OPEN-SOURCE SCRIPT

TSI Long/Short for BTC 2H

The TSI Long/Short for BTC 2H strategy is an advanced trend-following system designed specifically for trading Bitcoin (BTC) on a 2-hour timeframe. It leverages the True Strength Index (TSI) to identify momentum shifts and executes both long and short trades in response to dynamic market conditions.

Unlike traditional moving average-based strategies, this script uses a double-smoothed momentum calculation, enhancing signal accuracy and reducing noise. It incorporates automated position sizing, customizable leverage, and real-time performance tracking, ensuring a structured and adaptable trading approach.

🔹 What Makes This Strategy Unique?

Unlike simple crossover strategies or generic trend-following approaches, this system utilizes a customized True Strength Index (TSI) methodology that dynamically adjusts to market conditions.

🔸 True Strength Index (TSI) Filtering – The script refines the TSI by applying double exponential smoothing, filtering out weak signals and capturing high-confidence momentum shifts.

🔸 Adaptive Entry & Exit Logic – Instead of fixed thresholds, it compares the TSI value against a dynamically determined high/low range from the past 100 bars to confirm trade signals.

🔸 Leverage & Risk Optimization – Position sizing is dynamically adjusted based on account equity and leverage settings, ensuring controlled risk exposure.

🔸 Performance Monitoring System – A built-in performance tracking table allows traders to evaluate monthly and yearly results directly on the chart.

📊 Core Strategy Components

1️⃣ Momentum-Based Trade Execution

The strategy generates long and short trade signals based on the following conditions:

✅ Long Entry Condition – A buy signal is triggered when the TSI crosses above its 100-bar highest value (previously set), confirming bullish momentum.

✅ Short Entry Condition – A sell signal is generated when the TSI crosses below its 100-bar lowest value (previously set), indicating bearish pressure.

Each trade execution is fully automated, reducing emotional decision-making and improving trading discipline.

2️⃣ Position Sizing & Leverage Control

Risk management is a key focus of this strategy:

🔹 Dynamic Position Sizing – The script calculates position size based on:

Account Equity – Ensuring trade sizes adjust dynamically with capital fluctuations.

Leverage Multiplier – Allows traders to customize risk exposure via an adjustable leverage setting.

🔹 No Fixed Stop-Loss – The strategy relies on reversals to exit trades, meaning each position is closed when the opposite signal appears.

This design ensures maximum capital efficiency while adapting to market conditions in real time.

3️⃣ Performance Visualization & Tracking

Understanding historical performance is crucial for refining strategies. The script includes:

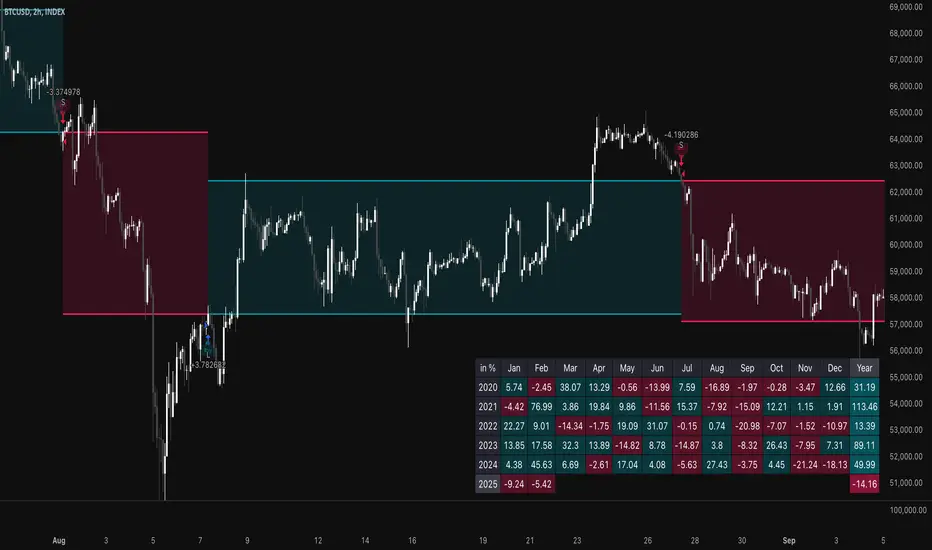

📌 Real-Time Trade Markers – Buy and sell signals are visually displayed on the chart for easy reference.

📌 Performance Metrics Table – Tracks monthly and yearly returns in percentage form, helping traders assess profitability over time.

📌 Trade History Visualization – Completed trades are displayed with color-coded boxes (green for long trades, red for short trades), visually representing profit/loss dynamics.

📢 Why Use This Strategy?

✔ Advanced Momentum Detection – Uses a double-smoothed TSI for more accurate trend signals.

✔ Fully Automated Trading – Removes emotional bias and enforces discipline.

✔ Customizable Risk Management – Adjust leverage and position sizing to suit your risk profile.

✔ Comprehensive Performance Tracking – Integrated reporting system provides clear insights into past trades.

This strategy is ideal for Bitcoin traders looking for a structured, high-probability system that adapts to both bullish and bearish trends on the 2-hour timeframe.

📌 How to Use: Simply add the script to your 2H BTC chart, configure your leverage settings, and let the system handle trade execution and tracking! 🚀

Unlike traditional moving average-based strategies, this script uses a double-smoothed momentum calculation, enhancing signal accuracy and reducing noise. It incorporates automated position sizing, customizable leverage, and real-time performance tracking, ensuring a structured and adaptable trading approach.

🔹 What Makes This Strategy Unique?

Unlike simple crossover strategies or generic trend-following approaches, this system utilizes a customized True Strength Index (TSI) methodology that dynamically adjusts to market conditions.

🔸 True Strength Index (TSI) Filtering – The script refines the TSI by applying double exponential smoothing, filtering out weak signals and capturing high-confidence momentum shifts.

🔸 Adaptive Entry & Exit Logic – Instead of fixed thresholds, it compares the TSI value against a dynamically determined high/low range from the past 100 bars to confirm trade signals.

🔸 Leverage & Risk Optimization – Position sizing is dynamically adjusted based on account equity and leverage settings, ensuring controlled risk exposure.

🔸 Performance Monitoring System – A built-in performance tracking table allows traders to evaluate monthly and yearly results directly on the chart.

📊 Core Strategy Components

1️⃣ Momentum-Based Trade Execution

The strategy generates long and short trade signals based on the following conditions:

✅ Long Entry Condition – A buy signal is triggered when the TSI crosses above its 100-bar highest value (previously set), confirming bullish momentum.

✅ Short Entry Condition – A sell signal is generated when the TSI crosses below its 100-bar lowest value (previously set), indicating bearish pressure.

Each trade execution is fully automated, reducing emotional decision-making and improving trading discipline.

2️⃣ Position Sizing & Leverage Control

Risk management is a key focus of this strategy:

🔹 Dynamic Position Sizing – The script calculates position size based on:

Account Equity – Ensuring trade sizes adjust dynamically with capital fluctuations.

Leverage Multiplier – Allows traders to customize risk exposure via an adjustable leverage setting.

🔹 No Fixed Stop-Loss – The strategy relies on reversals to exit trades, meaning each position is closed when the opposite signal appears.

This design ensures maximum capital efficiency while adapting to market conditions in real time.

3️⃣ Performance Visualization & Tracking

Understanding historical performance is crucial for refining strategies. The script includes:

📌 Real-Time Trade Markers – Buy and sell signals are visually displayed on the chart for easy reference.

📌 Performance Metrics Table – Tracks monthly and yearly returns in percentage form, helping traders assess profitability over time.

📌 Trade History Visualization – Completed trades are displayed with color-coded boxes (green for long trades, red for short trades), visually representing profit/loss dynamics.

📢 Why Use This Strategy?

✔ Advanced Momentum Detection – Uses a double-smoothed TSI for more accurate trend signals.

✔ Fully Automated Trading – Removes emotional bias and enforces discipline.

✔ Customizable Risk Management – Adjust leverage and position sizing to suit your risk profile.

✔ Comprehensive Performance Tracking – Integrated reporting system provides clear insights into past trades.

This strategy is ideal for Bitcoin traders looking for a structured, high-probability system that adapts to both bullish and bearish trends on the 2-hour timeframe.

📌 How to Use: Simply add the script to your 2H BTC chart, configure your leverage settings, and let the system handle trade execution and tracking! 🚀

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน