Good Afternoon,

I hope all is well. I have not posted lately - so here is one !

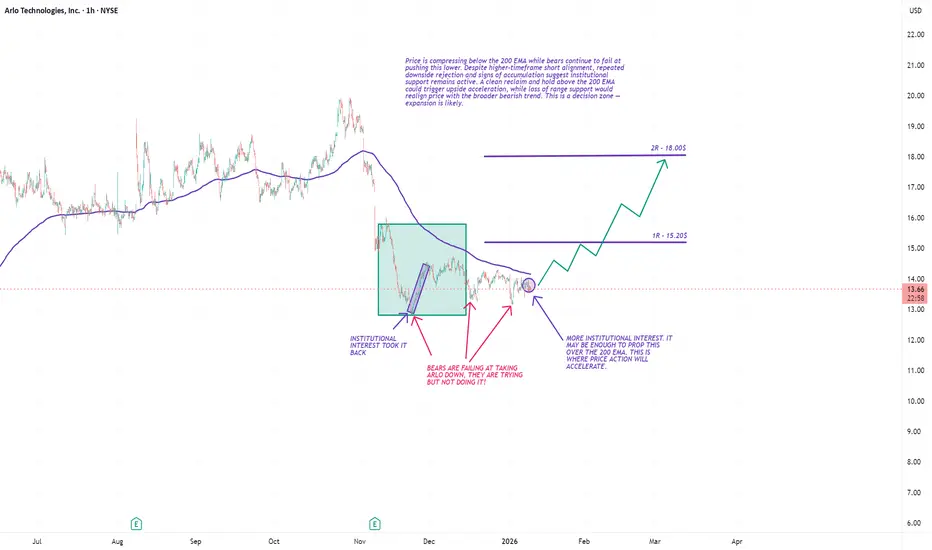

Scenario 1: Bullish Continuation / Breakout (Higher Probability if Confirmed)

Thesis:

Institutions defend current range and push price through the 200 EMA, triggering acceleration.

What confirms it

Clean 1h close above the 200 EMA

Follow-through volume expansion

Successful retest of EMA as support

Targets

$14.30–14.60 (prior range highs / supply)

Extension toward $15.00–15.50 if momentum builds

Risk Management

Invalidation: loss of $13.20

Ideal stop: below the consolidation base

Why it works

Bears have failed multiple breakdowns

Accumulation + compression often resolves upward

Short positioning can fuel a squeeze

Scenario 2: Range Extension / Continued Chop (Neutral)

Thesis:

Price remains trapped between range support and the 200 EMA, frustrating both sides.

What it looks like

Repeated EMA rejections

Higher lows but no follow-through

Declining volatility after spikes

Range

Support: $13.00–13.20

Resistance: $13.90–14.00

Trading Approach

Fade extremes (mean reversion)

Reduce size, quicker profit-taking

Wait for HTF confirmation

Risk

Overtrading in low-quality conditions

Scenario 3: Bearish Breakdown / HTF Alignment (Lower Probability, Higher Impact)

Thesis:

Institutional support fails and higher-timeframe shorts regain control.

What confirms it

Strong impulsive breakdown below $13.00

Acceptance below range (not a wick)

Volume expansion to the downside

Targets

$12.40–12.60 (prior demand)

Extension to $11.80–12.00 if selling accelerates

Risk Management

Invalidation: reclaim of $13.50

Avoid shorting into support without confirmation

Trade Safely!

Enjoy!

I hope all is well. I have not posted lately - so here is one !

Scenario 1: Bullish Continuation / Breakout (Higher Probability if Confirmed)

Thesis:

Institutions defend current range and push price through the 200 EMA, triggering acceleration.

What confirms it

Clean 1h close above the 200 EMA

Follow-through volume expansion

Successful retest of EMA as support

Targets

$14.30–14.60 (prior range highs / supply)

Extension toward $15.00–15.50 if momentum builds

Risk Management

Invalidation: loss of $13.20

Ideal stop: below the consolidation base

Why it works

Bears have failed multiple breakdowns

Accumulation + compression often resolves upward

Short positioning can fuel a squeeze

Scenario 2: Range Extension / Continued Chop (Neutral)

Thesis:

Price remains trapped between range support and the 200 EMA, frustrating both sides.

What it looks like

Repeated EMA rejections

Higher lows but no follow-through

Declining volatility after spikes

Range

Support: $13.00–13.20

Resistance: $13.90–14.00

Trading Approach

Fade extremes (mean reversion)

Reduce size, quicker profit-taking

Wait for HTF confirmation

Risk

Overtrading in low-quality conditions

Scenario 3: Bearish Breakdown / HTF Alignment (Lower Probability, Higher Impact)

Thesis:

Institutional support fails and higher-timeframe shorts regain control.

What confirms it

Strong impulsive breakdown below $13.00

Acceptance below range (not a wick)

Volume expansion to the downside

Targets

$12.40–12.60 (prior demand)

Extension to $11.80–12.00 if selling accelerates

Risk Management

Invalidation: reclaim of $13.50

Avoid shorting into support without confirmation

Trade Safely!

Enjoy!

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน