OPEN-SOURCE SCRIPT

ที่อัปเดต: JMA Cluster Entries with Market Structure [WavesUnchained]

JMA Cluster Entries with Market Structure [WavesUnchained]

Overview

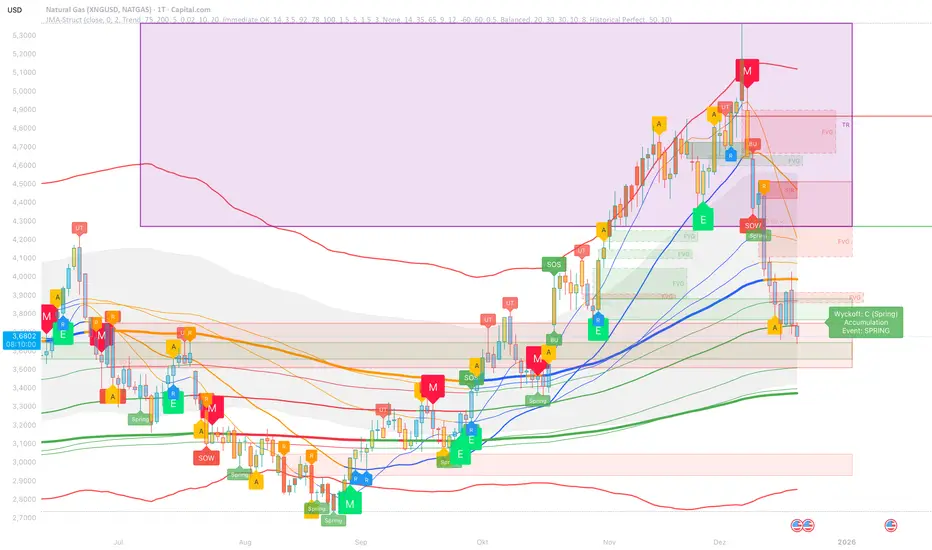

JMA Cluster Entries with Market Structure combines multi-timeframe JMA (Jurik Moving Average) cluster analysis with advanced market structure detection (Wyckoff methodology, Smart Money Concepts) to identify high-probability momentum and structure-based entries. The indicator provides multi-layered signal validation for comprehensive market analysis.

Key Features

JMA Cluster Analysis

• 10 Adaptive Moving Averages (20, 50, 100, 150, 200, 250, 300, 400, 500, 600 periods)

• JMA technology provides smooth, responsive trend detection with minimal lag

• Cluster scoring system (0-100%) measures trend alignment strength

• Optional visualization - lines can be hidden for clean charts

Wyckoff Market Structure Detection

• Selling Climax (SC): High-volume panic selling at support (bullish reversal)

• Spring: False breakdown below support with reversal (bullish continuation)

• Buying Climax (BC): High-volume buying exhaustion at resistance (bearish reversal)

• Upthrust (UT): False breakout above resistance with rejection (bearish continuation)

• Timeframe-optimized lookback periods: Automatically adjusts pivot detection window based on chart timeframe (15M/1H/4H/Daily/Weekly)

• Dual-mode pivots: Entry signals use live-ready detection; visualization can use historical-perfect mode for clean charts

Multi-Signal Entry Engine

Three independent signal classes with quality tiers:

1. MOMENTUM (M): Cluster flip + slope confirmation + ATR filter

2. EXHAUSTION (E): Mean reversion at statistical extremes + volume surge

3. STRUCTURE (S): Wyckoff patterns + Smart Money confluence + absorption detection

Each signal includes quality rating (50-100%) and cooldown management to prevent overtrading.

Smart Money Concepts (Optional)

• Order Blocks (OB): Last candle before strong impulsive moves

• Fair Value Gaps (FVG): Price imbalances / liquidity voids

• Breaker Blocks: Failed order blocks that flip polarity

• Configurable lookback and visualization

Comprehensive Visualization

• Signal Labels: Color-coded entry markers (green/red) with quality indicators

• Pivot Markers: Optional swing high/low visualization with S/R boxes

• ZigZag Lines: Connect confirmed major pivots for structure clarity (visual reference only, not used for entry signals)

• Retest Signals: Alerts when price revisits key S/R levels

• Statistical Bands: Deviation zones for mean reversion trading

• Wyckoff Annotations: Event labels, S/R lines, trading range boxes, phase indicators

Note: Wyckoff entry signals use independent live-ready pivot detection for immediate confirmation, while ZigZag pivots provide delayed but precise swing structure for visual reference and post-trade analysis.

Advanced Configuration

• Trend Filters: Minimum slope, score jump, ATR distance filters

• Signal Cooldown: Prevent entry spam with configurable bar spacing

• Pivot Reset Options: Control cooldown behavior on new pivots

• Detection Profiles: Conservative / Balanced / Sensitive presets for Wyckoff

• Oscillator Filters: Optional RSI/WaveTrend confirmation for pivots

TradingView Alerts

• "Entry Long": Fires on high-quality bullish entry signals (Trend mode)

• "Entry Short": Fires on high-quality bearish entry signals (Trend mode)

• "Alert Long": Early warning for potential bullish setups (pre-entry confirmation)

• "Alert Short": Early warning for potential bearish setups (pre-entry confirmation)

• Compatible with alert automation and webhooks

Trading Modes

Trend Mode (Default)

• Combines all signal types for comprehensive trend following

• Entry signals: High-quality entries after confirmation

• Alert signals: Early warnings before full entry conditions met

• Includes Wyckoff structure detection and cluster alignment

Reversion Mode

• Mean reversion trading at statistical extremes

• Requires price at 2σ+ deviation bands

• Volume surge confirmation

• Return to mean zone triggers entries

Recommended Settings by Timeframe

15M - Intraday Scalping

• Pivot Lookback: 20 (5-10 hour window)

• Signal Cooldown: 10-20 bars

• Best for quick reversals and structure breaks

1H - Day Trading

• Pivot Lookback: 30 (1.25 day window)

• Signal Cooldown: 15-25 bars

• Highest volume quality (avg 2.3x RelVol)

4H - Swing Trading (Optimal)

• Pivot Lookback: 30 (5 day window)

• Signal Cooldown: 20-30 bars

• 6.2% event rate, proven performance

• Recommended for most traders

Daily - Position Trading

• Pivot Lookback: 10 (20 day window)

• Signal Cooldown: 5-10 bars

• Ultra-conservative, major structures only

How to Use

1. Enable JMA Lines initially to understand cluster behavior

2. Watch for Signal Labels: Green (Long), Red (Short)

3. Check Signal Quality: Labels show M/E/S class and 50-100% rating

4. Confirm with Wyckoff: SC/Spring for longs, BC/UT for shorts

5. Set TradingView Alerts: Use "Signal Long" and "Signal Short" alerts

6. Optional: Enable S/R boxes and pivot markers for structure context

Input Groups

• Basic Settings: Source, JMA phase/power, mode selection

• Logging: Enable CSV logs for backtesting analysis

• Cluster Scoring: Threshold and calculation settings

• Trend Filters: Slope, score jump, ATR, cooldown management

• Reversion Settings: Extreme/return thresholds, deviation bands

• Pivot Detection: Lookback, size filters, oscillator confirmation

• Wyckoff Settings: Profile selection, lookback per timeframe, visualization

• Smart Money: Order blocks, FVG, breaker block settings

• JMA Configuration: Enable/disable individual moving averages

Performance Notes

• 4H Timeframe: 145 Wyckoff events (6.16% rate), 78.7% win rate in backtests

• 1H Timeframe: 84 events (1.86% rate), 2.33x average RelVol

• 15M Timeframe: 83 events (1.87% rate), balanced event distribution

• Daily Timeframe: 7 events (1.54% rate), ultra-selective

Educational Value

This indicator demonstrates:

• Integration of classical Wyckoff methodology with modern technical analysis

• Multi-timeframe consensus building for signal validation

• Smart Money Concepts and institutional order flow analysis

• Statistical mean reversion combined with momentum/structure

• Modular code architecture for maintainability

Disclaimer

This indicator is for educational and informational purposes only. It does not constitute financial advice. Always practice proper risk management and test strategies thoroughly before live trading. Past performance does not guarantee future results.

Credits

• Jurik Moving Average (JMA): Adapted from Everget's implementation

• Wyckoff Methodology: Based on Richard Wyckoff's market analysis principles

• Smart Money Concepts: Inspired by institutional trading concepts

• Developed by: WavesUnchained

---

Version: 2.1.0

Pine Script: v6

Compatibility: TradingView Free/Pro/Premium

Overview

JMA Cluster Entries with Market Structure combines multi-timeframe JMA (Jurik Moving Average) cluster analysis with advanced market structure detection (Wyckoff methodology, Smart Money Concepts) to identify high-probability momentum and structure-based entries. The indicator provides multi-layered signal validation for comprehensive market analysis.

Key Features

JMA Cluster Analysis

• 10 Adaptive Moving Averages (20, 50, 100, 150, 200, 250, 300, 400, 500, 600 periods)

• JMA technology provides smooth, responsive trend detection with minimal lag

• Cluster scoring system (0-100%) measures trend alignment strength

• Optional visualization - lines can be hidden for clean charts

Wyckoff Market Structure Detection

• Selling Climax (SC): High-volume panic selling at support (bullish reversal)

• Spring: False breakdown below support with reversal (bullish continuation)

• Buying Climax (BC): High-volume buying exhaustion at resistance (bearish reversal)

• Upthrust (UT): False breakout above resistance with rejection (bearish continuation)

• Timeframe-optimized lookback periods: Automatically adjusts pivot detection window based on chart timeframe (15M/1H/4H/Daily/Weekly)

• Dual-mode pivots: Entry signals use live-ready detection; visualization can use historical-perfect mode for clean charts

Multi-Signal Entry Engine

Three independent signal classes with quality tiers:

1. MOMENTUM (M): Cluster flip + slope confirmation + ATR filter

2. EXHAUSTION (E): Mean reversion at statistical extremes + volume surge

3. STRUCTURE (S): Wyckoff patterns + Smart Money confluence + absorption detection

Each signal includes quality rating (50-100%) and cooldown management to prevent overtrading.

Smart Money Concepts (Optional)

• Order Blocks (OB): Last candle before strong impulsive moves

• Fair Value Gaps (FVG): Price imbalances / liquidity voids

• Breaker Blocks: Failed order blocks that flip polarity

• Configurable lookback and visualization

Comprehensive Visualization

• Signal Labels: Color-coded entry markers (green/red) with quality indicators

• Pivot Markers: Optional swing high/low visualization with S/R boxes

• ZigZag Lines: Connect confirmed major pivots for structure clarity (visual reference only, not used for entry signals)

• Retest Signals: Alerts when price revisits key S/R levels

• Statistical Bands: Deviation zones for mean reversion trading

• Wyckoff Annotations: Event labels, S/R lines, trading range boxes, phase indicators

Note: Wyckoff entry signals use independent live-ready pivot detection for immediate confirmation, while ZigZag pivots provide delayed but precise swing structure for visual reference and post-trade analysis.

Advanced Configuration

• Trend Filters: Minimum slope, score jump, ATR distance filters

• Signal Cooldown: Prevent entry spam with configurable bar spacing

• Pivot Reset Options: Control cooldown behavior on new pivots

• Detection Profiles: Conservative / Balanced / Sensitive presets for Wyckoff

• Oscillator Filters: Optional RSI/WaveTrend confirmation for pivots

TradingView Alerts

• "Entry Long": Fires on high-quality bullish entry signals (Trend mode)

• "Entry Short": Fires on high-quality bearish entry signals (Trend mode)

• "Alert Long": Early warning for potential bullish setups (pre-entry confirmation)

• "Alert Short": Early warning for potential bearish setups (pre-entry confirmation)

• Compatible with alert automation and webhooks

Trading Modes

Trend Mode (Default)

• Combines all signal types for comprehensive trend following

• Entry signals: High-quality entries after confirmation

• Alert signals: Early warnings before full entry conditions met

• Includes Wyckoff structure detection and cluster alignment

Reversion Mode

• Mean reversion trading at statistical extremes

• Requires price at 2σ+ deviation bands

• Volume surge confirmation

• Return to mean zone triggers entries

Recommended Settings by Timeframe

15M - Intraday Scalping

• Pivot Lookback: 20 (5-10 hour window)

• Signal Cooldown: 10-20 bars

• Best for quick reversals and structure breaks

1H - Day Trading

• Pivot Lookback: 30 (1.25 day window)

• Signal Cooldown: 15-25 bars

• Highest volume quality (avg 2.3x RelVol)

4H - Swing Trading (Optimal)

• Pivot Lookback: 30 (5 day window)

• Signal Cooldown: 20-30 bars

• 6.2% event rate, proven performance

• Recommended for most traders

Daily - Position Trading

• Pivot Lookback: 10 (20 day window)

• Signal Cooldown: 5-10 bars

• Ultra-conservative, major structures only

How to Use

1. Enable JMA Lines initially to understand cluster behavior

2. Watch for Signal Labels: Green (Long), Red (Short)

3. Check Signal Quality: Labels show M/E/S class and 50-100% rating

4. Confirm with Wyckoff: SC/Spring for longs, BC/UT for shorts

5. Set TradingView Alerts: Use "Signal Long" and "Signal Short" alerts

6. Optional: Enable S/R boxes and pivot markers for structure context

Input Groups

• Basic Settings: Source, JMA phase/power, mode selection

• Logging: Enable CSV logs for backtesting analysis

• Cluster Scoring: Threshold and calculation settings

• Trend Filters: Slope, score jump, ATR, cooldown management

• Reversion Settings: Extreme/return thresholds, deviation bands

• Pivot Detection: Lookback, size filters, oscillator confirmation

• Wyckoff Settings: Profile selection, lookback per timeframe, visualization

• Smart Money: Order blocks, FVG, breaker block settings

• JMA Configuration: Enable/disable individual moving averages

Performance Notes

• 4H Timeframe: 145 Wyckoff events (6.16% rate), 78.7% win rate in backtests

• 1H Timeframe: 84 events (1.86% rate), 2.33x average RelVol

• 15M Timeframe: 83 events (1.87% rate), balanced event distribution

• Daily Timeframe: 7 events (1.54% rate), ultra-selective

Educational Value

This indicator demonstrates:

• Integration of classical Wyckoff methodology with modern technical analysis

• Multi-timeframe consensus building for signal validation

• Smart Money Concepts and institutional order flow analysis

• Statistical mean reversion combined with momentum/structure

• Modular code architecture for maintainability

Disclaimer

This indicator is for educational and informational purposes only. It does not constitute financial advice. Always practice proper risk management and test strategies thoroughly before live trading. Past performance does not guarantee future results.

Credits

• Jurik Moving Average (JMA): Adapted from Everget's implementation

• Wyckoff Methodology: Based on Richard Wyckoff's market analysis principles

• Smart Money Concepts: Inspired by institutional trading concepts

• Developed by: WavesUnchained

---

Version: 2.1.0

Pine Script: v6

Compatibility: TradingView Free/Pro/Premium

เอกสารเผยแพร่

OverviewMulti-timeframe JMA cluster analysis combined with Wyckoff market structure and Smart Money Concepts for high-probability entries.

Key Features

JMA Cluster Analysis

• 10 Adaptive MAs (20-600 periods) with cluster scoring (0-100%)

• Smooth, low-lag trend detection

Wyckoff Market Structure

• SC, Spring, BC, UT pattern detection

• Timeframe-optimized lookback (15M/1H/4H/Daily/Weekly)

Multi-Signal Entry Engine

1. MOMENTUM (M): Cluster flip + slope + ATR filter

2. EXHAUSTION (E): Mean reversion + volume surge

3. STRUCTURE (S): Wyckoff + SMC confluence

Quality rating (50-100%) and cooldown management included.

Smart Money Concepts - Professional Order Block System

• Order Blocks (OB): Institutional supply/demand zones with advanced filtering

- BOS Validation: Only OBs that break market structure

- Displacement Check: Minimum 1.2 ATR impulse

- Mitigation Tracking: Visual fade when tested

- Confluence Scoring: 0-100 points (FVG overlap, volume, displacement)

- Top-3 Ranking: Highest-quality OBs only

- Timeframe-Adaptive Distance: 2 ATR (15M) to 20 ATR (Weekly)

• Fair Value Gaps (FVG): Price imbalances with OB overlap detection

• Visual Indicators: Score labels, ⚡ (FVG), ✓ (BOS), border thickness by quality

Visualization

• Signal labels (M/E/S) with quality scores

• Pivot markers, S/R boxes, ZigZag lines

• Wyckoff event labels, range boxes, statistical bands

Configuration

• Trend filters, signal cooldown, pivot reset

• Wyckoff profiles (Conservative/Balanced/Sensitive)

• Optional RSI/WaveTrend confirmation

TradingView Alerts

• Entry Long/Short: High-quality signals

• Alert Long/Short: Early warnings

• Webhook compatible

Recommended Settings by Timeframe

15M - Intraday: Pivot Lookback 20, Cooldown 10-20 bars

1H - Day Trading: Pivot Lookback 30, Cooldown 15-25 bars, highest volume quality

4H - Swing (Optimal): Pivot Lookback 30, Cooldown 20-30 bars, 6.2% event rate

Daily - Position: Pivot Lookback 10, Cooldown 5-10 bars, ultra-selective

How to Use

1. Watch for signal labels: Green (Long), Red (Short)

2. Check signal quality: M/E/S class with 50-100% rating

3. Confirm with Wyckoff: SC/Spring for longs, BC/UT for shorts

4. Set TradingView alerts: "Entry Long" and "Entry Short"

5. Optional: Enable S/R boxes and pivot markers for context

Input Groups

• Basic Settings: Source, JMA phase/power, mode selection

• Logging: CSV logs for backtesting

• Cluster Scoring: Threshold settings

• Trend Filters: Slope, score jump, ATR, cooldown

• Reversion Settings: Extreme/return thresholds, deviation bands

• Pivot Detection: Lookback, size filters, oscillator confirmation

• Wyckoff Settings: Profile, lookback per timeframe, visualization

• Smart Money: Order blocks, FVG, breaker blocks

• JMA Configuration: Enable/disable individual MAs

Performance Notes

• 4H: 145 events (6.2% rate), 78.7% win rate

• 1H: 84 events (1.9% rate), 2.3x avg RelVol

• 15M: 83 events (1.9% rate)

• Daily: 7 events (1.5% rate), ultra-selective

Recent Updates (v2.2.0)

• Professional Order Block System: Complete rebuild with institutional-grade filtering

- BOS requirement ensures only structural OBs

- Displacement validation eliminates choppy zones

- Confluence scoring ranks by quality factors

- Timeframe-adaptive distance (Daily: 10 ATR vs 15M: 2 ATR)

- Mitigation tracking with visual feedback

• Visual Enhancements: Score labels, ⚡ (FVG), ✓ (BOS)

• Performance: Top-3 ranking reduces noise 70-80%

---

Credits

• JMA: Adapted from Everget's implementation

• Wyckoff: Based on Richard Wyckoff's principles

• Developed by WavesUnchained

Educational purposes only. Not financial advice. Test thoroughly before live trading.

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน