DXY Outlook: Volatility Dominates as Fed Uncertainty Persists

DXY (US Dollar Index) Analysis Report

🔎 Technical Outlook

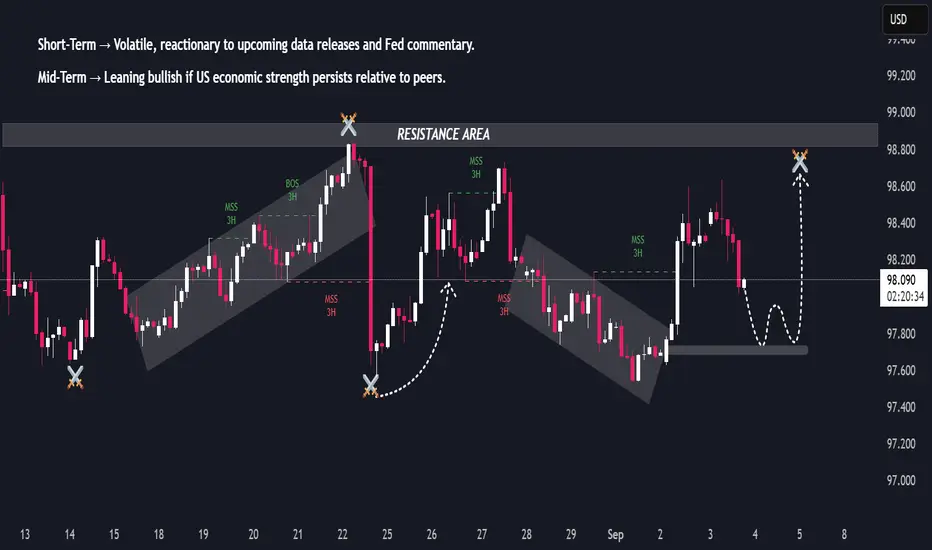

The index recently moved in a clear upward cycle, followed by a sharp rejection, highlighting the market’s sensitivity to macro shifts.

Price action has transitioned into volatile swings, with both bullish and bearish impulses shaping short-term structure.

Current momentum shows cyclical corrections within a broader attempt to sustain bullish rhythm, but intraday moves remain reactive to news flows.

Market behavior suggests traders are seeking liquidity both sides before choosing a decisive directional move.

🌍 Fundamental Outlook

Federal Reserve Policy: Speculation around rate adjustments remains the dominant driver. Softer inflation data has kept expectations for gradual easing alive, while labor market resilience adds uncertainty.

Global Risk Sentiment: Dollar demand fluctuates with equity market flows — stronger equities reduce safe-haven demand, while risk-off tones boost USD.

Geopolitical Factors: Ongoing tensions in trade and global supply chain disruptions support occasional flight-to-safety flows into the dollar.

Comparative Growth: While the US economy shows relative resilience versus peers, diverging central bank policies (ECB, BOJ, BOE) also influence dollar positioning.

Investor Behavior: Large funds are rebalancing exposure — maintaining a neutral to cautiously bullish stance on USD until clearer macro signals emerge.

DXY (US Dollar Index) Analysis Report

🔎 Technical Outlook

The index recently moved in a clear upward cycle, followed by a sharp rejection, highlighting the market’s sensitivity to macro shifts.

Price action has transitioned into volatile swings, with both bullish and bearish impulses shaping short-term structure.

Current momentum shows cyclical corrections within a broader attempt to sustain bullish rhythm, but intraday moves remain reactive to news flows.

Market behavior suggests traders are seeking liquidity both sides before choosing a decisive directional move.

🌍 Fundamental Outlook

Federal Reserve Policy: Speculation around rate adjustments remains the dominant driver. Softer inflation data has kept expectations for gradual easing alive, while labor market resilience adds uncertainty.

Global Risk Sentiment: Dollar demand fluctuates with equity market flows — stronger equities reduce safe-haven demand, while risk-off tones boost USD.

Geopolitical Factors: Ongoing tensions in trade and global supply chain disruptions support occasional flight-to-safety flows into the dollar.

Comparative Growth: While the US economy shows relative resilience versus peers, diverging central bank policies (ECB, BOJ, BOE) also influence dollar positioning.

Investor Behavior: Large funds are rebalancing exposure — maintaining a neutral to cautiously bullish stance on USD until clearer macro signals emerge.

👑 XAU_EMPIRE – XAU/USD Specialist

📊 Professional Forex Trader | Gold Signals Provider

⚡ Smart Money | Technicals | Fundamentals

📈 Daily Accurate Trade Setups & Market Outlook

🔥 Join Exclusive VIP Premium Telegram Channel

t.me/XAUEMPIRE2

📊 Professional Forex Trader | Gold Signals Provider

⚡ Smart Money | Technicals | Fundamentals

📈 Daily Accurate Trade Setups & Market Outlook

🔥 Join Exclusive VIP Premium Telegram Channel

t.me/XAUEMPIRE2

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

👑 XAU_EMPIRE – XAU/USD Specialist

📊 Professional Forex Trader | Gold Signals Provider

⚡ Smart Money | Technicals | Fundamentals

📈 Daily Accurate Trade Setups & Market Outlook

🔥 Join Exclusive VIP Premium Telegram Channel

t.me/XAUEMPIRE2

📊 Professional Forex Trader | Gold Signals Provider

⚡ Smart Money | Technicals | Fundamentals

📈 Daily Accurate Trade Setups & Market Outlook

🔥 Join Exclusive VIP Premium Telegram Channel

t.me/XAUEMPIRE2

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน