In last week's plan I wrote the following " Plan for next week is that we need to hold 6390, 6369. for us to continue higher. Ideally, we do not lose 6452 with 6426 being the breakout and 6390 the low of the week." We spent the first 2 days range bound and lost 6452 on Tuesday around 10am and flushed down and institutions started to buy at the 6369 level on Wednesday-Friday in anticipation of the 10am Jackson Hole meeting.

I wrote on Friday at 4:30am EST - "I missed the overnight flush of yesterday afternoon 6370 low (2:30am) and now price is coming into the overnight session resistance of 6399.25. I need to identify either a move to retest 6412, back test 6399 and then buy on the support for a move to test 6420. Ideally, we could sell off back to the 6364 level or even better 6350, scare retail investors and then wait for a reclaim of 6364 to get back in and ride up."

What did price do when it reclaimed the 6399 level? It built a nice bull flag between 6399-6407 from 4:30am-9:30am and instead of flushing one more time, institutions bought heavily at 10am and we rallied up the levels and then started to build a structure for the next move.

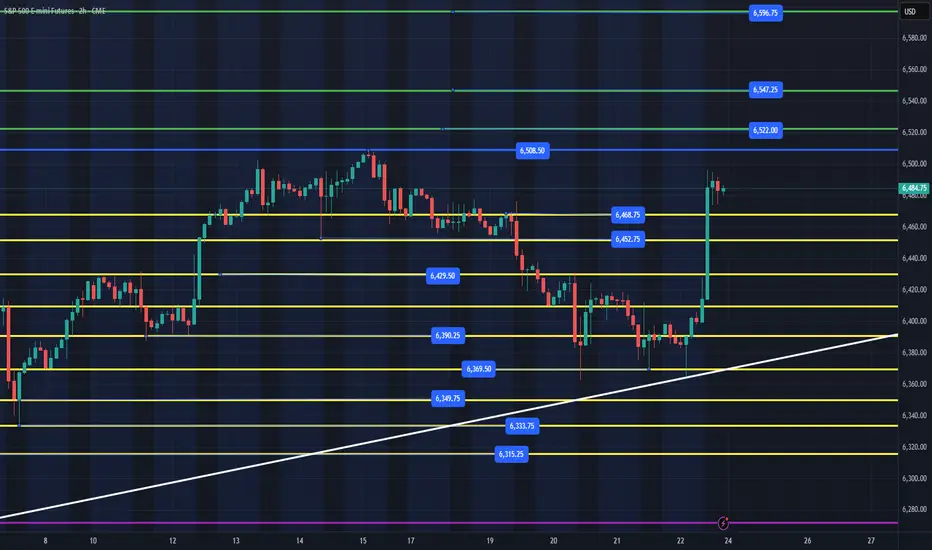

What is the plan for this week? When you look at the 2hr, 4hr, 8hr chart and zoom out, you can see that the trend is up and that we will probably need to digest Friday's rally and most likely chop around ideally above 6468, 6452 levels with 6429 being the lowest level we would want to test. Then we can retest the 6508 level and continue higher this week with 6522, 6547 my main targets with 6596 if bulls really want it.

IF, we lose 6369, my lean is that we will continue lower and a new market trend could be starting to unfold with 6245 the big area for us to hold to stay bullish in the bigger picture.

I will be posting my Daily Trade Plan for Monday before the session open.

I wrote on Friday at 4:30am EST - "I missed the overnight flush of yesterday afternoon 6370 low (2:30am) and now price is coming into the overnight session resistance of 6399.25. I need to identify either a move to retest 6412, back test 6399 and then buy on the support for a move to test 6420. Ideally, we could sell off back to the 6364 level or even better 6350, scare retail investors and then wait for a reclaim of 6364 to get back in and ride up."

What did price do when it reclaimed the 6399 level? It built a nice bull flag between 6399-6407 from 4:30am-9:30am and instead of flushing one more time, institutions bought heavily at 10am and we rallied up the levels and then started to build a structure for the next move.

What is the plan for this week? When you look at the 2hr, 4hr, 8hr chart and zoom out, you can see that the trend is up and that we will probably need to digest Friday's rally and most likely chop around ideally above 6468, 6452 levels with 6429 being the lowest level we would want to test. Then we can retest the 6508 level and continue higher this week with 6522, 6547 my main targets with 6596 if bulls really want it.

IF, we lose 6369, my lean is that we will continue lower and a new market trend could be starting to unfold with 6245 the big area for us to hold to stay bullish in the bigger picture.

I will be posting my Daily Trade Plan for Monday before the session open.

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน