OPEN-SOURCE SCRIPT

EMA Distance & Sector Info

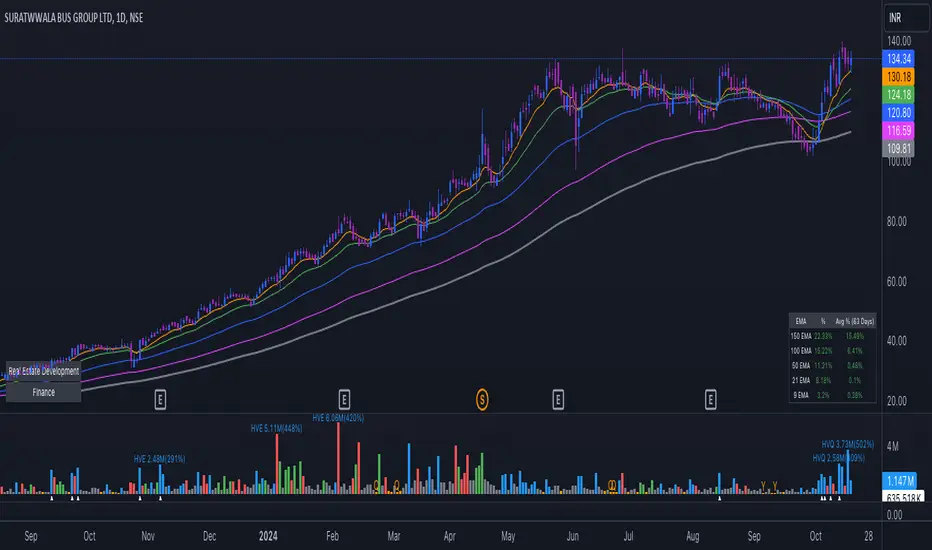

This indicator provides insights into price trends relative to Exponential Moving Averages (EMAs) and displays sector/industry information about the asset. Below is a detailed explanation of its purpose and what it is designed to achieve:

Purpose of the Code

The indicator offers two key functionalities:

1. Analyzing Price Distance from Multiple EMAs:

• Helps traders understand how far the current price is from key EMAs, expressed as a percentage.

• Calculates average percentage distances over a specified period (default: 63 days) to spot consistent trends or mean reversion opportunities.

• Useful for trend-following strategies, allowing the trader to see when the price is above or below important EMAs (e.g., 9, 21, 50, 100, and 150-period EMAs).

2. Displaying Asset Sector and Industry Information:

• Displays the sector and industry of the asset being analyzed (e.g., Technology, Consumer Goods).

• Provides additional context when evaluating performance across a specific sector or comparing an asset to its peers.

Who Would Use This Indicator?

This indicator is particularly helpful for:

1. Swing Traders and Positional Traders:

• They can use it to track whether the price is trading significantly above or below critical EMAs, which often signals overbought/oversold conditions or trend strength.

• The average percentage distances help to identify momentum shifts or pullback opportunities.

2. Sector/Industry-Focused Investors:

• Understanding an asset’s sector and industry helps investors gauge how the asset fits into the broader market context.

• This is valuable for sector rotation strategies, where investors shift funds between sectors based on performance trends.

How It Helps in Trading Decisions

1. Entry and Exit Points:

• If the price is far above an EMA (e.g., 21 EMA), it might indicate an overbought condition or a strong trend, while a negative percentage could signal a pullback or reversal opportunity.

• The average percentage distances smooth the fluctuations and reveal longer-term trends.

2. Contextual Information:

• Knowing the sector and industry is useful when analyzing trends. For example, if Technology stocks are doing well, and this asset belongs to that sector, it could indicate sector-wide momentum.

Summary of the Indicator’s Purpose

This code provides:

• EMA trend monitoring: Visualizes the price position relative to multiple EMAs and averages those distances for smoother insights.

• Sector and industry information: Adds valuable context for asset performance analysis.

• Decision-making support: Helps traders identify overbought/oversold levels and assess the asset within the broader market landscape.

In essence, this indicator is a multi-purpose tool that combines technical analysis (through EMA distances) with fundamental context (via sector/industry info), making it valuable for traders and investors aiming to time entries/exits or understand market behavior better.

Purpose of the Code

The indicator offers two key functionalities:

1. Analyzing Price Distance from Multiple EMAs:

• Helps traders understand how far the current price is from key EMAs, expressed as a percentage.

• Calculates average percentage distances over a specified period (default: 63 days) to spot consistent trends or mean reversion opportunities.

• Useful for trend-following strategies, allowing the trader to see when the price is above or below important EMAs (e.g., 9, 21, 50, 100, and 150-period EMAs).

2. Displaying Asset Sector and Industry Information:

• Displays the sector and industry of the asset being analyzed (e.g., Technology, Consumer Goods).

• Provides additional context when evaluating performance across a specific sector or comparing an asset to its peers.

Who Would Use This Indicator?

This indicator is particularly helpful for:

1. Swing Traders and Positional Traders:

• They can use it to track whether the price is trading significantly above or below critical EMAs, which often signals overbought/oversold conditions or trend strength.

• The average percentage distances help to identify momentum shifts or pullback opportunities.

2. Sector/Industry-Focused Investors:

• Understanding an asset’s sector and industry helps investors gauge how the asset fits into the broader market context.

• This is valuable for sector rotation strategies, where investors shift funds between sectors based on performance trends.

How It Helps in Trading Decisions

1. Entry and Exit Points:

• If the price is far above an EMA (e.g., 21 EMA), it might indicate an overbought condition or a strong trend, while a negative percentage could signal a pullback or reversal opportunity.

• The average percentage distances smooth the fluctuations and reveal longer-term trends.

2. Contextual Information:

• Knowing the sector and industry is useful when analyzing trends. For example, if Technology stocks are doing well, and this asset belongs to that sector, it could indicate sector-wide momentum.

Summary of the Indicator’s Purpose

This code provides:

• EMA trend monitoring: Visualizes the price position relative to multiple EMAs and averages those distances for smoother insights.

• Sector and industry information: Adds valuable context for asset performance analysis.

• Decision-making support: Helps traders identify overbought/oversold levels and assess the asset within the broader market landscape.

In essence, this indicator is a multi-purpose tool that combines technical analysis (through EMA distances) with fundamental context (via sector/industry info), making it valuable for traders and investors aiming to time entries/exits or understand market behavior better.

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน