OPEN-SOURCE SCRIPT

Risk Manage Position Sizer

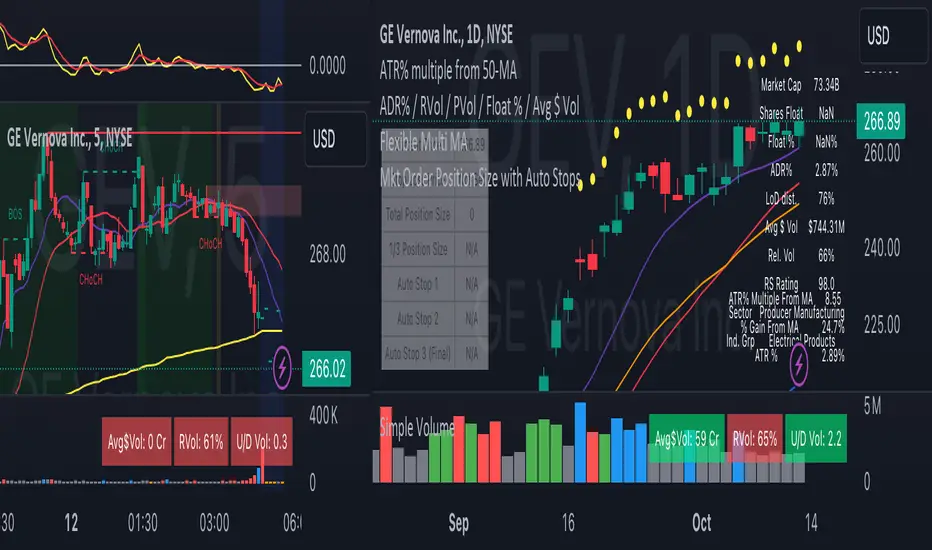

This is a risk management tool for traders. It calculates position sizes based on account balance and risk tolerance, and provides automated stop-loss suggestions. The script displays key information in a small table on the chart and plots important price levels.

How to use it:

Input Parameters:

Account Size: Enter your total trading account balance.

Risk Percentage: Set the percentage of your account you're willing to risk per trade.

Use Custom Stop Loss: Toggle this to use a manually entered stop loss price.

Custom Stop Loss Price: If enabled, enter your desired stop loss price.

Reading the Table:

The table displays:

Current Price

Stop Loss Price

Total Position Size (number of shares/contracts to trade)

1/3 Position Size (for scaling in/out)

Auto Stop 1, 2, and 3 (suggested stop loss levels)

Chart Indicators:

Red Line: Your stop loss level

Green Line: Auto Stop 1 (33% of range from entry to stop)

Yellow Line: Auto Stop 2 (67% of range)

Red Line: Auto Stop 3 (final stop, same as initial stop loss)

Trading Application:

Use the Total Position Size to determine how many shares/contracts to trade.

Consider using the 1/3 Position Size for scaling in or out of trades.

Use the Auto Stops to manage your risk as the trade progresses.

Customization:

Adjust the input parameters to fit your trading style and risk tolerance.

The script can be modified to add more features or change the calculation methods if needed.

This tool helps traders make more informed decisions about position sizing and stop placement, potentially improving risk management in their trading strategy. Remember, while this script provides suggestions, all trading decisions should be made based on your own analysis and risk tolerance.

How to use it:

Input Parameters:

Account Size: Enter your total trading account balance.

Risk Percentage: Set the percentage of your account you're willing to risk per trade.

Use Custom Stop Loss: Toggle this to use a manually entered stop loss price.

Custom Stop Loss Price: If enabled, enter your desired stop loss price.

Reading the Table:

The table displays:

Current Price

Stop Loss Price

Total Position Size (number of shares/contracts to trade)

1/3 Position Size (for scaling in/out)

Auto Stop 1, 2, and 3 (suggested stop loss levels)

Chart Indicators:

Red Line: Your stop loss level

Green Line: Auto Stop 1 (33% of range from entry to stop)

Yellow Line: Auto Stop 2 (67% of range)

Red Line: Auto Stop 3 (final stop, same as initial stop loss)

Trading Application:

Use the Total Position Size to determine how many shares/contracts to trade.

Consider using the 1/3 Position Size for scaling in or out of trades.

Use the Auto Stops to manage your risk as the trade progresses.

Customization:

Adjust the input parameters to fit your trading style and risk tolerance.

The script can be modified to add more features or change the calculation methods if needed.

This tool helps traders make more informed decisions about position sizing and stop placement, potentially improving risk management in their trading strategy. Remember, while this script provides suggestions, all trading decisions should be made based on your own analysis and risk tolerance.

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน

สคริปต์โอเพนซอร์ซ

ด้วยเจตนารมณ์หลักของ TradingView ผู้สร้างสคริปต์นี้ได้ทำให้เป็นโอเพนซอร์ส เพื่อให้เทรดเดอร์สามารถตรวจสอบและยืนยันฟังก์ชันการทำงานของมันได้ ขอชื่นชมผู้เขียน! แม้ว่าคุณจะใช้งานได้ฟรี แต่โปรดจำไว้ว่าการเผยแพร่โค้ดซ้ำจะต้องเป็นไปตาม กฎระเบียบการใช้งาน ของเรา

คำจำกัดสิทธิ์ความรับผิดชอบ

ข้อมูลและบทความไม่ได้มีวัตถุประสงค์เพื่อก่อให้เกิดกิจกรรมทางการเงิน, การลงทุน, การซื้อขาย, ข้อเสนอแนะ หรือคำแนะนำประเภทอื่น ๆ ที่ให้หรือรับรองโดย TradingView อ่านเพิ่มเติมใน ข้อกำหนดการใช้งาน