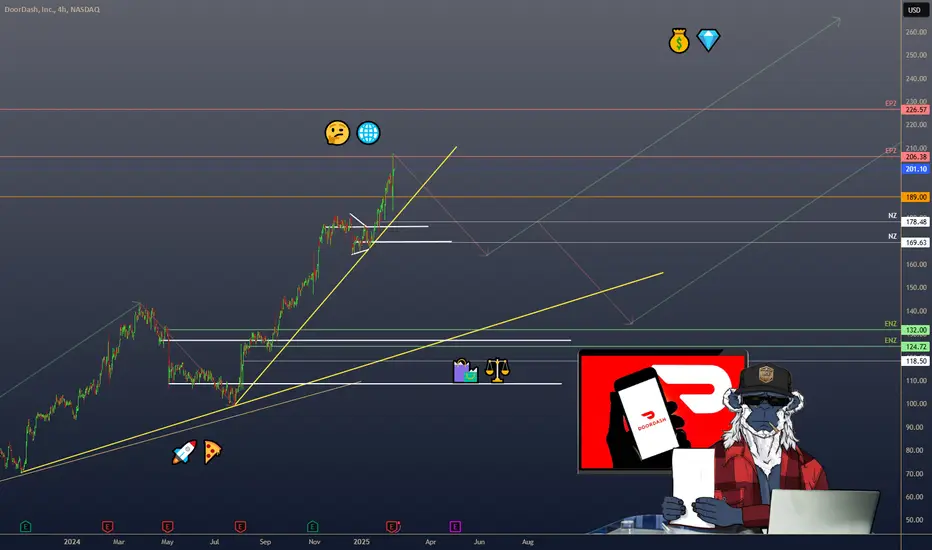

DOORDASH ( DASH) – FROM FOOD DELIVERY TO GLOBAL POWERHOUSE

DASH) – FROM FOOD DELIVERY TO GLOBAL POWERHOUSE

(1/7)

DoorDash just reported 25% YoY revenue growth to $2.9B! That’s a hearty slice of the delivery pie. 🚀🍕 Let’s dig into the numbers, risks, and what might lie ahead for $DASH.

(2/7) – EARNINGS SPOTLIGHT

• GAAP net income: $0.33/share—the second profitable quarter since going public! 💰

• Net revenue margin: 13.5%, inching up from last quarter.

• Plus, a 55B share repurchase plan signals management’s confidence in future earnings. 💎

(3/7) – SECTOR COMPARISON

• Market cap ~$80.2B, with the buyback at ~5% of that.

• Analysts (e.g., Oppenheimer) raising price targets → suggests undervaluation vs. Uber Eats & Grubhub. 🤔

• Strong performance in new verticals & international markets = diversification & growth advantage. 🌐

(4/7) – RISK FACTORS

• Market saturation: Competitors might lower prices or offer bigger discounts. 🛍️

• Regulatory: Gig worker laws could drive up costs. ⚖️

• Economic sensitivity: Consumer spending on delivery can be fickle during downturns. 💸

• Restaurant health: If restaurants stumble, so does DoorDash. 🍽️

(5/7) – SWOT HIGHLIGHTS

Strengths:

• Leading U.S. food delivery market share 🍔

• Expanding into grocery & retail → less restaurant dependence 🛒

• Solid international growth 🌍

Weaknesses:

• High operational costs to maintain delivery network 🚚

• Customer loyalty can be promo-driven vs. brand-driven 💳

Opportunities:

• Enter underpenetrated regions → more global share 🌐

• Expand non-restaurant deliveries → bigger wallet share 🏪

• AI-driven efficiency → streamlined ops 🤖

Threats:

• Heavy competition (direct & from self-delivery restaurants) ⚔️

• Consumer shift back to in-person dining if economy improves 🍴

(6/7) – BULL OR BEAR?

With 25% growth and a second profitable quarter, is DoorDash set to dominate? Or are looming regulatory and market saturation risks a speed bump? 🏁

(7/7) Where do you stand on DoorDash?

1️⃣ Bullish—They’ll keep delivering the goods! 🚀

2️⃣ Neutral—Impressed, but risks loom 🤔

3️⃣ Bearish—Competition & costs will weigh them down 🐻

Vote below! 🗳️👇

(1/7)

DoorDash just reported 25% YoY revenue growth to $2.9B! That’s a hearty slice of the delivery pie. 🚀🍕 Let’s dig into the numbers, risks, and what might lie ahead for $DASH.

(2/7) – EARNINGS SPOTLIGHT

• GAAP net income: $0.33/share—the second profitable quarter since going public! 💰

• Net revenue margin: 13.5%, inching up from last quarter.

• Plus, a 55B share repurchase plan signals management’s confidence in future earnings. 💎

(3/7) – SECTOR COMPARISON

• Market cap ~$80.2B, with the buyback at ~5% of that.

• Analysts (e.g., Oppenheimer) raising price targets → suggests undervaluation vs. Uber Eats & Grubhub. 🤔

• Strong performance in new verticals & international markets = diversification & growth advantage. 🌐

(4/7) – RISK FACTORS

• Market saturation: Competitors might lower prices or offer bigger discounts. 🛍️

• Regulatory: Gig worker laws could drive up costs. ⚖️

• Economic sensitivity: Consumer spending on delivery can be fickle during downturns. 💸

• Restaurant health: If restaurants stumble, so does DoorDash. 🍽️

(5/7) – SWOT HIGHLIGHTS

Strengths:

• Leading U.S. food delivery market share 🍔

• Expanding into grocery & retail → less restaurant dependence 🛒

• Solid international growth 🌍

Weaknesses:

• High operational costs to maintain delivery network 🚚

• Customer loyalty can be promo-driven vs. brand-driven 💳

Opportunities:

• Enter underpenetrated regions → more global share 🌐

• Expand non-restaurant deliveries → bigger wallet share 🏪

• AI-driven efficiency → streamlined ops 🤖

Threats:

• Heavy competition (direct & from self-delivery restaurants) ⚔️

• Consumer shift back to in-person dining if economy improves 🍴

(6/7) – BULL OR BEAR?

With 25% growth and a second profitable quarter, is DoorDash set to dominate? Or are looming regulatory and market saturation risks a speed bump? 🏁

(7/7) Where do you stand on DoorDash?

1️⃣ Bullish—They’ll keep delivering the goods! 🚀

2️⃣ Neutral—Impressed, but risks loom 🤔

3️⃣ Bearish—Competition & costs will weigh them down 🐻

Vote below! 🗳️👇

ปิดการเทรด: ถึงเป้าหมายการทำกำไร

⚡️ Request a trial or subscribe to our premium🛠️tools at ➡️DCAlpha.net

All scripts & content provided by DCAChampion are for informational & educational purposes only.

All scripts & content provided by DCAChampion are for informational & educational purposes only.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

⚡️ Request a trial or subscribe to our premium🛠️tools at ➡️DCAlpha.net

All scripts & content provided by DCAChampion are for informational & educational purposes only.

All scripts & content provided by DCAChampion are for informational & educational purposes only.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน