Technical Analysis

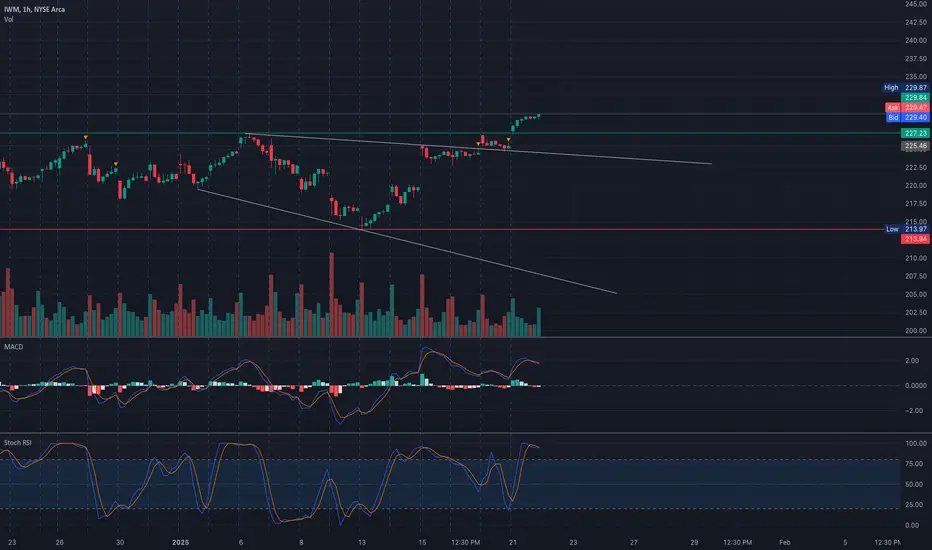

* Trend: IWM shows an upward momentum with a breakout above the previous resistance level at $227.

* Support and Resistance:

* Immediate Support: $227, previously a resistance level, may now act as support.

* Major Resistance: $230 is the next significant resistance level, aligned with the GEX 2nd

CALL Wall.

* Critical Support: $226 acts as a safety zone, below which the bearish sentiment might strengthen.

* Indicators:

* MACD: Positive momentum; however, the histogram shows slight consolidation.

* Stochastic RSI: Overbought zone, indicating caution for long entries in the short term.

Gamma Exposure (GEX)

* Key Levels:

* Highest Positive GEX (Call Resistance): $230 – Major resistance zone, where call option sellers may cap upward movement.

* Support Levels:

* $227: The 3rd CALL Wall level offering intermediate support.

* $226: HVL level aligned with GEX support zones.

* IVR & Sentiment:

* Implied Volatility Rank (IVR): 14.7 - Low IV, suggesting cheaper option premiums.

* GEX Sentiment: Positive skew with minimal PUT protection, indicating bullish sentiment overall.

Trading Plan

* Bullish Setup:

* Entry: Above $227 with volume confirmation.

* Target: $230.

* Stop-Loss: Below $226.

* Bearish Setup:

* Entry: Below $226 with high selling volume.

* Target: $224-$222 range.

* Stop-Loss: Above $228.

Disclaimer

This analysis is for educational purposes only. Always conduct your own due diligence and manage risk appropriately before trading.

* Trend: IWM shows an upward momentum with a breakout above the previous resistance level at $227.

* Support and Resistance:

* Immediate Support: $227, previously a resistance level, may now act as support.

* Major Resistance: $230 is the next significant resistance level, aligned with the GEX 2nd

CALL Wall.

* Critical Support: $226 acts as a safety zone, below which the bearish sentiment might strengthen.

* Indicators:

* MACD: Positive momentum; however, the histogram shows slight consolidation.

* Stochastic RSI: Overbought zone, indicating caution for long entries in the short term.

Gamma Exposure (GEX)

* Key Levels:

* Highest Positive GEX (Call Resistance): $230 – Major resistance zone, where call option sellers may cap upward movement.

* Support Levels:

* $227: The 3rd CALL Wall level offering intermediate support.

* $226: HVL level aligned with GEX support zones.

* IVR & Sentiment:

* Implied Volatility Rank (IVR): 14.7 - Low IV, suggesting cheaper option premiums.

* GEX Sentiment: Positive skew with minimal PUT protection, indicating bullish sentiment overall.

Trading Plan

* Bullish Setup:

* Entry: Above $227 with volume confirmation.

* Target: $230.

* Stop-Loss: Below $226.

* Bearish Setup:

* Entry: Below $226 with high selling volume.

* Target: $224-$222 range.

* Stop-Loss: Above $228.

Disclaimer

This analysis is for educational purposes only. Always conduct your own due diligence and manage risk appropriately before trading.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน