OPEN-SOURCE SCRIPT

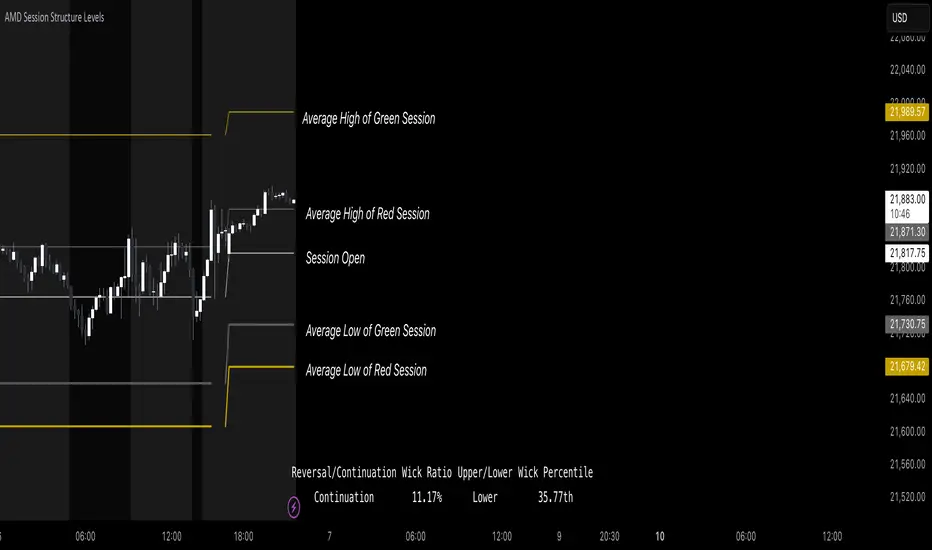

AMD Session Structure Levels

# Market Structure & Manipulation Probability Indicator

## Overview

This advanced indicator is designed for traders who want a systematic approach to analyzing market structure, identifying manipulation, and assessing probability-based trade setups. It incorporates four core components:

### 1. Session Price Action Analysis

- Tracks **OHLC (Open, High, Low, Close)** within defined sessions.

- Implements a **dual tracking system**:

- **Official session levels** (fixed from the session open to close).

- **Real-time max/min tracking** to differentiate between temporary spikes and real price acceptance.

### 2. Market Manipulation Detection

- Identifies **manipulative price action** using the relationship between the open and close:

- If **price closes below open** → assumes **upward manipulation**, followed by **downward distribution**.

- If **price closes above open** → assumes **downward manipulation**, followed by **upward distribution**.

- Normalized using **ATR**, ensuring adaptability across different volatility conditions.

### 3. Probability Engine

- Tracks **historical wick ratios** to assess trend vs. reversal conditions.

- Calculates **conditional probabilities** for price moves.

- Uses a **special threshold system (0.45 and 0.03)** for reversal signals.

- Provides **real-time probability updates** to enhance trade decision-making.

### 4. Market Condition Classification

- Classifies market conditions using a **wick-to-body ratio**:

```pine

wick_to_body_ratio = open > close ? upper_wick / (high - low) : lower_wick / (high - low)

```

- **Low ratio (<0.25)** → Likely a **trend day**.

- **High ratio (>0.25)** → Likely a **range day**.

---

## Why This Indicator Stands Out

### ✅ Smarter Level Detection

- Uses **ATR-based dynamic levels** instead of static support/resistance.

- Differentiates **manipulation from distribution** for better decision-making.

- Updates probabilities **in real-time**.

### ✅ Memory-Efficient Design

- Implements **circular buffers** to maintain efficiency:

```pine

var float[] manipUp = array.new_float(lookbackPeriod, 0.0)

var float[] manipDown = array.new_float(lookbackPeriod, 0.0)

```

- Ensures **constant memory usage**, even over extended trading sessions.

### ✅ Advanced Probability Calculation

- Utilizes **conditional probabilities** instead of simple averages.

- Incorporates **market context** through wick analysis.

- Provides **actionable signals** via a probability table.

---

## Trading Strategy Guide

### **Best Entry Setups**

✅ Wait for **price to approach manipulation levels**.

✅ Confirm using the **probability table**.

✅ Check the **wick ratio for context**.

✅ Enter when **conditional probability aligns**.

### **Smart Exit Management**

✅ Use **distribution levels** as **profit targets**.

✅ Scale out **when probabilities shift**.

✅ Monitor **wick percentiles** for confirmation.

### **Risk Management**

✅ Size positions based on **probability readings**.

✅ Place stops at **manipulation levels**.

✅ Adjust position size based on **trend vs. range classification**.

---

## Configuration Tips

### **Session Settings**

```pine

sessionTime = input.session("0830-1500", "Session Hours")

weekDays = input.string("23456", "Active Days")

```

- Match these to your **primary trading session**.

- Adjust for different **market opens** if needed.

### **Analysis Parameters**

```pine

lookbackPeriod = input.int(50, "Lookback Period")

low_threshold = input.float(0.25, "Trend/Range Threshold")

```

- **50 periods** is a good starting point but can be optimized per instrument.

- The **0.25 threshold** is ideal for most markets but may need adjustments.

---

## Market Structure Breakdown

### **Trend/Continuation Days**

- **Characteristics:**

✅ Small **opposing wicks** (minimal counter-pressure).

✅ Clean, **directional price movement**.

- **Bullish Trend Day Example:**

✅ Small **lower wicks** (minimal downward pressure).

✅ Strong **closes near the highs** → **Buyers in control**.

- **Bearish Trend Day Example:**

✅ Small **upper wicks** (minimal upward pressure).

✅ Strong **closes near the lows** → **Sellers in control**.

### **Reversal Days**

- **Characteristics:**

✅ **Large opposing wicks** → Failed momentum in the initial direction.

- **Bullish Reversal Example:**

✅ **Large upper wick early**.

✅ **Strong close from the lows** → **Sellers failed to maintain control**.

- **Bearish Reversal Example:**

✅ **Large lower wick early**.

✅ **Weak close from the highs** → **Buyers failed to maintain control**.

---

## Summary

This indicator systematically quantifies market structure by measuring **manipulation, distribution, and probability-driven trade setups**. Unlike traditional indicators, it adapts dynamically using **ATR, historical probabilities, and real-time tracking** to offer a structured, data-driven approach to trading.

🚀 **Use this tool to enhance your decision-making and gain an objective edge in the market!**

## Overview

This advanced indicator is designed for traders who want a systematic approach to analyzing market structure, identifying manipulation, and assessing probability-based trade setups. It incorporates four core components:

### 1. Session Price Action Analysis

- Tracks **OHLC (Open, High, Low, Close)** within defined sessions.

- Implements a **dual tracking system**:

- **Official session levels** (fixed from the session open to close).

- **Real-time max/min tracking** to differentiate between temporary spikes and real price acceptance.

### 2. Market Manipulation Detection

- Identifies **manipulative price action** using the relationship between the open and close:

- If **price closes below open** → assumes **upward manipulation**, followed by **downward distribution**.

- If **price closes above open** → assumes **downward manipulation**, followed by **upward distribution**.

- Normalized using **ATR**, ensuring adaptability across different volatility conditions.

### 3. Probability Engine

- Tracks **historical wick ratios** to assess trend vs. reversal conditions.

- Calculates **conditional probabilities** for price moves.

- Uses a **special threshold system (0.45 and 0.03)** for reversal signals.

- Provides **real-time probability updates** to enhance trade decision-making.

### 4. Market Condition Classification

- Classifies market conditions using a **wick-to-body ratio**:

```pine

wick_to_body_ratio = open > close ? upper_wick / (high - low) : lower_wick / (high - low)

```

- **Low ratio (<0.25)** → Likely a **trend day**.

- **High ratio (>0.25)** → Likely a **range day**.

---

## Why This Indicator Stands Out

### ✅ Smarter Level Detection

- Uses **ATR-based dynamic levels** instead of static support/resistance.

- Differentiates **manipulation from distribution** for better decision-making.

- Updates probabilities **in real-time**.

### ✅ Memory-Efficient Design

- Implements **circular buffers** to maintain efficiency:

```pine

var float[] manipUp = array.new_float(lookbackPeriod, 0.0)

var float[] manipDown = array.new_float(lookbackPeriod, 0.0)

```

- Ensures **constant memory usage**, even over extended trading sessions.

### ✅ Advanced Probability Calculation

- Utilizes **conditional probabilities** instead of simple averages.

- Incorporates **market context** through wick analysis.

- Provides **actionable signals** via a probability table.

---

## Trading Strategy Guide

### **Best Entry Setups**

✅ Wait for **price to approach manipulation levels**.

✅ Confirm using the **probability table**.

✅ Check the **wick ratio for context**.

✅ Enter when **conditional probability aligns**.

### **Smart Exit Management**

✅ Use **distribution levels** as **profit targets**.

✅ Scale out **when probabilities shift**.

✅ Monitor **wick percentiles** for confirmation.

### **Risk Management**

✅ Size positions based on **probability readings**.

✅ Place stops at **manipulation levels**.

✅ Adjust position size based on **trend vs. range classification**.

---

## Configuration Tips

### **Session Settings**

```pine

sessionTime = input.session("0830-1500", "Session Hours")

weekDays = input.string("23456", "Active Days")

```

- Match these to your **primary trading session**.

- Adjust for different **market opens** if needed.

### **Analysis Parameters**

```pine

lookbackPeriod = input.int(50, "Lookback Period")

low_threshold = input.float(0.25, "Trend/Range Threshold")

```

- **50 periods** is a good starting point but can be optimized per instrument.

- The **0.25 threshold** is ideal for most markets but may need adjustments.

---

## Market Structure Breakdown

### **Trend/Continuation Days**

- **Characteristics:**

✅ Small **opposing wicks** (minimal counter-pressure).

✅ Clean, **directional price movement**.

- **Bullish Trend Day Example:**

✅ Small **lower wicks** (minimal downward pressure).

✅ Strong **closes near the highs** → **Buyers in control**.

- **Bearish Trend Day Example:**

✅ Small **upper wicks** (minimal upward pressure).

✅ Strong **closes near the lows** → **Sellers in control**.

### **Reversal Days**

- **Characteristics:**

✅ **Large opposing wicks** → Failed momentum in the initial direction.

- **Bullish Reversal Example:**

✅ **Large upper wick early**.

✅ **Strong close from the lows** → **Sellers failed to maintain control**.

- **Bearish Reversal Example:**

✅ **Large lower wick early**.

✅ **Weak close from the highs** → **Buyers failed to maintain control**.

---

## Summary

This indicator systematically quantifies market structure by measuring **manipulation, distribution, and probability-driven trade setups**. Unlike traditional indicators, it adapts dynamically using **ATR, historical probabilities, and real-time tracking** to offer a structured, data-driven approach to trading.

🚀 **Use this tool to enhance your decision-making and gain an objective edge in the market!**

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน