OPEN-SOURCE SCRIPT

Multi-Mode Seasonality Map [BackQuant]

Multi-Mode Seasonality Map [BackQuant]

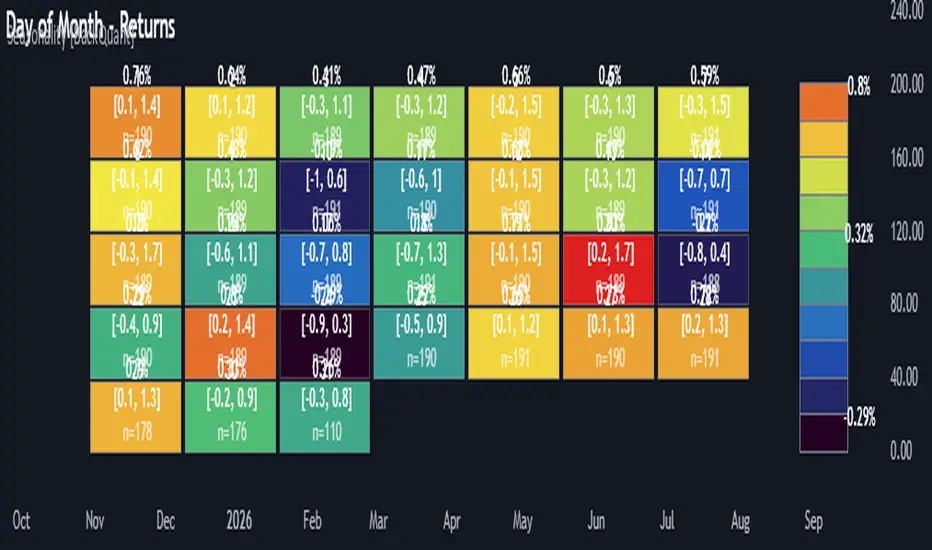

A fast, visual way to expose repeatable calendar patterns in returns, volatility, volume, and range across multiple granularities (Day of Week, Day of Month, Hour of Day, Week of Month). Built for idea generation, regime context, and execution timing.

What is “seasonality” in markets?

Seasonality refers to statistically repeatable patterns tied to the calendar or clock, rather than to price levels. Examples include specific weekdays tending to be stronger, certain hours showing higher realized volatility, or month-end flow boosting volumes. This tool measures those effects directly on your charted symbol.

Why seasonality matters

How traders use seasonality in practice

Why Day-of-Week (DOW) can be especially helpful

What this indicator does

How it’s calculated (under the hood)

How to read the heatmap

Suggested workflows

Parameter guidance

Interpreting common patterns

Best practices

Limitations & notes

Quick setup

The Multi-Mode Seasonality Map helps you convert the calendar from an afterthought into a quantitative edge, surfacing when an asset tends to move, expand, or stay quiet—so you can plan, size, and execute with intent.

A fast, visual way to expose repeatable calendar patterns in returns, volatility, volume, and range across multiple granularities (Day of Week, Day of Month, Hour of Day, Week of Month). Built for idea generation, regime context, and execution timing.

What is “seasonality” in markets?

Seasonality refers to statistically repeatable patterns tied to the calendar or clock, rather than to price levels. Examples include specific weekdays tending to be stronger, certain hours showing higher realized volatility, or month-end flow boosting volumes. This tool measures those effects directly on your charted symbol.

Why seasonality matters

- It’s orthogonal alpha: timing edges independent of price structure that can complement trend, mean reversion, or flow-based setups.

- It frames expectations: when a session typically runs hot or cold, you size and pace risk accordingly.

- It improves execution: entering during historically favorable windows, avoiding historically noisy windows.

- It clarifies context: separating normal “calendar noise” from true anomaly helps avoid overreacting to routine moves.

How traders use seasonality in practice

- Timing entries/exits: If Tuesday morning is historically weak for this asset, a mean-reversion buyer may wait for that drift to complete before entering.

- Sizing & stops: If 13:00–15:00 shows elevated volatility, widen stops or reduce size to maintain constant risk.

- Session playbooks: Build repeatable routines around the hours/days that consistently drive PnL.

- Portfolio rotation: Compare seasonal edges across assets to schedule focus and deploy attention where the calendar favors you.

Why Day-of-Week (DOW) can be especially helpful

- Flows cluster by weekday (ETF creations/redemptions, options hedging cadence, futures roll patterns, macro data releases), so DOW often encodes a stable micro-structure signal.

- Desk behavior and liquidity provision differ by weekday, impacting realized range and slippage.

- DOW is simple to operationalize: easy rules like “fade Monday afternoon chop” or “press Thursday trend extension” can be tested and enforced.

What this indicator does

- Multi-mode heatmaps: Switch between Day of Week, Day of Month, Hour of Day, Week of Month.

- Metric selection: Analyze Returns, Volatility ((high-low)/open), Volume (vs 20-bar average), or Range (vs 20-bar average).

- Confidence intervals: Per cell, compute mean, standard deviation, and a z-based CI at your chosen confidence level.

- Sample guards: Enforce a minimum sample size so thin data doesn’t mislead.

- Readable map: Color palettes, value labels, sample size, and an optional legend for fast interpretation.

- Scoreboard: Optional table highlights best/worst DOW and today’s seasonality with CI and a simple “edge” tag.

How it’s calculated (under the hood)

- Per bar, compute the chosen metric (return, vol, volume %, or range %) over your lookback window.

- Bucket that metric into the active calendar bin (e.g., Tuesday, the 15th, 10:00 hour, or Week-2 of month).

- For each bin, accumulate sum, sum of squares, and count, then at render compute mean, std dev, and confidence interval.

- Color scale normalizes to the observed min/max of eligible bins (those meeting the minimum sample size).

How to read the heatmap

- Color: Greener/warmer typically implies higher mean value for the chosen metric; cooler implies lower.

- Value label: The center number is the bin’s mean (e.g., average % return for Tuesdays).

- Confidence bracket: Optional “[low, high]” shows the CI for the mean, helping you gauge stability.

- n = sample size: More samples = more reliability. Treat small-n bins with skepticism.

Suggested workflows

- Pick the lens: Start with Analysis Type = Returns, Heatmap View = Day of Week, lookback ≈ 252 trading days. Note the best/worst weekdays and their CI width.

- Sanity-check volatility: Switch to Volatility to see which bins carry the most realized range. Use that to plan stop width and trade pacing.

- Check liquidity proxy: Flip to Volume, identify thin vs thick windows. Execute risk in thicker windows to reduce slippage.

- Drill to intraday: Use Hour of Day to reveal opening bursts, lunchtime lulls, and closing ramps. Combine with your main strategy to schedule entries.

- Calendar nuance: Inspect Week of Month and Day of Month for end-of-month, options-cycle, or data-release effects.

- Codify rules: Translate stable edges into rules like “no fresh risk during bottom-quartile hours” or “scale entries during top-quartile hours.”

Parameter guidance

- Analysis Period (Days): 252 for a one-year view. Shorten (100–150) to emphasize the current regime; lengthen (500+) for long-memory effects.

- Heatmap View: Start with DOW for robustness, then refine with Hour-of-Day for your execution window.

- Confidence Level: 95% is standard; use 90% if you want wider coverage with fewer false “insufficient data” bins.

- Min Sample Size: 10–20 helps filter noise. For Hour-of-Day on higher timeframes, consider lowering if your dataset is small.

- Color Scheme: Choose a palette with good mid-tone contrast (e.g., Red-Green or Viridis) for quick thresholding.

Interpreting common patterns

- Return-positive but low-vol bins: Favorable drift windows for passive adds or tight-stop trend continuation.

- Return-flat but high-vol bins: Opportunity for mean reversion or breakout scalping, but manage risk accordingly.

- High-volume bins: Better expected execution quality; schedule size here if slippage matters.

- Wide CI: Edge is unstable or sample is thin; treat as exploratory until more data accumulates.

Best practices

- Revalidate after regime shifts (new macro cycle, liquidity regime change, major exchange microstructure updates).

- Use multiple lenses: DOW to find the day, then Hour-of-Day to refine the entry window.

- Combine with your core setup signals; treat seasonality as a filter or weight, not a standalone trigger.

- Test across assets/timeframes—edges are instrument-specific and may not transfer 1:1.

Limitations & notes

- History-dependent: short histories or sparse intraday data reduce reliability.

- Not causal: a hot Tuesday doesn’t guarantee future Tuesday strength; treat as probabilistic bias.

- Aggregation bias: changing session hours or symbol migrations can distort older samples.

- CI is z-approximate: good for fast triage, not a substitute for full hypothesis testing.

Quick setup

- Use Returns + Day of Week + 252d to get a clean yearly map of weekday edge.

- Flip to Hour of Day on intraday charts to schedule precise entries/exits.

- Keep Show Values and Confidence Intervals on while you calibrate; hide later for a clean visual.

The Multi-Mode Seasonality Map helps you convert the calendar from an afterthought into a quantitative edge, surfacing when an asset tends to move, expand, or stay quiet—so you can plan, size, and execute with intent.

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

Check out whop.com/signals-suite for Access to Invite Only Scripts!

Or go to backquant.com/

Or go to backquant.com/

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

Check out whop.com/signals-suite for Access to Invite Only Scripts!

Or go to backquant.com/

Or go to backquant.com/

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน