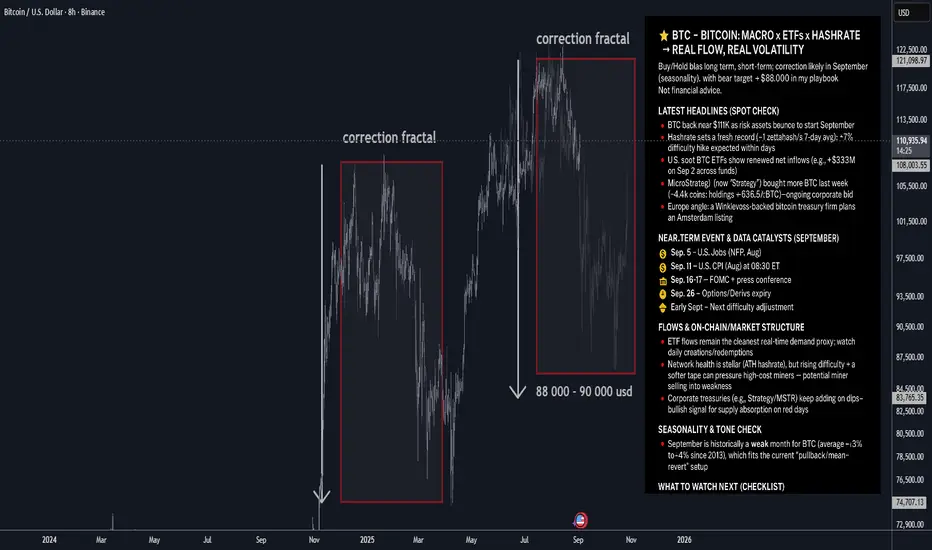

⭐️ BTC — Bitcoin: Macro x ETFs x Hashrate → Real Flow, Real Volatility

Buy/Hold bias long term; short-term: correction likely in September (seasonality), with bear target ≈ $88,000 in my playbook.

🔥 Latest headlines (spot check)

🔸BTC back near $111K as risk assets bounce to start September.

🔸Hashrate sets a fresh record (~1 zettahash/s 7-day avg); a >7% difficulty hike is expected within days. Network is the strongest ever, but miner margins tighten.

🔸U.S. spot BTC ETFs show renewed net inflows (e.g., +$333M on Sep 2 across funds). Flows remain a key daily demand gauge.

🔸MicroStrategy (now “Strategy”) bought more BTC last week (~4,4k coins; holdings ≈ 636.5k BTC)—ongoing corporate bid.

🔸Europe angle: a Winklevoss-backed bitcoin treasury firm plans an Amsterdam listing, signaling appetite for listed BTC exposure in the EU.

🗓 Near-term event & data catalysts (September)

🔸Fri, Sep 5 — U.S. Jobs (NFP, Aug) at 08:30 ET. Labor softness would bolster rate-cut odds and risk appetite; a beat could do the opposite.

🔸Wed, Sep 11 — U.S. CPI (Aug) at 08:30 ET. Inflation surprise drives real-rate expectations → BTC beta.

🔸Tue–Wed, Sep 16–17 — FOMC + press conference. Policy path & dot plot = macro volatility for BTC.

Fri, Sep 26 — Options/Derivs expiry:

• Deribit monthly BTC options expire 08:00 UTC (last Friday rule).

• CME Bitcoin monthly options settle Sep 26 as well.

These expiries often amplify gamma flows and spot-vol.

Early Sept — Next difficulty adjustment likely >7% up (tightens miner economics short-term).

Medium-dated overhang

Mt. Gox creditor deadline: Oct 31, 2025. Any schedule/details update could swing “supply overhang” narratives.

📈 Flows & on-chain/market structure

🔸ETF flows remain the cleanest real-time demand proxy; watch daily creations/redemptions. 🔸Sustained positives tend to align with spot strength; outsized outflows can weigh on price.

🔸Network health is stellar (ATH hashrate), but rising difficulty + a softer tape can pressure high-cost miners → potential miner selling into weakness.

🔸Corporate treasuries (e.g., Strategy/MSTR) keep adding on dips—bullish signal for supply absorption on red days.

🧠 Seasonality & tone check

September is historically a weak month for BTC (average ~−3% to −4% since 2013), which fits the current “pullback/mean-revert” setup.

📣 Social/flow buzz (signals, not noise)

🔸ETF flow posts (Farside, Bloomberg desks) are getting traction again—watch after U.S. close for prints.

🔸Saylor/Strategy buying headlines keep the “corporate bid” narrative front-and-center.

🧭 Levels & plan (author’s framework)

🔸Bias: Long-term constructive; near-term: correction mode likely extends through September (seasonality + event risk).

🔸Bear target: $88,000 (where I’d expect volatility to attract responsive buyers).

🔸Invalidation for bears (tactical): A strong reclaim/close above ~$113K–$115K with improving 🔸ETF inflows would weaken the pullback thesis.

🔸Sizing: Respect macro data days (NFP/CPI/Fed) and options expiry week—expect higher realized vol.

🗺 What to watch next (checklist)

🔸Daily U.S. spot BTC ETF flows (post-close updates). Momentum if creations persist; caution on redemptions clusters.

🔸Sep 5 — NFP (Aug) 08:30 ET. Risk-on if soft; risk-off if hot.

🔸Sep 11 — CPI (Aug) 08:30 ET. Headline/core surprises steer the FOMC tone.

🔸Sep 16–17 — FOMC + presser. Watch guidance on cuts, balance sheet, and growth.

🔸Sep 26 — Deribit & CME monthly expiries. Positioning/“max pain” dynamics into that Friday.

Difficulty adjustment (early Sept). If >7% up as projected, monitor miner behavior/sell pressure.

Buy/Hold bias long term; short-term: correction likely in September (seasonality), with bear target ≈ $88,000 in my playbook.

🔥 Latest headlines (spot check)

🔸BTC back near $111K as risk assets bounce to start September.

🔸Hashrate sets a fresh record (~1 zettahash/s 7-day avg); a >7% difficulty hike is expected within days. Network is the strongest ever, but miner margins tighten.

🔸U.S. spot BTC ETFs show renewed net inflows (e.g., +$333M on Sep 2 across funds). Flows remain a key daily demand gauge.

🔸MicroStrategy (now “Strategy”) bought more BTC last week (~4,4k coins; holdings ≈ 636.5k BTC)—ongoing corporate bid.

🔸Europe angle: a Winklevoss-backed bitcoin treasury firm plans an Amsterdam listing, signaling appetite for listed BTC exposure in the EU.

🗓 Near-term event & data catalysts (September)

🔸Fri, Sep 5 — U.S. Jobs (NFP, Aug) at 08:30 ET. Labor softness would bolster rate-cut odds and risk appetite; a beat could do the opposite.

🔸Wed, Sep 11 — U.S. CPI (Aug) at 08:30 ET. Inflation surprise drives real-rate expectations → BTC beta.

🔸Tue–Wed, Sep 16–17 — FOMC + press conference. Policy path & dot plot = macro volatility for BTC.

Fri, Sep 26 — Options/Derivs expiry:

• Deribit monthly BTC options expire 08:00 UTC (last Friday rule).

• CME Bitcoin monthly options settle Sep 26 as well.

These expiries often amplify gamma flows and spot-vol.

Early Sept — Next difficulty adjustment likely >7% up (tightens miner economics short-term).

Medium-dated overhang

Mt. Gox creditor deadline: Oct 31, 2025. Any schedule/details update could swing “supply overhang” narratives.

📈 Flows & on-chain/market structure

🔸ETF flows remain the cleanest real-time demand proxy; watch daily creations/redemptions. 🔸Sustained positives tend to align with spot strength; outsized outflows can weigh on price.

🔸Network health is stellar (ATH hashrate), but rising difficulty + a softer tape can pressure high-cost miners → potential miner selling into weakness.

🔸Corporate treasuries (e.g., Strategy/MSTR) keep adding on dips—bullish signal for supply absorption on red days.

🧠 Seasonality & tone check

September is historically a weak month for BTC (average ~−3% to −4% since 2013), which fits the current “pullback/mean-revert” setup.

📣 Social/flow buzz (signals, not noise)

🔸ETF flow posts (Farside, Bloomberg desks) are getting traction again—watch after U.S. close for prints.

🔸Saylor/Strategy buying headlines keep the “corporate bid” narrative front-and-center.

🧭 Levels & plan (author’s framework)

🔸Bias: Long-term constructive; near-term: correction mode likely extends through September (seasonality + event risk).

🔸Bear target: $88,000 (where I’d expect volatility to attract responsive buyers).

🔸Invalidation for bears (tactical): A strong reclaim/close above ~$113K–$115K with improving 🔸ETF inflows would weaken the pullback thesis.

🔸Sizing: Respect macro data days (NFP/CPI/Fed) and options expiry week—expect higher realized vol.

🗺 What to watch next (checklist)

🔸Daily U.S. spot BTC ETF flows (post-close updates). Momentum if creations persist; caution on redemptions clusters.

🔸Sep 5 — NFP (Aug) 08:30 ET. Risk-on if soft; risk-off if hot.

🔸Sep 11 — CPI (Aug) 08:30 ET. Headline/core surprises steer the FOMC tone.

🔸Sep 16–17 — FOMC + presser. Watch guidance on cuts, balance sheet, and growth.

🔸Sep 26 — Deribit & CME monthly expiries. Positioning/“max pain” dynamics into that Friday.

Difficulty adjustment (early Sept). If >7% up as projected, monitor miner behavior/sell pressure.

บันทึก

DUMP IN PROGRESSบันทึก

📢 Market Update – September 5, 2025 (Friday close)🧰 Macro driver of the day:

🧾 U.S. jobs miss + rising Fed-cut odds

NFP rose +22k and unemployment ticked to 4.3%, reinforcing expectations for a rate cut at the Sept 17 FOMC. U.S. stocks faded to finish modestly lower on the day. FX wrap: “Gold up $41 to $3,586 — fresh record high; CHF led, CAD lagged” into the North American close.

🥇 Gold – Record run, strong weekly close

Intraday spiked to a fresh ATH (NY) after the jobs miss; spot gold printed a session high near $3,600.90. Friday 5:00pm ET close: $3,585.30/oz.

💶 EUR/USD – Pop above 1.17 on USD slip

Intraday: ripped to ~1.1750–1.1760 after NFP.

Friday close (5:05pm ET): 1.1720 (+0.59% d/d).

💴 USD/JPY – Yen bid on yields lower

Intraday low pressed into the mid-146s as U.S. yields fell.

Friday close (5:05pm ET): 147.40 (−0.73% d/d).

💷 GBP/USD – Steady grind higher

Friday close (5:05pm ET): 1.3510 (+0.56% d/d).

🇨🇭 USD/CHF – CHF strongest major

Friday close (5:05pm ET): 0.7981 (−0.92% d/d).

💵 Dollar gauges – Broad pressure

DXY slipped back below 98 during the session; WSJ Dollar Index finished the week at 95.06 (down for a fifth straight week).

📉 U.S. equities – Soft finish

S&P 500 −0.3%, Dow −0.5%, Nasdaq marginally lower on Friday as growth worries outweighed rate-cut optimism.

📊 Friday closing board (5:00–5:05pm ET)

Gold (Spot): $3,585.30/oz

EUR/USD: 1.1720 | USD/JPY: 147.40 | GBP/USD: 1.3510 | USD/CHF: 0.7981

🧠 Key Takeaway:

A soft labor print + falling yields ignited safe-haven flows into gold and broad USD selling into the Friday close. Volatility stays elevated into next week’s inflation prints and the Sept 17 Fed meeting—size positions conservatively and pre-define risk.

การซื้อขายยังคงดำเนินอยู่

BOOMบันทึก

10 bln USD wiped out in crypto on 100% China tariffs🚨 Historic flush: ~$9.6B in crypto liquidations over 24h (some counts up to $16–19B as the cascade rolled on).

🧨 Trigger: U.S. hits China with 100% tariffs after rare-earth export curbs — global risk-off hits crypto hard.

📉 BTC move: Flash drop toward $102K before a volatile bounce.

👥 Who got rekt: 1.5M+ traders liquidated in a single day.

₿ BTC liqs: Around $1.37B in forced closes.

Ξ ETH liqs: Roughly $1.26B wiped out.

📊 By side: About $8B longs vs $1.5B shorts blown up.

🏦 Biggest single hit: Nearly $90M BTC/USDT liquidation on HTX.

🌍 Macro backdrop: Stocks and metals slid as tariff shock rippled through markets.

🧭 Bottom line: Macro shock + over-leverage = record liquidation and a brutal market reset.

ปิดการเทรด: ถึงเป้าหมายการทำกำไร

CRYPTO UPTOBER IN PROGRESS. I'VE WARNED YOU ALMOST A MONTH AGO ABOUT THIS.บันทึก

lesson learned: don't follow the media and the crowds. 90% of traders and analysts are wrong.look into contrarian trading, study the markets, use confluence for trading.

bitcoin does not trade by the book. just because you put some lines on the chart

does not mean BTC will respect any of them. good luck traders.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

การนำเสนอที่เกี่ยวข้อง

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน