🔹 Current Overview

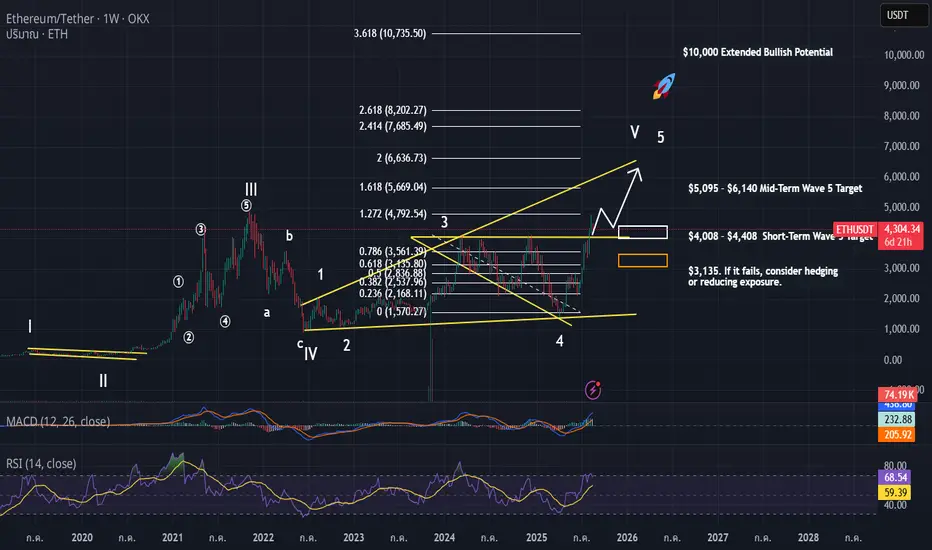

Ethereum (ETH) is approaching a critical decision point in the Elliott Wave cycle. Based on the long-term structure, we are now at a crossroads: either ETH confirms a Wave 5 bullish continuation, or we see an extended corrective Wave IV before resuming the uptrend.

📈 Bullish Scenario – Wave 5 Extension

Key Breakout Level: $4,400

If ETH can break and sustain above $4,400 with strong volume, Wave 5 will likely extend higher.

Upside Targets:

$5,095 – $5,350 (Fibo 1.272)

$5,850 – $6,140 (Fibo 1.618)

$9,800 – $10,000+ (Extended Wave 5 under Macro Bull Run)

Confirmation Signals:

RSI > 70 (Weekly)

MACD Golden Cross on higher timeframes

📉 Bearish Scenario – Extended Correction (Wave IV not complete)

Key Supports:

$3,580 (Fibo 0.5 retracement)

$3,135 (Fibo 0.618 retracement)

If ETH fails to hold $3,580, it could indicate that Wave IV correction is still in play.

A break below $3,135 would confirm a deeper correction, potentially targeting $2,650.

Warning Signals:

Decreasing volume on rallies

RSI unable to create higher highs

🎯 Trading Plan

If Breakout: Long/hold positions with targets at $5k+

If Breakdown: Wait for support test at $3,135. If it fails, consider hedging or reducing exposure.

Risk Management: Always use stop loss below $3,100 and limit exposure to 3–5% per position.

⚠️ Risk Disclaimer

This analysis is for educational purposes only and should not be taken as financial advice. Cryptocurrency markets are highly volatile – always do your own research and apply strict risk management before trading.

Ethereum (ETH) is approaching a critical decision point in the Elliott Wave cycle. Based on the long-term structure, we are now at a crossroads: either ETH confirms a Wave 5 bullish continuation, or we see an extended corrective Wave IV before resuming the uptrend.

📈 Bullish Scenario – Wave 5 Extension

Key Breakout Level: $4,400

If ETH can break and sustain above $4,400 with strong volume, Wave 5 will likely extend higher.

Upside Targets:

$5,095 – $5,350 (Fibo 1.272)

$5,850 – $6,140 (Fibo 1.618)

$9,800 – $10,000+ (Extended Wave 5 under Macro Bull Run)

Confirmation Signals:

RSI > 70 (Weekly)

MACD Golden Cross on higher timeframes

📉 Bearish Scenario – Extended Correction (Wave IV not complete)

Key Supports:

$3,580 (Fibo 0.5 retracement)

$3,135 (Fibo 0.618 retracement)

If ETH fails to hold $3,580, it could indicate that Wave IV correction is still in play.

A break below $3,135 would confirm a deeper correction, potentially targeting $2,650.

Warning Signals:

Decreasing volume on rallies

RSI unable to create higher highs

🎯 Trading Plan

If Breakout: Long/hold positions with targets at $5k+

If Breakdown: Wait for support test at $3,135. If it fails, consider hedging or reducing exposure.

Risk Management: Always use stop loss below $3,100 and limit exposure to 3–5% per position.

⚠️ Risk Disclaimer

This analysis is for educational purposes only and should not be taken as financial advice. Cryptocurrency markets are highly volatile – always do your own research and apply strict risk management before trading.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน