🧠 Chart Context & Wave Structure

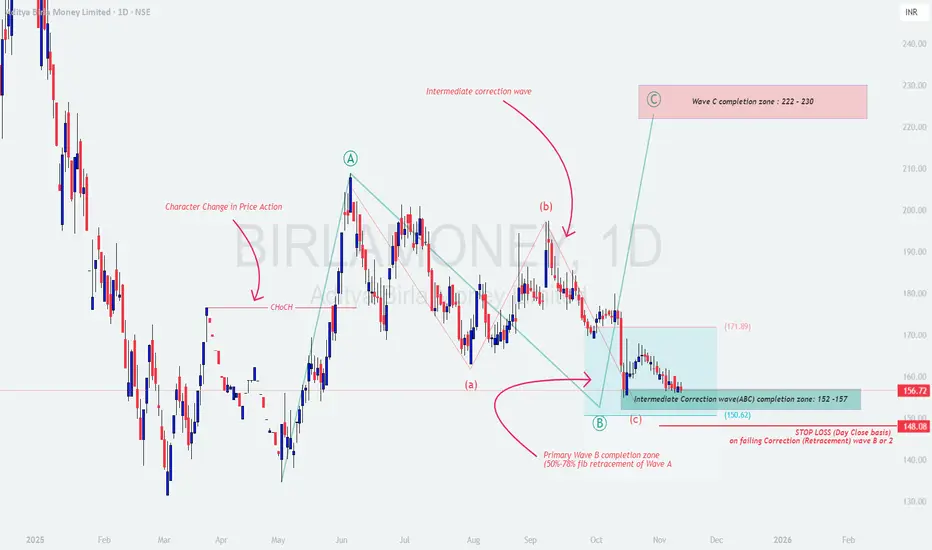

The chart displays a classic Elliott Wave corrective setup after a strong impulsive rally (Wave A).

Following the impulsive move, price entered a multi-stage correction, forming a clear (a-b-c) structure within Wave B.

Key Observations:

📈 Character Change in Price Action (ChoCH) signaled the initial shift from bearish to bullish structure.

Wave A marked a strong impulsive leg confirming bullish sentiment.

The ongoing Wave B correction is now nearing completion within the 50%-78% Fibonacci retracement zone of Wave A.

The Intermediate correction (ABC) seems to be completing between ₹152 – ₹157, aligning with strong confluence support.

📚 Educational Insights

1️⃣ Character Change in Price Action (ChoCH):

Marks the structural shift from lower highs/lows to higher highs/lows — the first clue of trend reversal.

2️⃣ Fibonacci Retracement Principle:

Most corrective waves retrace 50%–78.6% of the prior impulsive leg.

This “Golden Pocket” zone often acts as a high-probability reversal area where smart money accumulates.

3️⃣ Wave Structure Psychology:

Wave A: Impulsive rally driven by renewed optimism.

Wave B: Corrective pullback – often mistaken as a bearish reversal.

Wave C: Next impulsive leg resuming the primary uptrend; often equals or exceeds Wave A in magnitude.

🎯 Price Projection & Prediction

Wave B completion zone: ₹152 – ₹157 ✅

Wave C potential target zone: ₹222 – ₹230 🎯

Invalidation / Stop-Loss zone: Below ₹148 (Closing basis) 🚫

If price sustains above ₹157 and breaks ₹171.89, it strengthens the bullish probability for Wave C extension.

💡 Trading Strategy (Educational Purpose Only)

1️⃣ Entry Plan:

Watch for bullish reversal patterns (Hammer, Bullish Engulfing, or Double Bottom) near ₹152–₹157.

Aggressive Entry: Partial accumulation in this zone.

Conservative Entry: Wait for breakout confirmation above ₹165–₹171.89 zone.

2️⃣ Targets:

🎯 Target 1: ₹190 (Intermediate resistance)

🎯 Target 2: ₹222 – ₹230 (Wave C completion zone)

3️⃣ Stop-Loss:

Keep Closing basis SL below ₹148, as a break below it invalidates the current corrective completion structure.

⚖️ Risk Management Tips

Risk only 1–2% of your total trading capital per trade.

Avoid aggressive averaging during corrections.

For options traders — enter directional positions only after structure confirmation.

Combine structure + volume confirmation for high-probability setups.

Remember: Elliott Waves show probability, not certainty.

🧩 Summary & Conclusion

Aditya Birla Money appears to be completing its intermediate corrective Wave (ABC) within the ₹152–₹157 zone — a strong support confluence area.

If the structure holds, a potential impulsive Wave C rally could unfold toward ₹222–₹230 in the coming weeks.

Patience and confirmation will be key before entering this potential move.

⚠️ Disclaimer

I am not a SEBI-registered analyst.

This analysis is purely for educational and informational purposes only and should not be taken as investment advice.

Please consult your financial advisor before making any trading decisions.

The chart displays a classic Elliott Wave corrective setup after a strong impulsive rally (Wave A).

Following the impulsive move, price entered a multi-stage correction, forming a clear (a-b-c) structure within Wave B.

Key Observations:

📈 Character Change in Price Action (ChoCH) signaled the initial shift from bearish to bullish structure.

Wave A marked a strong impulsive leg confirming bullish sentiment.

The ongoing Wave B correction is now nearing completion within the 50%-78% Fibonacci retracement zone of Wave A.

The Intermediate correction (ABC) seems to be completing between ₹152 – ₹157, aligning with strong confluence support.

📚 Educational Insights

1️⃣ Character Change in Price Action (ChoCH):

Marks the structural shift from lower highs/lows to higher highs/lows — the first clue of trend reversal.

2️⃣ Fibonacci Retracement Principle:

Most corrective waves retrace 50%–78.6% of the prior impulsive leg.

This “Golden Pocket” zone often acts as a high-probability reversal area where smart money accumulates.

3️⃣ Wave Structure Psychology:

Wave A: Impulsive rally driven by renewed optimism.

Wave B: Corrective pullback – often mistaken as a bearish reversal.

Wave C: Next impulsive leg resuming the primary uptrend; often equals or exceeds Wave A in magnitude.

🎯 Price Projection & Prediction

Wave B completion zone: ₹152 – ₹157 ✅

Wave C potential target zone: ₹222 – ₹230 🎯

Invalidation / Stop-Loss zone: Below ₹148 (Closing basis) 🚫

If price sustains above ₹157 and breaks ₹171.89, it strengthens the bullish probability for Wave C extension.

💡 Trading Strategy (Educational Purpose Only)

1️⃣ Entry Plan:

Watch for bullish reversal patterns (Hammer, Bullish Engulfing, or Double Bottom) near ₹152–₹157.

Aggressive Entry: Partial accumulation in this zone.

Conservative Entry: Wait for breakout confirmation above ₹165–₹171.89 zone.

2️⃣ Targets:

🎯 Target 1: ₹190 (Intermediate resistance)

🎯 Target 2: ₹222 – ₹230 (Wave C completion zone)

3️⃣ Stop-Loss:

Keep Closing basis SL below ₹148, as a break below it invalidates the current corrective completion structure.

⚖️ Risk Management Tips

Risk only 1–2% of your total trading capital per trade.

Avoid aggressive averaging during corrections.

For options traders — enter directional positions only after structure confirmation.

Combine structure + volume confirmation for high-probability setups.

Remember: Elliott Waves show probability, not certainty.

🧩 Summary & Conclusion

Aditya Birla Money appears to be completing its intermediate corrective Wave (ABC) within the ₹152–₹157 zone — a strong support confluence area.

If the structure holds, a potential impulsive Wave C rally could unfold toward ₹222–₹230 in the coming weeks.

Patience and confirmation will be key before entering this potential move.

⚠️ Disclaimer

I am not a SEBI-registered analyst.

This analysis is purely for educational and informational purposes only and should not be taken as investment advice.

Please consult your financial advisor before making any trading decisions.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน