Vertical Line on Custom DateThis Pine Script code creates a custom indicator for TradingView that draws a vertical line on the chart at a specific date and time defined by the user.

User Input: Allows the user to specify the day, hour, and minute when the vertical line should appear.

Vertical Line Drawing: When the current date and time match the user’s inputs, a vertical line is drawn on the chart at the corresponding bar, offset by one bar to align properly.

Customizable Color and Width: The vertical line is displayed in purple with a customizable width.

Overall, this indicator helps traders visually mark important dates and times on their price charts.

ค้นหาในสคริปต์สำหรับ "chart"

FS Scorpion TailKey Features & Components:

1. Custom Date & Chart-Based Controls

The software allows users to define whether they want signals to start on a specific date (useSpecificDate) or base calculations on the visible chart’s range (useRelativeScreenSumLeft and useRelativeScreenSumRight).

Users can input the number of stocks to buy/sell per signal and decide whether to sell only for profit.

2. Technical Indicators Used

EMA (Exponential Moving Average): Users can define the length of the EMA and specify if buy/sell signals should occur when the EMA is rising or falling.

MACD (Moving Average Convergence Divergence): MACD crossovers, slopes of the MACD line, signal line, and histogram are used for generating buy/sell signals.

ATR (Average True Range): Signals are generated based on rising or falling ATR.

Aroon Indicator: Buy and sell signals are based on the behavior of the Aroon upper and lower lines.

RSI (Relative Strength Index): Tracks whether the RSI and its moving average are rising or falling to generate signals.

Bollinger Bands: Buy/sell signals depend on the basis, upper, and lower band behavior (rising or falling).

3. Signal Detection

The software creates arrays for each indicator to store conditions for buy/sell signals.

The allTrue() function checks whether all conditions for buy/sell signals are true, ensuring that only valid signals are plotted.

Signals are differentiated between buy-only, sell-only, and both buy and sell (dual signal).

4. Visual Indicators

Vertical Lines: When buy, sell, or dual signals are detected, vertical lines are drawn at the corresponding bar with configurable colors (green for buy, red for sell, silver for dual).

Buy/Sell Labels: Visual labels are plotted directly on the chart to denote buy or sell signals, allowing for clear interpretation of the strategy.

5. Cash Flow & Metrics Display

The software maintains an internal ledger of how many stocks are bought/sold, their prices, and whether a profit is being made.

A table is displayed at the bottom right of the chart, showing:

Initial investment

Current stocks owned

Last buy price

Market stake

Net profit

The table background turns green for profit and red for loss.

6. Dynamic Decision Making

Buy Condition: If a valid buy signal is generated, the software decrements the cash balance and adds stocks to the inventory.

Sell Condition: If the sell signal is valid (and meets the profit requirement), stocks are sold, and cash is incremented.

A fallback check ensures the sell logic prevents selling more stocks than are available and adjusts stock holding appropriately (e.g., sell half).

Customization and Usage

Indicator Adjustments: The user can choose which indicators to activate (e.g., EMA, MACD, RSI) via input controls. Each indicator has specific customizable parameters such as lengths, slopes, and conditions.

Signal Flexibility: The user can adjust conditions for buying and selling based on various technical indicators, which adds flexibility in implementing trading strategies. For example, users may require the RSI to be higher than its moving average or trigger sales only when MACD crosses under the signal line.

Profit Sensitivity: The software allows the option to sell only when a profit is assured by checking if the current price is higher than the last buy price.

Summary of Usage:

Indicator Selection: Enable or disable technical indicators like EMA, MACD, RSI, Aroon, ATR, and Bollinger Bands to fit your trading strategy.

Custom Date/Chart Settings: Choose whether to calculate based on specific time ranges or visible portions of the chart.

Dynamic Signal Plotting: Once buy or sell conditions are met, the software will visually plot signals on your chart, giving clear entry and exit points.

Investment Tracking: Real-time tracking of stock quantities, investments, and profit ensures a clear view of your trading performance.

Backtesting: Use this software for backtesting your strategy by analyzing how buy and sell signals would have performed historically based on the chosen indicators.

Conclusion

The FS Scorpion Tail software is a robust and flexible trading tool, allowing traders to develop custom strategies based on multiple well-known technical indicators. Its visual aid, coupled with real-time investment tracking, makes it valuable for systematic traders looking to automate or refine their trading approach.

Weekly High/Low Day BreakdownThe "Weekly High/Low Day Breakdown" is a tool designed to help identify patterns in market behaviour by analysing the days of the week when weekly highs and lows occur. This indicator calculates the frequency and percentage of weekly highs and lows for each day from Monday to Sunday within the visible range of your chart.

Features:

Weekly Analysis: Calculates weekly highs and lows based on daily open high and low prices from Monday to Sunday.

Day-Specific Breakdown: Tracks which day of the week each weekly high and low occurred.

Visible Range Focus: Only considers data within the current visible range of your chart for precise analysis.

Interactive Table Display: Presents the results in an easy-to-read table directly on your chart.

How It Works:

Data Collection: Fetches daily high, low, day of the week, and time data regardless of your chart's timeframe. Uses these daily figures to determine the weekly high and low for each week.

Weekly Tracking: Monitors the day of the week when the weekly high and low prices occur. Resets tracking at the end of each week (Sunday).

Visible Range Analysis: Only includes weeks that fall entirely within the visible time range of your chart. Ensures that the analysis is relevant to the period you are focusing on.

Percentage Calculation: Counts the occurrences of weekly highs and lows for each day. Calculates the percentage based on the total number of weeks in the visible range.

Result Display: Generates a table with days of the week as columns and "Weekly High" and "Weekly Low" as rows. Displays the percentage values, indicating how often highs and lows occur on each day.

How to Use:

Add the Indicator: Apply the "Weekly High/Low Day Breakdown" indicator to your TradingView chart.

Adjust Visible Range: Zoom in or out to set the desired visible time range for your analysis.

Interpret the Table:

Columns: Represent days from Monday to Sunday.

"Weekly High" Row: Shows the percentage of times the weekly high occurred on each day. "Weekly Low" Row: Shows the percentage of times the weekly low occurred on each day.

Colors: Blue text indicates high percentages, red text indicates low percentages.

Example Interpretation:

If the table shows a 30% value under "Tuesday" for "Weekly High," it means that in 30% of the weeks within the visible range, the highest price of the week occurred on a Tuesday.

Similarly, a 40% value under "Friday" for "Weekly Low" indicates that 40% of the weekly lows happened on a Friday.

Relative Measured Volatility (RMV) – Spot Tight Entry ZonesTitle: Relative Measured Volatility (RMV) – Spot Tight Entry Zones

Introduction

The Relative Measured Volatility (RMV) indicator is designed to highlight tight price consolidation zones , making it an ideal tool for traders seeking optimal entry points before potential breakouts. By focusing on tightness rather than general volatility, RMV offers traders a practical way to detect consolidation phases that often precede significant market moves.

How RMV Works

The RMV calculates short-term tightness by averaging three ATR (Average True Range) values over different lookback periods and then normalizing them within a specified lookback window. The result is a percentage-based scale from 0 to 100, indicating how tight the current price range is compared to recent history.

Here’s the breakdown:

Three ATR values are computed using user-defined short lookback periods to represent short-term price movements. An average of the ATRs provides a smoothed measure of current tightness. The RMV normalizes this average against the highest and lowest values over the defined lookback period, scaling it from 0 to 100.

This approach helps traders identify consolidation zones that are more likely to lead to breakouts.

Key Features of RMV

Multi-Period ATR Calculation : Uses three ATR values to effectively capture market tightness over the short term. Normalization : Converts the tightness measure to a 0-100 scale for easy interpretation. Dynamic Histogram and Background Colors : The RMV indicator uses a color-coded system for clarity.

How to Use the RMV Indicator

Identify Tight Consolidation Zones:

a - RMV values between 0-10 indicate very tight price ranges, making this the most optimal zone for potential entries before breakouts.

b - RMV values between 11-20 suggest moderate tightness, still favorable for entries.

Monitor Potential Breakout Areas:

As RMV moves from 21-30 , tightness reduces, signaling expanding volatility that may require wider stops or more flexible entry strategies.

Adjust Trading Strategies:

Use RMV values to identify tight zones for entering trades, especially in trending markets or at key support/resistance levels.

Customize the Indicator:

a - Adjust the short-term ATR lookback periods to control sensitivity.

b - Modify the lookback period to match your trading horizon, whether short-term or long-term.

Color-Coding Guide for RMV

ibb.co

How to Add RMV to Your Chart

Open your chart on TradingView.

Go to the “Indicators” section.

Search for "Relative Measured Volatility (RMV)" in the Community Scripts section.

Click on the indicator to add it to your chart.

Customize the input parameters to fit your trading strategy.

Input Parameters

Lookback Period : Defines the period over which tightness is measured and normalized.

Short-term ATR Lookbacks (1, 2, 3) : Control sensitivity to short-term tightness.

Histogram Threshold : Sets the threshold for differentiating between bright (tight) and dim (less tight) histogram colors.

Conclusion

The Relative Measured Volatility (RMV) is a versatile tool designed to help traders identify tight entry zones by focusing on market consolidation. By highlighting narrow price ranges, the RMV guides traders toward potential breakout setups while providing clear visual cues for better decision-making. Add RMV to your trading toolkit today and enhance your ability to identify optimal entry points!

Saturn Retrograde PeriodsSaturn Retrograde Periods Visualizer for TradingView

This Pine Script visualizes all Saturn retrograde periods since 2009, including the current retrograde ending on November 15, 2024. The script overlays yellow boxes on your TradingView chart to highlight the exact periods of Saturn retrograde. It's a great tool for astrologically-inclined traders or those interested in market timing based on astrological events.

Key Features:

Full Historical Coverage: Displays Saturn retrograde periods from 2009 (the inception of Bitcoin) to the current retrograde ending in November 2024.

Customizable Appearance: You can easily adjust the color and opacity of the boxes directly from the script's settings window, making it flexible for various chart styles.

Visual Clarity: The boxes span the full vertical range of your chart, ensuring the retrograde periods are clearly visible over any asset, timeframe, or price action.

How to Use:

Add the script to your TradingView chart.

Adjust the color and opacity in the settings to suit your preferences.

View all relevant Saturn retrograde periods and analyze how these astrological events may align with price movements in your selected asset.

This script is perfect for traders and analysts who want to combine astrology with financial market analysis!

scripted by chat.gpt - version 1.0

ICT Master Suite [Trading IQ]Hello Traders!

We’re excited to introduce the ICT Master Suite by TradingIQ, a new tool designed to bring together several ICT concepts and strategies in one place.

The Purpose Behind the ICT Master Suite

There are a few challenges traders often face when using ICT-related indicators:

Many available indicators focus on one or two ICT methods, which can limit traders who apply a broader range of ICT related techniques on their charts.

There aren't many indicators for ICT strategy models, and we couldn't find ICT indicators that allow for testing the strategy models and setting alerts.

Many ICT related concepts exist in the public domain as indicators, not strategies! This makes it difficult to verify that the ICT concept has some utility in the market you're trading and if it's worth trading - it's difficult to know if it's working!

Some users might not have enough chart space to apply numerous ICT related indicators, which can be restrictive for those wanting to use multiple ICT techniques simultaneously.

The ICT Master Suite is designed to offer a comprehensive option for traders who want to apply a variety of ICT methods. By combining several ICT techniques and strategy models into one indicator, it helps users maximize their chart space while accessing multiple tools in a single slot.

Additionally, the ICT Master Suite was developed as a strategy . This means users can backtest various ICT strategy models - including deep backtesting. A primary goal of this indicator is to let traders decide for themselves what markets to trade ICT concepts in and give them the capability to figure out if the strategy models are worth trading!

What Makes the ICT Master Suite Different

There are many ICT-related indicators available on TradingView, each offering valuable insights. What the ICT Master Suite aims to do is bring together a wider selection of these techniques into one tool. This includes both key ICT methods and strategy models, allowing traders to test and activate strategies all within one indicator.

Features

The ICT Master Suite offers:

Multiple ICT strategy models, including the 2022 Strategy Model and Unicorn Model, which can be built, tested, and used for live trading.

Calculation and display of key price areas like Breaker Blocks, Rejection Blocks, Order Blocks, Fair Value Gaps, Equal Levels, and more.

The ability to set alerts based on these ICT strategies and key price areas.

A comprehensive, yet practical, all-inclusive ICT indicator for traders.

Customizable Timeframe - Calculate ICT concepts on off-chart timeframes

Unicorn Strategy Model

2022 Strategy Model

Liquidity Raid Strategy Model

OTE (Optimal Trade Entry) Strategy Model

Silver Bullet Strategy Model

Order blocks

Breaker blocks

Rejection blocks

FVG

Strong highs and lows

Displacements

Liquidity sweeps

Power of 3

ICT Macros

HTF previous bar high and low

Break of Structure indications

Market Structure Shift indications

Equal highs and lows

Swings highs and swing lows

Fibonacci TPs and SLs

Swing level TPs and SLs

Previous day high and low TPs and SLs

And much more! An ongoing project!

How To Use

Many traders will already be familiar with the ICT related concepts listed above, and will find using the ICT Master Suite quite intuitive!

Despite this, let's go over the features of the tool in-depth and how to use the tool!

The image above shows the ICT Master Suite with almost all techniques activated.

ICT 2022 Strategy Model

The ICT Master suite provides the ability to test, set alerts for, and live trade the ICT 2022 Strategy Model.

The image above shows an example of a long position being entered following a complete setup for the 2022 ICT model.

A liquidity sweep occurs prior to an upside breakout. During the upside breakout the model looks for the FVG that is nearest 50% of the setup range. A limit order is placed at this FVG for entry.

The target entry percentage for the range is customizable in the settings. For instance, you can select to enter at an FVG nearest 33% of the range, 20%, 66%, etc.

The profit target for the model generally uses the highest high of the range (100%) for longs and the lowest low of the range (100%) for shorts. Stop losses are generally set at 0% of the range.

The image above shows the short model in action!

Whether you decide to follow the 2022 model diligently or not, you can still set alerts when the entry condition is met.

ICT Unicorn Model

The image above shows an example of a long position being entered following a complete setup for the ICT Unicorn model.

A lower swing low followed by a higher swing high precedes the overlap of an FVG and breaker block formed during the sequence.

During the upside breakout the model looks for an FVG and breaker block that formed during the sequence and overlap each other. A limit order is placed at the nearest overlap point to current price.

The profit target for this example trade is set at the swing high and the stop loss at the swing low. However, both the profit target and stop loss for this model are configurable in the settings.

For Longs, the selectable profit targets are:

Swing High

Fib -0.5

Fib -1

Fib -2

For Longs, the selectable stop losses are:

Swing Low

Bottom of FVG or breaker block

The image above shows the short version of the Unicorn Model in action!

For Shorts, the selectable profit targets are:

Swing Low

Fib -0.5

Fib -1

Fib -2

For Shorts, the selectable stop losses are:

Swing High

Top of FVG or breaker block

The image above shows the profit target and stop loss options in the settings for the Unicorn Model.

Optimal Trade Entry (OTE) Model

The image above shows an example of a long position being entered following a complete setup for the OTE model.

Price retraces either 0.62, 0.705, or 0.79 of an upside move and a trade is entered.

The profit target for this example trade is set at the -0.5 fib level. This is also adjustable in the settings.

For Longs, the selectable profit targets are:

Swing High

Fib -0.5

Fib -1

Fib -2

The image above shows the short version of the OTE Model in action!

For Shorts, the selectable profit targets are:

Swing Low

Fib -0.5

Fib -1

Fib -2

Liquidity Raid Model

The image above shows an example of a long position being entered following a complete setup for the Liquidity Raid Modell.

The user must define the session in the settings (for this example it is 13:30-16:00 NY time).

During the session, the indicator will calculate the session high and session low. Following a “raid” of either the session high or session low (after the session has completed) the script will look for an entry at a recently formed breaker block.

If the session high is raided the script will look for short entries at a bearish breaker block. If the session low is raided the script will look for long entries at a bullish breaker block.

For Longs, the profit target options are:

Swing high

User inputted Lib level

For Longs, the stop loss options are:

Swing low

User inputted Lib level

Breaker block bottom

The image above shows the short version of the Liquidity Raid Model in action!

For Shorts, the profit target options are:

Swing Low

User inputted Lib level

For Shorts, the stop loss options are:

Swing High

User inputted Lib level

Breaker block top

Silver Bullet Model

The image above shows an example of a long position being entered following a complete setup for the Silver Bullet Modell.

During the session, the indicator will determine the higher timeframe bias. If the higher timeframe bias is bullish the strategy will look to enter long at an FVG that forms during the session. If the higher timeframe bias is bearish the indicator will look to enter short at an FVG that forms during the session.

For Longs, the profit target options are:

Nearest Swing High Above Entry

Previous Day High

For Longs, the stop loss options are:

Nearest Swing Low

Previous Day Low

The image above shows the short version of the Silver Bullet Model in action!

For Shorts, the profit target options are:

Nearest Swing Low Below Entry

Previous Day Low

For Shorts, the stop loss options are:

Nearest Swing High

Previous Day High

Order blocks

The image above shows indicator identifying and labeling order blocks.

The color of the order blocks, and how many should be shown, are configurable in the settings!

Breaker Blocks

The image above shows indicator identifying and labeling order blocks.

The color of the breaker blocks, and how many should be shown, are configurable in the settings!

Rejection Blocks

The image above shows indicator identifying and labeling rejection blocks.

The color of the rejection blocks, and how many should be shown, are configurable in the settings!

Fair Value Gaps

The image above shows indicator identifying and labeling fair value gaps.

The color of the fair value gaps, and how many should be shown, are configurable in the settings!

Additionally, you can select to only show fair values gaps that form after a liquidity sweep. Doing so reduces "noisy" FVGs and focuses on identifying FVGs that form after a significant trading event.

The image above shows the feature enabled. A fair value gap that occurred after a liquidity sweep is shown.

Market Structure

The image above shows the ICT Master Suite calculating market structure shots and break of structures!

The color of MSS and BoS, and whether they should be displayed, are configurable in the settings.

Displacements

The images above show indicator identifying and labeling displacements.

The color of the displacements, and how many should be shown, are configurable in the settings!

Equal Price Points

The image above shows the indicator identifying and labeling equal highs and equal lows.

The color of the equal levels, and how many should be shown, are configurable in the settings!

Previous Custom TF High/Low

The image above shows the ICT Master Suite calculating the high and low price for a user-defined timeframe. In this case the previous day’s high and low are calculated.

To illustrate the customizable timeframe function, the image above shows the indicator calculating the previous 4 hour high and low.

Liquidity Sweeps

The image above shows the indicator identifying a liquidity sweep prior to an upside breakout.

The image above shows the indicator identifying a liquidity sweep prior to a downside breakout.

The color and aggressiveness of liquidity sweep identification are adjustable in the settings!

Power Of Three

The image above shows the indicator calculating Po3 for two user-defined higher timeframes!

Macros

The image above shows the ICT Master Suite identifying the ICT macros!

ICT Macros are only displayable on the 5 minute timeframe or less.

Strategy Performance Table

In addition to a full-fledged TradingView backtest for any of the ICT strategy models the indicator offers, a quick-and-easy strategy table exists for the indicator!

The image above shows the strategy performance table in action.

Keep in mind that, because the ICT Master Suite is a strategy script, you can perform fully automatic backtests, deep backtests, easily add commission and portfolio balance and look at pertinent metrics for the ICT strategies you are testing!

Lite Mode

Traders who want the cleanest chart possible can toggle on “Lite Mode”!

In Lite Mode, any neon or “glow” like effects are removed and key levels are marked as strict border boxes. You can also select to remove box borders if that’s what you prefer!

Settings Used For Backtest

For the displayed backtest, a starting balance of $1000 USD was used. A commission of 0.02%, slippage of 2 ticks, a verify price for limit orders of 2 ticks, and 5% of capital investment per order.

A commission of 0.02% was used due to the backtested asset being a perpetual future contract for a crypto currency. The highest commission (lowest-tier VIP) for maker orders on many exchanges is 0.02%. All entered positions take place as maker orders and so do profit target exits. Stop orders exist as stop-market orders.

A slippage of 2 ticks was used to simulate more realistic stop-market orders. A verify limit order settings of 2 ticks was also used. Even though BTCUSDT.P on Binance is liquid, we just want the backtest to be on the safe side. Additionally, the backtest traded 100+ trades over the period. The higher the sample size the better; however, this example test can serve as a starting point for traders interested in ICT concepts.

Community Assistance And Feedback

Given the complexity and idiosyncratic applications of ICT concepts amongst its proponents, the ICT Master Suite’s built-in strategies and level identification methods might not align with everyone's interpretation.

That said, the best we can do is precisely define ICT strategy rules and concepts to a repeatable process, test, and apply them! Whether or not an ICT strategy is trading precisely how you would trade it, seeing the model in action, taking trades, and with performance statistics is immensely helpful in assessing predictive utility.

If you think we missed something, you notice a bug, have an idea for strategy model improvement, please let us know! The ICT Master Suite is an ongoing project that will, ideally, be shaped by the community.

A big thank you to the @PineCoders for their Time Library!

Thank you!

ICT Panther (By Obicrypto) V1 ICT Panther Indicator: Full and Detailed Description

The ICT Panther Indicator, created by Obicrypto, is an advanced technical analysis tool designed specifically for traders looking to identify key price action events based on institutional trading techniques, particularly in the context of the Inner Circle Trader (ICT) methodology. This indicator helps traders spot market structure breaks, order blocks, and potential trade opportunities driven by institutional behaviors in the market. Here's a detailed breakdown of its features and how it works:

What Does the ICT Panther Indicator Do?

1. Market Structure Breaks (MSB) Identification:

The ICT Panther identifies critical points where the market changes direction, commonly referred to as a break of structure (BoS). When the price breaks above or below certain key levels (based on highs and lows or opens and closes), it signals a potential shift in market sentiment. These break-of-structure points are essential for traders to determine whether the market is likely to continue its trend or reverse.

2. Order Blocks Visualization:

The indicator plots demand (bullish) and supply (bearish) boxes, which represent areas where institutional traders might place significant buy or sell orders. These zones, known as order blocks, are areas where the price tends to pause or reverse, giving traders key insights into potential entry and exit points. The indicator shows these areas graphically as colored boxes on the chart, which can be used to plan trades based on market structure and price action.

3. Pivot Point Detection:

The ICT Panther identifies important pivot points by tracking higher highs and lower lows. These pivot points are critical in determining the strength of a trend and can help traders confirm the direction of the market. The indicator uses a unique algorithm to detect two levels of pivot points:

- First-Order Pivots: Major pivot points where the price makes notable highs and lows.

- Second-Order Pivots: Smaller pivot points, useful for detecting microtrends within the larger market structure.

4. Bullish and Bearish Break of Structure Lines:

When a significant market structure break (BoS) occurs, the indicator will automatically draw red lines (for bearish break of structure) and green lines (for bullish break of structure) at key price levels. These lines help traders quickly see where institutional moves have occurred in the past and where potential future price moves could originate from.

5. Tested and Filled Boxes:

The ICT Panther also has a built-in mechanism to dim previously tested order blocks. When the price tests an order block (returns to a previous demand or supply zone), the box's color dims to indicate that the area has already been tested, reducing its significance. If the price fully fills an order block, the box stops plotting, providing a clear and clutter-free chart.

Key Features

1. Market Structure Break (MSB) Trigger:

- The indicator allows users to select between highs/lows or opens/closes as the trigger for market structure breaks. This flexibility lets traders adjust the indicator to suit their personal trading style or the behavior of specific assets.

2. Order Block Detection and Visualization:

- The tool automatically plots bullish and bearish demand and supply boxes, representing institutional order blocks on the chart. These boxes provide visual cues for areas of potential price action, where institutional traders might be active.

3. Second-Order Pivot Highlighting:

- The ICT Panther offers an option to plot second-order pivots, highlighting smaller pivot points within the larger market structure. These pivots can be helpful for short-term traders who need to react to smaller price movements while still keeping the larger trend in mind.

4. Box Test and Fill Delays:

- Users can configure delays for box tests and box fills, meaning the indicator will only mark a box as tested or filled after a certain number of bars. This prevents false signals and helps confirm that a zone is truly significant in the market.

5. Customization and Visual Clarity:

- The indicator is highly customizable, allowing users to turn on or off various features like:

- Displaying second-order pivots.

- Highlighting candles that broke structure.

- Plotting market structure broke lines.

- Showing or hiding tested and filled demand boxes.

- Setting custom delays for box testing and filling to suit different market conditions.

6. Tested and Filled Order Block Visualization:

- The indicator visually adjusts the tested and filled order blocks, dimming tested zones and removing filled zones to avoid clutter on the chart. This ensures that traders can focus on active trading opportunities without distractions from historical data.

How Does It Work?

1. Detecting Market Structure Breaks (BoS):

- The indicator continuously tracks the market for key price action signals. When the price breaks through previous highs or lows (or opens and closes, depending on your selection), the indicator marks this as a break of structure. This is a critical signal used by institutional traders and retail traders alike to determine potential future price movements.

2. Order Block Identification:

- Whenever a bullish break of structure occurs, the indicator plots a green demand box to show the area where institutional buyers might have placed significant orders. Similarly, for a bearish break of structure, it plots a red supply box representing areas where institutional sellers are active.

3. Pivot Analysis and Tracking:

- As the market moves, the indicator continuously updates first-order and second-order pivot points based on highs and lows. These points help traders identify whether the market is trending or consolidating. Traders can use these pivot points in combination with the order blocks to make informed trading decisions.

4. Box Testing and Filling:

- When the price retests an existing order block, the box dims to show it has been tested. If the price fully fills the box, it is no longer shown, which helps traders focus on the most relevant, untested order blocks.

Benefits for Traders

- Improved Decision-Making: With clear visuals and advanced logic based on institutional trading strategies, this indicator provides a deeper understanding of market structure and price action.

- Reduced Clutter: The indicator intelligently manages the display of order blocks and pivot points, ensuring that traders focus only on the most relevant information.

- Adaptability: Whether you are a swing trader or a day trader, the ICT Panther can be adjusted to fit your trading style, offering robust and flexible tools for tracking market structure and order blocks.

- Institutional Edge: By identifying institutional-level order blocks and market structure breaks, traders using this indicator can trade in line with the strategies of large market participants.

Who Should Use the ICT Panther Indicator?

This indicator is ideal for:

- Crypto, Forex, and Stock Traders who want to incorporate institutional trading concepts into their strategies.

- Technical Analysts looking for precise tools to measure the market structure and price action.

- ICT Traders who follow the Inner Circle Trader methodology and want an advanced tool to automate and enhance their analysis.

- Price Action Traders seeking a reliable indicator to track pivot points, order blocks, and market structure breaks.

The ICT Panther Indicator is a powerful, versatile tool that brings institutional trading techniques to the fingertips of retail traders. Whether you are looking to identify key market structure breaks, order blocks, or crucial pivot points, this indicator offers detailed visualizations and customizable options to help you make more informed trading decisions. With its ability to track the activities of institutional traders, the ICT Panther Indicator equips traders with the insights needed to stay ahead of the market and trade with confidence.

With the ICT Panther Indicator, traders can follow the movements of institutional money, making it easier to predict market direction and capitalize on high-probability trading opportunities.

Enjoy it and share it with your friends!

AmirAli 20 Pairs/USDT&BTCThis TradingView indicator, titled "20 Pairs/USDT&BTC," is designed to analyze and display the Exponential Moving Averages (EMAs) of various cryptocurrency pairs against USDT and BTC. Here's a detailed breakdown of its features, functionality, and usage:

Key Features:

Pairs Display: The indicator allows users to select which cryptocurrency pairs they wish to display on the chart. The available options include popular cryptocurrencies such as Ethereum (ETH), Binance Coin (BNB), Solana (SOL), Dogecoin (DOGE), Ripple (XRP), Litecoin (LTC), Polkadot (DOT), Avalanche (AVAX), Uniswap (UNI), Chainlink (LINK), Cardano (ADA), Cosmos (ATOM), Filecoin (FIL), Stellar (XLM), VeChain (VET), Enjin (ENJ), Celo (CELO), Hedera (HBAR), and Sandbox (SAND).

Dynamic Price Retrieval: For each selected pair, the indicator retrieves the closing prices for both USDT and BTC from Binance. This is done using the request.security function, which fetches real-time data.

EMA Calculation: The indicator calculates and plots the EMA for each cryptocurrency pair over a user-defined length, allowing traders to identify trends and potential buy/sell signals based on price movements relative to their EMAs.

User Customization: Users can customize several parameters, including the time frame for data retrieval, EMA length, and the visibility of each pair.

Market Hours Visualization: The indicator highlights the trading hours with a gray background, helping users identify when the market is active.

How to Use the Indicator:

Adding the Indicator: To use the indicator, add it to your TradingView chart by searching for "20 Pairs/USDT&BTC" in the public library or by pasting the provided Pine Script code into a new indicator script.

Select Pairs: Enable or disable specific cryptocurrency pairs in the input options at the top of the script. For example, if you want to analyze ETH and ADA, ensure that the respective boxes are checked.

Adjust Time Frame: Set the time frame for the indicator. You can choose any time frame or leave it blank to use the current chart's time frame.

Set EMA Length: Choose the length for the EMA calculation based on your trading strategy. A shorter EMA (e.g., 5) reacts more quickly to price changes, while a longer EMA (e.g., 20) smooths out price fluctuations.

Observe Trends: Monitor the plotted EMAs for the selected pairs. Crossovers of the price with the EMA can indicate potential buy or sell signals. For instance, if the price crosses above the EMA, it may signal a bullish trend, whereas a crossover below could indicate a bearish trend.

Consider Market Hours: Pay attention to the gray background during U.S. trading hours, as this may indicate higher volatility and trading opportunities.

Conclusion

The "20 Pairs/USDT&BTC" indicator is a powerful tool for cryptocurrency traders looking to analyze multiple pairs simultaneously. By providing a visual representation of EMAs, it aids in identifying trends and potential trading opportunities in a user-friendly manner. Make sure to adapt the settings according to your trading strategy and market conditions for optimal results.

Amir Hasankhah & Ali Beyki

Liquidity VisualizerThe "Liquidity Visualizer" indicator is designed to help traders visualize potential areas of liquidity on a price chart. In trading, liquidity often accumulates around key levels where market participants have placed their stop orders or pending orders. These levels are commonly found at significant highs and lows, where traders tend to set their stop-losses or take-profit orders. The indicator aims to highlight these areas by drawing unbroken lines that extend indefinitely until breached by the price action.

Specifically, this indicator identifies and marks pivot highs and pivot lows, which are price levels where a trend changes direction. When a pivot high or pivot low is formed, it is represented on the chart with a horizontal line that continues to extend until the price touches or surpasses that level. The line remains in place as long as the level remains unbroken, which means there is potential liquidity still resting at that level.

The concept behind this indicator is that liquidity is likely to be resting at unbroken pivot points. These levels are areas where stop-loss orders or pending buy/sell orders may have accumulated, making them attractive zones for large market participants, such as institutions, to target. By visualizing these unbroken levels, traders can gain insight into where liquidity might be concentrated and where potential price reversals or significant movements could occur as liquidity is taken out.

The indicator helps traders make more informed decisions by showing them key price levels that may attract significant market activity. For instance, if a trader sees multiple unbroken pivot high lines above the current price, they might infer that there is a cluster of liquidity in that area, which could lead to a price spike as those levels are breached. Similarly, unbroken pivot lows may indicate areas where downside liquidity is concentrated.

In summary, this indicator acts as a "liquidity visualizer," providing traders with a clear, visual representation of potential liquidity resting at significant pivot points. This information can be valuable for understanding where price might be drawn to, and where large movements might occur as liquidity is targeted and removed by market participants.

Flat Tops/Bottoms aka Devil's MarkThis Pine script indicator is designed to visually depict price inefficiencies, as identified by Flat Top/Bottom Candles (aka Devil's Mark). A Flat Top/Bottom Candle is a scenario where there is an absence of a wick at the top or the bottom of the candle. These represent zones of inefficiency and will frequently act as magnets for price that the market will strive to rebalance in accordance with ICT principles.

Relevance:

Flat Top/Bottom Candles are zones where price delivery didn't provide opportunity for manipulation representing an inefficiency that the market will seek to rebalance. Consequently, these zones can provide good targets for entries in the opposite direction or take profit targets for previous entries in the direction of the Flat Top/Bottom Candle.

How It Works:

The indicator keeps track of all Flat Top/Bottom Candles from the beginning of the available history. It automatically removes all mitigated Flat Top/Bottom Candles, which are situations where the price has gone past the candle without a wick.

Configurability:

You can configure the colors, style & width of the lines used to represent flat top/bottom candles.

What makes this indicator different:

Designed with high performance in mind, to reduce impact on chart render time.

Only keeping the currently valid flat top/bottoms on the chart.

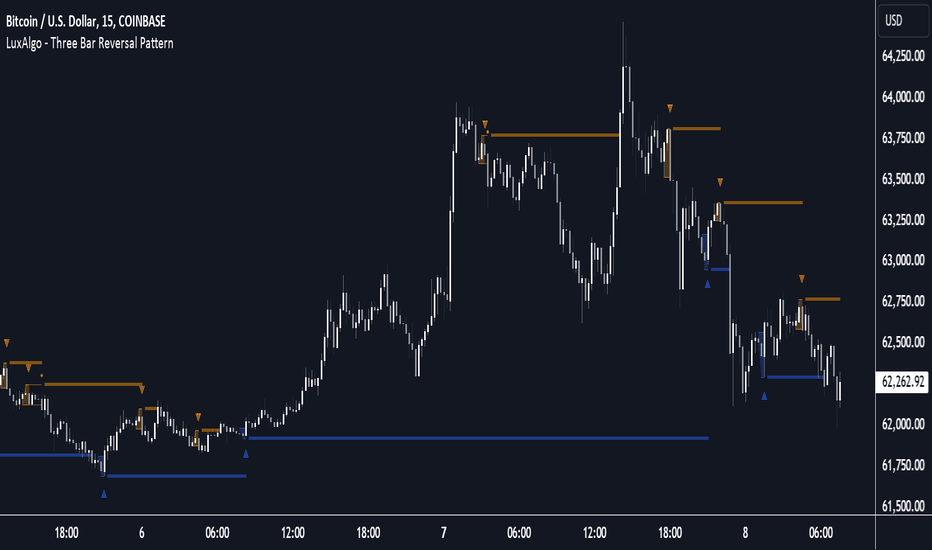

Three Bar Reversal Pattern [LuxAlgo]The Three Bar Reversal Pattern indicator identifies and highlights three bar reversal patterns on the user price chart.

The script also provides an option for incorporating various trend indicators used to filter out detected signals, allowing them to enhance their accuracy and help obtain a more comprehensive analysis.

🔶 USAGE

The script automates the detection of three-bar reversal patterns and provides a clear, visually identifiable signal for potential trend reversals.

When a reversal chart pattern is confirmed and price action aligns with the pattern, the pattern's boundaries are extended, forming levels, with the upper boundary often acting as a resistance and the lower boundary as a support.

The script allows users to filter patterns based on a specific trend direction detected by multiple trend indicators. Users can choose to view patterns that are either aligned with the detected trend or opposite to it.

Included trend indicators are: Moving Average Cloud, Supertrend, and Donchian Channels.

🔶 DETAILS

The three-bar reversal pattern is a technical analysis pattern that signals a potential reversal in the prevailing trend. The pattern consists of three consecutive bar formations:

First Bar and Second Bar: 2 consecutive of the same sentiment, representing the prevailing trend in the market.

Third Bar: Confirms the reversal by closing beyond the high or low of the first bar, signaling a potential change in market sentiment.

Various types of three-bar reversal patterns are documented. The script supports two main types:

Normal Pattern: Detects three-bar reversal patterns without requiring the third bar closing price to surpass the high (bullish pattern) or low (bearish pattern) of the first bar. It identifies basic formations signaling potential trend reversals.

Enhanced Pattern: Specifically identifies three-bar reversal patterns where the third bar closing price surpasses the high (bullish pattern) or low (bearish pattern) of the first bar. This type provides a more selective signal for stronger trend reversals.

🔶 SETTINGS

Pattern Type: Users can choose the type of 3-bar reversal patterns to detect: Normal, Enhanced, or All. "Normal" detects patterns that do not necessarily surpass the high/low of the first bar. "Enhanced" detects patterns where the third bar surpasses the high/low of the first bar. "All" detects both Normal and Enhanced patterns.

Derived Support and Resistance: Toggles the visibility of the support and resistance levels/zones.

🔹 Trend Filtering

Filtering: Allows users to filter patterns based on the trend indicators: Moving Average Cloud, Supertrend, and Donchian Channels. The "Aligned" option only detects patterns that align with the trend and conversely, the "Opposite" option detects patterns that go against the trend.

🔹 Trend Indicator Settings

Moving Average Cloud: Allows traders to choose the type of moving averages (SMA, EMA, HMA, etc.) and set the lengths for fast and slow-moving averages.

Supertrend: Options to set the ATR length and factor for Supertrend.

Donchian Channels: Option to set the length for the channel calculation.

🔶 RELATED SCRIPTS

Reversal-Candlestick-Structure .

Reversal-Signals .

Cumulative Volume Delta with VWAP-based Buy/Sell AlertsDescription:

This script combines Cumulative Volume Delta (CVD) with Volume Weighted Average Price (VWAP) to generate buy and sell signals. It plots both the cumulative volume delta and its moving average on the chart, but the actual buy and sell signals are now based on the crossover and crossunder of the price with the VWAP, a popular tool for tracking price relative to the volume-weighted average over time.

Features:

Cumulative Volume Delta (CVD) Plot:

CVD helps visualize the net buying or selling pressure by accumulating volume when the price is rising and subtracting it when the price is falling. The cumulative volume is plotted on the chart as a blue line.

Moving Average of CVD:

A simple moving average (SMA) of the cumulative volume delta is plotted in orange to smooth out fluctuations and help detect the trend of volume flow.

VWAP Calculation:

VWAP (Volume Weighted Average Price) is a standard benchmark widely used in trading. It gives insight into whether the price is trading above or below the average price at which most of the volume has traded, weighted by volume. The VWAP is plotted as a purple line on the chart.

Buy/Sell Signals Based on VWAP:

Buy Signal: Triggered when the price crosses above the VWAP, indicating potential upward momentum.

Sell Signal: Triggered when the price crosses below the VWAP, signaling potential downward momentum.

These signals are displayed on the chart with clear labels:

Buy Signal: A green upward label appears below the price.

Sell Signal: A red downward label appears above the price.

Alerts for Buy/Sell Conditions:

Alerts are built into the script, so traders can receive notifications when the following conditions are met:

Buy Alert: The price crosses above the VWAP.

Sell Alert: The price crosses below the VWAP.

Use Case:

This script is useful for traders looking to incorporate both volume-based indicators and the VWAP into their trading strategy. The combination of CVD and VWAP provides a more comprehensive view of both price and volume dynamics:

VWAP helps traders understand whether the price is trading above or below its volume-weighted average.

CVD highlights buying or selling pressure through cumulative volume analysis.

Customization:

Anchor Periods: The user can customize the anchor period to suit different timeframes and trading styles.

Custom Alerts: The alert conditions can be easily modified to integrate into any trader’s strategy.

This script can be adapted for both short-term and long-term trading strategies and is especially useful in high-volume markets.

How to Use:

Add the script to your TradingView chart.

Customize the timeframe and anchor period, if needed, to match your preferred trading style.

Watch for Buy/Sell signals based on price crossing the VWAP.

Set up alerts to receive notifications when Buy or Sell signals are triggered.

This script is designed to help traders make informed decisions based on both price action relative to volume and Cumulative Delta volume trends, giving a more comprehensive view of the market dynamics.

Volume candle by MoondIndicator Description: Equal Volume Candle Chart

This indicator creates a real-time candlestick chart where each candle forms upon the completion of a specific volume threshold, rather than within fixed time intervals. The candles update dynamically based on the total volume traded, providing a unique perspective that incorporates market activity directly into price movements.

Key Features:

Dynamic Candles Based on Volume: Candles form when a defined lot size of volume is reached, making each candle represent consistent trading activity rather than a fixed time period.

Customizable Volume Lot Size: Users can easily adjust the volume threshold to suit different trading styles or asset classes.

Real-Time Market Reflection: The chart responds to changes in market volume, offering a clearer view of market intensity and momentum.

Concept Behind the Indicator: Traditional candlestick charts operate on time intervals, which can ignore the influence of volume in price changes. By basing the candle formation on equal volumes, this indicator integrates both price and traded volume into the visual representation, helping traders capture key shifts in market sentiment and activity that might be missed on time-based charts

Custom Pattern DetectionOverview

Chart Patterns is a major tool for many traders. Pattern formation at specific location on the chart is used for investment/trading decisions.

This indicator is designed in a way to allow investors/traders to define patterns of their choice based on certain input parameters and then detect defined pattern on the chart.

Investors/traders can use their own creativity to create and detect patterns.

This indicator works in 2 modes

Create Pattern: One can define a pattern and verify sample pattern formation visually

Detect Pattern: Detect and mark patterns on the chart

Settings

Create Custom Pattern:

Show Custom Pattern – This will mark the pattern lines on the chart so that one can verify how pattern appears based on the input’s parameters provided for lines XA, AB, BC, CD, DE, EF

Offset – Used while pattern creation. Offset is horizonal distance between 2 lines.

XA Points – Used to draw XA line when sample pattern is drawn. XA points can be a negative or position number.

XA line is drawn based on Offset and XA Points. E.g. Offset = 5 and XA Points = -20. In this line would be drawn from last candle high to high – 20 (these are y1 and y2 points of a line). While drawing line distance of 5 candles would be placed between 2 line points (these are x1 and x2 points of a line). In XA line X forms start point and A forms end point of the line.

Line AB – Line AB is drawn from point X. To derive the end point of AB, average Fib% is derived based on From Fib% and To Fib% parameters. Finally end point is derived by applying Fib Retracement on Line XA based on average Fib%.

Line AB to Line EF – These points are derived as explained in Line AB.

The indicator can be used to define/create patterns up to 6 legs/lines. The line would be named as XA -> AB -> BC -> CD -> DE -> EF.

If one wish to create pattern consisting 3 legs then it can be achieved by unchecking/deselecting Line CD, DE and EF or by checking only Line AB and BC.

Based on the parameters above indicator draws a sample pattern after last candle/bar on the chart. Sample pattern helps to visually see how pattern will appear on the chart.

Pattern Identification

Indicator derive the swing high/low points based on the Pivot lookback and use as reference points while detecting patterns.

Use of From Fib% and To Fib% - While detecting pattern, retracement price points are derived for From Fib% and To Fib%. Price points between from Fib% and To Fib% are treated as valid retracement points.

How to configure and use indicator for detecting patterns

Sample Pattern 1

Sample Pattern 2

Sample Pattern 3

Sample Pattern 4

Pivot Points LIVE [CHE]Title:

Pivot Points LIVE Indicator

Subtitle:

Advanced Pivot Point Analysis for Real-Time Trading

Presented by:

Chervolino

Date:

September 24, 2024

Introduction

What are Pivot Points?

Definition:

Pivot Points are technical analysis indicators used to determine potential support and resistance levels in financial markets.

Purpose:

They help traders identify possible price reversal points and make informed trading decisions.

Overview of Pivot Points LIVE :

A comprehensive indicator designed for real-time pivot point analysis.

Offers advanced features for enhanced trading strategies.

Key Features

Pivot Points LIVE Includes:

Dynamic Pivot Highs and Lows:

Automatically detects and plots pivot high (HH, LH) and pivot low (HL, LL) points.

Customizable Visualization:

Multiple options to display markers, price labels, and support/resistance levels.

Fractal Breakouts:

Identifies and marks breakout and breakdown events with symbols.

Line Connection Modes:

Choose between "All Separate" or "Sequential" modes for connecting pivot points.

Pivot Extension Lines:

Extends lines from the latest pivot point to the current bar for trend analysis.

Alerts:

Configurable alerts for breakout and breakdown events.

Inputs and Configuration

Grouping Inputs for Easy Customization:

Source / Length Left / Length Right:

Pivot High Source: High price by default.

Pivot Low Source: Low price by default.

Left and Right Lengths: Define the number of bars to the left and right for pivot detection.

Colors: Customizable colors for pivot high and low markers.

Options:

Display Settings:

Show HH, LL, LH, HL markers and price labels.

Display support/resistance level extensions.

Option to show levels as a fractal chaos channel.

Enable fractal breakout/down symbols.

Line Connection Mode:

Choose between "All Separate" or "Sequential" for connecting lines.

Line Management:

Set maximum number of lines to display.

Customize line colors, widths, and styles.

Pivot Extension Line:

Visibility: Toggle the display of the last pivot extension line.

Customization: Colors, styles, and width for extension lines.

How It Works - Calculating Pivot Points

Pivot High and Pivot Low Detection:

Pivot High (PH):

Identified when a high price is higher than a specified number of bars to its left and right.

Pivot Low (PL):

Identified when a low price is lower than a specified number of bars to its left and right.

Higher Highs, Lower Highs, Higher Lows, Lower Lows:

Higher High (HH): Current PH is higher than the previous PH.

Lower High (LH): Current PH is lower than the previous PH.

Higher Low (HL): Current PL is higher than the previous PL.

Lower Low (LL): Current PL is lower than the previous PL.

Visual Elements

Markers and Labels:

Shapes:

HH and LH: Downward triangles above the bar.

HL and LL: Upward triangles below the bar.

Labels:

Optionally display the price levels of HH, LH, HL, and LL on the chart.

Support and Resistance Levels:

Extensions:

Lines extending from pivot points to indicate potential support and resistance zones.

Chaos Channels:

Display levels as a fractal chaos channel for enhanced trend analysis.

Fractal Breakout Symbols:

Buy Signals: Upward triangles below the bar.

Sell Signals: Downward triangles above the bar.

Slide 7: Line Connection Modes

All Separate Mode:

Description:

Connects pivot highs with pivot highs and pivot lows with pivot lows separately.

Use Case:

Ideal for traders who want to analyze highs and lows independently.

Sequential Mode:

Description:

Connects all pivot points in the order they occur, regardless of being high or low.

Use Case:

Suitable for identifying overall trend direction and momentum.

Pivot Extension Lines

Purpose:

Trend Continuation:

Visualize the continuation of the latest pivot point's price level.

Customization:

Colors:

Differentiate between bullish and bearish extensions.

Styles:

Solid, dashed, or dotted lines based on user preference.

Width:

Adjustable line thickness for better visibility.

Dynamic Updates:

The extension line updates in real-time as new bars form, providing ongoing trend insights.

Alerts and Notifications

Configurable Alerts:

Fractal Break Arrow:

Triggered when a breakout or breakdown occurs.

Long and Short Signals:

Specific alerts for bullish breakouts (Long) and bearish breakdowns (Short).

Benefits:

Timely Notifications:

Stay informed of critical market movements without constant monitoring.

Automated Trading Strategies:

Integrate with trading bots or automated systems for executing trades based on alerts.

Customization and Optimization

User-Friendly Inputs:

Adjustable Parameters:

Tailor pivot detection sensitivity with left and right lengths.

Color and Style Settings:

Match the indicator aesthetics to personal or platform preferences.

Line Management:

Maximum Lines Displayed:

Prevent chart clutter by limiting the number of lines.

Dynamic Line Handling:

Automatically manage and delete old lines to maintain chart clarity.

Flexibility:

Adapt to Different Markets:

Suitable for various financial instruments including stocks, forex, and cryptocurrencies.

Scalability:

Efficiently handles up to 500 labels and 100 lines for comprehensive analysis.

Practical Use Cases

Identifying Key Support and Resistance:

Entry and Exit Points:

Use pivot levels to determine optimal trade entry and exit points.

Trend Confirmation:

Validate market trends through the connection of pivot points.

Breakout and Breakdown Strategies:

Trading Breakouts:

Enter long positions when price breaks above pivot highs.

Trading Breakdowns:

Enter short positions when price breaks below pivot lows.

Risk Management:

Setting Stop-Loss and Take-Profit Levels:

Utilize pivot levels to place strategic stop-loss and take-profit orders.

Slide 12: Benefits for Traders

Real-Time Analysis:

Provides up-to-date pivot points for timely decision-making.

Enhanced Visualization:

Clear markers and lines improve chart readability and analysis efficiency.

Customizable and Flexible:

Adapt the indicator to fit various trading styles and strategies.

Automated Alerts:

Stay ahead with instant notifications on key market events.

Comprehensive Toolset:

Combines pivot points with fractal analysis for deeper market insights.

Conclusion

Pivot Points LIVE is a robust and versatile indicator designed to enhance your trading strategy through real-time pivot point analysis. With its advanced features, customizable settings, and automated alerts, it equips traders with the tools needed to identify key market levels, execute timely trades, and manage risks effectively.

Ready to Elevate Your Trading?

Explore Pivot Points LIVE and integrate it into your trading toolkit today!

Q&A

Questions?

Feel free to ask any questions or request further demonstrations of the Pivot Points LIVE indicator.

PDL PWL [Dans]PDL PWL

Overview:

The PDL PWL indicator is a simple-designed for traders seeking to visualize key price levels derived from previous daily and weekly trading sessions. By incorporating significant price points such as Previous Day High (PDH), Previous Day Low (PDL), Previous Week High (PWH), and Previous Week Low (PWL), this indicator helps to make informed decisions based on historical price action.

Key Features:

Toggle Options:

Easily toggle the visibility of Previous Daily Levels and Previous Weekly Levels. This flexibility allows you to customize your chart according to your trading style and preferences.

Customizable Colors :

Personalize your chart by selecting colors for PDH, PDL, PWH, and PWL.

Equilibrium Levels:

The indicator calculates and displays equilibrium levels (EQ) for both daily and weekly levels.

Dynamic Updates:

The indicator automatically updates at 18:00 NY time, ensuring that you always have the latest previous high and low levels on your chart.

Daily Divider:

A daily divider line is drawn at the start of each trading day, helping you distinguish between trading sessions (daily) easily.

How to Use: Simply add the PDL PWL indicator to your chart, adjust the settings to fit your trading style, and observe how price interacts with the key levels.

Hope you will find this insightful !

Love,

Dans.

Heikin Ashi & Swing Highs/LowsHeikin Ashi & Swing Highs/Lows

Indicator Description:

The "Heikin Ashi & Swing Highs/Lows" indicator combines Heikin Ashi candle analysis with the identification of significant swing highs and lows on the chart. This indicator is useful for traders looking to spot trend changes and key points in the market.

Key Features:

Heikin Ashi:

Calculation and Visualization: Utilizes the Heikin Ashi method to smooth out the candlestick chart, helping to visualize trends and reduce market noise. Heikin Ashi candles are calculated from the standard candles (Open, High, Low, Close) and are displayed on the chart with a green color for bullish signals and red for bearish signals.

Vertical Offset Adjustment: Provides options to adjust the vertical offset of the candles based on the selected timeframe, with specific adjustments for short, medium, long, and super-long periods.

Swing Highs/Lows:

Key Point Identification: Marks significant swing highs and lows on the chart using a configurable period. Swing highs are displayed in red and swing lows in green.

Candlestick Patterns: Detects and labels common candlestick patterns such as:

Hammer: A bullish candlestick pattern with a small body and a long lower wick.

Inverted Hammer: Similar to the Hammer, but with a long upper wick.

Bullish Engulfing: A two-candle pattern where a bullish candle completely engulfs a previous bearish candle.

Hanging Man: A bearish pattern with a small body and a long lower wick, appearing at the end of an uptrend.

Shooting Star: A bearish pattern with a small body and a long upper wick, appearing at the end of an uptrend.

Bearish Engulfing: A two-candle pattern where a bearish candle completely engulfs a previous bullish candle.

Settings:

Timeframe: Allows you to select the desired timeframe to adjust the Heikin Ashi candle analysis.

Vertical Offset: Customize the vertical offset of Heikin Ashi candles based on the selected timeframe.

Swing Point Style: Configure the colors of the significant swing highs and lows on the chart.

Recommended Use:

This indicator is ideal for traders looking for a clear representation of trends through Heikin Ashi candles and who want to identify key reversal points in the market by detecting swing highs/lows and candlestick patterns.

Benefits:

Facilitates the identification of smooth trends and trend reversals.

Provides a clear visual representation of critical market points.

Helps traders recognize important candlestick patterns that may indicate changes in market direction.

The Vet [TFO]In collaboration with @mickey1984 , "The Vet" was created to showcase various statistical measures of price.

The first core measurement utilizes the Defining Range (DR) concept on a weekly basis. For example, we might track the session from 09:30-10:30 on Mondays to get the DR high, DR low, IDR high, and IDR low. The DR high and low are the highest high and lowest low of the session, respectively, whereas the IDR high and low would be the highest candle body level (open or close) and lowest candle body level, respectively, during this window of time.

From this data, we use the IDR range (from IDR high to IDR low) to extrapolate several, custom projections of this range from its high and low so that we can collect data on how often these levels are hit, from the close of one DR session to the open of the next one.

This information is displayed in the Range Projection Table with a few main columns of information:

- The leftmost column indicates each level that is projected from the IDR range, where (+) indicates a projection above the range high, and (-) indicates a projection below the range low

- The "First Touch" column indicates how often price has reached these levels in the past at any point until the next weekly DR session

- The "Other Side Touch" column indicates how often price has reached a given level, then reversed to hit the opposing level of the same magnitude. For example, the above chart shows that if price hit the +1 projection, ~33% of instances also hit the -1 projection before the next weekly DR session. For this reason, the probabilities will be the same for projection levels of the same but opposite magnitude (+1 would be the same as -1, +3 would be the same as -3, etc.)

- The "Next Level Touch" column provides insight into how often price reaches the next greatest projection level. For example, in the above chart, the red box in the projection table is highlighting that once price hits the -2 projection, ~86% of instances reached the -3 projection before the next weekly DR session

- The last columns, "Within ADR" and "Within AWR" show if any of the projection levels are within the current Average Daily Range, or Average Weekly Range, respectively, which can both be enabled from the Average Range section

The next section, Distributions, primarily measures and displays the average price movements from specified intraday time windows. The option to Show Distribution Boxes will overlay a box showing each respective session's average range, while adjusting itself to encapsulate the price action of that session until the average range is met/exceeded. Users can choose to display the range average by Day of Week, or the Total average from all days. Values for average ranges can either be shown as point or percent values. We can also show a table to display this information about price's average ranges for each given session, and show labels displaying the current range vs its average.

The final section, Average Range, simply offers the ability to plot the Average Daily Range (ADR) and Average Weekly Range (AWR) of a specified length. An ADR of 10 for example would take the average of the last 10 days, from high to low, while an AWR of 10 would take the average of the last 10 weeks (if the current chart provides enough data to support this). Similarly, we can also show the Average Range Table to indicate what these ADR/AWR values are, what our current range is and how it compares to those values, as well as some simple statistics on how often these levels are hit. As an example, "Hit +/- ADR: 40%/35%" in this table would indicate that price has hit the upper ADR limit 40% of the time, and the lower limit 35% of the time, for the amount of data available on the current chart.

Magic Order Blocks [MW]Add a slim design, minimalist view of the most relevant higher and lower order blocks to your chart. Use our novel method of filtering that uses both the the number of consecutive bullish or bearish candles that follow the order block, and the number of ATRs that the asset’s price changed following the order block. View just the order blocks above and below the current price, or view the backgrounds for each and every one. And, if you're up to it, dig into a comprehensive view of the data for each order block candle.

Settings:

General Settings

Minimum # of Consecutive Bars Following Order Block

Show Bullish Order Blocks Below / Hide Last Bullish Block

Show Bearish Order Blocks Above / Hide Last Bearish Block

Use ATR Filter - Select # of ATRs Below

Closest Order Block is Followed by This Many ATRs

Preferences

Right Offset of Indicator Label

Show Mid-Line from Recent Order Block Indicator Label

Use ATRs Instead of Consecutive Candles in Label Indicator

Show Timestamp of Recent Order Block

Show Large Order Block Detail Labels

Show Small Order Block Labels

Background Settings

Show Background for Recent Order Block Indicator Label

# of Backgrounds to Show Before Now

Show All Bullish Order Block Backgrounds

Show All Bearish Order Block Backgrounds

Calculations

This indicator creates a matrix of each order block that is followed by the user-specified number of consecutive bullish or bearish candles. The data can be further filtered by the number of ATRs that the price moves after the order block - also user-defined. The most recent bearish order block above the current price takes arrays from the initial filtered matrix of arrays, filters once more by the “mid-price” of the order block (the average between the order block candle high and low) and selects the last element from this order block matrix. The same follows for the latest bearish order block above the current price.

How to Use

An order block refers to a price range or zone on a chart where large institutional orders have been placed, causing a significant shift in market direction. These zones are crucial because they often indicate areas of strong buying or selling interest, which can lead to future support or resistance levels. Traders use order blocks to identify potential points of market reversal or continuation.

The Magic Order Blocks default view shows the most recent overhead bearish order block above the current price, and the most recent bullish order block below. These can presumably act as support or resistance levels, because they reflect the last price where a significant price move occurred. “Significant” meaning that the order block candle was followed by many consecutive bullish or bearish candles. Based on the user-defined settings, it can also mean that price moved multiples of the asset's average true range (ATR). More consecutive candles means that the duration of the move lasted a long time. A higher ATR move indicates that the price moved impulsively in one direction.

The default view also shows a label to the right of the current price that provides the price level, the time stamp of the order block (optional), and a sequence of bars that show the significance of the level. By default, these bars represent the number of ATRs that price rose or fell following the order block, but they can be toggled to show the number of consecutive bullish or bearish candles that followed the order block.

Although the default view provides the zones that are most relevant to the current price, past order block candles can also be identified visually with labels as well with translucent backgrounds color-coded for bullish or bearish bias. Overlapping backgrounds can identify an area that has been repeatedly been an area of support or resistance.

A detailed view of each order block can also be viewed the includes the following data points:

Bar Index

Timestamp

Consecutive Accumulated Volume

Consecutive Bars

Price Change over Consecutive Bars

Price/Volume Ratio Over Consecutive Bars

Mid Price of Order Block

High Price of Order Block

Low Price of Order Block

ATRs over Consecutive Bars

- Other Usage Notes and Limitations:

The calculations used only provide an estimated relationship or a close approximation, and are not exact.

It's important for traders to be aware of the limitations of any indicator and to use them as part of a broader, well-rounded trading strategy that includes risk management, fundamental analysis, and other tools that can help with reducing false signals, determining trend direction, and providing additional confirmation for a trade decision. Diversifying strategies and not relying solely on one type of indicator or analysis can help mitigate some of these risks.

Things to keep in mind. Longer timeframes don’t necessarily have a as many consecutive candle drops or gains as with shorter timeframes, so be sure to adjust your settings when moving to 1 hour, 1 day, or 1 week timeframes from 1 minute, 5 minute, or 15 minute timeframes.

Reflected ema Difference (RED) This script, titled "Reflected EMA Difference (RED)," is based on the logic of evaluating the percentage of convergence and divergence between two moving averages, specifically the Hull Moving Averages (HMA), to make price-related decisions. The Hull Moving Average, created by Alan Hull, is used as the foundation of this strategy, offering a faster and more accurate way to analyze market trends. In this script, the concept is employed to measure and reflect price variations.

Script Functionality Overview:

Hull Moving Averages (HMA): The script utilizes two HMAs, one short-term and one long-term. The main idea is to compute the Delta Difference between these two moving averages, which represents how much they are converging or diverging from each other. This difference is key to identifying potential market trend changes.

Reflected HMA Value: Using the Delta Difference between the HMAs, the value of the short-term HMA is reflected, creating a visual reference point that helps traders see the relationship between price and HMAs on the chart.

Percentage Change Index: The second key parameter is the percentage change index. This determines when a trend is reversing, allowing buy or sell orders to be established based on significant changes in the relationship between the HMAs and the price.

Delta Multiplier: The script comes with a default Delta multiplier of 2 for calculating the difference between HMAs, allowing traders to adjust the sensitivity of the analysis based on the time frame being analyzed.

Trend Reversal Signals: When the price crosses the thresholds defined by the percentage change index, buy or sell signals are triggered, based on the detection of a potential trend reversal.

Visual Cues with Boxes: Boxes are drawn on the chart when the HullMA crosses the reflected HMA value, providing a visual aid to identify critical moments where risk should be evaluated.

Alerts for Receiving Signals:

This script allows you to set up buy and sell alerts via TradingView's alert system. These alerts are triggered when trend changes are detected based on the conditions coded in the script. Traders can receive instant notifications, allowing them to make decisions without needing to constantly monitor the chart.

Additional Considerations:

The percentage change parameter is adjustable and should be configured based on the time frame you are trading on. For longer time frames, it's advisable to use a larger percentage change to avoid false signals.

The use of Hull Moving Averages (HMA) provides a faster and more reactive approach to trend evaluation compared to other moving averages, making it a powerful tool for traders seeking quick reversal signals.

This approach combines the power of Hull Moving Averages with an alert system to improve the trader’s response to trend changes.

Spanish

Este script, titulado "Reflected EMA Difference (RED)", está fundamentado en la lógica de evaluar el porcentaje de acercamiento y distancia entre dos medias móviles, específicamente las medias móviles de Hull (HMA), para tomar decisiones sobre el valor del precio. El creador de la media móvil de Hull, Alan Hull, diseñó este indicador para ofrecer una forma más rápida y precisa de analizar tendencias de mercado, y en este script se utiliza su concepto como base para medir y reflejar las variaciones de precio.

Descripción del funcionamiento:

Medias Móviles de Hull (HMA): Se utilizan dos HMAs, una de corto plazo y otra de largo plazo. La idea principal es calcular la diferencia Delta entre estas dos medias móviles, que representa cuánto se están alejando o acercando entre sí. Esta diferencia es clave para identificar cambios potenciales en la tendencia del mercado.

Valor Reflejado de la HMA: Con la diferencia Delta calculada entre las HMAs, se refleja el valor de la HMA corta, creando un punto de referencia visual que ayuda a los traders a observar la relación entre el precio y las HMAs en el gráfico.

Índice de Cambio de Porcentaje: El segundo parámetro clave del script es el índice de cambio porcentual. Este define el momento en que una tendencia está revirtiendo, permitiendo establecer órdenes de compra o venta en función de un cambio significativo en la relación entre las HMAs y el precio.

Multiplicador Delta: El script tiene un multiplicador predeterminado de 2 para el cálculo de la diferencia Delta, lo que permite ajustar la sensibilidad del análisis según la temporalidad del gráfico.

Señales de Reversión de Tendencia: Cuando el precio cruza los límites definidos por el índice de cambio porcentual, se emiten señales para comprar o vender, basadas en la detección de una posible reversión de tendencia.

Visualización con Cajas: Se dibujan cajas en el gráfico cuando el indicador HullMA cruza el valor reflejado de la HMA, ayudando a identificar visualmente los momentos críticos en los que se debe evaluar el riesgo de las operaciones.

Alertas para Recibir Señales: