OPEN-SOURCE SCRIPT

ที่อัปเดต: Waldo RSI Overlay :o

Waldo RSI Overlay :o Indicator Guide

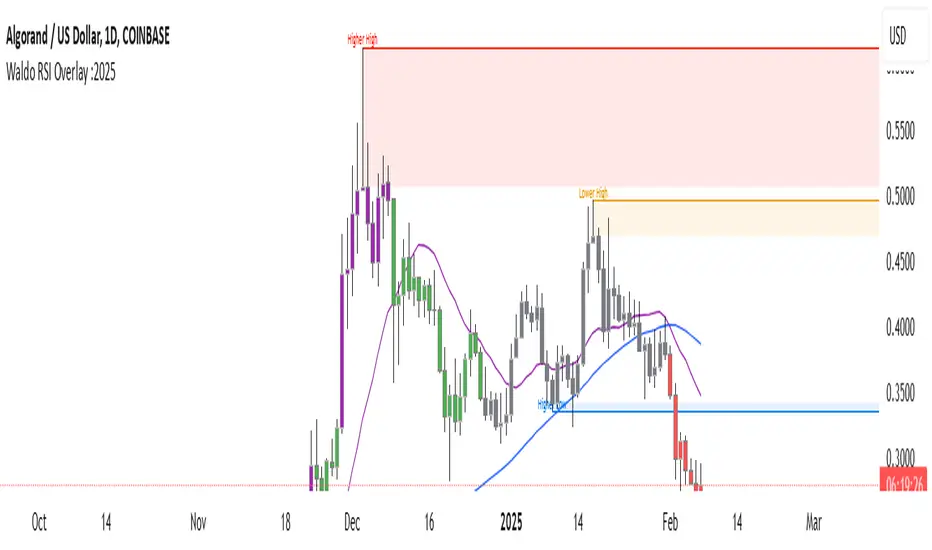

Welcome to the guide for the Waldo RSI Overlay :o indicator on TradingView. This tool enhances your trading analysis through RSI-based overlays for trend analysis, divergence detection, and breakout/breakdown signals when used with its companion indicator, Waldo RSI :o.

Key Features:

RSI Overlay:

• RSI Source: Choose from:

o ON RSI: Uses the RSI values directly to detect pivots, focusing on RSI highs and lows for trend analysis.

o ON HIGH, ON CLOSE, ON LOW, ON OPEN:

These options base pivot detection on price action at those specific points, offering an alternative market structure view.

• RSI Settings:

o Source: Default is (H+L)/2, but you can select any price for RSI calculation.

o Length: Default RSI length is 7, which you can adjust for sensitivity.

Trend Lines:

• Show Trend Lines: Toggle to display trend lines based on pivot points.

• Zigzag Length: Sets the sensitivity of pivot point detection.

• Confirm Length: Ensures the validity of pivot points (default is 3).

• Colors: Customize colors for Higher Highs (HH), Lower Highs (LH), Higher Lows (HL), and Lower Lows (LL).

• Transparency and Line Width: Control how trend lines and fills appear.

• Label Size: Adjust the size of labels identifying pivot points.

Divergences:

• Classic Divergences:

o Show Classic Div: Enable to highlight regular divergences where price and RSI move in opposite directions.

o Colors: Define colors for bullish and bearish divergence lines and labels.

o Transparency and Line Width: Adjust the visual impact of divergence signals.

• Hidden Divergences:

o Similar settings as classic, but these highlight divergences indicating trend continuation.

Breakout/Breakdown:

• Show Breakout/Breakdown: When activated, this feature signals when the price breaks through previous highs or lows. To activate these breakouts, you need the companion indicator Waldo RSI :o, select the SRC in the External section, and select the crossovers for each one.

This combination provides RSI confirmation for breakout/breakdown events.

Overbought/Oversold Zones:

• Show Overbought and Oversold Zones: Bars are colored when RSI exceeds 70 (purple) or falls below 30 (blue), indicating potential market extremes.

Moving Averages (Optional):

• Show Moving Averages: Option to overlay two moving averages for trend confirmation.

• Source, Type, Length: Customize each MA's configuration.

Ghost Lines (Optional):

• Ghost Lines: When enabled, trend lines extend for only a specified period (Ghost Length) instead of indefinitely.

How to Use the Indicator:

1. Setup:

o Configure RSI settings by choosing the RSI Source and adjusting the RSI Length to suit your trading style.

o Set the Zigzag Length and Confirm Length for trend line sensitivity based on market volatility.

2. Trend Analysis:

o Look at the colored horizontal lines and fills for HH, LH, HL, LL to discern market structure and potential reversal points.

3. Divergence Detection:

o Identify divergences where price and RSI diverge. Regular divergences might signal trend exhaustion, while hidden ones could indicate trend persistence.

4. Breakout/Breakdown Signals:

o Ensure you have both the Waldo RSI Overlay :o and Waldo RSI :o indicators applied. Green triangles below bars signal breakouts; red ones above indicate breakdowns, based on price movement with RSI confirmation from the companion indicator.

5. Overbought/Oversold:

o Use these colored zones to spot potential momentum shifts or reversal areas.

6. Moving Averages on RSI:

o If used, these can help confirm trends or identify crossover signals for additional trade confirmation.

7. Ghost Lines:

o For a less cluttered chart, enable this to limit how far trend lines extend.

Tips for Usage:

• Always combine this indicator with other analytical tools for better confirmation. No single indicator should guide all decisions.

• Adjust settings according to the asset's behavior and your trading timeframe.

• Regularly review your settings as market dynamics change.

Remember, trading involves risk, and past performance doesn't predict future outcomes. Use this indicator within a comprehensive trading strategy.

Welcome to the guide for the Waldo RSI Overlay :o indicator on TradingView. This tool enhances your trading analysis through RSI-based overlays for trend analysis, divergence detection, and breakout/breakdown signals when used with its companion indicator, Waldo RSI :o.

Key Features:

RSI Overlay:

• RSI Source: Choose from:

o ON RSI: Uses the RSI values directly to detect pivots, focusing on RSI highs and lows for trend analysis.

o ON HIGH, ON CLOSE, ON LOW, ON OPEN:

These options base pivot detection on price action at those specific points, offering an alternative market structure view.

• RSI Settings:

o Source: Default is (H+L)/2, but you can select any price for RSI calculation.

o Length: Default RSI length is 7, which you can adjust for sensitivity.

Trend Lines:

• Show Trend Lines: Toggle to display trend lines based on pivot points.

• Zigzag Length: Sets the sensitivity of pivot point detection.

• Confirm Length: Ensures the validity of pivot points (default is 3).

• Colors: Customize colors for Higher Highs (HH), Lower Highs (LH), Higher Lows (HL), and Lower Lows (LL).

• Transparency and Line Width: Control how trend lines and fills appear.

• Label Size: Adjust the size of labels identifying pivot points.

Divergences:

• Classic Divergences:

o Show Classic Div: Enable to highlight regular divergences where price and RSI move in opposite directions.

o Colors: Define colors for bullish and bearish divergence lines and labels.

o Transparency and Line Width: Adjust the visual impact of divergence signals.

• Hidden Divergences:

o Similar settings as classic, but these highlight divergences indicating trend continuation.

Breakout/Breakdown:

• Show Breakout/Breakdown: When activated, this feature signals when the price breaks through previous highs or lows. To activate these breakouts, you need the companion indicator Waldo RSI :o, select the SRC in the External section, and select the crossovers for each one.

This combination provides RSI confirmation for breakout/breakdown events.

Overbought/Oversold Zones:

• Show Overbought and Oversold Zones: Bars are colored when RSI exceeds 70 (purple) or falls below 30 (blue), indicating potential market extremes.

Moving Averages (Optional):

• Show Moving Averages: Option to overlay two moving averages for trend confirmation.

• Source, Type, Length: Customize each MA's configuration.

Ghost Lines (Optional):

• Ghost Lines: When enabled, trend lines extend for only a specified period (Ghost Length) instead of indefinitely.

How to Use the Indicator:

1. Setup:

o Configure RSI settings by choosing the RSI Source and adjusting the RSI Length to suit your trading style.

o Set the Zigzag Length and Confirm Length for trend line sensitivity based on market volatility.

2. Trend Analysis:

o Look at the colored horizontal lines and fills for HH, LH, HL, LL to discern market structure and potential reversal points.

3. Divergence Detection:

o Identify divergences where price and RSI diverge. Regular divergences might signal trend exhaustion, while hidden ones could indicate trend persistence.

4. Breakout/Breakdown Signals:

o Ensure you have both the Waldo RSI Overlay :o and Waldo RSI :o indicators applied. Green triangles below bars signal breakouts; red ones above indicate breakdowns, based on price movement with RSI confirmation from the companion indicator.

5. Overbought/Oversold:

o Use these colored zones to spot potential momentum shifts or reversal areas.

6. Moving Averages on RSI:

o If used, these can help confirm trends or identify crossover signals for additional trade confirmation.

7. Ghost Lines:

o For a less cluttered chart, enable this to limit how far trend lines extend.

Tips for Usage:

• Always combine this indicator with other analytical tools for better confirmation. No single indicator should guide all decisions.

• Adjust settings according to the asset's behavior and your trading timeframe.

• Regularly review your settings as market dynamics change.

Remember, trading involves risk, and past performance doesn't predict future outcomes. Use this indicator within a comprehensive trading strategy.

เอกสารเผยแพร่

I updated the V2 option to calculate the high and low "hl2" prices. Small fixเอกสารเผยแพร่

Updated the v2 Options.เอกสารเผยแพร่

https://www.tradingview.com/x/Ro7TGvHN/The indicator has been updated with a different default-src value, RSI default length set to 14, zlen length change, updated moving averages, and a revised color scheme, with small changes that users can still adjust to optimize for their trading style.

เอกสารเผยแพร่

Changed the RSI Length default to 50 to match the RSI OSC.เอกสารเผยแพร่

I'm optimizing the MA lengths for this indicator, setting them to 16, 66, 16, and 66 respectively.เอกสารเผยแพร่

Changed default settings: Change settings as you wish.rsiLengthInput2 = input.int(50, title="RSI Fast MA Length", group="MA Settings")

rsiLengthInput3 = input.int(200, title="RSI Slow MA Length", group="MA Settings")

added more MA

/ Function to calculate MA based on the selected type

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

// Input for choosing MA type for all MAs

globalMAType = input.string("SMA", title="Global MA Type", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="General Settings")

เอกสารเผยแพร่

Updated TradingView Description:Crossover Logic for Market Sentiment:

The script now employs a sophisticated method to determine market sentiment through crossovers:

When the Fast Moving Average (ma1) crosses over the Slow Moving Average (ma2), the script sets isPriceBullish to true, indicating a bullish market condition, and isPriceBearish to false. Conversely, if ma1 crosses under ma2, isPriceBullish becomes false and isPriceBearish is set to true, signaling a bearish market condition.

Similarly, for the RSI Moving Averages, if the Fast RSI MA (rsiMA) calculated over a 50-period length crosses above the Slow RSI MA (rsiMA2) over a 200-period length, isRSIBullish is set to true and isRSIBearish to false, suggesting bullish momentum in the RSI. If rsiMA crosses below rsiMA2, isRSIBullish is false and isRSIBearish turns true, indicating bearish momentum.

Color Scheme Aligned with RSI Indicator:

To enhance visual consistency with the companion RSI indicator ("Waldo RSI :2025"), the color scheme for the Bollinger Bands cloud has been updated:

BullishColor: Green, used when both price and RSI conditions are bullish, indicating potential upward momentum.

BearishColor: Orange, applied when both price and RSI suggest a bearish trend, signaling potential downward movement. This color represents a warning of potential downward price action, often used to highlight areas where traders might consider short positions or exiting long positions.

NeutralColor: Grey, for situations where neither bullish nor bearish conditions are clearly defined.

OverboughtColor: Purple, for when the RSI is above the overbought level, highlighting potential for a price pullback.

OversoldColor: Blue, when the RSI falls below the oversold level, suggesting a possible price recovery.

Under50Color: Red, when the RSI is below 50, indicating general bearish sentiment or weakening bullish momentum.

Overbought/Oversold (OB/OS) Conditions:

The Overbought and Oversold conditions are determined using a 14-period RSI (rsi2). Specifically, if the 14-period RSI is above 70, it's considered overbought, and if it's below 30, it's considered oversold. These conditions dictate when the cloud turns purple or blue, respectively.

General RSI Settings:

The rest of the script, including the dynamic Bollinger Bands color logic for other conditions, operates off a 50-period RSI (rsi1). This longer timeframe offers a broader perspective on market momentum, smoothing out short-term fluctuations for a clearer trend analysis.

The color of the cloud between the Bollinger Bands is dynamically determined based on the following conditions:

If the 14-period RSI (rsi2) is above the overbought level (overboughtLevel), the cloud turns purple.

If the 14-period RSI is below the oversold level (oversoldLevel), the cloud color changes to blue.

When the 50-period RSI (rsi1) is less than 50, the cloud is colored red, showing a general bearish or neutral sentiment.

In bullish market conditions, where both price and RSI are bullish (isPriceBullish and isRSIBullish are true), and the price (srcWaldo) is above the slow MA (ma2), the cloud is green.

For bearish conditions, where both price and RSI are bearish (isPriceBearish and isRSIBearish are true), and the price is below ma2, the cloud turns orange.

If none of these specific conditions are met, the cloud defaults to a neutral grey.

This updated color logic, along with the dual RSI period approach, ensures that the visual representation of the Waldo Momentum Cloud Bollinger Bands closely aligns with the sentiment and momentum insights provided by the RSI, offering traders a more integrated view of market conditions across different timeframes and indicators.

This description provides a comprehensive overview, correcting the application of the 14-period RSI for OB/OS conditions while maintaining the use of the 50-period RSI for other aspects of the script's logic

เอกสารเผยแพร่

I had to fix the MA plotsเอกสารเผยแพร่

Optimizing color conditions เอกสารเผยแพร่

Added a dropdown for trend type. สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน