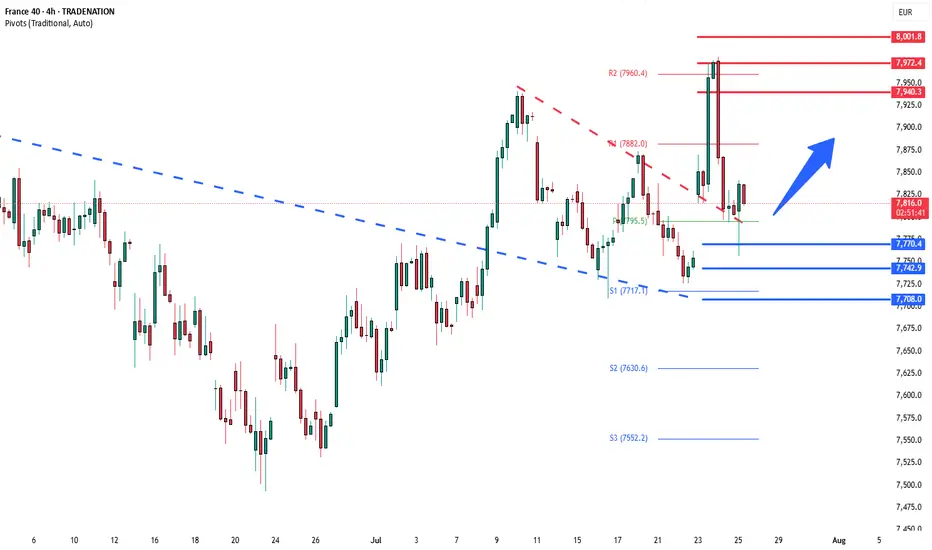

The CAC 40 index continues to display a bullish bias, underpinned by a well-established rising trend. Recent intraday price action indicates a breakout from consolidation, suggesting renewed upward momentum.

Key Technical Levels:

Support:

7770 – This level marks the prior consolidation zone and now serves as critical support.

7740 – Secondary support, guarding against deeper downside.

7700 – Key psychological and technical level; a breach would suggest trend weakness.

Resistance:

7940 – Immediate upside target from the breakout pattern.

7970 – Minor resistance within an extended bullish leg.

8000 – Major psychological resistance and potential profit-taking zone.

Trading Scenarios:

Bullish Scenario:

A corrective pullback toward the 7770 level, followed by a bullish reversal, would confirm support and potentially set the stage for an advance toward 7940, with scope to extend to 7970 and 8000 in the medium term.

Bearish Scenario:

A daily close below 7770 would invalidate the bullish breakout and suggest a short-term trend reversal. This would open the door to a retracement toward 7740, with extended downside risk to 7700.

Conclusion:

The CAC 40 remains technically bullish as long as price holds above the 7770 support level. Traders should watch for confirmation of support on pullbacks to position for a continuation higher. A decisive break below 7770, however, would shift sentiment to neutral-to-bearish, triggering a deeper correction.

Key Technical Levels:

Support:

7770 – This level marks the prior consolidation zone and now serves as critical support.

7740 – Secondary support, guarding against deeper downside.

7700 – Key psychological and technical level; a breach would suggest trend weakness.

Resistance:

7940 – Immediate upside target from the breakout pattern.

7970 – Minor resistance within an extended bullish leg.

8000 – Major psychological resistance and potential profit-taking zone.

Trading Scenarios:

Bullish Scenario:

A corrective pullback toward the 7770 level, followed by a bullish reversal, would confirm support and potentially set the stage for an advance toward 7940, with scope to extend to 7970 and 8000 in the medium term.

Bearish Scenario:

A daily close below 7770 would invalidate the bullish breakout and suggest a short-term trend reversal. This would open the door to a retracement toward 7740, with extended downside risk to 7700.

Conclusion:

The CAC 40 remains technically bullish as long as price holds above the 7770 support level. Traders should watch for confirmation of support on pullbacks to position for a continuation higher. A decisive break below 7770, however, would shift sentiment to neutral-to-bearish, triggering a deeper correction.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน