OPEN-SOURCE SCRIPT

ที่อัปเดต: Volume Spread Analysis [TANHEF]

Volume Spread Analysis: Understanding Market Intentions through the Interpretation of Volume and Price Movements.

█ Simple Explanation:

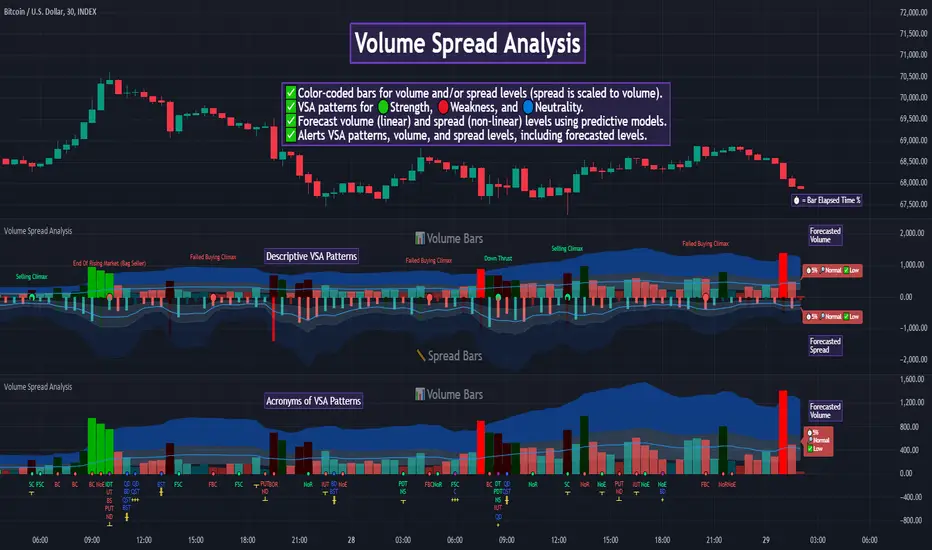

The Volume Spread Analysis (VSA) indicator is a comprehensive tool that helps traders identify key market patterns and trends based on volume and spread data. This indicator highlights significant VSA patterns and provides insights into market behavior through color-coded volume/spread bars and identification of bars indicating strength, weakness, and neutrality between buyers and sellers. It also includes powerful volume and spread forecasting capabilities.

█ Laws of Volume Spread Analysis (VSA):

The origin of VSA begins with Richard Wyckoff, a pivotal figure in its development. Wyckoff made significant contributions to trading theory, including the formulation of three basic laws:

█ Volume and Spread Analysis Bars:

Display: Volume and/or spread bars that consist of color coded levels. If both of these are displayed, the number of spread bars can be limited for visual appeal and understanding, with the spread bars scaled to match the volume bars. While automatic calculation of the number of visual bars for auto scaling is possible, it is avoided to prevent the indicator from reloading whenever the number of visual price bars on the chart is adjusted, ensuring uninterrupted analysis. A displayable table (Legend) of bar colors and levels can give context and clarify to each volume/spread bar.

Calculation: Levels are calculated using multipliers applied to moving averages to represent key levels based on historical data: low, normal, high, ultra. This method smooths out short-term fluctuations and focuses on longer-term trends.

This illustrates the appearance of Volume and Spread bars when scaled and plotted together:

https://www.tradingview.com/x/VqFLABPt/

█ Forecasting Capabilities:

Display: Forecasted volume and spread levels using predictive models.

Calculation: Volume and Spread prediction calculations differ as volume is linear and spread is non-linear.

The following compares forecasted volume with actual resulting volume, highlighting the power of early identifying increased volume through forecasted levels:

https://www.tradingview.com/x/r6EAlr3K/

█ VSA Patterns:

Criteria and descriptions for each VSA pattern are available as tooltips beside them within the indicator’s settings. These tooltips provide explanations of potential developments based on the volume and spread data.

Signs of Strength (🟢): Patterns indicating strong buying pressure and potential market upturns.

Signs of Weakness (🔴): Patterns indicating strong selling pressure and potential market downturns.

Neutral Patterns (🔵): Patterns indicating market indecision and potential for continuation or reversal.

Bar Patterns (🟡): Common candlestick patterns that offer insights into market sentiment. These are required in some VSA patterns and can also be displayed independently.

This demonstrates the acronym and descriptive options for displaying bar patterns, with the ability to hover over text to reveal the descriptive text along with what type of pattern:

https://www.tradingview.com/x/OD7Jkohz/

█ Alerts:

█ Inputs and Settings:

█ Usage:

The Volume Spread Analysis indicator is a helpful tool for leveraging volume spread analysis to make informed trading decisions. It offers comprehensive visual and textual cues on the chart, making it easier to identify market conditions, potential reversals, and continuations. Whether analyzing historical data or forecasting future trends, this indicator provides insights into the underlying factors driving market movements.

█ Simple Explanation:

The Volume Spread Analysis (VSA) indicator is a comprehensive tool that helps traders identify key market patterns and trends based on volume and spread data. This indicator highlights significant VSA patterns and provides insights into market behavior through color-coded volume/spread bars and identification of bars indicating strength, weakness, and neutrality between buyers and sellers. It also includes powerful volume and spread forecasting capabilities.

█ Laws of Volume Spread Analysis (VSA):

The origin of VSA begins with Richard Wyckoff, a pivotal figure in its development. Wyckoff made significant contributions to trading theory, including the formulation of three basic laws:

- The Law of Supply and Demand: This fundamental law states that supply and demand balance each other over time. High demand and low supply lead to rising prices until demand falls to a level where supply can meet it. Conversely, low demand and high supply cause prices to fall until demand increases enough to absorb the excess supply.

- The Law of Cause and Effect: This law assumes that a 'cause' will result in an 'effect' proportional to the 'cause'. A strong 'cause' will lead to a strong trend (effect), while a weak 'cause' will lead to a weak trend.

- The Law of Effort vs. Result: This law asserts that the result should reflect the effort exerted. In trading terms, a large volume should result in a significant price move (spread). If the spread is small, the volume should also be small. Any deviation from this pattern is considered an anomaly.

█ Volume and Spread Analysis Bars:

Display: Volume and/or spread bars that consist of color coded levels. If both of these are displayed, the number of spread bars can be limited for visual appeal and understanding, with the spread bars scaled to match the volume bars. While automatic calculation of the number of visual bars for auto scaling is possible, it is avoided to prevent the indicator from reloading whenever the number of visual price bars on the chart is adjusted, ensuring uninterrupted analysis. A displayable table (Legend) of bar colors and levels can give context and clarify to each volume/spread bar.

Calculation: Levels are calculated using multipliers applied to moving averages to represent key levels based on historical data: low, normal, high, ultra. This method smooths out short-term fluctuations and focuses on longer-term trends.

- Low Level: Indicates reduced volatility and market interest.

- Normal Level: Reflects typical market activity and volatility.

- High Level: Indicates increased activity and volatility.

- Ultra Level: Identifies extreme levels of activity and volatility.

This illustrates the appearance of Volume and Spread bars when scaled and plotted together:

https://www.tradingview.com/x/VqFLABPt/

█ Forecasting Capabilities:

Display: Forecasted volume and spread levels using predictive models.

Calculation: Volume and Spread prediction calculations differ as volume is linear and spread is non-linear.

- Volume Forecast (Linear Forecasting): Predicts future volume based on current volume rate and bar time till close.

- Spread Forecast (Non-Linear Dynamic Forecasting): Predicts future spread using a dynamic multiplier, less near midpoint (consolidation) and more near low or high (trending), reflecting non-linear expansion.

- Moving Averages: In forecasting, moving averages utilize forecasted levels instead of actual levels to ensure the correct level is forecasted (low, normal, high, or ultra).

The following compares forecasted volume with actual resulting volume, highlighting the power of early identifying increased volume through forecasted levels:

https://www.tradingview.com/x/r6EAlr3K/

█ VSA Patterns:

Criteria and descriptions for each VSA pattern are available as tooltips beside them within the indicator’s settings. These tooltips provide explanations of potential developments based on the volume and spread data.

Signs of Strength (🟢): Patterns indicating strong buying pressure and potential market upturns.

- Down Thrust

- Selling Climax

- No Effort → Bearish Result

- Bearish Effort → No Result

- Inverse Down Thrust

- Failed Selling Climax

- Bull Outside Reversal

- End of Falling Market (Bag Holder)

- Pseudo Down Thrust

- No Supply

Signs of Weakness (🔴): Patterns indicating strong selling pressure and potential market downturns.

- Up Thrust

- Buying Climax

- No Effort → Bullish Result

- Bullish Effort → No Result

- Inverse Up Thrust

- Failed Buying Climax

- Bear Outside Reversal

- End of Rising Market (Bag Seller)

- Pseudo Up Thrust

- No Demand

Neutral Patterns (🔵): Patterns indicating market indecision and potential for continuation or reversal.

- Quiet Doji

- Balanced Doji

- Strong Doji

- Quiet Spinning Top

- Balanced Spinning Top

- Strong Spinning Top

- Quiet High Wave

- Balanced High Wave

- Strong High Wave

- Consolidation

Bar Patterns (🟡): Common candlestick patterns that offer insights into market sentiment. These are required in some VSA patterns and can also be displayed independently.

- Bull Pin Bar

- Bear Pin Bar

- Doji

- Spinning Top

- High Wave

- Consolidation

This demonstrates the acronym and descriptive options for displaying bar patterns, with the ability to hover over text to reveal the descriptive text along with what type of pattern:

https://www.tradingview.com/x/OD7Jkohz/

█ Alerts:

- VSA Pattern Alerts: Notifications for identified VSA patterns at bar close.

- Volume and Spread Alerts: Alerts for confirmed and forecasted volume/spread levels (Low, High, Ultra).

- Forecasted Volume and Spread Alerts: Alerts for forecasted volume/spread levels (High, Ultra) include a minimum percent time elapsed input to reduce false early signals by ensuring sufficient bar time has passed.

█ Inputs and Settings:

- Display Volume and/or Spread: Choose between displaying volume bars, spread bars, or both with different lookback periods.

- Indicator Bar Color: Select color schemes for bars (Normal, Detail, Levels).

- Indicator Moving Average Color: Select schemes for bars (Fill, Lines, None).

- Price Bar Colors: Options to color price bars based on VSA patterns and volume levels.

- Legend: Display a table of bar colors and levels for context and clarity of volume/spread bars.

- Forecast: Configure forecast display and prediction details for volume and spread.

- Average Multipliers: Define multipliers for different levels (Low, High, Ultra) to refine the analysis.

- Moving Average: Set volume and spread moving average settings.

- VSA: Select the VSA patterns to be calculated and displayed (Strength, Weakness, Neutral).

- Bar Patterns: Criteria for bar patterns used in VSA (Doji, Bull Pin Bar, Bear Pin Bar, Spinning Top, Consolidation, High Wave).

- Colors: Set exact colors used for indicator bars, indicator moving averages, and price bars.

- More Display Options: Specify how VSA pattern text is displayed (Acronym, Descriptive), positioning, and sizes.

- Alerts: Configure alerts for VSA patterns, volume, and spread levels, including forecasted levels.

█ Usage:

The Volume Spread Analysis indicator is a helpful tool for leveraging volume spread analysis to make informed trading decisions. It offers comprehensive visual and textual cues on the chart, making it easier to identify market conditions, potential reversals, and continuations. Whether analyzing historical data or forecasting future trends, this indicator provides insights into the underlying factors driving market movements.

เอกสารเผยแพร่

Improved tooltips wording.เอกสารเผยแพร่

Library 'VolumeSpreadAnalysis' updated to version 2 (fixed minor logic issue in 'Quiet High Wave').Improved display options for 'Forecast'.

เอกสารเผยแพร่

Enhanced tooltips for signs of strength, signs of weakness, and continuation patterns. The updated criteria and descriptions improve clarity and minimize confusion.Added options for legend to display a table comparing volume and spread relative to their averages for the current bar, prior bar, and two bars prior.

เอกสารเผยแพร่

Minor fix.เอกสารเผยแพร่

Bug fix for an issue causing forecasting to display while a bar was not open while using custom ticker pairs (ticker1/ticker2).สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

tanhef.com/

Scripts and content from TanHef are solely for information and education. Past performance does not guarantee of future results.

Scripts and content from TanHef are solely for information and education. Past performance does not guarantee of future results.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

tanhef.com/

Scripts and content from TanHef are solely for information and education. Past performance does not guarantee of future results.

Scripts and content from TanHef are solely for information and education. Past performance does not guarantee of future results.

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน