OPEN-SOURCE SCRIPT

Scale Ability [TrendX_]

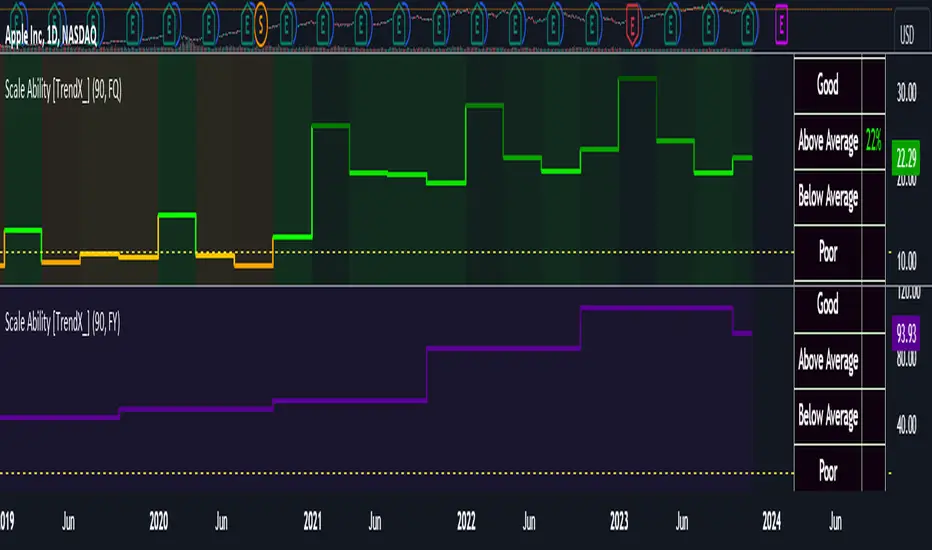

Scale Ability indicator can indicate a company’s potential for future growth and profitability.

A scalable company is one that can increase its revenue and market share without increasing its costs proportionally, which can benefit from economies of scale. Therefore, the high-scale ability can generate more value for its shareholders - which is important for investment decisions.

Scale Ability indicator consists of 3 financial components:

These measures can help investors assess how efficiently and effectively a company uses its resources to generate revenue and profit.

Note:

FUNCTION

CFIA / TA Ratio

A company with a net income to total debt of 9% could indicate that it is investing in its assets to keep up with the market demand and the technological changes which can create competitive advantages.

NI/ TD Ratio

A company with a net income to total debt of 9% could show that it is profitable and has a strong financial position, which can easily cover its debt payments.

EBITDA / E Ratio

A company with a net income to total debt of 14% illustrates that it is generating a high return on its equity.

USAGE

Scale index division:

> 43 : Excellent

32 - 43 : Good

12 - 31 : Above Average

= 11 : Average

8 - 10 : Below Average

5 - 7 : Poor

< 4 : Very Poor

DISCLAIMER

This is only a rough estimate, and the actual ratio may differ significantly depending on the stage of the business cycle and the company’s strategy, and the comparison of each company and its peers.

This indicator is not financial advice, it can only help traders make better decisions. There are many factors and uncertainties that can affect the outcome of any endeavor, and no one can guarantee or predict with certainty what will occur.

Therefore, one should always exercise caution and judgment when making decisions based on past performance.

A scalable company is one that can increase its revenue and market share without increasing its costs proportionally, which can benefit from economies of scale. Therefore, the high-scale ability can generate more value for its shareholders - which is important for investment decisions.

Scale Ability indicator consists of 3 financial components:

- Cash Flow from Investing Activities to Total Assets Ratio (CFIA / TA)

- Net Income to Total Debt Ratio (NI / TD)

- Earnings Before Interest, Taxes, Depreciation and Amortization to Equity Ratio (EBITDA / E)

These measures can help investors assess how efficiently and effectively a company uses its resources to generate revenue and profit.

Note:

- This can be customizable between Fiscal Quarter (FQ) and Fiscal Year (Fy)

- This is suitable for companies in fast-growing industries.

FUNCTION

CFIA / TA Ratio

A company with a net income to total debt of 9% could indicate that it is investing in its assets to keep up with the market demand and the technological changes which can create competitive advantages.

NI/ TD Ratio

A company with a net income to total debt of 9% could show that it is profitable and has a strong financial position, which can easily cover its debt payments.

EBITDA / E Ratio

A company with a net income to total debt of 14% illustrates that it is generating a high return on its equity.

USAGE

Scale index division:

> 43 : Excellent

32 - 43 : Good

12 - 31 : Above Average

= 11 : Average

8 - 10 : Below Average

5 - 7 : Poor

< 4 : Very Poor

DISCLAIMER

This is only a rough estimate, and the actual ratio may differ significantly depending on the stage of the business cycle and the company’s strategy, and the comparison of each company and its peers.

This indicator is not financial advice, it can only help traders make better decisions. There are many factors and uncertainties that can affect the outcome of any endeavor, and no one can guarantee or predict with certainty what will occur.

Therefore, one should always exercise caution and judgment when making decisions based on past performance.

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน