Hey whats up traders,

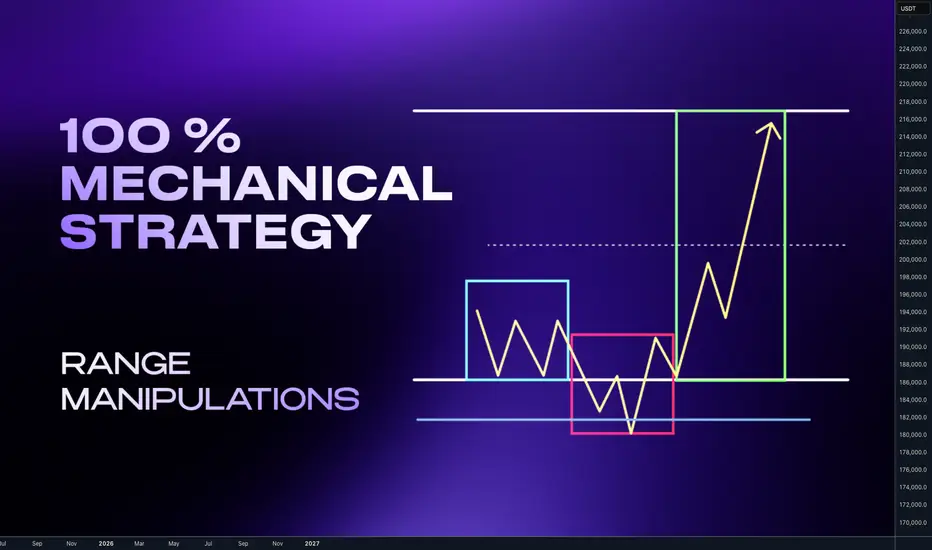

Today Im going reveal simple but effective way to analyze and trade any markets - Stocks, Indices, Forex and Crypto. This thing works on everything because it's based on liquidity manipulations.

It's 100% mechanical structured aproach with fixed targets and defined. So unlike traders who trade various patterns and have on charts different patterns and diagonal subjective lines, you can backtest it and measure its and yours execution performance to get your statistical data for Risk Reward and Winning Ratio.

‼️Once you obtain such data from data sample large enough you will also solve biggest trading problems - FEAR, GREED and OVERTRADING. Why ?

📊Because if you know you win rate is 60 - 70 % trades with RR 2.3 with aprox. 4 trades in a month per instrument, why would you then do following?

... and many more psychological and undisciplined mistakes which discretional pattern traders without EDGE and statistical data about their strategy are doing.

🧠 Having mechanical system with backtested data is your EDGE.

💪 That is what makes you DISCIPLINED TRADER.

🧩Basic Concept

Im looking for the fake break out of the range. Whether we call it manipulation or Stop hunt. It really doesn't matter. The idea is that once big candle is created it creates fomo and break out traders are entering continuation. I trade against them.

📍Bullish continuation setups

Model 1 - Entry after manipulation - 50% target

Model 2 - Entry on pullback on level between 61.8 - 80% pullback

📍Bearish Continuation setups

📍Bearish Continuation setups

Model 1 - Entry after manipulation - 50% target

Model 2 - Entry on pullback on level between 61.8 - 80% pullback

🧩 Manipulation phase

🧩 Manipulation phase

is key for this concept. Without it happening, institutional move cant happen. Why ? Market makers are not looking to stop hunt our stop losses. They dont care about your or mine stop losses even if we trade 100 lots. Most of the brokers are B-Book anyway. But they are seeking the liquidity and they are placed above the highs and lows. You dont even need to read order book or book map to know it. To understand liqudity better read this post below

Now you understand after the liquidity was swept. Big players have guns loaded and the move can start. This is what we want to participate. But !! What I have just shown you are patterns. Without adding them in to the right context with the market they will not have highest winning ratio. You must be selective. Basically you want to:

Now you understand after the liquidity was swept. Big players have guns loaded and the move can start. This is what we want to participate. But !! What I have just shown you are patterns. Without adding them in to the right context with the market they will not have highest winning ratio. You must be selective. Basically you want to:

📍Down Trend - Trade Stop hunts above the highs

📍Up Trend - Trade Stop Hunt below the lows

📍Up Trend - Trade Stop Hunt below the lows

In other words we want be buying lows and selling highs. 🧪How to do it I explained in this post below

In other words we want be buying lows and selling highs. 🧪How to do it I explained in this post below  📍Top- Down analysis

📍Top- Down analysis

Before we go to the refined entries we must understand top down analysis and what to look for on the charts. Never start with LTF. You always must go with top Down analysis.

🧩 TOP Down analysis

🧪Range is mostly created close the key level. If any candle close above the range - Its makes it invalid.

🧪We want see and trade wicks above the range, there you are looking for LTF entry.

📍Bearish Scenario - (ITF view ) Price should not have candle close above the range on the same timeframe otherwise setup is invalidated and new range created. 📍Bearish Scenario - (LTF view) - price (yellow has structured movements and should be crating AMD profiles on the edge of the range. We need to drop to LTF to read the structure.

📍Bearish Scenario - (LTF view) - price (yellow has structured movements and should be crating AMD profiles on the edge of the range. We need to drop to LTF to read the structure.  📍Bullish Scenario ITF view - Price should not have candle close below the range on the same timeframe otherwise setup is invalidated and new range created.

📍Bullish Scenario ITF view - Price should not have candle close below the range on the same timeframe otherwise setup is invalidated and new range created.  📍Bullish Scenario - (LTF view) - price (yellow) has structured movements and should be crating AMD profiles on the edge of the range. We need to drop to LTF to read the structure.

📍Bullish Scenario - (LTF view) - price (yellow) has structured movements and should be crating AMD profiles on the edge of the range. We need to drop to LTF to read the structure.  ‼️Note that Im always referring to the key level. It's called key level , because it's key for the success of the setup. Without it it will work only sometimes. This element must be part of the setup. I personally like the Order Block in other word Supply / Demand zone.

‼️Note that Im always referring to the key level. It's called key level , because it's key for the success of the setup. Without it it will work only sometimes. This element must be part of the setup. I personally like the Order Block in other word Supply / Demand zone.

🧪 I have explained Order block in the post below Before we go to trade setup let's clarify timeframes again. Price is fractal you can basically trade this on any timeframes, but you still need to keep structure of 3 Timeframes.

Before we go to trade setup let's clarify timeframes again. Price is fractal you can basically trade this on any timeframes, but you still need to keep structure of 3 Timeframes.

🧩 Timeframe Alignments

🧪Short Term Trading

🧪Swing Trading

🧪Day trading

🧪Scalping

🔥I recommend to trade daily and weekly ranges. Im not saying Day trading and Scalping is impossible. But Im sure none of us started trading for being isolated nerd behind the PC whole day stressing yourself about every minute. You want live social live and enjoy the freedom which trading can give you and mainly Daily and weekly ranges are higher probability.

🧩 AMD- Accumulation Manipulation Distribution

This is happening on the markets over and over. Everyone who trades profitably use it and if not they are not continuous about using it but they use it is what is necessary to move the market. And we want see It on the Edge of the range with confluence of the key level.

Today Im going reveal simple but effective way to analyze and trade any markets - Stocks, Indices, Forex and Crypto. This thing works on everything because it's based on liquidity manipulations.

It's 100% mechanical structured aproach with fixed targets and defined. So unlike traders who trade various patterns and have on charts different patterns and diagonal subjective lines, you can backtest it and measure its and yours execution performance to get your statistical data for Risk Reward and Winning Ratio.

‼️Once you obtain such data from data sample large enough you will also solve biggest trading problems - FEAR, GREED and OVERTRADING. Why ?

📊Because if you know you win rate is 60 - 70 % trades with RR 2.3 with aprox. 4 trades in a month per instrument, why would you then do following?

- Try to look for trade every day when there is not your setup.

- Fear open next trade after few losses?

- Open huge gamble trade if you know 30% of trades can be loss

- Try to hold for unrealistic target if you know most of your trades hit 2.5 RR

- Try to pass prop challenge in one trade ?

... and many more psychological and undisciplined mistakes which discretional pattern traders without EDGE and statistical data about their strategy are doing.

🧠 Having mechanical system with backtested data is your EDGE.

💪 That is what makes you DISCIPLINED TRADER.

🧩Basic Concept

Im looking for the fake break out of the range. Whether we call it manipulation or Stop hunt. It really doesn't matter. The idea is that once big candle is created it creates fomo and break out traders are entering continuation. I trade against them.

📍Bullish continuation setups

Model 1 - Entry after manipulation - 50% target

Model 2 - Entry on pullback on level between 61.8 - 80% pullback

Model 1 - Entry after manipulation - 50% target

Model 2 - Entry on pullback on level between 61.8 - 80% pullback

is key for this concept. Without it happening, institutional move cant happen. Why ? Market makers are not looking to stop hunt our stop losses. They dont care about your or mine stop losses even if we trade 100 lots. Most of the brokers are B-Book anyway. But they are seeking the liquidity and they are placed above the highs and lows. You dont even need to read order book or book map to know it. To understand liqudity better read this post below

📍Down Trend - Trade Stop hunts above the highs

Before we go to the refined entries we must understand top down analysis and what to look for on the charts. Never start with LTF. You always must go with top Down analysis.

🧩 TOP Down analysis

- HTF Timeframe for the trend

- ITF - Timeframe - Ranges and Key Levels

- LTF - Timeframe Profiling and entries

🧪Range is mostly created close the key level. If any candle close above the range - Its makes it invalid.

🧪We want see and trade wicks above the range, there you are looking for LTF entry.

📍Bearish Scenario - (ITF view ) Price should not have candle close above the range on the same timeframe otherwise setup is invalidated and new range created.

🧪 I have explained Order block in the post below

🧩 Timeframe Alignments

🧪Short Term Trading

- Trend - Monthly - Directional draw on liquidity

- RangeS - Weekly - Stop hunts

- AMD Profiles / Entries - H4/H1

🧪Swing Trading

- Trend - Weekly - Directional draw on liquidity

- Range - Daily - Stop hunts

- AMD Profiles / Entries - H1/M15

🧪Day trading

- Trend - Daily - Directional draw on liquidity

- Range - H4 - Stop Hunts

- AMD Profiles / Entries - M15/ M5

🧪Scalping

- Trend - H4 - Directional draw on liquidity

- Range - H1 - Stop hunts

- AMD Profiles / Entries - M5/M1

🔥I recommend to trade daily and weekly ranges. Im not saying Day trading and Scalping is impossible. But Im sure none of us started trading for being isolated nerd behind the PC whole day stressing yourself about every minute. You want live social live and enjoy the freedom which trading can give you and mainly Daily and weekly ranges are higher probability.

🧩 AMD- Accumulation Manipulation Distribution

This is happening on the markets over and over. Everyone who trades profitably use it and if not they are not continuous about using it but they use it is what is necessary to move the market. And we want see It on the Edge of the range with confluence of the key level.

บันทึก

📍Bearish ScenarioAccumulation / Consolidation on the edge of our range close to the key level and wait for the manipulation above the range and participate during the distribution phase down.

Accumulation / Consolidation on the edge of our range close to the key level and wait for the manipulation above the range and participate during the distribution phase down.

Read the post below where I explained filtering of the key levels with Dealing Ranges

บันทึก

🧪 Trade Setup Model 1We are entering at the moment when we flip from manipulation phase in to the distribution.

It's the moment when order flow changes. Means that on our LTF timeframe order block has to be created. Close below last up down candle is important if you enter before the close, you are not following the strategy rules. Be patient.

📍Bullish Scenario LTF Change in order flow is important aspect of the trade if you dont wait patiently for the candle close on the right timeframe, setup is invalid.

as you can see price action never looks completely same you need to practice your eyes to see it, profiles, levels and what is happening on the edge of the range.

🧩 Trade setup checklist

- Define HTF Trend

- Look for pullbacks to the Discount / Premium

- Define the range

- Wait for manipulation below the Low / Highs around range

- Manipulation should go to the Key Level - Order block, FVG, IFVG

- Once manipulation stage is over and price create LTF Order Block

- It's ready to enter model 1 - Target Liquidity around 50% of the range

- Stop loss above / bellow manipulation highs / lows

- Always Take partial or full close at 50%

- After that price can retrace , if you within trend take model 2 entry

- Model 2 entry is not always offered but if it retrace then

- Look for key level between 61.8 - 80%

- Enter model 2 and target full range (for model 2 you must be right with bias)

บันทึก

Now you must backtest it on 300 trades at least. To build your statistical edge.It will make you confident and help eliminate FEAR GREED, OVERTRADING, UNCERTAINTY etc...

❌ Is it holly grail ? NO

❌Do I win every Trade ? NO

❌Do I fear open another trade after loss ? NO

✅Am I profitable in series of Trades ? YES

🧠 Remember: Trading is hard , great strategy is just a 20% of success.

What turn strategy in to profitable one ?

✅Your confidence backed by statistical edge

✅Patience to wait for the setup.

✅Discipline in the execution

✅Not worrying about the trade outcome.

And all the above is same aspects which any athlete must have. They gain it by training. For us as traders training is backtesting. Not only for developing new strategy but regular backtesting. It's your training.

‼️ PS I skipped explaining model 2 in details you will find out when you do backtesting.

Adapt usefull , Reject useless and add something specifically your own. !!

David Perk aka Dave Fx Hunter

🟣 Free Trading Academy

🟣 Live Trading Streams

🟣 Daily Updates

🟣 Community

👉 linktr.ee/davidperk

🟣 Live Trading Streams

🟣 Daily Updates

🟣 Community

👉 linktr.ee/davidperk

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

🟣 Free Trading Academy

🟣 Live Trading Streams

🟣 Daily Updates

🟣 Community

👉 linktr.ee/davidperk

🟣 Live Trading Streams

🟣 Daily Updates

🟣 Community

👉 linktr.ee/davidperk

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน