Knowing how to work with the datas in a company's financial statements is an essential skill for stock investors. The meaningful interpretation and analysis of balance sheets, income statements, and cash flow statements to discern a company's investment qualities is the basis for smart investment choices.

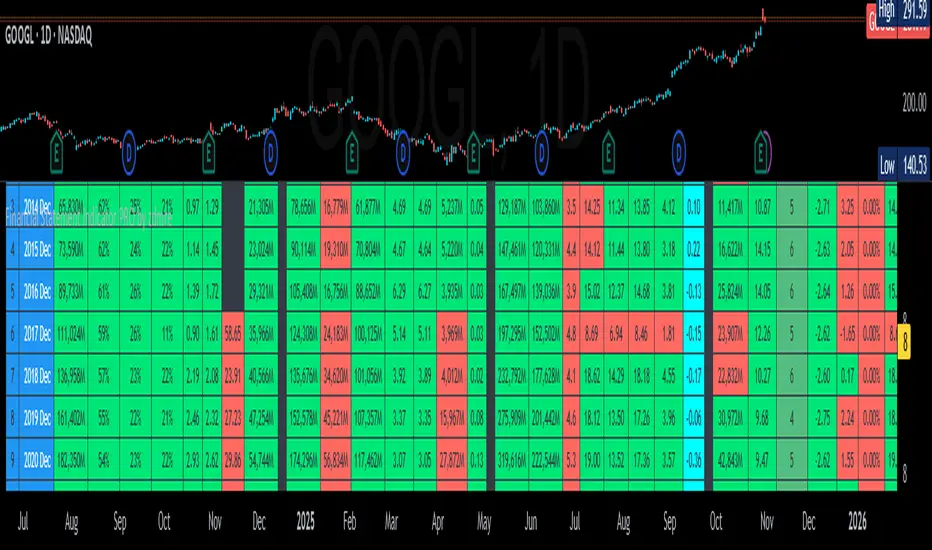

You can access to the financials tables of the companies as a summary with this indicator.

3 Tables;

Income Statement Table:

Revenue

Net Profit

EPS

EPS-D

P/E

Balance Sheet Table:

Current Asset

Total Asset

Total Equity

Book Value per Share

Total Debt

Debt/Equity

Statistics & Cash Flow Table:

Return On Equity

Return On Asset

Return On Invested Capital

Quick Ratio

Free Cash Flow

You can access to the financials tables of the companies as a summary with this indicator.

3 Tables;

Income Statement Table:

Revenue

Net Profit

EPS

EPS-D

P/E

Balance Sheet Table:

Current Asset

Total Asset

Total Equity

Book Value per Share

Total Debt

Debt/Equity

Statistics & Cash Flow Table:

Return On Equity

Return On Asset

Return On Invested Capital

Quick Ratio

Free Cash Flow

เอกสารเผยแพร่

- Added Tooltips

Added Filtering Data by Color

Fixed P/E Ratio

เอกสารเผยแพร่

- Added editable Text Color option.

เอกสารเผยแพร่

Fixed "FUND Error"Added EPS-D & P/E (Plot Data)

เอกสารเผยแพร่

Fixed Basic EPS

P/E Ratio

เอกสารเผยแพร่

- Added BETA Value and improvements made to the visuals.

เอกสารเผยแพร่

Removed

- BVPS (Book Value Per Share)

Added

*P/B (Price-to-Book Ratio)

*ROE/PB (Return on Equity / Price-to-Book Ratio)

*EPS Est (Earning Per Share Estimated)

เอกสารเผยแพร่

- Fixed Earnings Date problem.

เอกสารเผยแพร่

Added 4th Table and improvements made to the visuals.Statistics (Others):

Dividend Payout

Dividend Yield

PEG Ratio

PE Ratio (Forward 1y)

Sustainable Growth Rate (SGR)

Altman Z-SCORE

Beneish Model

Graham Number

Piotroski Score

Springate Score

Zmijewski Score

เอกสารเผยแพร่

New design - Added Headers

Added Tooltips for Titles

Table & Cell merging

เอกสารเผยแพร่

Added Net Margin / Operating Margin FilterHidden NaN values

เอกสารเผยแพร่

- Some additions have been made to the Plot data.

- The EPS data has been changed from Basic to Diluted.

- Minor UI improvements.

เอกสารเผยแพร่

Bug fixes.เอกสารเผยแพร่

What's New? I've added four critical metrics:

- Gross Margin

- Current Ratio

- Working Capital

- EBITDA

What's Improved?

Tables Reorganized: I've completely restructured the data into 4 logical tables (Profitability, Financial Health, Performance, Advanced Analytics) to make the analysis flow better.

Better Visuals: The color-coding system is now more consistent. The gradients for the Altman Z-Score and Piotroski F-Score are now much more informative.

More Data: You can now analyze 24 periods instead of 10.

Configurable Beta: You can now change the benchmark (default is SPX).

All settings menus and tooltips have been cleaned up to be more understandable.

What's Removed?

I removed a few metrics to streamline the analysis and reduce clutter:

Graham Numbers: Limited practical use in modern analysis.

Dividend Payout Ratio: Dividend Yield already covers this.

Technical Fixes

Cleaned up and optimized the code in the background.

Fixed several minor bugs related to color logic, NA value handling, and array indexing.

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน