CycleVISION [BitAura]

This Pine Script® indicator combines a long-term trend-following strategy with a cycle valuation Z-score analysis to generate a Trend Probability Indicator (TPI). The TPI aggregates signals from multiple trend and on-chain metrics to identify optimal entry and exit points for a single asset, with USD as a cash position. The system also calculates a comprehensive Z-score based on performance and valuation metrics to assess market cycles, aiming to enhance risk-adjusted returns for long-term investors.

Logic and Core Concepts

The 𝐂ycle𝑽𝑰𝑺𝑰𝑶𝑵 System uses two primary components to guide investing decisions:

1. Trend Probability Indicator (TPI)

- Mechanism: Aggregates five proprietary, universal, trend signals and three on-chain metrics into a composite TPI score, normalized between -1 and 1.

- Thresholds: Enters a long position when the TPI score exceeds a user-defined long threshold (default: 0.0) and exits to cash when it falls below a short threshold (default: -0.5).

- Execution: Trades are executed only on confirmed bars within a user-specified backtest date range, ensuring robust signal reliability.

2. Cycle Valuation Z-Score

- Mechanism: Computes an average Z-score from six metrics: Sharpe Ratio, Sortino Ratio, Omega Ratio, Weekly RSI, Crosby Ratio, and Price Z-Score, using a 1200-bar lookback period.

- Purpose: Identifies overvalued or undervalued market conditions to complement TPI signals, with thresholds at ±1.8 for extreme valuations.

[8]Visualization: Displays the average Z-score and individual components, with gradient-based bar coloring to reflect valuation strength.

Features

- Dynamic Trend Signals: Combines trend and on-chain data into a single TPI score for clear long/cash decisions.

- Comprehensive Valuation: Calculates Z-scores for multiple performance and price metrics to assess market cycles.

- Customizable Inputs: Allows users to adjust TPI thresholds, backtest date ranges, and valuation metrics visibility.

- Visual Outputs:

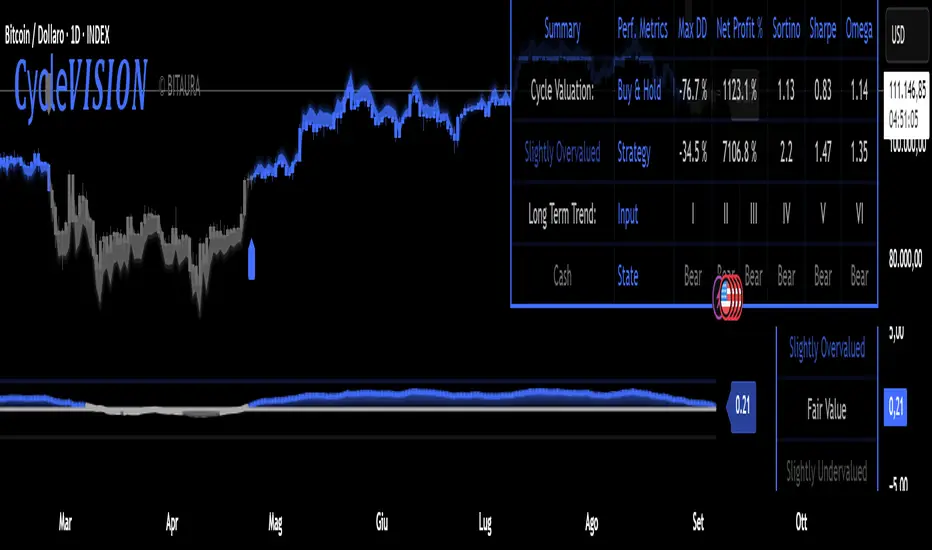

Valuation Table: Displays TPI score, Z-scores, and performance metrics (Sharpe, Sortino, Omega, Max Drawdown, Net Profit) in a configurable table (Lite, Medium, Full).

Equity Curve: Plots the system’s equity curve compared to buy-and-hold performance.

Price and TPI Plot: Overlays TPI-adjusted price bands with glow effects and filled gaps for trend visualization on the price chart.

Valuation Coloring: Applies backgrounds based on Z-score ranges (e.g., strong buy above 1.8, strong sell below -1.8). - Configurable Alerts: Notifies users of TPI signal changes (Long to Cash or Cash to Long) with detailed messages.

- Color Presets: Offers five color themes (e.g., Arctic Blast, Fire vs. Ice) or custom color options for long/short signals.

- Pine Script v6: Leverages matrices, tables, and gradient coloring for enhanced usability.

How to Use- Add to Chart: Apply the indicator to any chart (the chart’s ticker is used for calculations, e.g.,

BTCUSD).

- Configure Settings: Adjust TPI thresholds, backtest start date (default: 01 Feb 2018), and valuation metrics visibility in the Inputs menu.

- Select Color Theme: Choose a preset color mode (e.g., Arctic Blast) or enable custom colors in the Colors group.

- Monitor Outputs: Check the Valuation Table for TPI and Z-score data, and view the Price and TPI Plot for trend signals.

- Analyze Performance: Enable the equity curve and performance metrics in the Backtesting Options group to compare results.

- Set Alerts: Right-click a plot, select "Add alert," and choose "Trend Change: Long to Cash" or "Trend Change: Cash to Long" for notifications.

Notes- The script is closed-source.

- Use a standard price series (not Heikin Ashi or other non-standard types) for accurate results.

- The script avoids lookahead bias by using barmerge.lookahead_off in request.security() calls.

- A minimum 1200-bar lookback is mandatory for Z-score calculations to avoid errors, with warnings displayed if insufficient price history is available.

- The BitAura watermark can be toggled in the Table Settings group.

- Add to Chart: Apply the indicator to any chart (the chart’s ticker is used for calculations, e.g.,

สคริปต์แบบเฉพาะผู้ได้รับเชิญเท่านั้น

เฉพาะผู้ใช้งานที่ผู้เขียนอนุมัตเท่านั้นจึงจะสามารถเข้าถึงสคริปต์นี้ได้ คุณจะต้องขอและได้รับอนุญาตก่อนใช้งาน ซึ่งโดยทั่วไปจะได้รับอนุญาตหลังจากชำระเงินแล้ว สำหรับรายละเอียดเพิ่มเติม โปรดทำตามคำแนะนำของผู้เขียนด้านล่าง หรือติดต่อ BitAura โดยตรง

TradingView ไม่แนะนำให้จ่ายเงินหรือใช้สคริปต์ เว้นแต่คุณจะเชื่อถือผู้เขียนและเข้าใจวิธีการทำงานของสคริปต์นั้นอย่างถ่องแท้ คุณยังสามารถหาทางเลือกแบบโอเพนซอร์สฟรีได้ใน สคริปต์ชุมชนของเรา

คำแนะนำของผู้เขียน

คำจำกัดสิทธิ์ความรับผิดชอบ

สคริปต์แบบเฉพาะผู้ได้รับเชิญเท่านั้น

เฉพาะผู้ใช้งานที่ผู้เขียนอนุมัตเท่านั้นจึงจะสามารถเข้าถึงสคริปต์นี้ได้ คุณจะต้องขอและได้รับอนุญาตก่อนใช้งาน ซึ่งโดยทั่วไปจะได้รับอนุญาตหลังจากชำระเงินแล้ว สำหรับรายละเอียดเพิ่มเติม โปรดทำตามคำแนะนำของผู้เขียนด้านล่าง หรือติดต่อ BitAura โดยตรง

TradingView ไม่แนะนำให้จ่ายเงินหรือใช้สคริปต์ เว้นแต่คุณจะเชื่อถือผู้เขียนและเข้าใจวิธีการทำงานของสคริปต์นั้นอย่างถ่องแท้ คุณยังสามารถหาทางเลือกแบบโอเพนซอร์สฟรีได้ใน สคริปต์ชุมชนของเรา