INVITE-ONLY SCRIPT

PnD [Intromoto]

ที่อัปเดต:

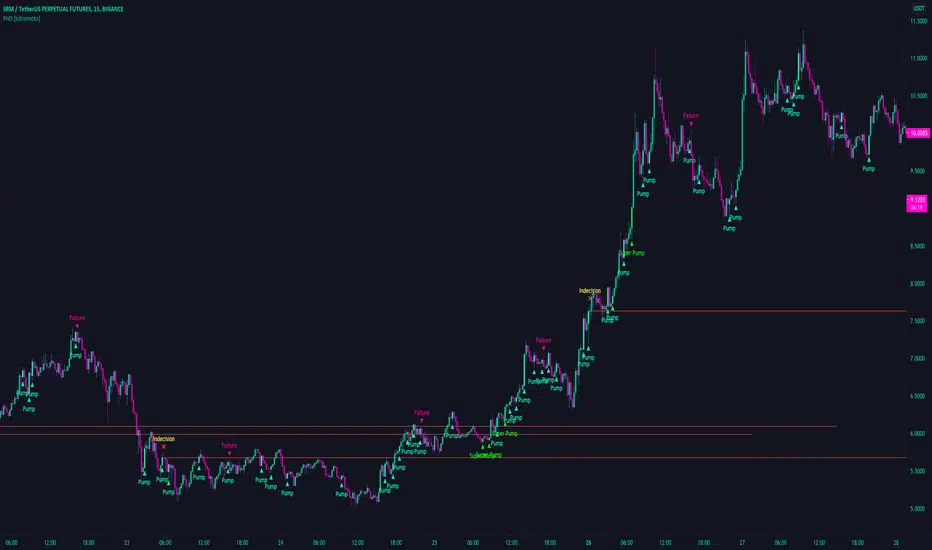

This scripts forms a range based on time, then looks for the levels of premium (the difference between spot and perpetual price) and plots a signal depending on breakout or breakout.

The indicator only works properly on Binance perpetual futures charts. If you're not on a Binance perp chart, the metrics will default to a Biannce:BTCUSDT vs Binance:BTCUSDTPERP premium comparison.

This indicator automatically calls the appropriate spot vs future comparison. i.e if you're on the Binance:MATICUSDTPERP chart it knows to check the Binance:MATICUSDT chart for contrast.

"Super Pumps" are range breakouts with extreme levels of backwardation - set in user inputs

"Pumps" are range breakouts with less extreme backwardation - no user input

"Push" occurs where there are irregularities in the premium vs price sequence, indicating a potential bottom

"Pull" occurs where there are irregularities in the premium vs price sequence, indicating a potential top

"Dumps" are range breakdowns with extreme levels of premium - set in user inputs by %, indicating a potential top

Users can set the base range period, i.e the duration (length) of the range, as well as the range height, established by the first candle of the new range.

User inputs a resolution of candle close required to trigger the signal. i.e "15" would mean price needs to close a 15 minute candle outside of the established range for the signal to appear.

Example: Base period 240, Range Period 15. This would create an invisible range every 4 hours from its first fifteen minute candle. Any price closing (based on resolution in the inputs) would alert a breakout or breakdown.

DM for access.

Thanks

The indicator only works properly on Binance perpetual futures charts. If you're not on a Binance perp chart, the metrics will default to a Biannce:BTCUSDT vs Binance:BTCUSDTPERP premium comparison.

This indicator automatically calls the appropriate spot vs future comparison. i.e if you're on the Binance:MATICUSDTPERP chart it knows to check the Binance:MATICUSDT chart for contrast.

"Super Pumps" are range breakouts with extreme levels of backwardation - set in user inputs

"Pumps" are range breakouts with less extreme backwardation - no user input

"Push" occurs where there are irregularities in the premium vs price sequence, indicating a potential bottom

"Pull" occurs where there are irregularities in the premium vs price sequence, indicating a potential top

"Dumps" are range breakdowns with extreme levels of premium - set in user inputs by %, indicating a potential top

Users can set the base range period, i.e the duration (length) of the range, as well as the range height, established by the first candle of the new range.

User inputs a resolution of candle close required to trigger the signal. i.e "15" would mean price needs to close a 15 minute candle outside of the established range for the signal to appear.

Example: Base period 240, Range Period 15. This would create an invisible range every 4 hours from its first fifteen minute candle. Any price closing (based on resolution in the inputs) would alert a breakout or breakdown.

DM for access.

Thanks

เอกสารเผยแพร่

Added line output for indecisive structure, which usually turns into either support or resistance.Changes plotshape size. Added a "Failure" for when the range breakouts get rejected

เอกสารเผยแพร่

Added style options and reorganized code. เอกสารเผยแพร่

Removed "Pull", giving a few too many false signalsเอกสารเผยแพร่

Removed "Hard Pull" & Pic changeเอกสารเผยแพร่

Added a Bullish Indecision line and removes unnecessary code. สคริปต์เฉพาะผู้ได้รับเชิญเท่านั้น

การเข้าถึงสคริปต์นี้จำกัดเฉพาะผู้ใช้ที่ได้รับอนุญาตจากผู้เขียน และมักจะต้องชำระเงินก่อน คุณสามารถเพิ่มลงในรายการโปรดของคุณได้ แต่คุณจะสามารถใช้งานได้หลังจากขออนุญาตและขอรับจากผู้เขียนเท่านั้น ติดต่อ Intromoto สำหรับข้อมูลเพิ่มเติม หรือทำตามคำแนะนำของผู้เขียนด้านล่าง

TradingView ไม่แนะนำให้ชำระเงินสำหรับการซื้อสคริปต์และไม่แนะนำให้ใช้งานสคริปต์นั้นๆ จนกว่าคุณจะเชื่อมั่นในผู้เขียนสคริปต์ 100% และเข้าใจว่าสคริปต์ทำงานอย่างไร ในกรณีอื่นๆ คุณสามารถหาทางเลือกโอเพนซอร์สที่ดีได้ฟรีใน สคริปต์ชุมชน ของเรา

คำแนะนำของผู้เขียน

″DM for access

ต้องการที่จะใช้สคริปต์นี้บนชาร์ตใช่ไหม?

คำเตือน: กรุณาอ่าน ก่อนร้องขอการเข้าถึง

DM for access.

Follow on Twitter for updates.

One time fee, no subscription

twitter.com/IntroMoto

Follow on Twitter for updates.

One time fee, no subscription

twitter.com/IntroMoto

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมที่ ข้อกำหนดการใช้งาน