Trigger (Bearish Model #1): Our entry signal (the Bearish Model #1) will only be confirmed IF price closes decisively back below the CRTH line after the liquidity sweep (the failure candle).

Targets:

Primary Objective (CRTL): If the Turtle Soup and reversal confirm, we expect a strong, fast drop (the Distribution, or Candle 3, phase) targeting the CRTL (Candle Range Theory Low) at 24,507.90. This low is holding significant Sell Side Liquidity (SSL).

Discipline: This is a high-risk, high-reward setup. Do not enter until the Turtle Soup has completed and the Bearish Model #1 reversal candle has closed. Patience is required to avoid being the liquidity that fuels the institutional move.

Wait for the Sweep. Trade the Reversal.

Greetings,

MrYounity

The Nasdaq is setting up a crucial liquidity event that aligns perfectly with the CRT Manipulation (Candle 2) phase. We are currently consolidating just below a major structural high, which is acting as a magnetic zone for stops.

Here is the speculative short thesis:

The Trap Zone: The level at 24,985.90 is marked as the CRTH (Candle Range Theory High) and our "Potential TS" line. This is where most early breakout traders will place their buy stops, or where swing traders will look to enter short.

The Liquidity Hunt: We anticipate the market will execute a Turtle Soup—an aggressive spike above 24,985.90, potentially reaching the secondary resistance (RL) at 25,049.65, before immediately failing. This sweep is required to fuel the subsequent massive drop.

The Trigger (Bearish Model #1): Our entry signal (the Bearish Model #1) will only be confirmed IF price closes decisively back below the CRTH line after the liquidity sweep (the failure candle).

Targets:

Primary Objective (CRTL): If the Turtle Soup and reversal confirm, we expect a strong, fast drop (the Distribution, or Candle 3, phase) targeting the CRTL (Candle Range Theory Low) at 24,507.90. This low is holding significant Sell Side Liquidity (SSL).

Discipline: This is a high-risk, high-reward setup. Do not enter until the Turtle Soup has completed and the Bearish Model #1 reversal candle has closed. Patience is required to avoid being the liquidity that fuels the institutional move.

Wait for the Sweep. Trade the Reversal.

Greetings,

MrYounity

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน