Summary

BNB just put in a vertical move on market cap and the BNB Chain narrative has flipped risk-on. Perp flow spiked, memecoin breadth exploded, and CEX/Wallet primitives are amplifying the loop. I’m positioning for continuation with a “buy dips / rotate to BNB Chain beta” plan, with clear invalidations.

What’s happening (from the provided charts)

Perp flow: Daily perp volume on BSC crossed ~$100B two days ago (screenshot from BnBChain). Liquidity + leverage are back, and that historically fuels multi-day trend moves.

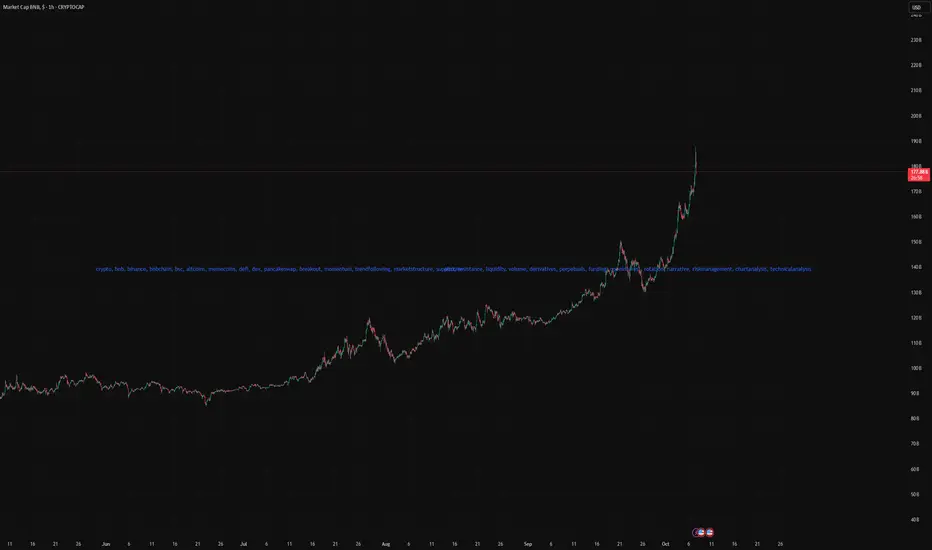

Market cap structure: BNB market cap chart (1h) shows a clean breakout to ~$180B after a month of stair-step advances. Vertical extension suggests momentum, but also raises the odds of sharp pullbacks.

Breadth / heat: Multiple watchlists show BNB memecoins ripping (Palu, “4”, BINA, GIGGLE, etc.). You’ve got 100–200M MC runners across the board and “OKX Wallet Trending” screenshots with BNB-pairs at the top.

Distribution layer: Trust Wallet is actively pushing SOL→BNB swaps (giveaway post), which validates and accelerates the rotation flow.

Narrative lock-in: Multiple posts repeat “BNB Szn” with compounding social proof (CMC Boosts, DEXScreener Boosts/Ads on $SZN, “BNB > XRP/USDT market-cap rank #3” callouts). This is the reflexive feedback loop you want during the early innings of a chain season.

Thesis

BNB is entering a chain-season regime: high perp activity → higher spot liquidity → memecoin breadth → more attention → more perp activity. Until perp volumes cool and breadth narrows, continuation is the base case.

Levels & structure (using the market-cap chart)

Breakout area: ~$170–172B mcap (prior ceiling). First buy-the-dip zone if momentum cools.

Trend support: rising 1h/4h structure sits roughly mid-170s B. Lose this with heavy perp unwind = momentum broken.

Upside magnet: $200B psychological round number. Extension targets beyond that depend on breadth staying hot.

Rotations

Core beta: BNB spot/perp on dips to prior highs.

Chain beta: BNB memecoins with liquidity + CEX/Wallet visibility. Names in your screenshots (Palu, “4”, BINA, GIGGLE) are already in motion; stick to rule-based entries (liquidity > $1–3M, no stealth revokes, active socials).

Tools signal: “Trending” tabs (OKX Wallet, Dexscreener Boosts, CMC boosts) are acting like momentum filters this week—lean into them while the season is hot.

Catalysts to monitor

Bottom line

As long as perp flow stays elevated and breadth remains wide, trend-following + dip-buying BNB and rotating into liquid BNB-chain beta is the optimal stance. Lose trend support + perp dries up → exit to strength and wait for the next setup.

BNB just put in a vertical move on market cap and the BNB Chain narrative has flipped risk-on. Perp flow spiked, memecoin breadth exploded, and CEX/Wallet primitives are amplifying the loop. I’m positioning for continuation with a “buy dips / rotate to BNB Chain beta” plan, with clear invalidations.

What’s happening (from the provided charts)

Perp flow: Daily perp volume on BSC crossed ~$100B two days ago (screenshot from BnBChain). Liquidity + leverage are back, and that historically fuels multi-day trend moves.

Market cap structure: BNB market cap chart (1h) shows a clean breakout to ~$180B after a month of stair-step advances. Vertical extension suggests momentum, but also raises the odds of sharp pullbacks.

Breadth / heat: Multiple watchlists show BNB memecoins ripping (Palu, “4”, BINA, GIGGLE, etc.). You’ve got 100–200M MC runners across the board and “OKX Wallet Trending” screenshots with BNB-pairs at the top.

Distribution layer: Trust Wallet is actively pushing SOL→BNB swaps (giveaway post), which validates and accelerates the rotation flow.

Narrative lock-in: Multiple posts repeat “BNB Szn” with compounding social proof (CMC Boosts, DEXScreener Boosts/Ads on $SZN, “BNB > XRP/USDT market-cap rank #3” callouts). This is the reflexive feedback loop you want during the early innings of a chain season.

Thesis

BNB is entering a chain-season regime: high perp activity → higher spot liquidity → memecoin breadth → more attention → more perp activity. Until perp volumes cool and breadth narrows, continuation is the base case.

Levels & structure (using the market-cap chart)

Breakout area: ~$170–172B mcap (prior ceiling). First buy-the-dip zone if momentum cools.

Trend support: rising 1h/4h structure sits roughly mid-170s B. Lose this with heavy perp unwind = momentum broken.

Upside magnet: $200B psychological round number. Extension targets beyond that depend on breadth staying hot.

Rotations

Core beta: BNB spot/perp on dips to prior highs.

Chain beta: BNB memecoins with liquidity + CEX/Wallet visibility. Names in your screenshots (Palu, “4”, BINA, GIGGLE) are already in motion; stick to rule-based entries (liquidity > $1–3M, no stealth revokes, active socials).

Tools signal: “Trending” tabs (OKX Wallet, Dexscreener Boosts, CMC boosts) are acting like momentum filters this week—lean into them while the season is hot.

Catalysts to monitor

- More DEXScreener/CMC boosts for BNB-pairs.

- CEX wallet trending panels featuring BNB tokens.

- Trust Wallet / Binance ecosystem promos (SOL→BNB incentives).

Bottom line

As long as perp flow stays elevated and breadth remains wide, trend-following + dip-buying BNB and rotating into liquid BNB-chain beta is the optimal stance. Lose trend support + perp dries up → exit to strength and wait for the next setup.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน