VWAP Entry Assistant (v1.0)Description:

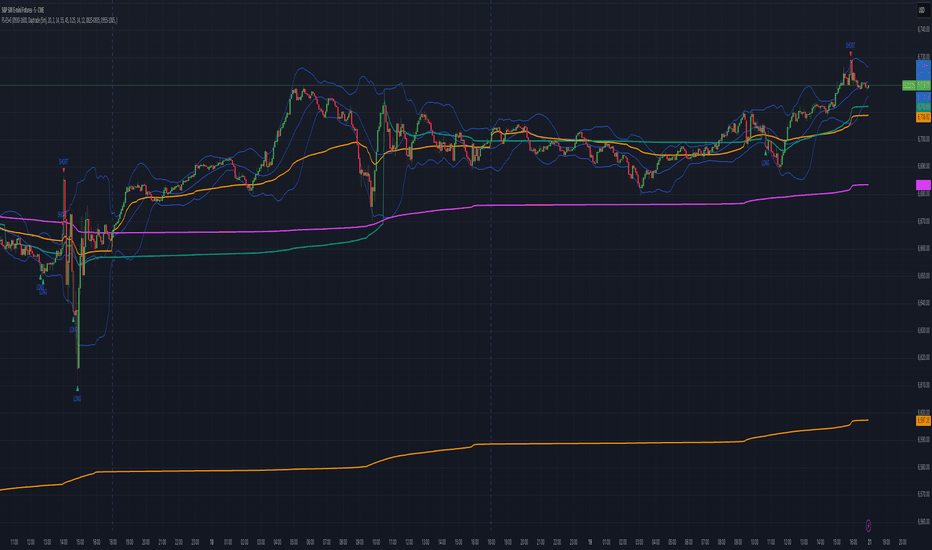

Anchored VWAP with a lightweight assistant for VWAP reversion trades.

It shows the distance to VWAP, an estimated hit probability for the current bar, the expected number of bars to reach VWAP, and a recommended entry price.

If the chance of touching VWAP is low, the script suggests an adjusted limit using a fraction of ATR.

The VWAP line is white by default, and a compact summary table appears at the bottom-left.

Educational tool. Not financial advice. Not affiliated with TradingView or any exchange. Always backtest before use.

อินดิเคเตอร์ Pine Script®