META

First Long then Short

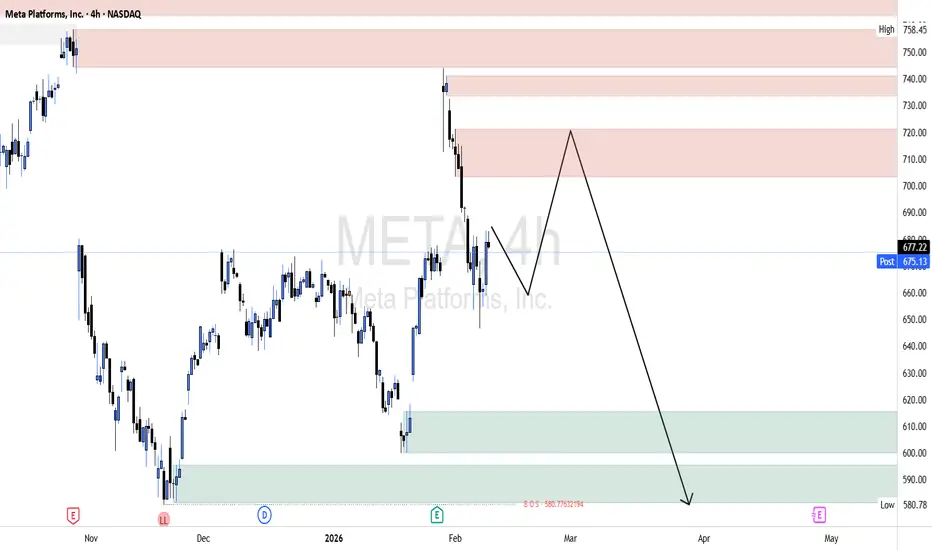

We are still operating within a larger bearish market structure. The prior impulse to the downside remains dominant, and the recent upside move is corrective, not a trend reversal. Price has already shown weakness after tapping into higher supply, and overall structure favors continuation lower.

From a supply and demand perspective, META is currently trading below multiple stacked supply zones. The most relevant supply sits between roughly 710 to 750, where strong institutional selling previously occurred. Price reacted sharply from this region, confirming it as a valid and active supply zone. On the downside, demand is clearly defined between 600 to 580, which aligns with the prior base and liquidity pool. This lower zone is unmitigated and remains the primary downside magnet.

Looking at price action, the recent push higher lacks follow-through. Price is forming lower-quality structure, showing overlap and hesitation, which signals distribution rather than accumulation. The projected path reflects a pullback into supply, followed by a strong bearish rotation that targets lower demand.

Trade bias remains bearish. The preferred scenario is for price to fail below supply, roll over, and expand lower toward 600 first, with continuation toward 580 if momentum accelerates.

Invalidation occurs on sustained acceptance above the upper supply zone, which would signal a structural shift — currently unlikely based on price behavior.

Momentum is weakening, and bullish candles are corrective in nature. There is no strong displacement to the upside, reinforcing the idea that buyers are being absorbed rather than in control.

First Long then Short

We are still operating within a larger bearish market structure. The prior impulse to the downside remains dominant, and the recent upside move is corrective, not a trend reversal. Price has already shown weakness after tapping into higher supply, and overall structure favors continuation lower.

From a supply and demand perspective, META is currently trading below multiple stacked supply zones. The most relevant supply sits between roughly 710 to 750, where strong institutional selling previously occurred. Price reacted sharply from this region, confirming it as a valid and active supply zone. On the downside, demand is clearly defined between 600 to 580, which aligns with the prior base and liquidity pool. This lower zone is unmitigated and remains the primary downside magnet.

Looking at price action, the recent push higher lacks follow-through. Price is forming lower-quality structure, showing overlap and hesitation, which signals distribution rather than accumulation. The projected path reflects a pullback into supply, followed by a strong bearish rotation that targets lower demand.

Trade bias remains bearish. The preferred scenario is for price to fail below supply, roll over, and expand lower toward 600 first, with continuation toward 580 if momentum accelerates.

Invalidation occurs on sustained acceptance above the upper supply zone, which would signal a structural shift — currently unlikely based on price behavior.

Momentum is weakening, and bullish candles are corrective in nature. There is no strong displacement to the upside, reinforcing the idea that buyers are being absorbed rather than in control.

Looking for powerful AI trading signals? Visit ProSignal.ai and take your trading to the next level! or join our telegram channel at t.me/prosignalai

Discord: discord.gg/qQmChQYG

Discord: discord.gg/qQmChQYG

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

Looking for powerful AI trading signals? Visit ProSignal.ai and take your trading to the next level! or join our telegram channel at t.me/prosignalai

Discord: discord.gg/qQmChQYG

Discord: discord.gg/qQmChQYG

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน