OPEN-SOURCE SCRIPT

ที่อัปเดต: Hyper MA Loop | QuantEdgeB

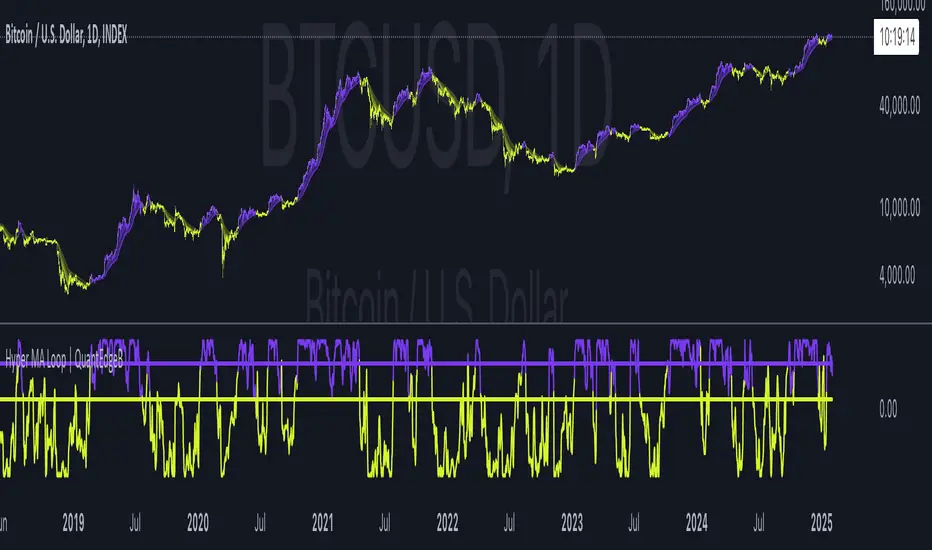

Introducing Hyper MA Loop by QuantEdgeB

Hyper MA Loop | QuantEdgeB is an advanced trend-following indicator that leverages a custom Hyper Moving Average (HyMA) and an innovative loop-based scoring system to assess trend strength and direction. This tool is designed to provide a dynamic perspective on market momentum, allowing traders to capture trends effectively while filtering out market noise.

Key Features:

1. Hyper Moving Average (HyMA) 🟣

- A weighted moving average that enhances trend responsiveness by applying a custom

weight function.

- Ensures smoother trend detection while maintaining reactivity to price changes.

2. Loop-Based Trend Scoring 🔄

- Utilizes a for-loop function to analyze the movement of HyMA over a specified period.

- Compares current values to past values, generating a cumulative score indicating bullish or

bearish momentum.

- Dynamic thresholds adjust to market conditions for better trend filtering.

3. Threshold-Based Signal System ✅❌

- Long Signals: Triggered when the loop score exceeds the long threshold.

- Short Signals: Activated when the score falls below the short threshold.

- Avoids false signals by requiring sustained strength before confirming a trend.

4. Customizable Visualization & Colors 🎨

- Multiple color modes (Default, Solar, Warm, Cool, Classic) for tailored aesthetics.

- Extra plot options enhance visualization of market structure and volatility.

________

How It Works:

- HyMA Calculation: A unique moving average with a specialized weighting function to

smooth out price action.

- Loop Function: Iterates over past HyMA values, assessing whether price is consistently

higher or lower.

- Threshold Comparison: The loop score is compared against pre-set thresholds to

determine bullish or bearish conditions.

- Signal Generation:

1. Bullish (🔵): If the score crosses the long threshold

2. Bearish (🔴): If the score drops below the short threshold.

- Plotting & Styling: Dynamic candles and gradient overlays provide an intuitive

visualization of rend shifts.

________

Use Cases:

✅ Ideal for trend-following traders looking for solid trends confirmation.

✅ Helps filter out choppy market conditions by adjusting sensitivity dynamically.

✅ Works well with other indicators (e.g., ADX, volume-based filters) for added confirmation.

✅ Suitable for both short-term and long-term trend analysis.

________

Customization Options:

- Adjustable HyMA Length: Modify the responsiveness of the moving average. Default se to 2.

- For-Loop Parameters: Fine-tune how far back the trend analysis should consider. Default se to Start = 1 , End = -1.

- Thresholds for Long & Short: Control signal sensitivity to market fluctuations. Default set to Long = 40, Short = 8.

- Color Modes & Extra Plots: Personalize visualization for better clarity.

________

Conclusion:

The Hyper MA Loop | QuantEdgeB is a powerful, adaptive indicator that combines custom moving averages with loop-based trend analysis to deliver accurate, visually intuitive market signals. Whether you're looking to ride strong trends or filter out weak setups, this tool provides the precision and flexibility needed for effective decision-making. 🚀📈

🔹 Disclaimer: Past performance is not indicative of future results. No trading indicator can guarantee success in financial markets.

🔹 Strategic Consideration: As always, backtesting and strategic adjustments are essential to fully optimize this indicator for real-world trading. Traders should consider risk management practices and adapt settings to their specific market conditions and trading style.

Hyper MA Loop | QuantEdgeB is an advanced trend-following indicator that leverages a custom Hyper Moving Average (HyMA) and an innovative loop-based scoring system to assess trend strength and direction. This tool is designed to provide a dynamic perspective on market momentum, allowing traders to capture trends effectively while filtering out market noise.

Key Features:

1. Hyper Moving Average (HyMA) 🟣

- A weighted moving average that enhances trend responsiveness by applying a custom

weight function.

- Ensures smoother trend detection while maintaining reactivity to price changes.

2. Loop-Based Trend Scoring 🔄

- Utilizes a for-loop function to analyze the movement of HyMA over a specified period.

- Compares current values to past values, generating a cumulative score indicating bullish or

bearish momentum.

- Dynamic thresholds adjust to market conditions for better trend filtering.

3. Threshold-Based Signal System ✅❌

- Long Signals: Triggered when the loop score exceeds the long threshold.

- Short Signals: Activated when the score falls below the short threshold.

- Avoids false signals by requiring sustained strength before confirming a trend.

4. Customizable Visualization & Colors 🎨

- Multiple color modes (Default, Solar, Warm, Cool, Classic) for tailored aesthetics.

- Extra plot options enhance visualization of market structure and volatility.

________

How It Works:

- HyMA Calculation: A unique moving average with a specialized weighting function to

smooth out price action.

- Loop Function: Iterates over past HyMA values, assessing whether price is consistently

higher or lower.

- Threshold Comparison: The loop score is compared against pre-set thresholds to

determine bullish or bearish conditions.

- Signal Generation:

1. Bullish (🔵): If the score crosses the long threshold

2. Bearish (🔴): If the score drops below the short threshold.

- Plotting & Styling: Dynamic candles and gradient overlays provide an intuitive

visualization of rend shifts.

________

Use Cases:

✅ Ideal for trend-following traders looking for solid trends confirmation.

✅ Helps filter out choppy market conditions by adjusting sensitivity dynamically.

✅ Works well with other indicators (e.g., ADX, volume-based filters) for added confirmation.

✅ Suitable for both short-term and long-term trend analysis.

________

Customization Options:

- Adjustable HyMA Length: Modify the responsiveness of the moving average. Default se to 2.

- For-Loop Parameters: Fine-tune how far back the trend analysis should consider. Default se to Start = 1 , End = -1.

- Thresholds for Long & Short: Control signal sensitivity to market fluctuations. Default set to Long = 40, Short = 8.

- Color Modes & Extra Plots: Personalize visualization for better clarity.

________

Conclusion:

The Hyper MA Loop | QuantEdgeB is a powerful, adaptive indicator that combines custom moving averages with loop-based trend analysis to deliver accurate, visually intuitive market signals. Whether you're looking to ride strong trends or filter out weak setups, this tool provides the precision and flexibility needed for effective decision-making. 🚀📈

🔹 Disclaimer: Past performance is not indicative of future results. No trading indicator can guarantee success in financial markets.

🔹 Strategic Consideration: As always, backtesting and strategic adjustments are essential to fully optimize this indicator for real-world trading. Traders should consider risk management practices and adapt settings to their specific market conditions and trading style.

เอกสารเผยแพร่

Added extra plotsเอกสารเผยแพร่

Update colors selection for more customization. เอกสารเผยแพร่

Added alertsสคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

🔹 Get access to our premium tools:

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

🔹 Get access to our premium tools:

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน