OPEN-SOURCE SCRIPT

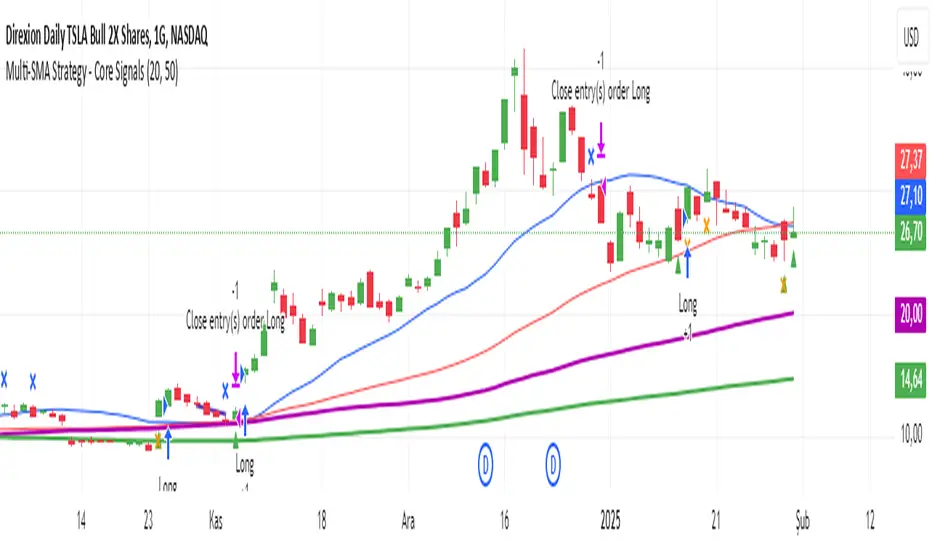

Multi-SMA Strategy - Core Signals

Tick-Precise Cross Detection:

Uses bar's high/low for real-time cross detection

Compares current price action with previous bar's position

Works across all timezones and trading sessions

Three-Layer Trend Filter:

Requires 50 > 100 > 200 SMA for uptrends

Requires 50 < 100 < 200 SMA for downtrends

Adds inherent market structure confirmation

Responsive Exit System:

Closes longs when price breaks below 20 SMA

Closes shorts when price breaks above 20 SMA

Uses same tick-precise logic as entries

Universal Time Application:

No fixed time references

Pure price-based calculations

Works on any chart timeframe (1m - monthly)

Signal Logic Summary:

+ Long Entry: Tick cross above 50 SMA + Uptrend hierarchy

- Long Exit: Price closes below 20 SMA

+ Short Entry: Tick cross below 50 SMA + Downtrend hierarchy

- Short Exit: Price closes above 20 SMA

Komut

//version=5

strategy("Multi-SMA Strategy - Core Signals", overlay=true)

// ———— Universal Inputs ———— //

int smaPeriod1 = input(20, "Fast SMA")

int smaPeriod2 = input(50, "Medium SMA")

bool useTickCross = input(true, "Use Tick-Precise Crosses")

// ———— Timezone-Neutral Calculations ———— //

sma20 = ta.sma(close, smaPeriod1)

sma50 = ta.sma(close, smaPeriod2)

sma100 = ta.sma(close, 100)

sma200 = ta.sma(close, 200)

// ———— Tick-Precise Cross Detection ———— //

golden_cross = useTickCross ?

(high >= sma50 and low[1] < sma50[1]) :

ta.crossover(sma20, sma50)

death_cross = useTickCross ?

(low <= sma50 and high[1] > sma50[1]) :

ta.crossunder(sma20, sma50)

// ———— Trend Filter ———— //

uptrend = sma50 > sma100 and sma100 > sma200

downtrend = sma50 < sma100 and sma100 < sma200

// ———— Entry Conditions ———— //

longCondition = golden_cross and uptrend

shortCondition = death_cross and downtrend

// ———— Exit Conditions ———— //

exitLong = ta.crossunder(low, sma20)

exitShort = ta.crossover(high, sma20)

// ———— Strategy Execution ———— //

strategy.entry("Long", strategy.long, when=longCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

strategy.close("Long", when=exitLong)

strategy.close("Short", when=exitShort)

// ———— Clean Visualization ———— //

plot(sma20, "20 SMA", color.new(color.blue, 0))

plot(sma50, "50 SMA", color.new(color.red, 0))

plot(sma100, "100 SMA", color.new(#B000B0, 0), linewidth=2)

plot(sma200, "200 SMA", color.new(color.green, 0), linewidth=2)

// ———— Signal Markers ———— //

plotshape(longCondition, "Long Entry", shape.triangleup, location.belowbar, color.green, 0)

plotshape(shortCondition, "Short Entry", shape.triangledown, location.abovebar, color.red, 0)

plotshape(exitLong, "Long Exit", shape.xcross, location.abovebar, color.blue, 0)

plotshape(exitShort, "Short Exit", shape.xcross, location.belowbar, color.orange, 0)

Uses bar's high/low for real-time cross detection

Compares current price action with previous bar's position

Works across all timezones and trading sessions

Three-Layer Trend Filter:

Requires 50 > 100 > 200 SMA for uptrends

Requires 50 < 100 < 200 SMA for downtrends

Adds inherent market structure confirmation

Responsive Exit System:

Closes longs when price breaks below 20 SMA

Closes shorts when price breaks above 20 SMA

Uses same tick-precise logic as entries

Universal Time Application:

No fixed time references

Pure price-based calculations

Works on any chart timeframe (1m - monthly)

Signal Logic Summary:

+ Long Entry: Tick cross above 50 SMA + Uptrend hierarchy

- Long Exit: Price closes below 20 SMA

+ Short Entry: Tick cross below 50 SMA + Downtrend hierarchy

- Short Exit: Price closes above 20 SMA

Komut

//version=5

strategy("Multi-SMA Strategy - Core Signals", overlay=true)

// ———— Universal Inputs ———— //

int smaPeriod1 = input(20, "Fast SMA")

int smaPeriod2 = input(50, "Medium SMA")

bool useTickCross = input(true, "Use Tick-Precise Crosses")

// ———— Timezone-Neutral Calculations ———— //

sma20 = ta.sma(close, smaPeriod1)

sma50 = ta.sma(close, smaPeriod2)

sma100 = ta.sma(close, 100)

sma200 = ta.sma(close, 200)

// ———— Tick-Precise Cross Detection ———— //

golden_cross = useTickCross ?

(high >= sma50 and low[1] < sma50[1]) :

ta.crossover(sma20, sma50)

death_cross = useTickCross ?

(low <= sma50 and high[1] > sma50[1]) :

ta.crossunder(sma20, sma50)

// ———— Trend Filter ———— //

uptrend = sma50 > sma100 and sma100 > sma200

downtrend = sma50 < sma100 and sma100 < sma200

// ———— Entry Conditions ———— //

longCondition = golden_cross and uptrend

shortCondition = death_cross and downtrend

// ———— Exit Conditions ———— //

exitLong = ta.crossunder(low, sma20)

exitShort = ta.crossover(high, sma20)

// ———— Strategy Execution ———— //

strategy.entry("Long", strategy.long, when=longCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

strategy.close("Long", when=exitLong)

strategy.close("Short", when=exitShort)

// ———— Clean Visualization ———— //

plot(sma20, "20 SMA", color.new(color.blue, 0))

plot(sma50, "50 SMA", color.new(color.red, 0))

plot(sma100, "100 SMA", color.new(#B000B0, 0), linewidth=2)

plot(sma200, "200 SMA", color.new(color.green, 0), linewidth=2)

// ———— Signal Markers ———— //

plotshape(longCondition, "Long Entry", shape.triangleup, location.belowbar, color.green, 0)

plotshape(shortCondition, "Short Entry", shape.triangledown, location.abovebar, color.red, 0)

plotshape(exitLong, "Long Exit", shape.xcross, location.abovebar, color.blue, 0)

plotshape(exitShort, "Short Exit", shape.xcross, location.belowbar, color.orange, 0)

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน