Universal Valuation Z_score -> PROFABIGHI_CAPITAL

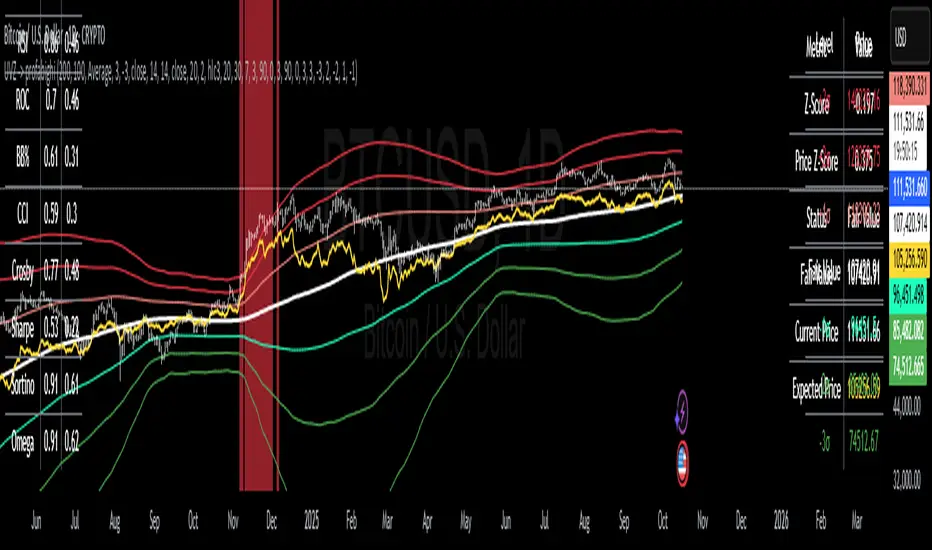

The Universal Valuation Z-Score indicator provides a comprehensive multi-indicator valuation framework by computing Z-scores across momentum oscillators, volatility bands, and risk-adjusted metrics to assess over/undervaluation relative to historical norms. It weights these signals based on correlation strength with price, generates fair value estimates, and highlights extreme levels through color-coded candles and vertical bars for intuitive market positioning.

⚙️ General Settings

- Z-Score Lookback Period: Adjustable historical window for normalizing indicator deviations from mean

- Correlation Analysis Period: Timeframe for measuring indicator-price relationships and beta factors

- Show Threshold Lines: Toggle visibility of dynamic overbought/oversold boundaries on the chart

- Show Indicator Selection: Choose to display the composite average Z-score or a specific metric like RSI or Sharpe

- Use Price Weighting: Incorporate direct price Z-score into the final valuation blend

- Adaptive Weighting: Dynamically adjust indicator influence based on their correlation to price movements

📊 Barchoice Settings

- Overbought Threshold: Extreme upper level triggering vertical bar highlights for potential reversals

- Oversold Threshold: Extreme lower level signaling vertical bar alerts for buying opportunities

📈 RSI Configuration

- Enable RSI: Toggle inclusion of RSI Z-score in the weighted valuation

- RSI Source: Select the price input for momentum oscillation

- RSI Length: Period for calculating relative strength index deviations

📈 ROC Configuration

- Enable ROC: Include rate-of-change Z-score for momentum acceleration analysis

- ROC Period: Lookback for measuring percentage price shifts

📈 BB% Configuration

- Enable BB%: Factor in Bollinger Bands percentage Z-score for volatility positioning

- BB% Source: Data input for band-based normalization

- BB Length: Smoothing period for the central moving average

- BB Standard Deviation: Multiplier defining band width for extreme deviation detection

📈 CCI Configuration

- Enable CCI: Add Commodity Channel Index Z-score for cyclical deviation tracking

- CCI Source: Typical price or custom input for momentum extremes

- CCI Length: Period for typical price averaging and deviation

📈 Crosby Ratio Configuration

- Enable Crosby Ratio: Incorporate angle-based trend strength Z-score

- Crosby Length: Smoothing span for Heikin Ashi close and ATR comparison

📈 Sharpe Ratio Configuration

- Enable Sharpe Ratio: Include risk-adjusted return Z-score for efficiency weighting

- Sharpe Period: Window for return/volatility normalization

- Sharpe Smoothing: EMA length to stabilize efficiency readings

📈 Sortino Ratio Configuration

- Enable Sortino Ratio: Factor downside-focused efficiency Z-score

- Sortino Period: Historical scope for negative deviation analysis

- Risk-Free Rate: Benchmark yield subtracted from returns

- Sortino Smoothing: Filter for refined downside ratio

📈 Omega Ratio Configuration

- Enable Omega Ratio: Add probability-weighted gains/losses Z-score

- Omega Period: Lookback for return distribution evaluation

- Target Return: Threshold separating gains from losses

- Omega Smoothing: EMA to smooth ratio fluctuations

📏 Threshold Values

- Extreme Overbought Level: Upper Z-score boundary for strongest sell signals

- Extreme Oversold Level: Lower Z-score boundary for strongest buy signals

- Overbought Level: Moderate upper threshold for cautionary alerts

- Oversold Level: Moderate lower threshold for opportunity alerts

- Neutral Upper: Boundary separating fair value from slight overvaluation

- Neutral Lower: Boundary separating fair value from slight undervaluation

🎨 Color Settings

- Neutral Color: Default shade for balanced Z-score zones

- Overbought Color: Alert red for high valuation extremes

- Oversold Color: Alert green for low valuation extremes

- Neutral Upper Color: Subtle pink for mild overvaluation

- Neutral Lower Color: Subtle teal for mild undervaluation

- Light Overbought: Pale red for approaching overbought

- Light Oversold: Pale green for approaching oversold

- Zero Line Color: Gray reference for fair value centerline

📊 Valuation Calculation Methods

Z-Score Normalization:

- Computes standard deviations from historical means for each enabled indicator

- Standardizes diverse metrics into comparable deviation scores

- Handles insufficient data with null values for robustness

Correlation and Beta Analysis:

- Measures linear relationships between indicator Z-scores and price movements

- Calculates sensitivity (beta) for scaling deviations to price impact

- Uses rolling windows to capture evolving indicator relevance

Weighted Composite Formation:

- Applies equal or correlation-based weights to blend indicator Z-scores

- Incorporates price Z-score optionally for direct market alignment

- Adjusts via beta and absolute correlation for predictive strength

Fair Value Estimation:

- Derives mean price over lookback as central valuation anchor

- Projects expected price from composite Z-score and standard deviation

- Generates symmetric threshold bands at ±1, ±2, ±3 deviations

📈 Visual and Status Features

Z-Score Overlay Plot:

- Displays selected or average Z-score as a dynamic line on price chart

- Color gradients from neutral to extreme for instant valuation cues

- Zero line and threshold horizontals for reference boundaries

Candle Coloring:

- Tints bars based on Z-score zones for quick over/undervaluation scanning

- Applies to current bar only to avoid historical clutter

- Integrates with overlay for contextual price action review

Vertical Extreme Bars:

- Highlights bars where price wicks touch extreme Z-derived levels

- Semi-transparent backgrounds for non-intrusive alerts

- Combines price and Z-score conditions for dual confirmation

📋 Information Tables

Current Values Panel:

- Top-right summary of Z-score, price deviation, status, and fair value

- Color-codes entries matching the active Z-score zone

- Includes expected price projection for forward guidance

Correlation Matrix:

- Bottom-left grid showing indicator-price correlations and betas

- Rows for each metric with decimal precision for relationship strength

- Aids in understanding which signals drive valuation most

Price Levels Summary:

- Bottom-right ladder of Z-derived thresholds from -3 to +3 sigma

- Lists corresponding price levels for potential support/resistance

- Toggles with threshold display for integrated analysis

🔔 Alert System

- Overbought Crossover: Triggers when Z-score enters upper threshold zone

- Oversold Crossunder: Fires on Z-score dropping into lower threshold

- Price vs. Expectation Cross: Alerts on price diverging from indicator-derived target

- Extreme Wick Hits: Notifies when highs/lows breach far Z-boundaries

✅ Key Takeaways

- Holistic Valuation Tool: Blends multiple Z-scores for robust over/undervaluation signals

- Adaptive Intelligence: Correlation-weighted indicators prioritize price-relevant metrics

- Visual Simplicity: Color gradients, tables, and bars make complex analysis intuitive

- Customizable Depth: Toggle indicators and thresholds to fit any market or style

- Forward Projection: Expected prices guide targets beyond current fair value

- Risk-Aware Framework: Sharpe, Sortino, and Omega add efficiency layers to momentum

- Alert Precision: Zone crosses and wick extremes ensure timely notifications

สคริปต์แบบเฉพาะผู้ได้รับเชิญเท่านั้น

เฉพาะผู้ใช้ที่ได้รับการอนุมัติจากผู้เขียนเท่านั้นที่สามารถเข้าถึงสคริปต์นี้ได้ คุณจะต้องร้องขอและได้รับอนุญาตก่อนจึงจะสามารถใช้งานได้ โดยปกติจะได้รับอนุญาตหลังจากชำระเงินแล้ว สำหรับรายละเอียดเพิ่มเติม ทำตามคำแนะนำของผู้เขียนด้านล่างหรือติดต่อ PROFABIGHI_CAPITAL โดยตรง

TradingView ไม่แนะนำให้ชำระเงินหรือใช้สคริปต์ เว้นแต่ว่าคุณจะเชื่อถือผู้เขียนสคริปต์และเข้าใจวิธีการทำงานของมัน คุณยังอาจพบทางเลือกของโอเพนซอร์ส แบบฟรีในสคริปต์ชุมชนของเรา

คำแนะนำของผู้เขียน

คำจำกัดสิทธิ์ความรับผิดชอบ

สคริปต์แบบเฉพาะผู้ได้รับเชิญเท่านั้น

เฉพาะผู้ใช้ที่ได้รับการอนุมัติจากผู้เขียนเท่านั้นที่สามารถเข้าถึงสคริปต์นี้ได้ คุณจะต้องร้องขอและได้รับอนุญาตก่อนจึงจะสามารถใช้งานได้ โดยปกติจะได้รับอนุญาตหลังจากชำระเงินแล้ว สำหรับรายละเอียดเพิ่มเติม ทำตามคำแนะนำของผู้เขียนด้านล่างหรือติดต่อ PROFABIGHI_CAPITAL โดยตรง

TradingView ไม่แนะนำให้ชำระเงินหรือใช้สคริปต์ เว้นแต่ว่าคุณจะเชื่อถือผู้เขียนสคริปต์และเข้าใจวิธีการทำงานของมัน คุณยังอาจพบทางเลือกของโอเพนซอร์ส แบบฟรีในสคริปต์ชุมชนของเรา