Week Ahead Plan: September 2-6, 2025

Analysis Period: August 26-30, 2025 Review | September 2-6, 2025 Outlook

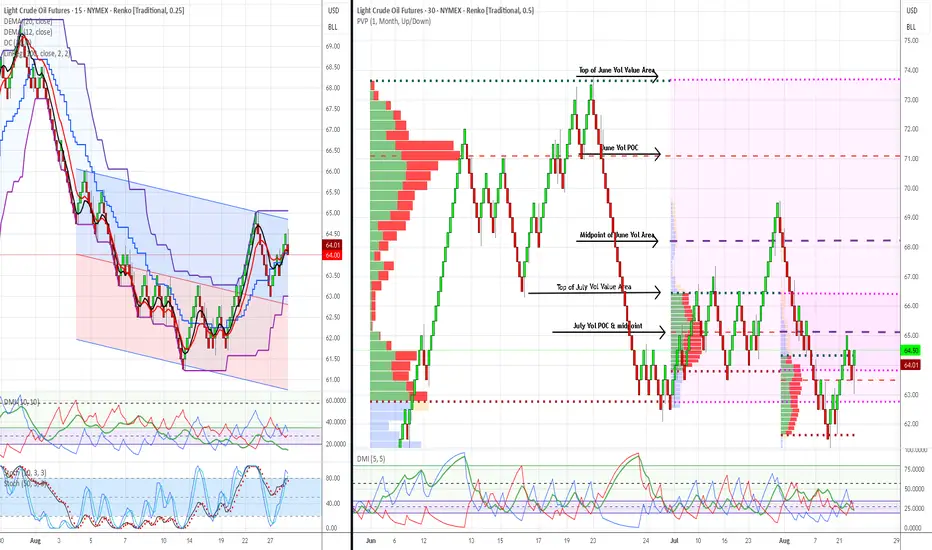

Market: WTI Crude Oil Futures (CL1!)

Methodology: Dual Renko Chart System ($0.25/15min + $0.50/30min)

Current Price: $64.00 (August 30, 2025)

________________________________________

Strategic Outlook & Market Setup

Primary Scenario (70% Probability): Pullback First, Then Recovery

What to Expect: Market opens lower Tuesday ($63.00-63.50 range) due to bearish signal on short-term chart. This creates a buying opportunity if support holds.

Trading Plan:

Secondary Scenario (25% Probability): Sideways Consolidation

What to Expect: Market trades in $63.50-64.50 range for several days while technical signals realign.

Trading Plan:

Low Probability Scenario (5% Probability): Immediate Continuation Up

What to Expect: Market gaps up above $64.25 and keeps rising.

Trading Plan:

________________________________________

Market Risk Factors & Monitoring

Critical Support Level: $62.00

Key Events This Week:

Warning Signs to Watch:

Positive Signs to Look For:

________________________________________

Forward-Looking Adjustments

Modified Risk Management:

Revised Entry Strategy:

Before Buying, Confirm ALL Three:

Timeline Expectations:

Success Metrics:

Simplified Decision Framework:

Green Light to Buy: Price near $62-63 + Short-term trend bullish + Good volume Yellow Light (Wait): Mixed signals, choppy price action, low volume

Red Light (Exit): Price below $62, bearish trend continuing, time limit exceeded

________________________________________

Bottom Line: The bigger picture remains bullish, but short-term signals suggest a pullback first. Use any weakness to $62-63 as a buying opportunity, but only with proper confirmation. Be patient - the setup is still valid but timing may be delayed by a few days.

________________________________________

Document Classification: Trading Analysis

Next Update: September 6, 2025 (Weekly Review)

Risk Level: Moderate (controlled institutional setup)

This analysis represents continued validation of a systematic, institutional-grade trading methodology with demonstrated predictive accuracy and risk control capabilities. This is a view that represents possible scenarios but ultimate responsibility is with each individual trader.

Risk Disclaimer: Past performance does not guarantee future results. All trading involves risk of loss.

Analysis Period: August 26-30, 2025 Review | September 2-6, 2025 Outlook

Market: WTI Crude Oil Futures (CL1!)

Methodology: Dual Renko Chart System ($0.25/15min + $0.50/30min)

Current Price: $64.00 (August 30, 2025)

________________________________________

Strategic Outlook & Market Setup

Primary Scenario (70% Probability): Pullback First, Then Recovery

What to Expect: Market opens lower Tuesday ($63.00-63.50 range) due to bearish signal on short-term chart. This creates a buying opportunity if support holds.

Trading Plan:

- Tuesday Opening: Expect gap down - don't panic, this was anticipated

- Buy Zone: Look for entries between $62.00-63.50 (strong institutional support)

- Confirmation Needed: Wait for short-term trend to flip bullish again before buying

- Target: Still aiming for $66.50 but may take extra 3-5 days to get there

Secondary Scenario (25% Probability): Sideways Consolidation

What to Expect: Market trades in $63.50-64.50 range for several days while technical signals realign.

Trading Plan:

- Strategy: Be patient - don't force trades in choppy conditions

- Wait For: Clear breakout above $64.50 with volume

- Risk: Could waste 1-2 weeks in sideways action

Low Probability Scenario (5% Probability): Immediate Continuation Up

What to Expect: Market gaps up above $64.25 and keeps rising.

Trading Plan:

- Verify: Make sure both short-term and long-term signals turn bullish

- Caution: Be skeptical without strong volume confirmation

- Action: Can buy but use smaller position sizes until confirmed

________________________________________

Market Risk Factors & Monitoring

Critical Support Level: $62.00

- Why Important: Massive institutional buying occurred here - if it breaks, the bullish case is dead

- Action If Broken: Exit all long positions immediately, wait for new setup

- Probability of Break: Low (15%) but must be respected

Key Events This Week:

- Tuesday: ISM Services data (economic health indicator)

- Wednesday: Weekly oil inventory report (could cause volatility)

- Friday: Jobs report (affects overall market sentiment)

Warning Signs to Watch:

- Technical: Short-term trend staying bearish for more than 3 days

- Volume: Declining volume on any bounce attempts

- Support: Any trading below $62.50 for extended periods

- Time: No progress toward $66.50 target within 10 total trading days

Positive Signs to Look For:

- Technical: Short-term trend flipping back to bullish (key confirmation)

- Volume: Above-average volume on any recovery moves

- Support: Strong buying interest at $62-63 zone

- Momentum: Clean breakout above $64.50 with follow-through

________________________________________

Forward-Looking Adjustments

Modified Risk Management:

- Position Size: Use 50% of normal position size until both timeframes align bullish

- Stop Loss: Tighter stops at $62.75 (just below support zone)

- Entry Patience: Don't chase - wait for pullback to support levels

- Profit Taking: Be more aggressive taking profits at first target ($66.50)

Revised Entry Strategy:

Before Buying, Confirm ALL Three:

- Price: Trading at or near $62-63 support zone

- Technical: Short-term trend signal flips back to bullish

- Volume: Above-average buying interest visible

Timeline Expectations:

- Days 1-3: Expect pullback/consolidation phase

- Days 4-5: Look for bullish confirmation signals

- Days 6-10: Resume advance toward $66.50 target if signals align

- Beyond Day 10: If no progress, reassess entire strategy

Success Metrics:

- Minimum Goal: Protect capital during pullback phase

- Primary Target: $66.50 within 2 weeks (revised from 1 week)

- Risk Limit: Maximum 2% account loss if support fails

- Time Limit: Exit strategy if no directional progress within 10 days total

Simplified Decision Framework:

Green Light to Buy: Price near $62-63 + Short-term trend bullish + Good volume Yellow Light (Wait): Mixed signals, choppy price action, low volume

Red Light (Exit): Price below $62, bearish trend continuing, time limit exceeded

________________________________________

Bottom Line: The bigger picture remains bullish, but short-term signals suggest a pullback first. Use any weakness to $62-63 as a buying opportunity, but only with proper confirmation. Be patient - the setup is still valid but timing may be delayed by a few days.

________________________________________

Document Classification: Trading Analysis

Next Update: September 6, 2025 (Weekly Review)

Risk Level: Moderate (controlled institutional setup)

This analysis represents continued validation of a systematic, institutional-grade trading methodology with demonstrated predictive accuracy and risk control capabilities. This is a view that represents possible scenarios but ultimate responsibility is with each individual trader.

Risk Disclaimer: Past performance does not guarantee future results. All trading involves risk of loss.

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน