OPEN-SOURCE SCRIPT

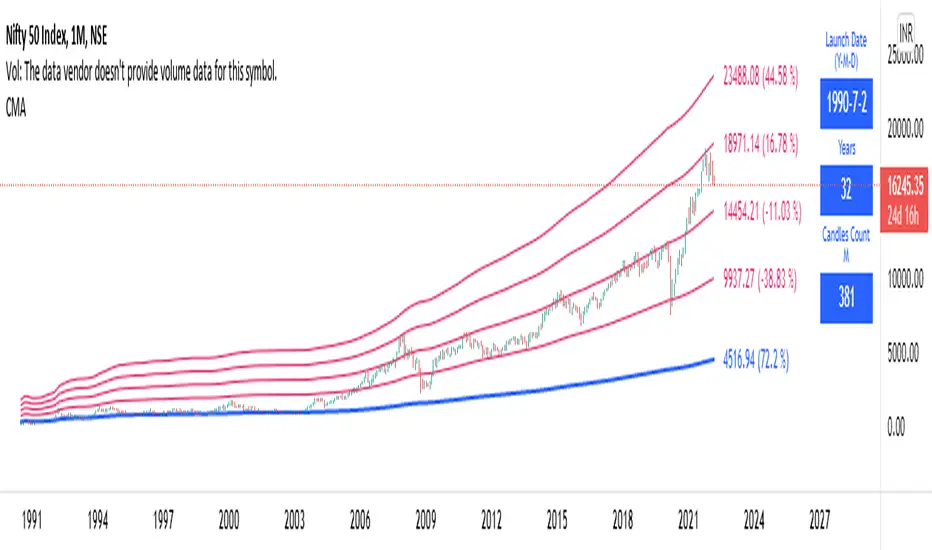

Long Term: Cumulative Moving Average

Who to use?

This indicator is for Long Term Investors or for Position trading and not for Day traders.

What time-frame to use?

• Daily, Weekly or Monthly

What is Blue line?

• Blue line is Cumulative Moving Average. It is cumulative sum of closing price.

• It is a trend reversal level.

• It is a strong support level.

• If price is below Blue line better not to take any Long position until it crosses above it.

What are Red lines?

• Red lines are Multiplier levels.

• These are target levels to exit the position.

• It can be breakout or pull back levels.

• The level combination numbers can be fully odd or even numbers.

• For example in certain stocks the working levels will be 1x, 3x, 5x etc., in others it will be even numbers like 2x, 4x, 6x etc.

• In some cases the levels need to be tweaked with custom decimals like 1.1x, 2.1x, 3.1x, 4.1x etc. to align the support & resistance levels.

How to use?

Entry

• Enter when the Price reach closer to the Blue line.

• Enter Long when the Price takes a pullback or breakout at the Red lines.

Exit

• Exit position when the Price reach closer to the Red lines in Long positions.

Indicator Menu

• Works only in higher time-frames like D, W & M.

• Will not work in Lower time-frames less than "D" or the Launch Date shows wrong in Lower time-frames.

Multipliers:

(Read above What are Red lines?)

Launch Date:

• Launch Date: Starting date of stock when it appeared in the exchange. Works only in D, W & M timeframes.

• Years: Total number of years from the Launch Date. Accurate date will be shown in Daily timeframe.

• Candles Count: Total number of candles from the Launch Date in the current timeframe.

Labels:

• First number is last traded price.

• Second number in () is percentage change from last traded price to that level.

This indicator is for Long Term Investors or for Position trading and not for Day traders.

What time-frame to use?

• Daily, Weekly or Monthly

What is Blue line?

• Blue line is Cumulative Moving Average. It is cumulative sum of closing price.

• It is a trend reversal level.

• It is a strong support level.

• If price is below Blue line better not to take any Long position until it crosses above it.

What are Red lines?

• Red lines are Multiplier levels.

• These are target levels to exit the position.

• It can be breakout or pull back levels.

• The level combination numbers can be fully odd or even numbers.

• For example in certain stocks the working levels will be 1x, 3x, 5x etc., in others it will be even numbers like 2x, 4x, 6x etc.

• In some cases the levels need to be tweaked with custom decimals like 1.1x, 2.1x, 3.1x, 4.1x etc. to align the support & resistance levels.

How to use?

Entry

• Enter when the Price reach closer to the Blue line.

• Enter Long when the Price takes a pullback or breakout at the Red lines.

Exit

• Exit position when the Price reach closer to the Red lines in Long positions.

Indicator Menu

• Works only in higher time-frames like D, W & M.

• Will not work in Lower time-frames less than "D" or the Launch Date shows wrong in Lower time-frames.

Multipliers:

(Read above What are Red lines?)

Launch Date:

• Launch Date: Starting date of stock when it appeared in the exchange. Works only in D, W & M timeframes.

• Years: Total number of years from the Launch Date. Accurate date will be shown in Daily timeframe.

• Candles Count: Total number of candles from the Launch Date in the current timeframe.

Labels:

• First number is last traded price.

• Second number in () is percentage change from last traded price to that level.

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน