BANK NIFTY TRADING PLAN – 09-Sep-2025

📌 Key Levels to Watch:

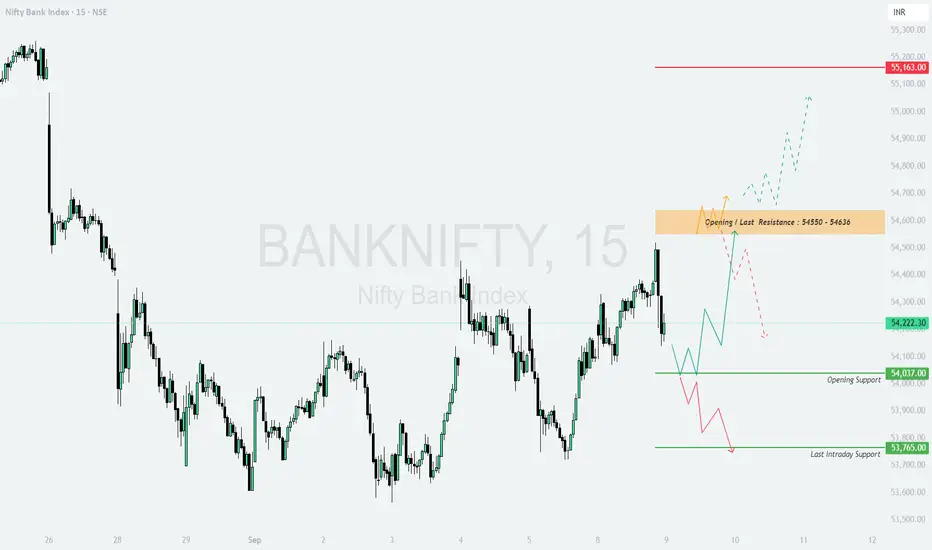

Major Resistance Zone: 54,550 – 54,636

Upside Extension Resistance: 55,163

Opening Support: 54,037

Last Intraday Support: 53,765

The index is now trading near a decision-making point. Price behavior around the resistance zone and support levels will set the tone for the next move.

🔼 1. Gap-Up Opening (200+ points above 54,636)

If Bank Nifty opens above 54,636, it will open doors for bullish continuation.

📌 Plan of Action:

👉 Educational Note: Gap-ups above resistance zones often trap late sellers. But fresh longs should be added only if the price sustains for 15–30 mins above resistance.

➖ 2. Flat Opening (Around 54,200 – 54,300)

A flat start gives traders an opportunity to observe early market sentiment.

📌 Plan of Action:

👉 Educational Note: Flat openings are ideal for option sellers in the first hour. Buyers should wait for confirmation of breakout/breakdown before initiating trades.

🔽 3. Gap-Down Opening (200+ points below 54,000)

If the index opens sharply lower, bearish momentum may dominate.

📌 Plan of Action:

👉 Educational Note: Gap-downs create panic, but seasoned traders wait for a reversal signal near strong support zones to capture short-covering rallies.

🛡️ Risk Management Tips for Options Traders

📌 Summary & Conclusion

🟢 Above 54,636 → Bullish trend continuation towards 55,163+.

🟧 Flat Opening → Range-bound play; above 54,300 bullish, below 54,037 weak.

🔴 Below 54,000 → Bearish momentum, testing 53,765 and possibly lower.

⚠️ Critical Zone: 54,550 – 54,636 (Major Resistance). A clear breakout here will define the bullish trend continuation.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational purposes and should not be considered as financial advice. Please consult your financial advisor before making trading decisions.

📌 Key Levels to Watch:

Major Resistance Zone: 54,550 – 54,636

Upside Extension Resistance: 55,163

Opening Support: 54,037

Last Intraday Support: 53,765

The index is now trading near a decision-making point. Price behavior around the resistance zone and support levels will set the tone for the next move.

🔼 1. Gap-Up Opening (200+ points above 54,636)

If Bank Nifty opens above 54,636, it will open doors for bullish continuation.

📌 Plan of Action:

- [] Sustaining above 54,636 can lead to a strong rally towards 55,163.

[] If momentum continues, the index may even attempt new highs beyond 55,200+. - Watch for early profit booking near 55,163, as this level could act as a supply zone.

👉 Educational Note: Gap-ups above resistance zones often trap late sellers. But fresh longs should be added only if the price sustains for 15–30 mins above resistance.

➖ 2. Flat Opening (Around 54,200 – 54,300)

A flat start gives traders an opportunity to observe early market sentiment.

📌 Plan of Action:

- [] If Bank Nifty sustains above 54,300, expect a test of the 54,550 – 54,636 resistance zone.

[] A clean breakout above 54,636 can extend the move towards 55,163. - On the downside, a failure to hold 54,037 (opening support) may drag prices towards 53,765.

👉 Educational Note: Flat openings are ideal for option sellers in the first hour. Buyers should wait for confirmation of breakout/breakdown before initiating trades.

🔽 3. Gap-Down Opening (200+ points below 54,000)

If the index opens sharply lower, bearish momentum may dominate.

📌 Plan of Action:

- [] Immediate support lies at 53,765 (last intraday support).

[] A breakdown below 53,765 can accelerate selling, targeting 53,500 – 53,400 levels. - However, if Bank Nifty takes support at 53,765 and rebounds strongly, expect a short-covering rally back towards 54,037.

👉 Educational Note: Gap-downs create panic, but seasoned traders wait for a reversal signal near strong support zones to capture short-covering rallies.

🛡️ Risk Management Tips for Options Traders

- [] Always trade with a pre-defined stop-loss on hourly closing basis.

[] Keep position sizing under control — risk only 1–2% of total capital per trade.

[] On volatile days, prefer option spreads (bull call spread, bear put spread) over naked options to manage time decay.

[] Avoid chasing gap-ups or gap-downs blindly; wait for confirmation candles. - Scale out profits near resistance zones like 54,636 and trail stop-losses on remaining positions.

📌 Summary & Conclusion

🟢 Above 54,636 → Bullish trend continuation towards 55,163+.

🟧 Flat Opening → Range-bound play; above 54,300 bullish, below 54,037 weak.

🔴 Below 54,000 → Bearish momentum, testing 53,765 and possibly lower.

⚠️ Critical Zone: 54,550 – 54,636 (Major Resistance). A clear breakout here will define the bullish trend continuation.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational purposes and should not be considered as financial advice. Please consult your financial advisor before making trading decisions.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน